Attorney-Approved Investment Letter of Intent Form

Form Preview Example

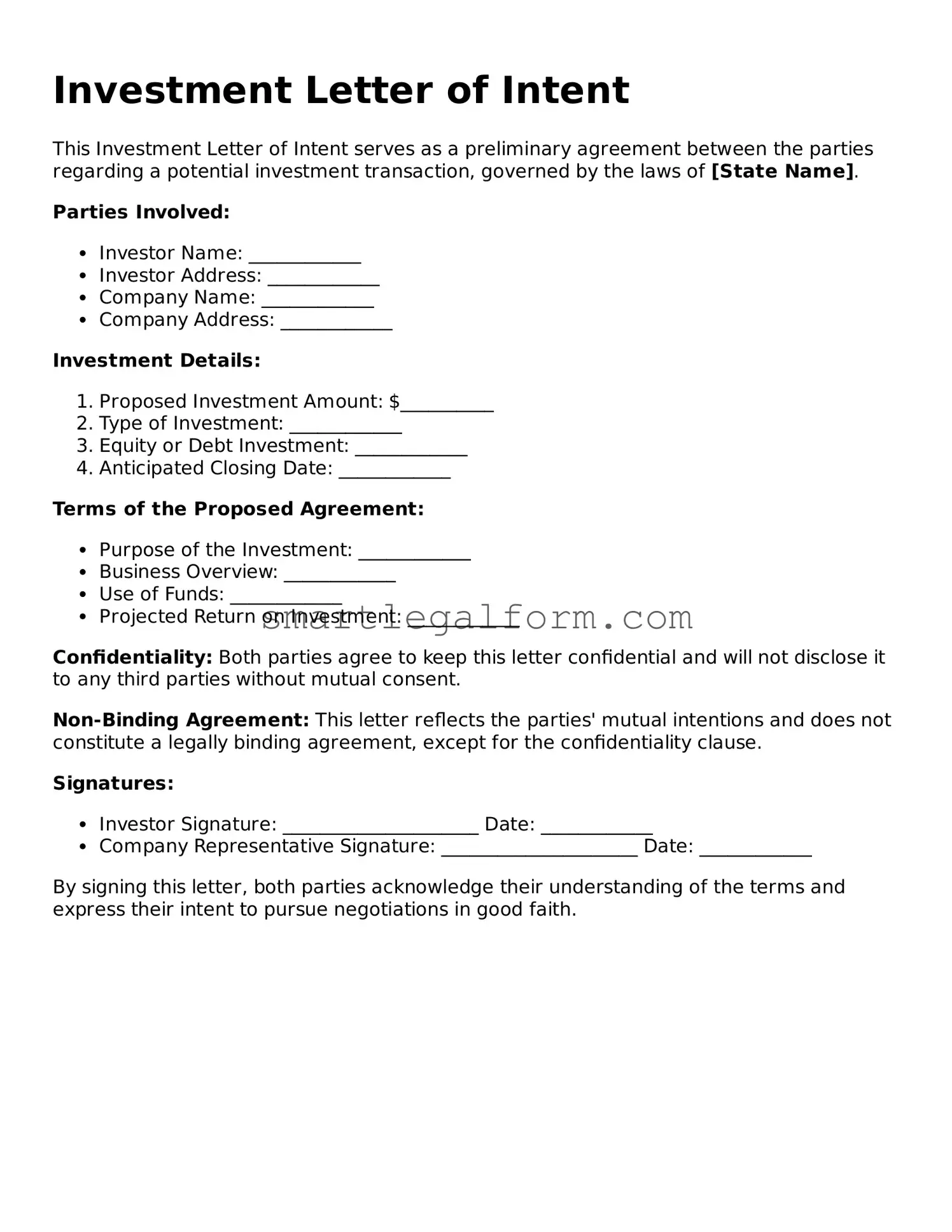

Investment Letter of Intent

This Investment Letter of Intent serves as a preliminary agreement between the parties regarding a potential investment transaction, governed by the laws of [State Name].

Parties Involved:

- Investor Name: ____________

- Investor Address: ____________

- Company Name: ____________

- Company Address: ____________

Investment Details:

- Proposed Investment Amount: $__________

- Type of Investment: ____________

- Equity or Debt Investment: ____________

- Anticipated Closing Date: ____________

Terms of the Proposed Agreement:

- Purpose of the Investment: ____________

- Business Overview: ____________

- Use of Funds: ____________

- Projected Return on Investment: ____________

Confidentiality: Both parties agree to keep this letter confidential and will not disclose it to any third parties without mutual consent.

