Free Generic Direct Deposit Form

Form Preview Example

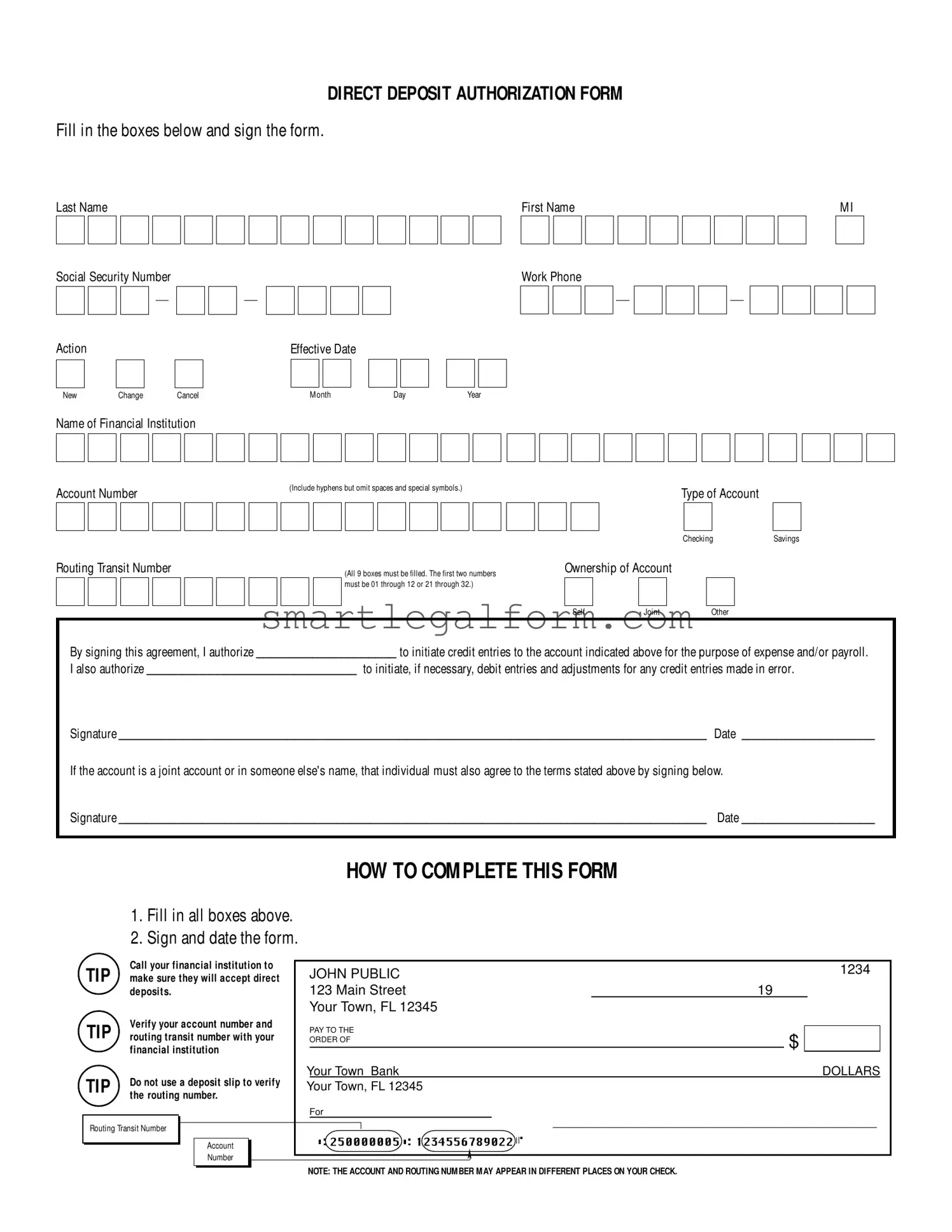

DIRECT DEPOSIT AUTHORIZATION FORM

Fill in the boxes below and sign the form.

