Free Goodwill donation receipt Form

Form Preview Example

Goodwill |

1516 Magnavox Way |

|

Toll Free: |

||

|

Fort Wayne, IN 46804 |

|

|

Phone: (260) |

|

Industries of Northeast Indiana, Inc. |

FAX: (260) |

|

TTY: (260) |

||

|

||

|

www.fwgoodwill.org |

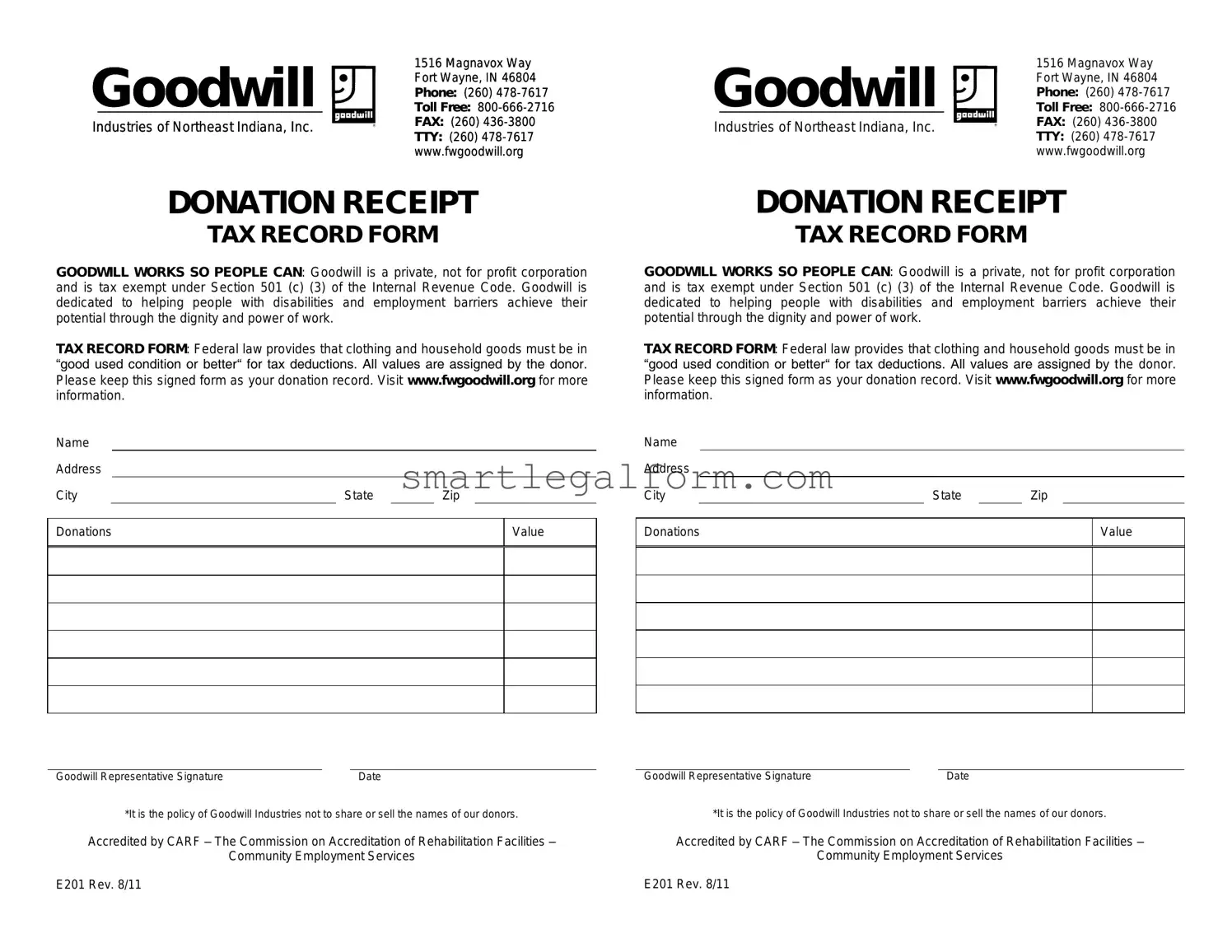

DONATION RECEIPT

TAX RECORD FORM

GOODWILL WORKS SO PEOPLE CAN: Goodwill is a private, not for profit corporation and is tax exempt under Section 501 (c) (3) of the Internal Revenue Code. Goodwill is dedicated to helping people with disabilities and employment barriers achieve their potential through the dignity and power of work.

TAX RECORD FORM: Federal law provides that clothing and household goods must be in “good used condition or better“ for tax deductions. All values are assigned by the donor. Please keep this signed form as your donation record. Visit www.fwgoodwill.org for more information.

Name

Address

City |

|

State |

|

Zip |

|

|

|

|

|

|

|

|

|

Donations |

|

|

|

|

Value |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Goodwill Representative Signature |

|

Date |

*It is the policy of Goodwill Industries not to share or sell the names of our donors.

Accredited by CARF – The Commission on Accreditation of Rehabilitation Facilities –

Community Employment Services

E201 Rev. 8/11

Goodwill |

1516 Magnavox Way |

|

Toll Free: |

||

|

Fort Wayne, IN 46804 |

|

|

Phone: (260) |

|

Industries of Northeast Indiana, Inc. |

FAX: (260) |

|

TTY: (260) |

||

|

||

|

www.fwgoodwill.org |

DONATION RECEIPT

TAX RECORD FORM

GOODWILL WORKS SO PEOPLE CAN: Goodwill is a private, not for profit corporation and is tax exempt under Section 501 (c) (3) of the Internal Revenue Code. Goodwill is dedicated to helping people with disabilities and employment barriers achieve their potential through the dignity and power of work.

