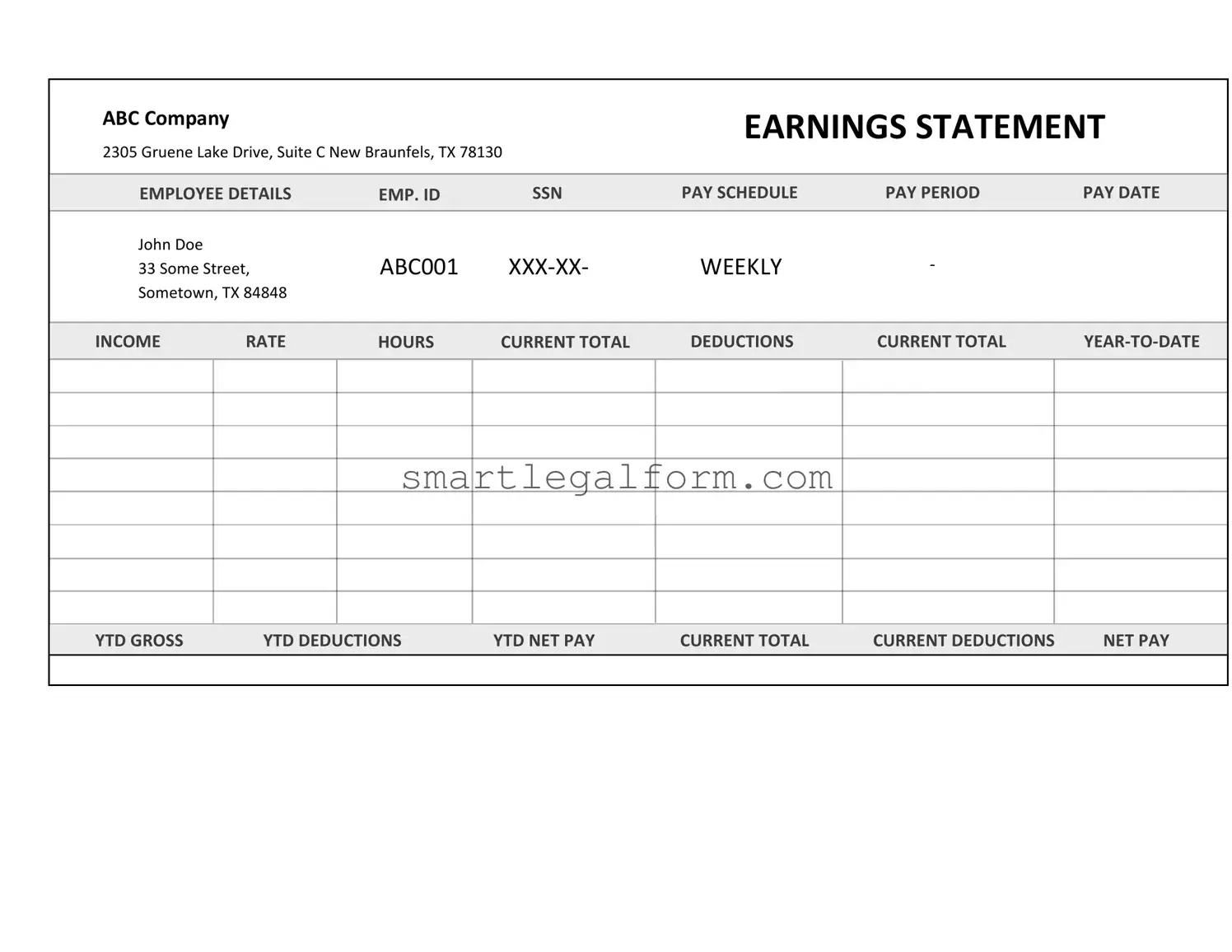

Free Independent Contractor Pay Stub Form

Form Preview Example

ABC Company |

|

|

|

EARNINGS STATEMENT |

||

|

|

|

|

|

|

|

2305 Gruene Lake Drive, Suite C New Braunfels, TX 78130 |

|

|

|

|||

EMPLOYEE DETAILS |

EMP. ID |

SSN |

PAY SCHEDULE |

PAY PERIOD |

PAY DATE |

|

John Doe |

|

ABC001 |

WEEKLY |

- |

|

|

33 Some Street, |

|

|||||

Sometown, TX 84848 |

|

|

|

|

|

|

INCOME |

RATE |

HOURS |

CURRENT TOTAL |

DEDUCTIONS |

CURRENT TOTAL |

|

YTD GROSS |

YTD DEDUCTIONS |

YTD NET PAY |

CURRENT TOTAL |

CURRENT DEDUCTIONS |

NET PAY |

Common mistakes

When filling out the Independent Contractor Pay Stub form, many individuals make common mistakes that can lead to confusion or delays in payment. One frequent error is failing to include accurate personal information. Contractors should ensure that their name, address, and Social Security number are correct. Inaccurate details can result in payment issues or tax complications.

