Printable Illinois Transfer-on-Death Deed Document

Form Preview Example

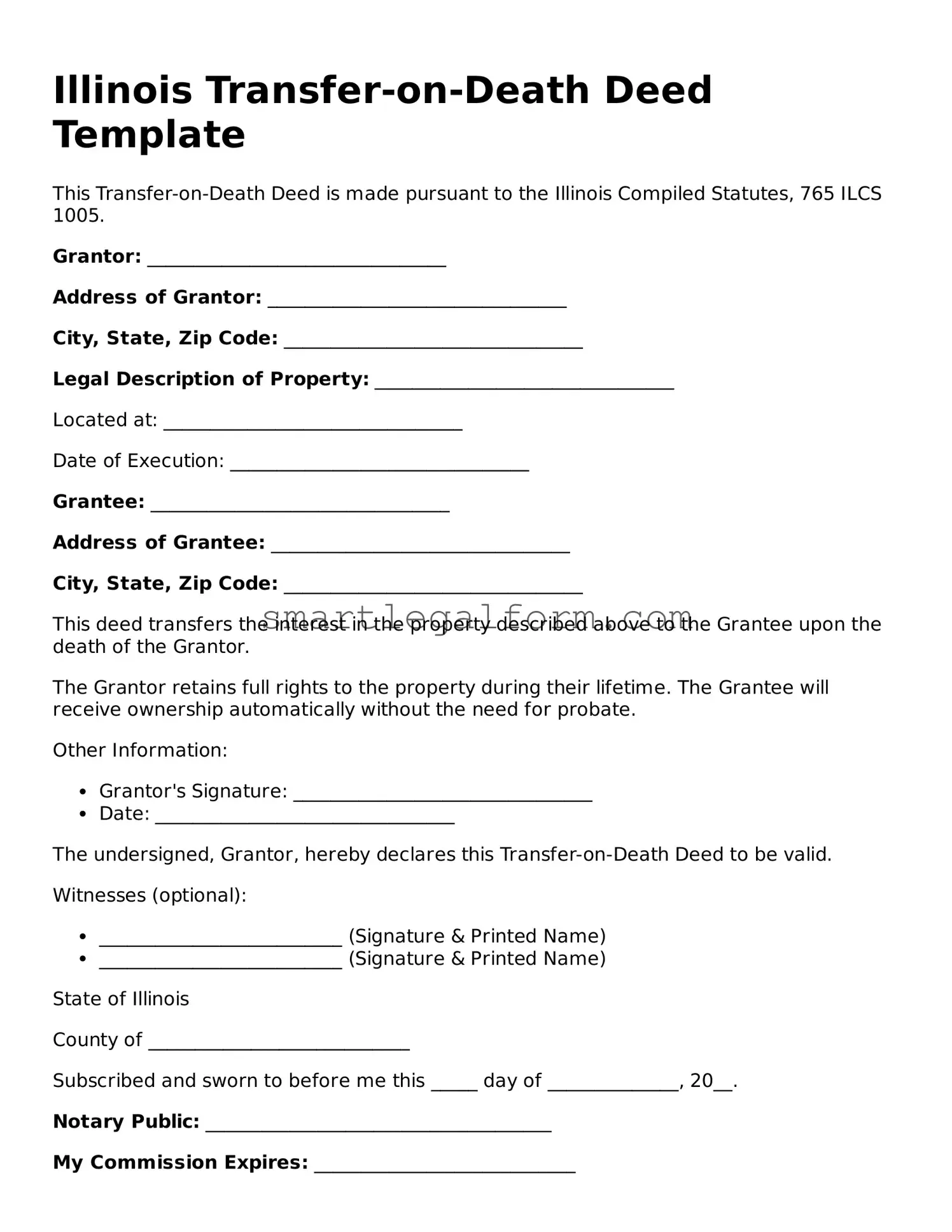

Illinois Transfer-on-Death Deed Template

This Transfer-on-Death Deed is made pursuant to the Illinois Compiled Statutes, 765 ILCS 1005.

Grantor: ________________________________

Address of Grantor: ________________________________

City, State, Zip Code: ________________________________

Legal Description of Property: ________________________________

Located at: ________________________________

Date of Execution: ________________________________

Grantee: ________________________________

Address of Grantee: ________________________________

City, State, Zip Code: ________________________________

This deed transfers the interest in the property described above to the Grantee upon the death of the Grantor.

The Grantor retains full rights to the property during their lifetime. The Grantee will receive ownership automatically without the need for probate.

Other Information:

- Grantor's Signature: ________________________________

- Date: ________________________________

The undersigned, Grantor, hereby declares this Transfer-on-Death Deed to be valid.

Witnesses (optional):

- __________________________ (Signature & Printed Name)

- __________________________ (Signature & Printed Name)

State of Illinois

County of ____________________________

Subscribed and sworn to before me this _____ day of ______________, 20__.

