Printable Illinois Articles of Incorporation Document

Form Preview Example

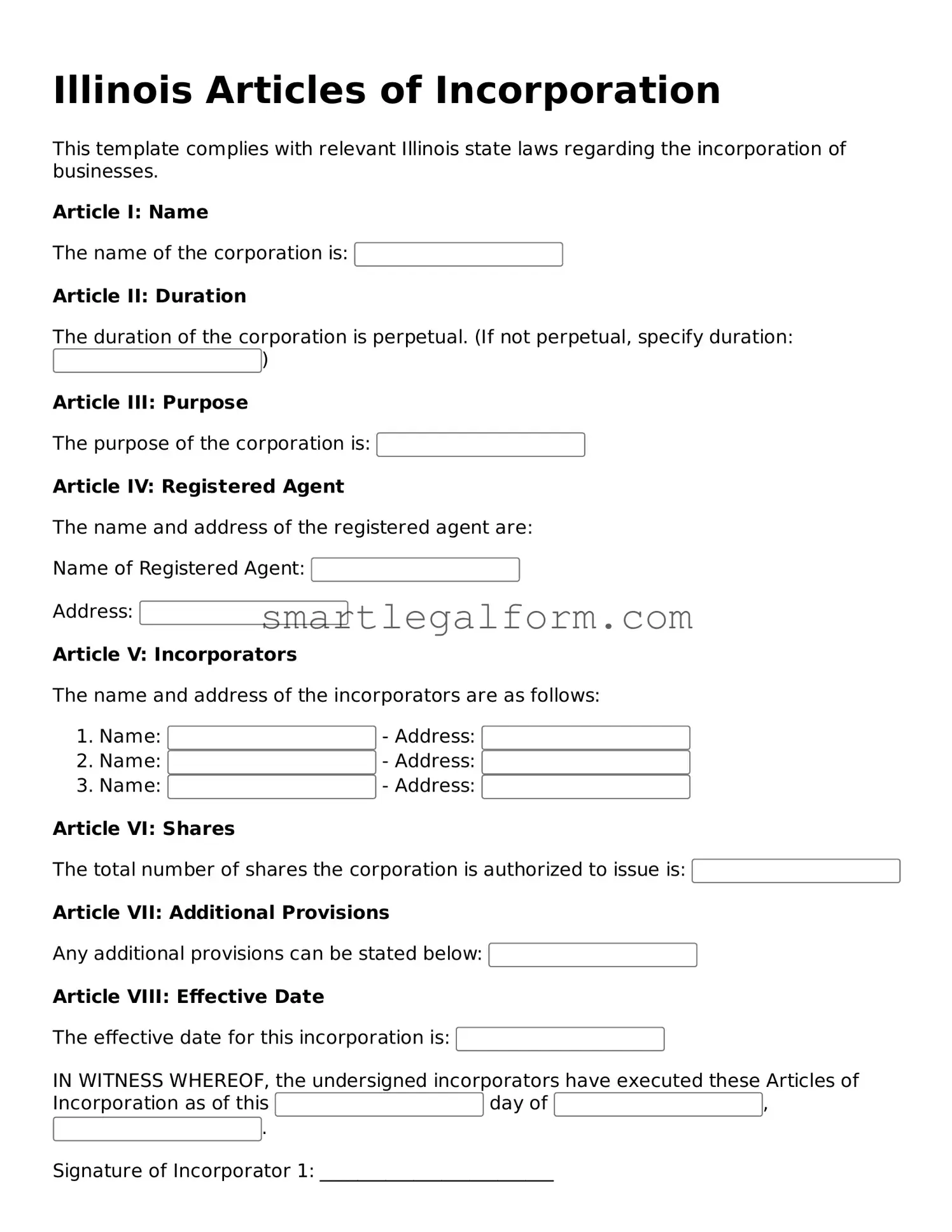

Illinois Articles of Incorporation

This template complies with relevant Illinois state laws regarding the incorporation of businesses.

Article I: Name

The name of the corporation is:

Article II: Duration

The duration of the corporation is perpetual. (If not perpetual, specify duration: )

Article III: Purpose

The purpose of the corporation is:

Article IV: Registered Agent

The name and address of the registered agent are:

Name of Registered Agent:

Address:

Article V: Incorporators

The name and address of the incorporators are as follows:

- Name: - Address:

- Name: - Address:

- Name: - Address:

Article VI: Shares

The total number of shares the corporation is authorized to issue is:

Article VII: Additional Provisions

Any additional provisions can be stated below:

Article VIII: Effective Date

The effective date for this incorporation is:

IN WITNESS WHEREOF, the undersigned incorporators have executed these Articles of Incorporation as of this day of , .

