Free Gift Letter Form

Form Preview Example

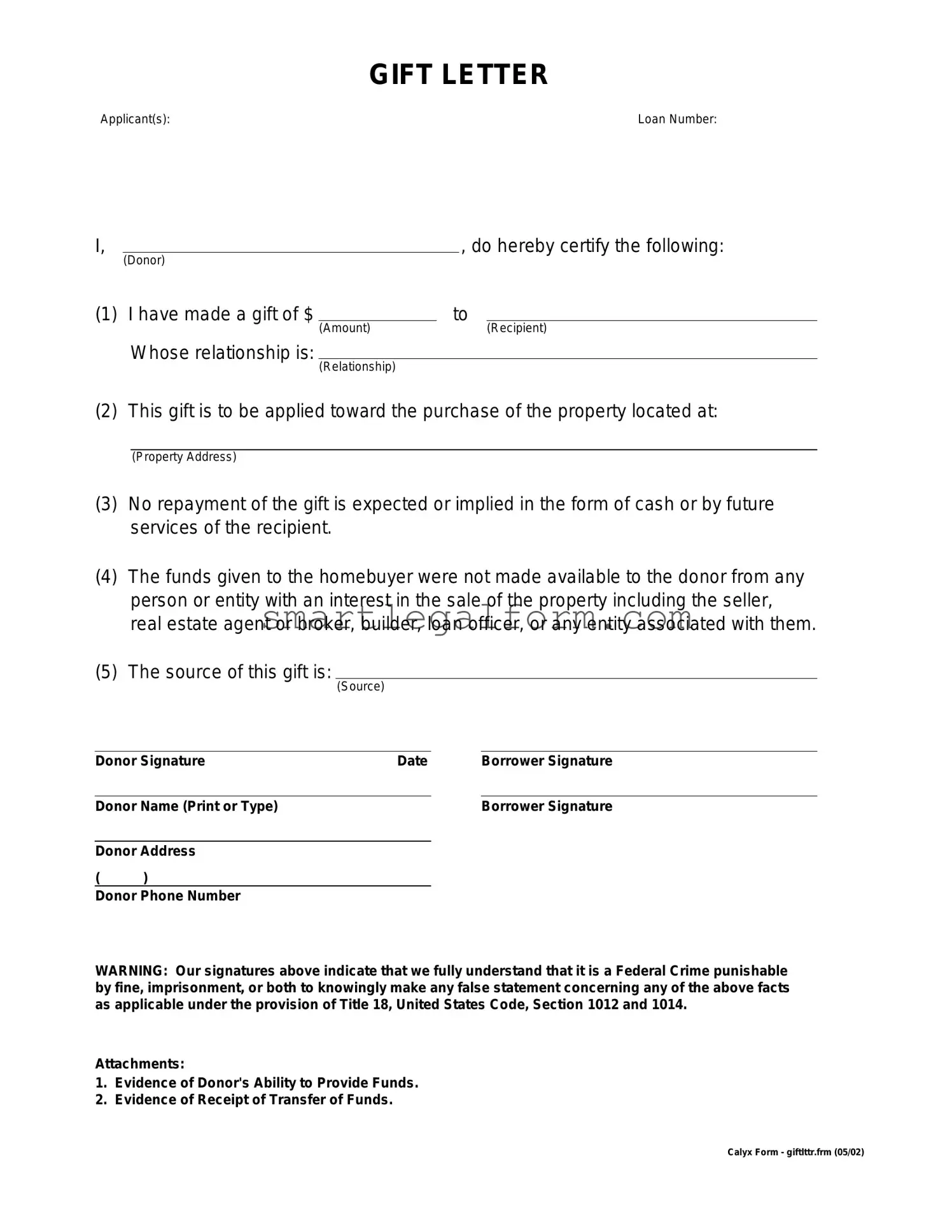

GIFT LETTER

Applicant(s): |

Loan Number: |

I, |

|

|

, do hereby certify the following: |

||

|

(Donor) |

|

|

|

|

(1) I have made a gift of $ |

|

to |

|

||

|

|

(Amount) |

|

|

(Recipient) |

|

Whose relationship is: |

|

|

|

|

|

|

(Relationship) |

|

|

|

(2) This gift is to be applied toward the purchase of the property located at:

(Property Address)

(3)No repayment of the gift is expected or implied in the form of cash or by future services of the recipient.

(4)The funds given to the homebuyer were not made available to the donor from any person or entity with an interest in the sale of the property including the seller, real estate agent or broker, builder, loan officer, or any entity associated with them.

(5)The source of this gift is:

(Source)

Donor Signature |

Date |

Borrower Signature |

||

|

|

|

|

|

Donor Name (Print or Type) |

|

|

Borrower Signature |

|

|

|

|

|

|

Donor Address |

|

|

|

|

( |

) |

|

|

|

Donor Phone Number

WARNING: Our signatures above indicate that we fully understand that it is a Federal Crime punishable by fine, imprisonment, or both to knowingly make any false statement concerning any of the above facts as applicable under the provision of Title 18, United States Code, Section 1012 and 1014.

Attachments:

1.Evidence of Donor's Ability to Provide Funds.

2.Evidence of Receipt of Transfer of Funds.

