Printable Illinois Deed in Lieu of Foreclosure Document

Form Preview Example

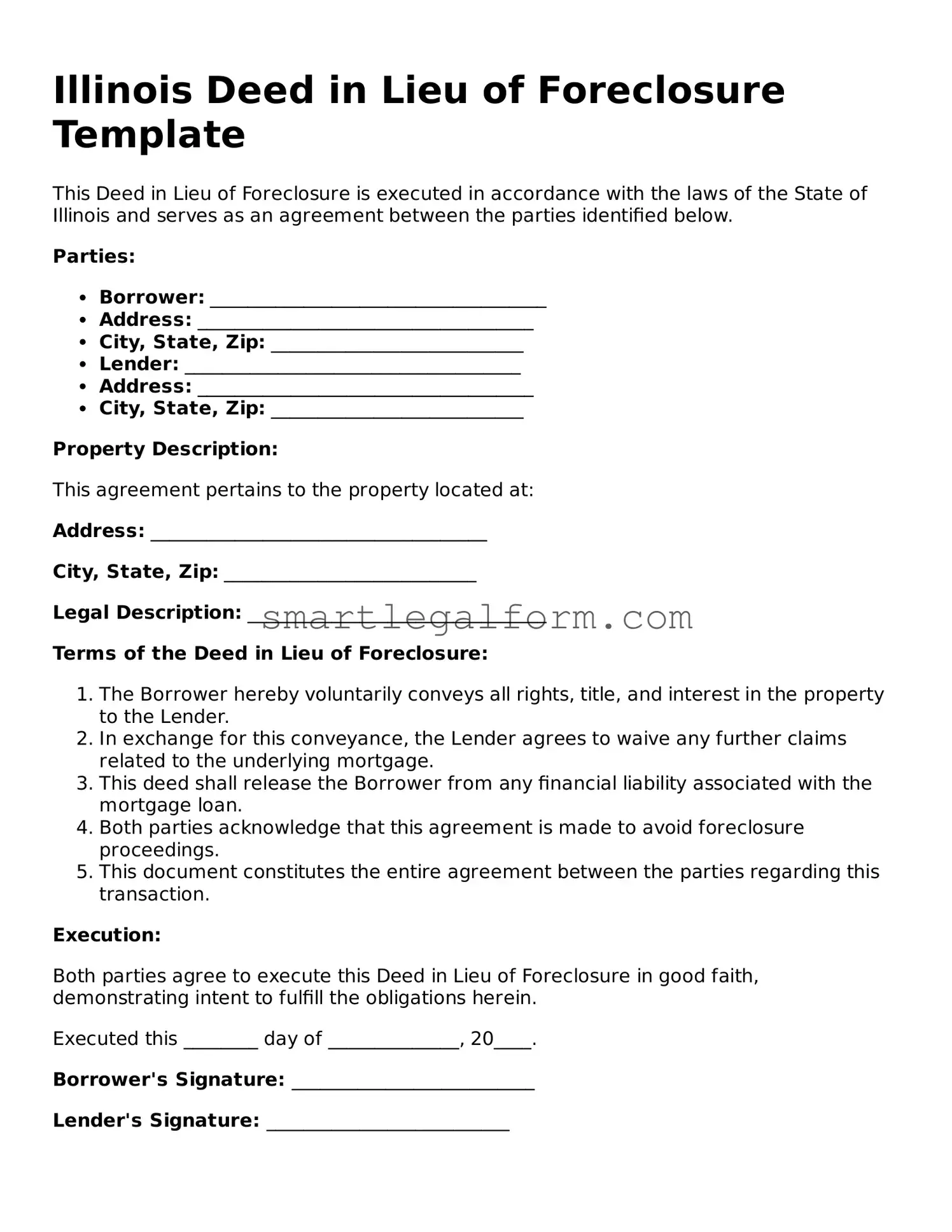

Illinois Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure is executed in accordance with the laws of the State of Illinois and serves as an agreement between the parties identified below.

Parties:

- Borrower: ____________________________________

- Address: ____________________________________

- City, State, Zip: ___________________________

- Lender: ____________________________________

- Address: ____________________________________

- City, State, Zip: ___________________________

Property Description:

This agreement pertains to the property located at:

Address: ____________________________________

City, State, Zip: ___________________________

Legal Description: ________________________________

Terms of the Deed in Lieu of Foreclosure:

- The Borrower hereby voluntarily conveys all rights, title, and interest in the property to the Lender.

- In exchange for this conveyance, the Lender agrees to waive any further claims related to the underlying mortgage.

- This deed shall release the Borrower from any financial liability associated with the mortgage loan.

- Both parties acknowledge that this agreement is made to avoid foreclosure proceedings.

- This document constitutes the entire agreement between the parties regarding this transaction.

Execution:

Both parties agree to execute this Deed in Lieu of Foreclosure in good faith, demonstrating intent to fulfill the obligations herein.

Executed this ________ day of ______________, 20____.

Borrower's Signature: __________________________

Lender's Signature: __________________________

It is advisable for both parties to seek independent legal counsel before signing this document to ensure understanding and compliance with the laws of Illinois.

