Printable Illinois Last Will and Testament Document

Form Preview Example

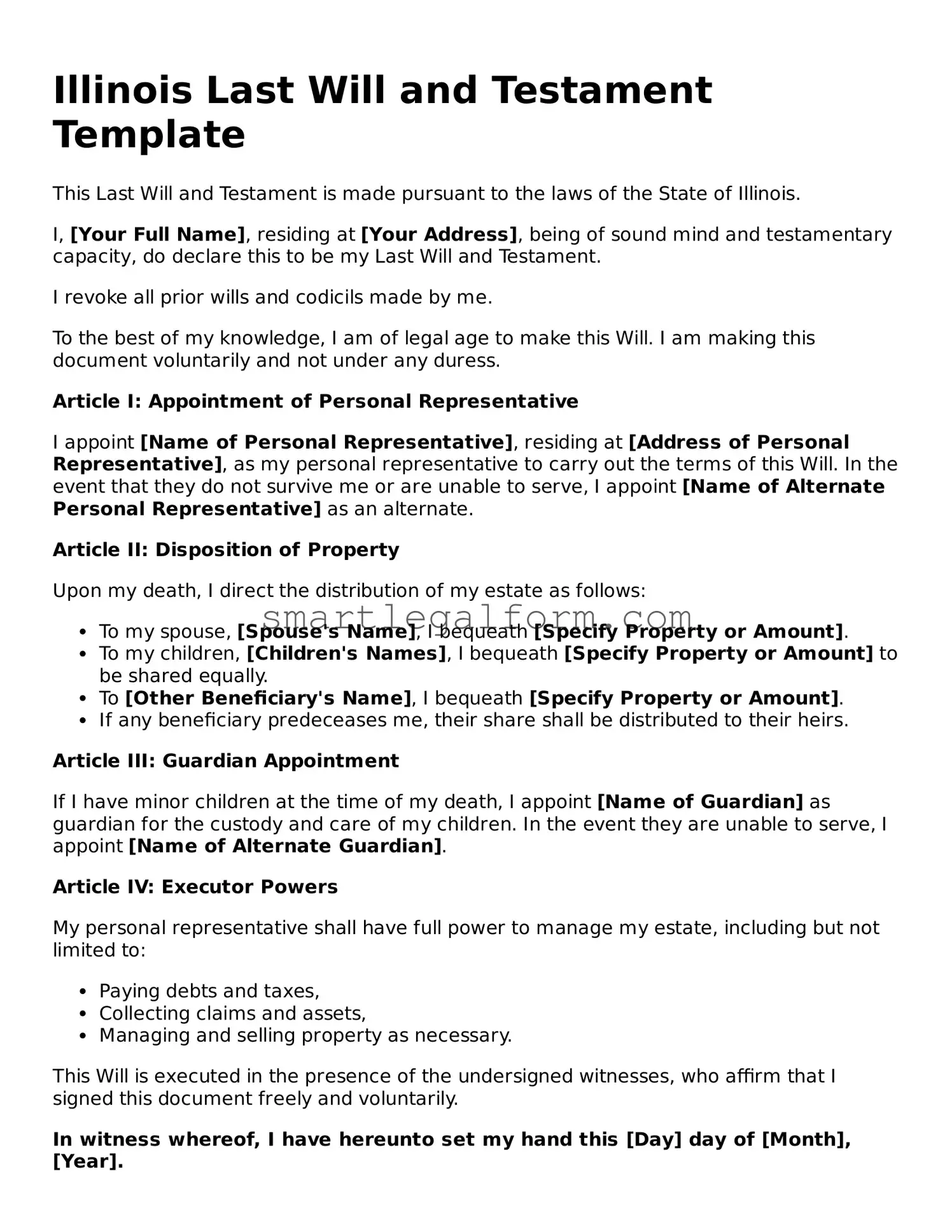

Illinois Last Will and Testament Template

This Last Will and Testament is made pursuant to the laws of the State of Illinois.

I, [Your Full Name], residing at [Your Address], being of sound mind and testamentary capacity, do declare this to be my Last Will and Testament.

I revoke all prior wills and codicils made by me.

To the best of my knowledge, I am of legal age to make this Will. I am making this document voluntarily and not under any duress.

Article I: Appointment of Personal Representative

I appoint [Name of Personal Representative], residing at [Address of Personal Representative], as my personal representative to carry out the terms of this Will. In the event that they do not survive me or are unable to serve, I appoint [Name of Alternate Personal Representative] as an alternate.

Article II: Disposition of Property

Upon my death, I direct the distribution of my estate as follows:

- To my spouse, [Spouse's Name], I bequeath [Specify Property or Amount].

- To my children, [Children's Names], I bequeath [Specify Property or Amount] to be shared equally.

- To [Other Beneficiary's Name], I bequeath [Specify Property or Amount].

- If any beneficiary predeceases me, their share shall be distributed to their heirs.

Article III: Guardian Appointment

If I have minor children at the time of my death, I appoint [Name of Guardian] as guardian for the custody and care of my children. In the event they are unable to serve, I appoint [Name of Alternate Guardian].