Last NameFirst NameM I

□□□□□□□□□□□□□□ □□□□□□□□□

□

□

Social Security Number

□□□- □□

- □□□□

- □□□□

Action |

□ □ |

Effective Date |

□New |

□□ □□ □□ |

|

|

ChangeCancel |

M onthDayYear |

Work Phone

Name of Financial Institution

□□□□□□□□□□□□□□□□□□□□□□□□□□

Account Number |

(Include hyphens but omit spaces and special symbols.) |

Type of Account |

|

|

Savings |

||

|

|

Checking |

|

□□□□□□□□□□□□□□□□□ |

□ |

□ |

|

Routing Transit Number

□□□□□□□□□

(All 9 boxes must be filled. The first two numbers |

Ownership of Account |

|

|||

|

|

|

|

|

|

must be 01 through 12 or 21 through 32.) |

|

|

|

|

|

|

|

|

|

|

|

|

Self |

Joint |

Other |

||

|

□ |

□ |

□ |

||

By signing this agreement, I authorize ____________________ to initiate credit entries to the account indicated above for the purpose of expense and/or payroll.

I also authorize ______________________________ to initiate, if necessary, debit entries and adjustments for any credit entries made in error.

Signature ____________________________________________________________________________________ Date ___________________

If the account is a joint account or in someone else's name, that individual must also agree to the terms stated above by signing below.

Signature ____________________________________________________________________________________ Date ___________________

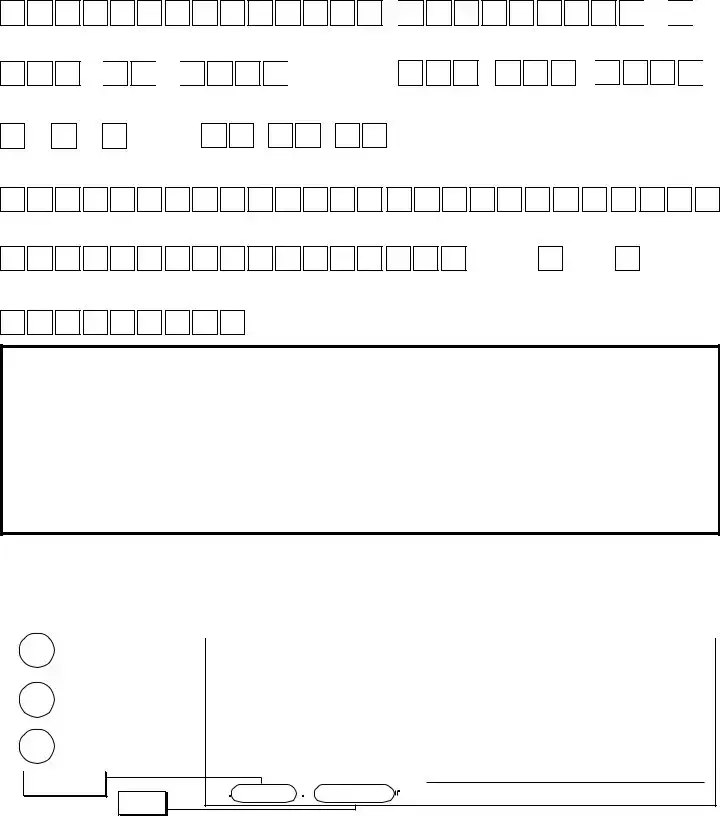

HOW TO COM PLETE THIS FORM

1.Fill in all boxes above.

2.Sign and date the form.

|

TIP |

Call your financial institution to |

|

JOHN PUBLIC |

1234 |

|

|||||

|

make sure they will accept direct |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|||