Non-Binding Agreement: This letter reflects the parties' mutual intentions and does not constitute a legally binding agreement, except for the confidentiality clause.

Signatures:

- Investor Signature: _____________________ Date: ____________

- Company Representative Signature: _____________________ Date: ____________

By signing this letter, both parties acknowledge their understanding of the terms and express their intent to pursue negotiations in good faith.

Common mistakes

Filling out an Investment Letter of Intent form can be a straightforward process, but many people make common mistakes that can lead to delays or complications. One frequent error is providing incomplete information. If you leave out essential details, such as your contact information or the amount you intend to invest, it can slow down the review process and potentially jeopardize your investment opportunity.

Another mistake is failing to read the instructions carefully. Each form may have specific requirements or guidelines that must be followed. Ignoring these can result in submitting a form that does not meet the necessary criteria. Always take the time to read through the instructions to ensure you understand what is required.

Many individuals also overlook the importance of signatures. Some may forget to sign the form altogether, while others may fail to provide the correct signatures if multiple parties are involved. Ensure that all required signatures are present before submitting the form to avoid unnecessary back-and-forth communication.

Additionally, people often underestimate the significance of accurate financial information. Providing incorrect figures or outdated valuations can lead to misunderstandings or mistrust. Double-check all financial data to confirm its accuracy before submission.

Another common pitfall is neglecting to keep a copy of the submitted form. Failing to do so can create confusion later on, especially if there are questions about the investment terms or if follow-up is needed. Always retain a copy for your records.

Lastly, many forget to follow up after submission. Once you’ve sent in your Investment Letter of Intent, it’s a good idea to check in with the relevant parties. This can help ensure that your form was received and is being processed. A simple follow-up can save time and clarify any potential issues.

Dos and Don'ts

When filling out the Investment Letter of Intent form, it is important to approach the task with care. Here are five things to keep in mind:

- Do: Read the instructions carefully before starting.

- Do: Provide accurate and complete information.

- Do: Double-check your entries for any errors.

- Do: Sign and date the form where required.

- Do: Keep a copy of the completed form for your records.

- Don't: Rush through the form without reviewing it.

- Don't: Leave any required fields blank.

- Don't: Use jargon or unclear language.

- Don't: Submit the form without ensuring all information is accurate.

- Don't: Forget to follow up if you do not receive confirmation of receipt.

More Types of Investment Letter of Intent Forms:

Sample Letter of Intent to Homeschool - Completing this letter can empower parents to take charge of their child's educational path.

Similar forms

- Memorandum of Understanding (MOU): Like the Investment Letter of Intent, an MOU outlines the preliminary agreements between parties. It serves as a framework for future negotiations, detailing the intentions of each party without creating a legally binding obligation.

- Term Sheet: A term sheet summarizes the key terms and conditions of an investment or agreement. Similar to the Investment Letter of Intent, it lays out the expectations and basic structure of the deal, providing a reference point for the final agreement.

- Non-Disclosure Agreement (NDA): An NDA protects sensitive information shared between parties during negotiations. While the Investment Letter of Intent expresses intent to invest, an NDA ensures that proprietary information remains confidential during discussions.

- Purchase Agreement: This document formalizes the sale of an asset or business. It is similar to the Investment Letter of Intent in that both documents outline the terms of a transaction, but the purchase agreement is more detailed and legally binding.

- Joint Venture Agreement: A joint venture agreement establishes a partnership for a specific project or business endeavor. Like the Investment Letter of Intent, it outlines the intentions of the parties involved, although it typically includes more detailed operational guidelines.

- Letter of Intent (LOI): An LOI is often used in various business transactions to express the intention of parties to enter into a formal agreement. It shares similarities with the Investment Letter of Intent in that both documents convey preliminary intentions and key terms.

- Subscription Agreement: This document is used when an investor agrees to purchase shares in a company. Similar to the Investment Letter of Intent, it outlines the terms of the investment but is more specific about the financial commitment and obligations.

- Shareholder Agreement: A shareholder agreement governs the relationship between shareholders and the company. It resembles the Investment Letter of Intent by outlining expectations and responsibilities, but it is more comprehensive and binding.

- Investment Agreement: This formal contract details the terms of an investment, including rights and obligations of the parties. While the Investment Letter of Intent expresses preliminary interest, the investment agreement solidifies the transaction.

- Collaboration Agreement: A collaboration agreement outlines the terms under which two or more parties will work together on a project. Similar to the Investment Letter of Intent, it establishes mutual intentions but typically includes more specifics regarding roles and responsibilities.