Notary Public: _____________________________________

My Commission Expires: ____________________________

Common mistakes

When filling out the Illinois Transfer-on-Death Deed form, individuals may encounter several common mistakes that can lead to complications in the future. One frequent error is failing to include the legal description of the property. This description is essential for clearly identifying the property being transferred. Without it, the deed may not be valid, and the intended beneficiaries could face difficulties claiming the property.

Another mistake often made is not properly signing the deed. In Illinois, the deed must be signed by the property owner in the presence of a witness. If the signature is missing or if the signing does not adhere to the legal requirements, the deed may be rendered invalid. It is crucial to ensure that all signatures are in place and witnessed correctly to avoid any issues later on.

People sometimes overlook the need to record the deed with the appropriate county recorder's office. Simply filling out the form is not sufficient. If the deed is not recorded, it may not be enforceable, and beneficiaries may not be able to claim the property after the owner's death. Timely recording helps protect the interests of all parties involved.

Additionally, individuals may neglect to update the deed after changes in circumstances. Life events such as marriage, divorce, or the birth of a child can affect the intended beneficiaries. If the deed is not revised to reflect these changes, it may lead to confusion or disputes among family members when the time comes to transfer ownership.

Another common oversight is failing to consider the implications of the transfer on taxes. While the Transfer-on-Death Deed allows for the transfer of property outside of probate, it does not exempt the beneficiaries from potential tax liabilities. Understanding these implications can help beneficiaries prepare for any financial responsibilities they may face after the transfer.

Finally, some individuals may not fully understand the nature of the transfer itself. A Transfer-on-Death Deed allows the property owner to retain full control of the property during their lifetime. However, misconceptions about this can lead to misunderstandings among family members. Clear communication about the intentions behind the deed can help prevent disputes and ensure that everyone is on the same page.

Dos and Don'ts

When filling out the Illinois Transfer-on-Death Deed form, it is important to follow certain guidelines to ensure the process goes smoothly. Below is a list of things to do and avoid.

- Do ensure that you have the correct property description. This includes the legal description of the property.

- Do include the names of all beneficiaries clearly. Each beneficiary should be identified to avoid confusion.

- Do sign the form in front of a notary public. This step is necessary for the deed to be valid.

- Do file the completed deed with the appropriate county recorder's office. This finalizes the process.

- Do keep a copy of the filed deed for your records. This can be important for future reference.

- Don't leave any sections of the form blank. Incomplete forms may be rejected.

- Don't forget to check for errors before submitting. Mistakes can lead to complications.

- Don't use informal language or abbreviations in the property description. Clarity is essential.

- Don't forget to consider the tax implications of transferring property upon death. Consulting a professional may be wise.

- Don't assume that verbal agreements will suffice. All details should be documented in the deed.

Other Transfer-on-Death Deed State Forms

Where Can I Get a Tod Form - This deed type enables a seamless transfer of real estate, ensuring that heirs receive property directly upon the owner's passing.

Florida Transfer on Death Deed Form - Can help avoid family conflicts over property inheritance.

By utilizing a Michigan Hold Harmless Agreement, parties can establish clarity and protection in their dealings. It is crucial to ensure that all potential liabilities are addressed, which not only fosters trust but also prevents disputes in the future. For comprehensive templates and further information regarding the legalities of these agreements, refer to TopTemplates.info.

Transfer on Death Deed Form Ohio - It’s essential to properly execute and file the deed to avoid any complications down the line.

Deed Upon Death Form - A Transfer-on-Death Deed can be a reliable tool for single or married individuals to facilitate their estate wishes.

Similar forms

- Last Will and Testament: Like a Transfer-on-Death Deed, a Last Will outlines how a person's assets will be distributed after their death. However, it goes through probate, while a Transfer-on-Death Deed allows for direct transfer without probate.

- Living Trust: A Living Trust serves to manage assets during a person's lifetime and distribute them after death. Both documents avoid probate, but a Living Trust requires more management and can be more complex to set up.

- Beneficiary Designation: Similar to a Transfer-on-Death Deed, beneficiary designations are used for certain assets like life insurance policies and retirement accounts. They allow assets to pass directly to a named individual without going through probate.

-

The Employment Verification form is essential for confirming an individual's work history, including job titles and dates of employment. For more information, you can refer to documentonline.org/blank-employment-verification/.

- Payable-on-Death (POD) Accounts: These bank accounts allow funds to be transferred directly to a designated beneficiary upon the account holder's death. Like the Transfer-on-Death Deed, POD accounts bypass probate.

- Joint Tenancy with Right of Survivorship: This property ownership arrangement allows co-owners to automatically inherit the property upon the death of one owner. It shares similarities with the Transfer-on-Death Deed in that it avoids probate.

- Life Estate Deed: A Life Estate Deed allows a person to live in a property for their lifetime, with the property passing to another upon their death. Both documents facilitate a transfer of property but differ in the rights retained during the owner's life.

- Community Property with Right of Survivorship: In community property states, this form allows spouses to own property together, ensuring that it automatically transfers to the surviving spouse upon death. It is similar in intent to the Transfer-on-Death Deed but applies specifically to married couples.