Calyx Form - giftlttr.frm (05/02)

Common mistakes

When it comes to filling out a Gift Letter form, many people unknowingly make mistakes that can lead to delays or complications in their financial transactions. One common error is providing insufficient information about the donor. It’s crucial to include the donor's full name, address, and contact information. Omitting any of these details can raise questions about the legitimacy of the gift.

Another frequent mistake involves the relationship between the donor and the recipient. Some individuals may neglect to specify how they are connected. This relationship is important for lenders to understand the context of the gift, especially when it comes to mortgages or loans. A clear explanation can prevent misunderstandings later on.

Many people also fail to indicate the exact amount of the gift. It might seem straightforward, but leaving this blank or providing an incorrect figure can lead to complications. Lenders need to know the precise amount to assess the financial situation accurately. Furthermore, it’s essential to ensure that the amount aligns with any relevant documentation, such as bank statements.

Additionally, some individuals overlook the need for a signature from the donor. A Gift Letter is not just a formality; it serves as a legal document. Without the donor's signature, the letter may not hold up if questioned. This oversight can create unnecessary hurdles in the gifting process.

Another mistake is failing to date the letter. A Gift Letter should clearly indicate when the gift was made or is intended to be made. This date is important for record-keeping and can help clarify the timing of the transaction, especially if the funds are being used for a specific purpose, like a home purchase.

People sometimes forget to include a statement confirming that the gift does not need to be repaid. This assurance is vital for lenders, as it distinguishes a gift from a loan. Without this clarification, there could be confusion regarding the nature of the funds, potentially jeopardizing the approval of a loan application.

Moreover, some individuals may not provide adequate context for the gift. Including a brief explanation of the purpose of the gift can be beneficial. Whether it’s for a down payment on a house or assistance with educational expenses, context helps lenders understand the financial dynamics at play.

Another common oversight is not reviewing the entire form for accuracy. Typos or incorrect information can lead to delays or even rejection of the application. Taking the time to double-check every detail can save a lot of trouble down the line.

Lastly, people often neglect to keep a copy of the Gift Letter for their records. This documentation can be invaluable for future reference, especially if questions arise later about the source of funds. Keeping a copy ensures that both the donor and recipient have a clear understanding of the transaction.

In conclusion, filling out a Gift Letter form may seem simple, but it requires careful attention to detail. By avoiding these common mistakes, individuals can ensure a smoother process and help facilitate their financial transactions.

Dos and Don'ts

When filling out a Gift Letter form, it is important to follow certain guidelines to ensure accuracy and compliance. Here are some do's and don'ts to consider:

- Do provide complete and accurate information about the gift giver and recipient.

- Do specify the amount of the gift clearly.

- Do include a statement confirming that the gift is not a loan.

- Do sign and date the form to validate it.

- Don't omit any required details; missing information can delay processing.

- Don't use vague language; be clear about the purpose of the gift.

Other PDF Documents

How to Check Your Pay Stub - View detailed information about employee benefits contributions.

The California Power of Attorney form is a legal document that allows a person to appoint another individual to make decisions on their behalf. This power can cover a range of matters, including financial, legal, and health-related decisions. For more details about creating this essential document, you can visit TopTemplates.info, as it becomes a crucial tool for planning and managing affairs when someone cannot do so themselves.

How to Get a No Trespass Order - Officially restricts access to the marked property.

Bbb File a Complaint - Warranty service was denied unjustly.

Similar forms

The Gift Letter form is an important document often used in financial transactions, particularly in real estate. It serves as a declaration that funds given to a buyer are a gift and not a loan. Here are seven documents that share similarities with the Gift Letter form:

- Affidavit of Support: This document is used to confirm that an individual is providing financial assistance to another person, typically in immigration cases. Like the Gift Letter, it outlines the nature of the support and clarifies that it is not a loan.

- Loan Agreement: While a Loan Agreement specifies terms for repayment, it also serves to document the transfer of funds. Both documents outline the financial arrangement, but the Gift Letter emphasizes that no repayment is expected.

- Promissory Note: This is a written promise to pay a specified amount of money. Similar to the Gift Letter, it involves a financial transaction, but it obligates the borrower to repay the lender, whereas the Gift Letter does not.

- Motor Vehicle Bill of Sale: This form is crucial for the transfer of ownership in Florida. It includes key information about the vehicle and the parties involved, similar to a Gift Letter's role in validating financial exchanges, providing insights on this form can be found at documentonline.org/blank-florida-motor-vehicle-bill-of-sale.

- Financial Statement: A Financial Statement provides an overview of an individual’s financial situation. Like the Gift Letter, it can be used to demonstrate financial capability, but the Gift Letter specifically focuses on the source of gifted funds.

- Bank Statement: This document shows transactions and balances in a bank account. Both the Bank Statement and Gift Letter can verify the source of funds, but the Gift Letter specifically identifies the funds as a gift.

- Letter of Intent: This document outlines the intentions of parties involved in a transaction. Similar to the Gift Letter, it sets the stage for a financial arrangement, but it may not specifically address the nature of the funds.

- Settlement Statement: Often used in real estate transactions, this document details the costs associated with closing a deal. While it provides a comprehensive view of financial obligations, the Gift Letter focuses solely on the gift aspect of the funds.