Printable Illinois Loan Agreement Document

Form Preview Example

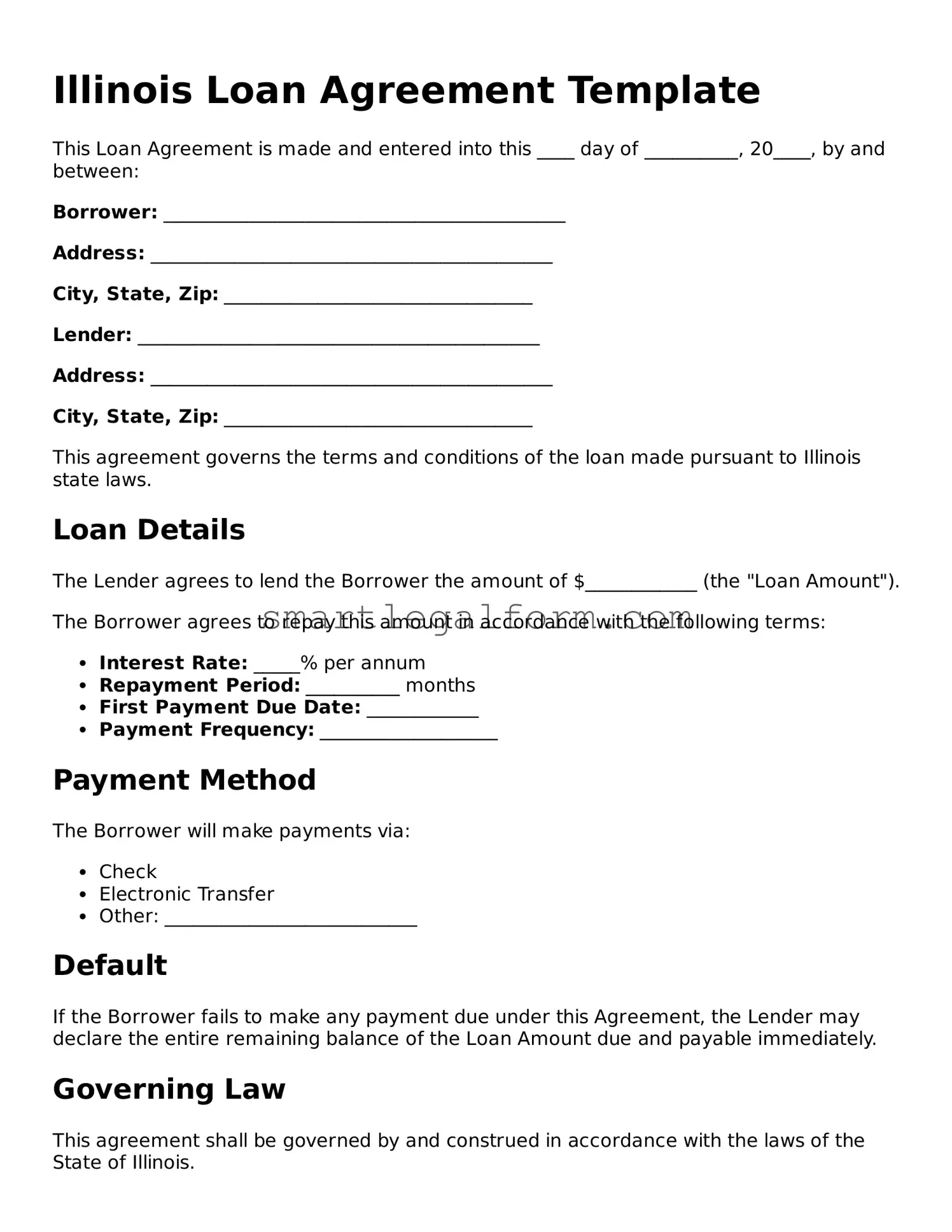

Illinois Loan Agreement Template

This Loan Agreement is made and entered into this ____ day of __________, 20____, by and between:

Borrower: ___________________________________________

Address: ___________________________________________

City, State, Zip: _________________________________

Lender: ___________________________________________

Address: ___________________________________________

City, State, Zip: _________________________________

This agreement governs the terms and conditions of the loan made pursuant to Illinois state laws.

Loan Details

The Lender agrees to lend the Borrower the amount of $____________ (the "Loan Amount").

The Borrower agrees to repay this amount in accordance with the following terms:

- Interest Rate: _____% per annum

- Repayment Period: __________ months

- First Payment Due Date: ____________

- Payment Frequency: ___________________

Payment Method

The Borrower will make payments via:

- Check

- Electronic Transfer

- Other: ___________________________

Default

If the Borrower fails to make any payment due under this Agreement, the Lender may declare the entire remaining balance of the Loan Amount due and payable immediately.

Governing Law

This agreement shall be governed by and construed in accordance with the laws of the State of Illinois.