Signature of Incorporator 1: _________________________

Signature of Incorporator 2: _________________________

Signature of Incorporator 3: _________________________

Common mistakes

Filling out the Illinois Articles of Incorporation form is a crucial step in establishing a corporation. However, many individuals encounter common pitfalls during this process. One frequent mistake is failing to choose an appropriate name for the corporation. The name must be unique and not already in use by another entity in Illinois. Additionally, it should include a designation such as "Corporation," "Incorporated," or an abbreviation like "Inc." Neglecting these requirements can lead to delays or rejections.

Another common error involves incorrect or incomplete information regarding the registered agent. The registered agent is responsible for receiving legal documents on behalf of the corporation. It is essential to provide the correct name and address of the registered agent. If this information is inaccurate, it may result in missed legal notifications, which could have serious consequences.

Many individuals also overlook the necessity of including the corporation's purpose. The Articles of Incorporation must specify the business activities the corporation intends to engage in. A vague or overly broad description can lead to complications later on. It is advisable to be clear and concise while ensuring that the purpose aligns with the business's goals.

Some people make the mistake of not including the number of shares the corporation is authorized to issue. This information is crucial, as it outlines the ownership structure of the corporation. Failing to specify this can lead to confusion regarding ownership rights and responsibilities.

Another frequent oversight is neglecting to sign and date the Articles of Incorporation. The form must be signed by the incorporators, and the date of signing should be clearly indicated. Without proper signatures, the form may be deemed invalid, causing delays in the incorporation process.

Additionally, individuals sometimes forget to file the Articles of Incorporation with the appropriate state office. Simply completing the form is not enough; it must be submitted along with the required filing fee. Failure to do so will result in the corporation not being legally recognized.

Some filers also miscalculate the filing fees. The required fee can vary based on several factors, including the type of corporation being formed. It is essential to verify the current fee structure before submitting the form to avoid any financial discrepancies.

Lastly, individuals may not keep a copy of the submitted Articles of Incorporation. Retaining a copy is important for future reference and for maintaining accurate records. Without this documentation, it may be challenging to prove the corporation's existence or to access important information later on.

Dos and Don'ts

When filling out the Illinois Articles of Incorporation form, it is essential to follow specific guidelines to ensure a smooth process. Below are some important dos and don'ts to keep in mind.

- Do provide accurate and complete information. Ensure that all sections of the form are filled out correctly.

- Do include the name of your corporation. Make sure it complies with Illinois naming requirements.

- Do designate a registered agent. This individual or business must have a physical address in Illinois.

- Do specify the purpose of your corporation. Be clear and concise about what your business will do.

- Don't leave any sections blank. Incomplete forms may lead to delays or rejection.

- Don't use prohibited words in your corporation's name. Familiarize yourself with the restrictions to avoid issues.

- Don't forget to sign and date the form. An unsigned form will not be accepted.

By adhering to these guidelines, you can help ensure that your incorporation process in Illinois goes smoothly. Take your time, review your entries, and seek assistance if needed.

Other Articles of Incorporation State Forms

Pa Articles of Amendment - Shareholders are often listed in the Articles, indicating their stake in the company.

Sunbiz Articles of Incorporation - Defines specific rights and responsibilities of shareholders.

Similar forms

Bylaws: Bylaws serve as the internal governing document for a corporation. While the Articles of Incorporation establish the corporation's existence and basic structure, bylaws outline the rules for managing the corporation, including the roles of officers and procedures for meetings.

Operating Agreement: This document is particularly relevant for limited liability companies (LLCs). Similar to the Articles of Incorporation, it defines the structure of the business and the responsibilities of its members. Both documents set the foundation for how the entity will operate and be governed.

Certificate of Incorporation: In some jurisdictions, this term is used interchangeably with Articles of Incorporation. It serves the same purpose of formally establishing a corporation and includes essential details such as the company name, purpose, and registered agent.

Partnership Agreement: For partnerships, this agreement outlines the terms of the partnership, including profit-sharing, responsibilities, and decision-making processes. Like the Articles of Incorporation, it is crucial for defining the structure and governance of the business entity.

Business Plan: While not a legal document, a business plan outlines the vision, strategy, and operational plans for a business. It complements the Articles of Incorporation by providing a roadmap for how the corporation intends to achieve its goals and objectives.