Printable Illinois Promissory Note Document

Form Preview Example

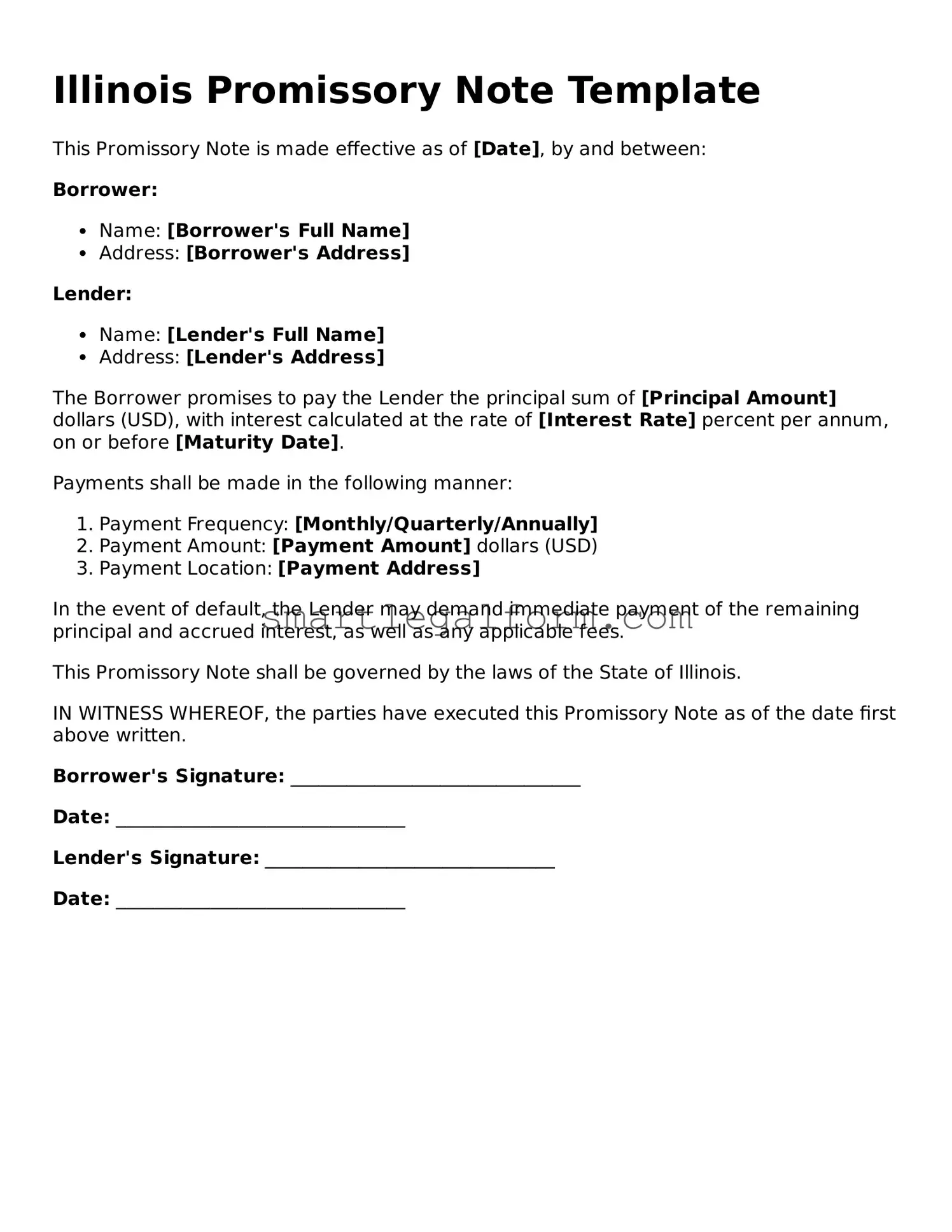

Illinois Promissory Note Template

This Promissory Note is made effective as of [Date], by and between:

Borrower:

- Name: [Borrower's Full Name]

- Address: [Borrower's Address]

Lender:

- Name: [Lender's Full Name]

- Address: [Lender's Address]

The Borrower promises to pay the Lender the principal sum of [Principal Amount] dollars (USD), with interest calculated at the rate of [Interest Rate] percent per annum, on or before [Maturity Date].

Payments shall be made in the following manner:

- Payment Frequency: [Monthly/Quarterly/Annually]

- Payment Amount: [Payment Amount] dollars (USD)

- Payment Location: [Payment Address]

In the event of default, the Lender may demand immediate payment of the remaining principal and accrued interest, as well as any applicable fees.