Signatures

In witness whereof, the parties hereto have executed this Loan Agreement as of the date first above written.

Borrower's Signature: ___________________________

Date: _______________

Lender's Signature: ___________________________

Date: _______________

Common mistakes

Filling out the Illinois Loan Agreement form can be straightforward, but many people make common mistakes that can lead to confusion or even legal issues. One frequent error is not including all necessary parties. If there are multiple borrowers or lenders, it’s crucial to list everyone involved. Omitting a party can complicate the agreement and may lead to disputes later.

Another common mistake is failing to specify the loan amount clearly. It’s essential to write the amount in both numbers and words. This helps prevent misunderstandings about how much money is being borrowed. For instance, writing “$5,000” and “Five thousand dollars” ensures clarity.

People often overlook the importance of detailing the repayment terms. This includes the interest rate, payment schedule, and due dates. Not being specific can create confusion about when payments are due and how much is owed. Clear terms protect both the lender and the borrower.

Some individuals forget to include a late payment clause. This clause outlines what happens if a payment is missed. Without it, borrowers may not understand the consequences of late payments, which can lead to additional fees or penalties.

Additionally, failing to provide a clear purpose for the loan can be problematic. Stating the purpose helps both parties understand the context of the loan. It can also be helpful in case any disputes arise regarding how the funds are used.

Another mistake is neglecting to sign and date the agreement. Without signatures, the document may not hold up in court. Both parties must sign and date the form to make it legally binding.

Many people also forget to keep a copy of the signed agreement. It’s important for both parties to have a copy for their records. This ensures that everyone has access to the terms agreed upon, which can be helpful in case of misunderstandings.

Some individuals do not read the entire agreement before signing. It’s essential to understand every part of the document. Skimming through can lead to missing important details that could affect the loan.

Another mistake is not seeking legal advice when needed. If the loan amount is significant or the terms are complex, consulting with a legal expert can provide peace of mind. They can help clarify any confusing aspects and ensure that the agreement is fair.

Lastly, people sometimes ignore state-specific laws and regulations. Each state has its own rules regarding loan agreements. Being aware of these regulations can help ensure that the agreement complies with Illinois law.

Dos and Don'ts

When filling out the Illinois Loan Agreement form, it's important to pay attention to detail. Here’s a list of things you should and shouldn’t do to ensure a smooth process.

- Do read the entire form carefully before filling it out.

- Do provide accurate and complete information to avoid delays.

- Do double-check your numbers and calculations, especially for loan amounts.

- Do sign and date the form in the designated areas.

- Don’t leave any required fields blank; this can lead to rejection.

- Don’t use abbreviations or shorthand that could cause confusion.

- Don’t rush through the process; take your time to ensure everything is correct.

Following these guidelines can help you navigate the Illinois Loan Agreement form with ease and confidence.

Other Loan Agreement State Forms

Promissory Note Template New York - There may be a section for co-signers in the Loan Agreement.

To create an effective and appealing gift-giving experience, businesses can utilize a well-designed Gift Certificate form, which can be found at TopTemplates.info. This resource helps streamline the process of providing a thoughtful gift while promoting customer loyalty and engagement within the brand.

Promissory Note Template California - A Loan Agreement outlines the terms between a borrower and a lender.

Similar forms

The Loan Agreement form shares similarities with several other financial and legal documents. Each of these documents serves a specific purpose but often contains overlapping elements, such as terms, conditions, and obligations. Below is a list of eight documents that are comparable to a Loan Agreement:

- Promissory Note: This document outlines a borrower's promise to repay a loan, detailing the amount borrowed, interest rate, and repayment schedule, much like a Loan Agreement.

- Mortgage Agreement: Similar to a Loan Agreement, this document secures a loan with real property as collateral, establishing the terms of the loan and the rights of both parties.

- Employment Application PDF Form: This standardized document is essential for employers to gather vital information from job applicants, including personal details, work history, and qualifications. For more details, refer to the https://documentonline.org/blank-employment-application-pdf/.

- Security Agreement: This agreement provides a lender with a security interest in specific assets of the borrower, akin to the collateral provisions often found in Loan Agreements.

- Credit Agreement: This document outlines the terms under which credit is extended, including repayment terms and interest rates, paralleling the structure of a Loan Agreement.

- Lease Agreement: While primarily for renting property, it includes terms and obligations similar to those found in Loan Agreements, particularly regarding payment schedules and penalties for default.

- Partnership Agreement: This document governs the relationship between business partners, including financial contributions and profit-sharing, which can reflect similar financial arrangements as in a Loan Agreement.

- Installment Sale Agreement: In this type of agreement, the buyer makes payments over time to purchase an asset, resembling the payment structure of a Loan Agreement.

- Debt Settlement Agreement: This document outlines the terms under which a debtor will repay a portion of their debt, often including payment plans and conditions, similar to the repayment terms in a Loan Agreement.