This Deed in Lieu of Foreclosure is intended to reflect the mutual agreement reached between Borrower and Lender regarding the loan secured by the aforementioned property.

Common mistakes

Filling out the Illinois Deed in Lieu of Foreclosure form can be a complex process. Many individuals make critical mistakes that can lead to delays or even rejection of their application. One common error is failing to provide accurate property information. Ensure that the property address and legal description are correct. Any discrepancies can complicate the process.

Another frequent mistake is not obtaining the necessary signatures. All parties involved in the property must sign the deed. If a spouse or co-owner neglects to sign, the deed may be deemed invalid. This oversight can create significant setbacks.

People often overlook the importance of including a clear statement of intent. The form should explicitly state that the transfer is voluntary and intended to satisfy the mortgage obligation. Without this clarity, lenders may question the legitimacy of the transfer.

Not providing the lender with a copy of the completed form is another common error. Submit the deed to the lender along with any required documentation. Failure to do so may result in the lender not recognizing the deed, which can lead to further complications.

Some individuals mistakenly believe that a notary is not required. In Illinois, a notary public must witness the signing of the deed. Neglecting this step can render the document unenforceable.

People also often forget to check for outstanding liens on the property. If there are existing liens, they must be addressed before the deed can be executed. Ignoring this can lead to legal issues down the line.

Inadequate communication with the lender is another pitfall. It's essential to keep the lender informed throughout the process. A lack of communication can create misunderstandings and lead to delays in processing the deed.

Lastly, individuals sometimes fail to keep copies of all documents submitted. Retaining a copy of the deed and any correspondence with the lender is crucial for your records. This practice ensures that you have proof of submission should any issues arise.

Dos and Don'ts

When filling out the Illinois Deed in Lieu of Foreclosure form, it's important to approach the process with care. Here are some essential dos and don'ts to keep in mind:

- Do ensure that all information is accurate and complete. Double-check names, addresses, and property details.

- Do consult with a legal professional if you have any questions or uncertainties about the form.

- Don't rush through the process. Taking your time can help prevent mistakes that could delay the deed's acceptance.

- Don't forget to keep copies of all documents submitted for your records. This can be helpful in case of future disputes.

Other Deed in Lieu of Foreclosure State Forms

Deed in Lieu of Foreclosure Ny - This form generally results in a cleaner transfer of property than a foreclosure sale, which can be messy.

The Employment Application PDF form serves as a crucial instrument for employers to gather necessary information from prospective employees, facilitating a clear and efficient hiring process. By filling out this form, applicants can provide key details about their background and skills, which can be accessed in full at https://documentonline.org/blank-employment-application-pdf/, ensuring that all required information is readily available for review.

What Does an Arizona Homeowner Lose When Choosing to Use Deed in Lieu of Foreclosure? - Homeowners considering this option should be proactive to maximize potential benefits during negotiations.

Similar forms

- Mortgage Satisfaction Document: This document signifies that a mortgage has been fully paid off. Like a Deed in Lieu of Foreclosure, it releases the borrower from the obligation of the loan and clears the property title.

- Short Sale Agreement: In a short sale, the lender agrees to accept less than the total amount owed on the mortgage. Similar to a Deed in Lieu of Foreclosure, it allows the homeowner to avoid foreclosure and settle the debt.

- Loan Modification Agreement: This document alters the terms of an existing mortgage to make payments more manageable. Both documents aim to prevent foreclosure and provide relief to the borrower.

- Release of Liability: This document releases a borrower from personal liability for a debt. Like a Deed in Lieu of Foreclosure, it helps the borrower avoid further financial obligations related to the property.

- Hold Harmless Agreement: A Hold Harmless Agreement in California is essential for protecting parties from legal liability in various situations. For a more in-depth understanding, visit TopTemplates.info.

- Quitclaim Deed: A quitclaim deed transfers any ownership interest in a property without guaranteeing that the title is clear. It can be used to transfer property ownership in a manner similar to a Deed in Lieu of Foreclosure.

- Forebearance Agreement: This agreement allows a borrower to temporarily pause or reduce mortgage payments. Both documents serve as alternatives to foreclosure, providing the borrower with options to manage their financial situation.

- Deed of Trust: This document secures a loan with real property. Like a Deed in Lieu of Foreclosure, it involves the transfer of property rights, though it is typically used at the beginning of a loan rather than as a solution to foreclosure.

- Property Settlement Agreement: Often used in divorce proceedings, this agreement divides property between parties. Similar to a Deed in Lieu of Foreclosure, it can involve the transfer of property ownership to resolve financial obligations.

- Bankruptcy Filing: Filing for bankruptcy can halt foreclosure proceedings and provide a structured way to deal with debts. Both processes aim to relieve financial pressure on the borrower.

- Settlement Statement: This document outlines the financial details of a real estate transaction. While it typically relates to the sale of a property, it shares similarities with the Deed in Lieu of Foreclosure in terms of finalizing financial obligations related to a property.