TAX RECORD FORM: Federal law provides that clothing and household goods must be in “good used condition or better“ for tax deductions. All values are assigned by the donor. Please keep this signed form as your donation record. Visit www.fwgoodwill.org for more information.

Name

Address

City |

|

State |

|

Zip |

|

|

|

|

|

|

|

|

|

Donations |

|

|

|

|

Value |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Goodwill Representative Signature |

|

Date |

*It is the policy of Goodwill Industries not to share or sell the names of our donors.

Accredited by CARF – The Commission on Accreditation of Rehabilitation Facilities –

Community Employment Services

E201 Rev. 8/11

Common mistakes

When filling out the Goodwill donation receipt form, many individuals make common mistakes that can lead to confusion or issues later. One frequent error is failing to provide a complete description of the donated items. Without a clear list, it becomes challenging to assess the value of the donation, which can complicate tax deductions.

Another mistake is neglecting to estimate the value of the items. Donors often skip this step, thinking it’s unnecessary. However, having a reasonable estimate helps both the donor and Goodwill understand the donation's worth. Inaccurate or missing values can lead to complications during tax season.

Some people forget to sign the receipt. A signature is essential as it validates the donation. Without it, the receipt may not be accepted for tax purposes, leading to frustration for the donor when trying to claim deductions.

Additionally, individuals sometimes misplace the receipt after filling it out. Keeping the receipt in a safe location is crucial for record-keeping. Losing it can mean losing out on potential tax benefits, which can be a significant oversight.

Another common issue arises when donors fail to keep a copy of the receipt. While Goodwill provides a receipt, having a personal copy ensures that the donor has proof of the donation for their records. This can be particularly important if questions arise later regarding the donation.

People also occasionally overlook the date of the donation. This detail is vital for tax records. Without a clear date, it may be difficult to establish the timing of the donation, which can affect tax filings.

Some donors make the mistake of not checking the form for accuracy before submitting it. Errors in the information provided can lead to complications later. Taking a moment to review the form can prevent these issues.

Another mistake involves not understanding the difference between a donation receipt and a sales receipt. A donation receipt is for tax purposes, while a sales receipt is for purchases. Misunderstanding this can lead to confusion about what is required for tax deductions.

Lastly, individuals sometimes underestimate the importance of documenting their donations. Keeping detailed records, including photos and descriptions, can provide additional support if needed for tax purposes. This practice can save time and hassle in the long run.

Dos and Don'ts

When filling out a Goodwill donation receipt form, it's important to ensure that all information is accurate and complete. Here are some key dos and don'ts to keep in mind:

- Do provide a detailed description of the items you are donating. This helps both you and Goodwill track the donation accurately.

- Do include your name and contact information. This ensures that Goodwill can reach you if needed.

- Do keep a copy of the receipt for your records. This can be useful for tax purposes.

- Do check the form for completeness before submitting it. Make sure all necessary fields are filled out.

- Don't underestimate the value of your items. Be honest about their condition and worth.

- Don't forget to date the receipt. This is important for record-keeping and tax deductions.

- Don't leave any fields blank, especially those that are required. Incomplete forms can lead to issues later.

- Don't ignore the guidelines provided by Goodwill. Following their instructions can make the process smoother.

Other PDF Documents

Ca Marriage Records - The certificate must be obtained from the appropriate registry office following the ceremony.

The Employment Verification form is a crucial document used by employers to confirm the employment status of an individual, and as a resource, you can access it at documentonline.org/blank-employment-verification/. This form serves as a means of validating a person's work history, including job titles, dates of employment, and responsibilities. Understanding its purpose can benefit both job seekers and employers alike.

Western Union Receipt - Western Union offers quick and convenient money transfer services.

Roof Condition Certification Form - Contractors should follow up with clients to reinforce trust.

Similar forms

The Goodwill donation receipt form serves as proof of a charitable contribution, but it shares similarities with several other documents. Below is a list of ten documents that are comparable to the Goodwill donation receipt form, highlighting their similarities:

- Charitable Contribution Receipt: Like the Goodwill receipt, this document provides a record of a donation made to a charity, detailing the items donated and their estimated value.

- Tax Deduction Receipt: This receipt confirms a donation for tax purposes, similar to the Goodwill form, which can be used to claim deductions on income tax returns.

- Donation Acknowledgment Letter: Charities often send these letters to donors, acknowledging their contributions, much like how Goodwill provides a receipt for donations.

- Nonprofit Donation Form: This form captures donor information and details about the donation, paralleling the Goodwill receipt in its purpose of documenting charitable giving.

- Gift-in-Kind Receipt: This document is issued for non-cash donations, similar to the Goodwill receipt, which is often used for items like clothing and household goods.

Hold Harmless Agreement: This crucial document serves to protect individuals or entities from legal liability, particularly in Texas. It is essential in high-risk scenarios, outlining the responsibilities associated with various activities. For more information, visit TopTemplates.info.

- Volunteer Hours Receipt: Some organizations provide receipts for volunteer hours contributed, similar to how Goodwill receipts recognize the value of donated items.

- Event Sponsorship Receipt: When individuals sponsor events, they receive receipts that confirm their financial support, akin to the Goodwill donation receipt.

- Matching Gift Form: This form is used to verify donations made by employees for matching contributions, similar to how Goodwill documents individual donations.

- In-Kind Donation Agreement: This document outlines the terms of a non-cash donation, much like the Goodwill receipt that details what was donated.

- Endowment Fund Contribution Receipt: Similar to the Goodwill receipt, this document acknowledges contributions made to an endowment fund for tax purposes.

Each of these documents serves to verify and acknowledge contributions, helping donors maintain accurate records for tax and personal purposes.