Another mistake is not specifying the correct payment period. Contractors must clearly indicate the start and end dates for the work performed. Omitting this information can cause misunderstandings regarding the amount owed and the timeframe of services rendered.

Many people also overlook the importance of itemizing their services. It is essential to provide a detailed description of the work completed and the corresponding rates. Without this clarity, clients may question the legitimacy of the charges or dispute the payment.

Additionally, some individuals forget to calculate their totals correctly. Double-checking the math is crucial. Errors in calculations can lead to underpayment or overpayment, creating unnecessary complications for both the contractor and the client.

Another common oversight is neglecting to sign the pay stub. A signature is a vital part of the document, as it signifies that the contractor agrees with the information provided. Without a signature, the form may be considered incomplete and could delay processing.

Lastly, failing to keep a copy of the submitted pay stub can be detrimental. Contractors should always retain a copy for their records. This practice ensures that they have documentation to refer back to in case of any disputes or questions regarding payment.

Dos and Don'ts

When filling out the Independent Contractor Pay Stub form, it is important to follow certain guidelines to ensure accuracy and compliance. Here is a list of things to do and avoid:

- Do read the instructions carefully before starting the form.

- Do include your full legal name and correct contact information.

- Do accurately report the hours worked and the rate of pay.

- Do provide any necessary tax identification numbers, such as your Social Security Number or Employer Identification Number.

- Do keep a copy of the completed pay stub for your records.

- Don't leave any sections blank; fill in all required fields.

- Don't use nicknames or informal names; always use your legal name.

- Don't forget to double-check for any errors before submitting the form.

- Don't submit the form without ensuring that all information is accurate and up to date.

Other PDF Documents

Minor Travel Consent Letter - The form outlines the responsibilities of the parent or guardian.

When considering the importance of a Durable Power of Attorney, it's vital to understand its role in ensuring that your preferences are respected and upheld during times of incapacity. This form not only provides clarity and authority to a designated individual but also alleviates the stress that can arise during difficult situations. For more information on the specifics of this important document, visit TopTemplates.info, where you can find comprehensive resources to guide you through the process.

Ucc 1 308 - It includes provisions for notary acknowledgment, adding legal weight to the document.

Act of Donation of a Movable - Completing the act of donation can be a straightforward process for both parties involved.

Similar forms

The Independent Contractor Pay Stub form serves as an important document for independent contractors, outlining their earnings and deductions. Several other documents share similarities with this form, each serving a unique purpose while providing essential financial information. Below are seven documents that are comparable to the Independent Contractor Pay Stub form:

- W-2 Form: This document is issued by employers to report an employee's annual wages and the taxes withheld. Like the pay stub, it provides a summary of earnings and deductions but is specifically for employees rather than independent contractors.

- 1099-MISC Form: Used to report payments made to independent contractors, this form details the total income earned throughout the year. Similar to the pay stub, it summarizes earnings but is provided at the end of the tax year.

- Payroll Summary Report: This report outlines the total wages, deductions, and net pay for employees over a specific period. Like the pay stub, it gives a clear picture of earnings and deductions, but it is typically used for employees rather than independent contractors.

- Invoice: An invoice is a document sent by a contractor to a client requesting payment for services rendered. While it details the work performed and amount due, it serves a similar purpose of tracking earnings, much like a pay stub.

- Payment Receipt: This document confirms that a payment has been made. It provides information about the amount paid and the services provided, similar to how a pay stub confirms earnings for a given period.

- Expense Report: This document allows independent contractors to report business-related expenses. While it focuses on costs rather than income, it complements the pay stub by providing a complete financial picture.

- Motor Vehicle Bill of Sale: Essential for transferring ownership of a vehicle in Florida, this document ensures that all necessary details are captured, protecting both buyer and seller. More information can be found at https://documentonline.org/blank-florida-motor-vehicle-bill-of-sale/.

- Profit and Loss Statement: This financial report summarizes revenues and expenses over a specific period. It provides a broader view of financial health, similar to how a pay stub details individual earnings and deductions.