Article IV: Executor Powers

My personal representative shall have full power to manage my estate, including but not limited to:

- Paying debts and taxes,

- Collecting claims and assets,

- Managing and selling property as necessary.

This Will is executed in the presence of the undersigned witnesses, who affirm that I signed this document freely and voluntarily.

In witness whereof, I have hereunto set my hand this [Day] day of [Month], [Year].

[Your Signature]

Witnesses:

- [First Witness Name], residing at [Address].

- [Second Witness Name], residing at [Address].

Common mistakes

Filling out an Illinois Last Will and Testament form can be straightforward, but many people make common mistakes that can complicate the process. One of the most frequent errors is not properly identifying the beneficiaries. It’s crucial to clearly state who will inherit your assets. Vague descriptions or nicknames can lead to confusion and disputes later on.

Another mistake is failing to sign the will. In Illinois, a will must be signed by the testator, the person making the will. Without a signature, the document is not valid. Additionally, not having the required witnesses present during the signing can invalidate the will. Illinois law requires at least two witnesses who must also sign the document.

Some individuals overlook the importance of updating their wills. Life changes, such as marriage, divorce, or the birth of a child, should prompt a review and possible revision of the will. Not doing so can result in outdated information that does not reflect your current wishes.

People often forget to include specific bequests. If you want to leave particular items to certain individuals, clearly listing these items is essential. Otherwise, those items may be treated as part of the general estate and distributed according to the law, not your wishes.

Another common oversight is neglecting to appoint an executor. This person will be responsible for managing your estate after your passing. Without appointing someone, the court may have to choose an executor, which might not align with your preferences.

Some individuals make the mistake of not considering tax implications. Understanding how estate taxes work can help in planning your estate effectively. Failing to account for taxes may leave your beneficiaries with unexpected financial burdens.

In addition, using outdated or incorrect forms can be a significant issue. Always ensure you are using the most current version of the Illinois Last Will and Testament form. Legal requirements can change, and using an old form may lead to complications.

People also sometimes forget to include a residuary clause. This clause addresses what happens to any remaining assets not specifically mentioned in the will. Without it, those assets may not be distributed according to your wishes.

Lastly, many individuals do not seek legal advice. While filling out the form may seem simple, consulting with a legal professional can help ensure that everything is completed correctly and according to Illinois law. This step can prevent costly mistakes in the future.

Dos and Don'ts

When preparing to fill out the Illinois Last Will and Testament form, it is essential to approach the task with care. Here are five important do's and don'ts to consider:

- Do ensure that you are of sound mind and at least 18 years old when completing the form.

- Do clearly identify yourself and your beneficiaries to avoid any confusion.

- Do sign the will in the presence of at least two witnesses who are not beneficiaries.

- Don't use vague language; be specific about your wishes regarding the distribution of your assets.

- Don't forget to review the will periodically and update it as necessary to reflect changes in your life circumstances.

Other Last Will and Testament State Forms

Can I Create My Own Will - Can reaffirm existing estate plans and promote thorough planning for the distribution of wealth.

Will Template Texas - Many choose to create a Last Will with the help of legal professionals to ensure that it meets all necessary legal requirements.

Completing the USCIS I-589 form accurately not only helps applicants present their case effectively but also ensures that they are aware of the resources available to assist them through the process. For further guidance and templates, you can refer to https://toptemplates.info, which provides valuable information for those navigating the asylum application process.

Free Last Will and Testament Forms - Can serve as a foundation for discussions about family wealth and legacy planning.

Last Will and Testament Pennsylvania Pdf - Highlights the importance of planning ahead for unexpected life events.

Similar forms

- Living Will: A Living Will outlines your preferences for medical treatment in case you become unable to communicate your wishes. Similar to a Last Will and Testament, it reflects your desires, but it focuses specifically on healthcare decisions rather than the distribution of your assets after death.

- Florida Motor Vehicle Bill of Sale: This form is crucial for transferring ownership of a vehicle and includes vital details about the vehicle, seller, and buyer. For a comprehensive guide, visit https://documentonline.org/blank-florida-motor-vehicle-bill-of-sale/.

- Durable Power of Attorney: This document allows you to appoint someone to make financial or legal decisions on your behalf if you become incapacitated. Like a Last Will, it is a way to ensure that your wishes are respected, but it operates during your lifetime rather than after your death.

- Trust Agreement: A Trust Agreement establishes a fiduciary relationship where one party holds property for the benefit of another. While a Last Will dictates how your estate is handled after death, a Trust can manage your assets during your lifetime and beyond, providing flexibility in how your wishes are carried out.

- Advance Healthcare Directive: This document combines a Living Will and a Durable Power of Attorney for healthcare. It specifies your healthcare preferences and designates someone to make decisions on your behalf. Similar to a Last Will, it ensures your wishes are followed, focusing specifically on medical care.

- Codicil: A Codicil is a supplement to your Last Will and Testament that allows you to make changes or updates without creating an entirely new will. Just as a Last Will provides instructions for asset distribution, a Codicil modifies those instructions while maintaining the original document's validity.