This Promissory Note shall be governed by the laws of the State of Illinois.

IN WITNESS WHEREOF, the parties have executed this Promissory Note as of the date first above written.

Borrower's Signature: _______________________________

Date: _______________________________

Lender's Signature: _______________________________

Date: _______________________________

Common mistakes

When filling out the Illinois Promissory Note form, individuals often encounter common pitfalls that can lead to confusion or even legal issues down the line. One frequent mistake is failing to clearly specify the loan amount. It may seem straightforward, but writing the amount in both numerical and written form is crucial. Omitting one of these can create ambiguity, which could lead to disputes about the actual amount owed.

Another mistake involves neglecting to include the interest rate. Many people assume that interest is implied or that it will be understood. However, failing to state the interest rate explicitly can result in misunderstandings. This omission may leave the borrower unsure of their repayment obligations, and it can complicate matters if the loan goes into default.

People also often overlook the importance of identifying the parties involved. The Promissory Note should clearly name both the lender and the borrower. This includes using full legal names and addresses. Incomplete or incorrect information can create challenges if legal action is required later. Ensuring that all parties are correctly identified helps to establish clear accountability.

Finally, many individuals forget to sign and date the document. A Promissory Note is not legally binding without the signatures of both parties. This oversight can render the entire agreement unenforceable. Taking the time to ensure that all necessary signatures are present is essential for protecting everyone’s interests.

Dos and Don'ts

When filling out the Illinois Promissory Note form, it is important to approach the task with care and attention to detail. Here are some guidelines to help you navigate the process effectively.

- Do: Clearly state the amount of money being borrowed. This should be a specific number to avoid confusion.

- Do: Include the names and addresses of both the borrower and the lender. Accurate identification is essential.

- Do: Specify the interest rate, if applicable. This should be clearly defined to ensure both parties understand the terms.

- Do: Outline the repayment schedule. Indicate when payments are due and the method of payment.

- Don't: Leave any sections blank. Incomplete forms can lead to misunderstandings or disputes later on.

- Don't: Use vague language. Be precise in your wording to avoid ambiguity in the agreement.

- Don't: Forget to sign and date the document. Both parties must provide their signatures to validate the note.

- Don't: Ignore state laws regarding interest rates. Make sure your terms comply with Illinois regulations to avoid legal issues.

By following these guidelines, you can help ensure that your Promissory Note is clear, legally binding, and fair to both parties involved.

Other Promissory Note State Forms

Ohio Promissory Note Requirements - Understanding the repayment terms is crucial for effective budgeting.

Create a Promissory Note - The note's enforceability can depend on its compliance with state laws.

Before entering into any agreements, it's crucial to understand the details and implications of a Hold Harmless Agreement form in Florida, as outlined by resources like TopTemplates.info. This legal document effectively shifts liability, ensuring that one party is not held responsible for certain losses, especially in scenarios involving risk, such as construction or special events, and provides protection against potential financial and legal repercussions.

Personal Loan Promissory Note - Promissory notes can be transferable, allowing lenders to sell the note to third parties.

Similar forms

- Loan Agreement: Like a promissory note, a loan agreement outlines the terms of a loan, including the amount borrowed, interest rate, and repayment schedule. However, it typically includes more detailed provisions regarding the rights and responsibilities of both the lender and the borrower.

- Mortgage: A mortgage is a specific type of promissory note secured by real property. It establishes the borrower's obligation to repay the loan while giving the lender a claim on the property if the borrower defaults.

- Employment Verification Form: This form is essential for validating a candidate's employment history and qualifications. For further details, you can refer to the official document at https://documentonline.org/blank-employment-verification-form.

- Credit Agreement: This document is similar in that it specifies the terms under which credit is extended. It details the amount of credit, the interest rate, and the repayment terms, much like a promissory note, but it often applies to ongoing credit relationships rather than a single loan.

- IOU (I Owe You): An IOU is a simpler form of a promissory note. It acknowledges a debt but may lack the formal structure and specific terms found in a promissory note, such as interest rates or repayment schedules.

- Personal Guarantee: This document involves an individual agreeing to be responsible for a debt if the primary borrower defaults. It shares the essence of a promissory note in that it creates a financial obligation, though it is more about guaranteeing another's debt rather than establishing a direct loan.

- Security Agreement: This document is related to a promissory note when a borrower pledges collateral to secure a loan. It details the collateral and the lender's rights to it, similar to how a promissory note outlines the borrower's obligation to repay.