Attorney-Approved Gift Deed Form

Gift Deed for Particular US States

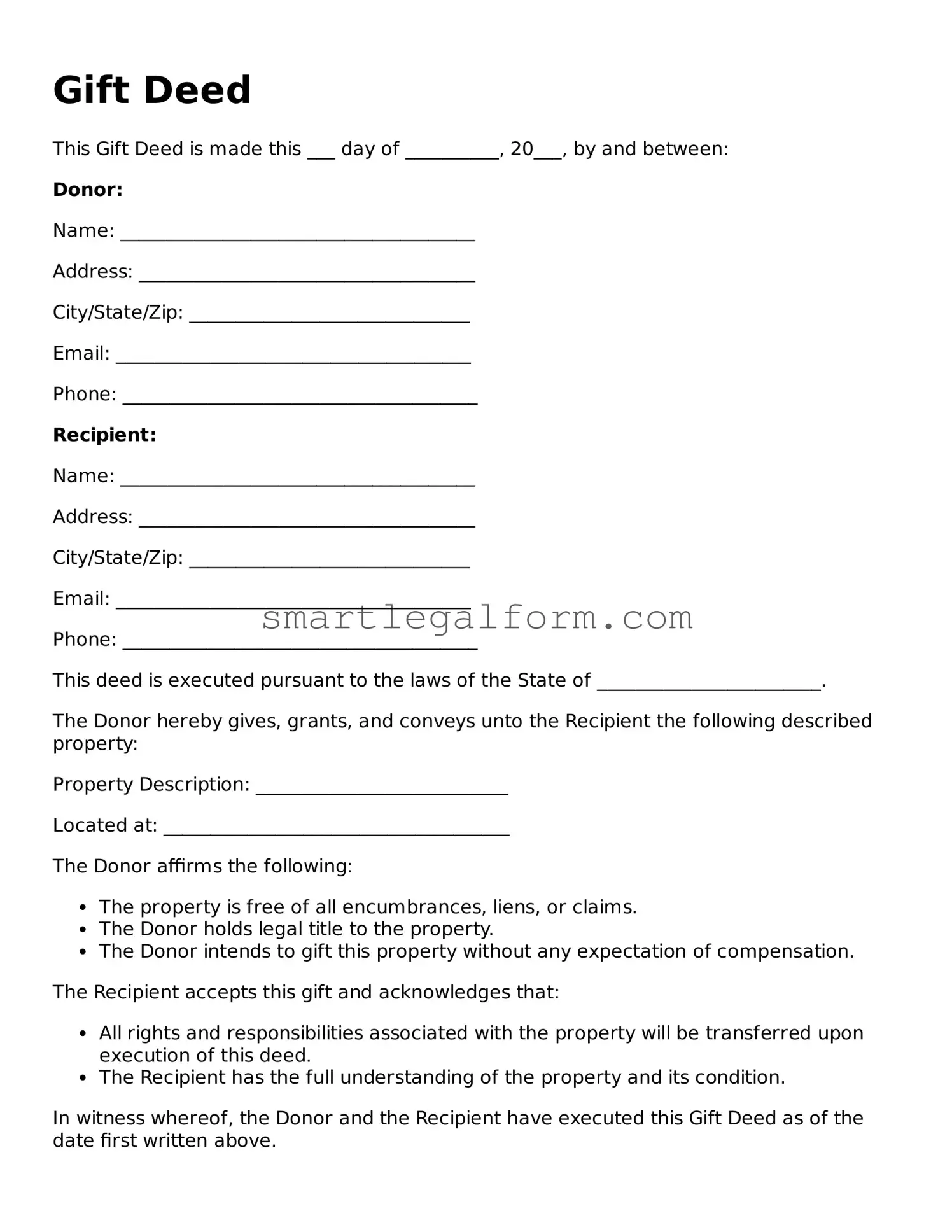

Form Preview Example

Gift Deed

This Gift Deed is made this ___ day of __________, 20___, by and between:

Donor:

Name: ______________________________________

Address: ____________________________________

City/State/Zip: ______________________________

Email: ______________________________________

Phone: ______________________________________

Recipient:

Name: ______________________________________

Address: ____________________________________

City/State/Zip: ______________________________

Email: ______________________________________

Phone: ______________________________________

This deed is executed pursuant to the laws of the State of ________________________.

The Donor hereby gives, grants, and conveys unto the Recipient the following described property:

Property Description: ___________________________

Located at: _____________________________________

The Donor affirms the following:

- The property is free of all encumbrances, liens, or claims.

- The Donor holds legal title to the property.

- The Donor intends to gift this property without any expectation of compensation.

The Recipient accepts this gift and acknowledges that:

- All rights and responsibilities associated with the property will be transferred upon execution of this deed.

- The Recipient has the full understanding of the property and its condition.

In witness whereof, the Donor and the Recipient have executed this Gift Deed as of the date first written above.

Donor Signature: ___________________________

Date: ___________________________________________

Recipient Signature: _______________________

Date: ___________________________________________

Witnessed by:

Name: ________________________________________

Signature: ____________________________________

Date: _________________________________________

Common mistakes

Filling out a Gift Deed form can be straightforward, but many people make common mistakes that can lead to complications. One frequent error is not including all necessary details about the property. It is crucial to provide a complete description, including the address and any specific identifiers, like parcel numbers. Without this information, the deed may not be legally binding.

Another mistake often made is failing to include the names of both the donor and the recipient. Both parties must be clearly identified to ensure that the gift is valid. Omitting a name or misspelling it can create confusion and might even invalidate the deed.

People sometimes overlook the importance of signatures. The Gift Deed must be signed by the donor, and in some cases, witnesses may also be required. Not having the proper signatures can lead to disputes or challenges regarding the validity of the gift.

Additionally, many individuals forget to consider the tax implications of gifting property. Depending on the value of the property, there may be tax consequences for both the donor and the recipient. Ignoring these details can result in unexpected financial burdens later on.

Lastly, not recording the Gift Deed with the appropriate local authority is a common oversight. Once the deed is signed, it should be filed with the county recorder's office. This step is essential to protect the recipient’s ownership rights. Failing to do so can lead to future legal issues regarding the property.

Dos and Don'ts

When filling out a Gift Deed form, it’s essential to follow certain guidelines to ensure everything is completed correctly. Here’s a list of things you should and shouldn't do:

- Do ensure that the names of both the giver and the receiver are spelled correctly.

- Don't leave any sections of the form blank; all fields should be filled out.

- Do include a clear description of the gift being transferred.

- Don't use vague terms; be specific about the item or property.

- Do sign and date the form in the appropriate places.

- Don't forget to have the document notarized if required by state law.

- Do keep a copy of the completed Gift Deed for your records.

- Don't assume that verbal agreements are enough; written documentation is crucial.

- Do consult with a legal professional if you have any questions.

- Don't rush through the process; take your time to ensure accuracy.

More Types of Gift Deed Forms:

Corrective Deed California - Ownership records can be effectively updated using a Corrective Deed.

The California Power of Attorney form is a legal document that allows a person to appoint another individual to make decisions on their behalf. This power can cover a range of matters, including financial, legal, and health-related decisions. For more information about the specifics of this form, you can visit https://toptemplates.info/. It becomes a crucial tool for planning and managing affairs when someone cannot do so themselves.

Similar forms

- Quitclaim Deed: This document transfers ownership of property from one party to another without any guarantees or warranties. Like a Gift Deed, it is often used to transfer property between family members or friends, emphasizing the intent to give rather than sell.

- Hold Harmless Agreement: This legally binding document ensures that one party does not hold the other responsible for any liabilities during a transaction, serving as a protective measure in various situations, much like the information found at OnlineLawDocs.com.

- Warranty Deed: A Warranty Deed provides a guarantee that the grantor holds clear title to the property and has the right to transfer it. While it is more formal than a Gift Deed, both documents serve to convey ownership and are often used in real estate transactions.

- Transfer on Death Deed: This deed allows property owners to designate a beneficiary who will automatically receive the property upon their death. Similar to a Gift Deed, it facilitates the transfer of ownership without going through probate.

- Deed of Trust: A Deed of Trust is used in real estate transactions to secure a loan. While it serves a different purpose than a Gift Deed, both documents involve the transfer of property rights and can be part of larger estate planning strategies.

- Bill of Sale: This document is used to transfer ownership of personal property, such as vehicles or furniture. Like a Gift Deed, a Bill of Sale can be used to give items as gifts, though it typically pertains to movable property rather than real estate.

- Power of Attorney: A Power of Attorney grants someone the authority to act on another person's behalf in legal matters. While not a deed, it can be used to facilitate the transfer of property, similar to how a Gift Deed allows one person to give property to another.