0 deposit s. |

|

123 MAIN STREET |

19 |

|

|

|

|

||||

|

|

|

|

|

YOUR TOWN, FL 12345 |

|

|

|

|

|

|

|

TIP |

Verify your account number and |

|

PAY TO THE |

|

|

|

|

|

||

|

routing transit number with your |

|

ORDER OF |

|

|

|

|

|

|||

0 financial institution |

|

|

|

|

$ |

|

|

|

|||

|

|

|

|

|

|

||||||

YOUR TOWN BANK |

|

|

|

DOLLARS |

|||||||

|

TIP |

Do not use a deposit slip to verify |

|

|

|

|

|

|

|

|

|

|

YOUR TOWN, FL 12345 |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

||||

|

0 the routing |

number. |

|

FOR |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

IRouting Transit Number |

I |

|

➤ |

I |

Account |

l~::::::::,(~::250000005::)•:(~:=1234556789022~):..1·___________ J |

|

|

|

Number |

➤ |

NOTE: THE ACCOUNT AND ROUTING NUM BER M AY APPEAR IN DIFFERENT PLACES ON YOUR CHECK.

Common mistakes

Filling out the Generic Direct Deposit form can be straightforward, but several common mistakes can lead to delays or issues with processing. One frequent error is failing to complete all required fields. Each box must be filled in, including the Social Security Number and account details. Leaving any section blank can result in the form being rejected.

Another common mistake is incorrect account information. It is essential to double-check both the account number and the routing transit number. Many individuals mistakenly enter these numbers without verifying them with their financial institution. This can lead to funds being deposited into the wrong account, causing unnecessary complications.

Some people also overlook the importance of signing and dating the form. Without a signature, the authorization is not valid. Additionally, if the account is a joint account, both account holders must sign. Failing to obtain the necessary signatures can lead to processing delays.

Not specifying the type of account is another error. The form requires individuals to indicate whether the account is a savings or checking account. Omitting this detail can create confusion and may result in funds being deposited incorrectly.

Another mistake involves using a deposit slip to verify the routing number. The form advises against this practice, as deposit slips may contain different routing numbers than those used for direct deposits. It is always best to confirm the routing number directly with the financial institution.

Lastly, people often forget to check the effective date of the changes. If the form is not processed by the desired date, individuals may experience delays in receiving their funds. It is crucial to ensure that the effective date aligns with the intended timing of the deposit.

Dos and Don'ts

When filling out the Generic Direct Deposit form, keeping a few best practices in mind can make the process smoother. Here’s a handy list of things to do and avoid:

- Do fill in all the required boxes completely.

- Do sign and date the form where indicated.

- Do verify your account number and routing transit number with your financial institution.

- Do call your financial institution to ensure they accept direct deposits.

- Don’t use a deposit slip to verify the routing number.

- Don’t leave any boxes blank; incomplete forms can delay processing.

- Don’t forget to have a joint account holder sign if the account is in both names.

Other PDF Documents

Hiv-positive Report Sample - The use of a counselor's signature reflects an additional layer of oversight in the testing process.

Free Printable Puppy Shot Record - Supports communication between pet owners and veterinarians.

For those looking to understand the essential elements of a Quitclaim Deed process, this document plays a pivotal role in transferring property rights smoothly. It acts as a simple yet effective means of ensuring ownership transitions, particularly when parties are familiar with one another, thereby reducing the chance of disputes in the future.

Florida Realtors Lease Agreement Pdf - It includes detailed information about the parties involved in the transaction.

Similar forms

- Payroll Deduction Authorization Form: This document allows employees to authorize deductions from their paychecks for various purposes, similar to how the direct deposit form authorizes funds to be deposited into a bank account.

- Automatic Payment Authorization Form: Like the direct deposit form, this document enables individuals to authorize recurring payments to be deducted from their bank accounts automatically, ensuring timely payments without manual intervention.

- Bank Account Change Form: This form is used to update the banking information for direct deposits. It shares similarities with the direct deposit form in that it requires details about the new account and authorization for changes.

- Direct Payment Authorization Form: This document allows businesses or individuals to authorize a company to withdraw funds directly from their bank account, much like the direct deposit form facilitates the deposit of funds.

- Wage Garnishment Authorization Form: This form permits a portion of an employee's wages to be withheld and sent to a creditor. It is similar to the direct deposit form as both require authorization and involve the management of funds from an employee’s paycheck.

- Motorcycle Bill of Sale: Essential for transferring ownership of a motorcycle, the Motorcycle Bill of Sale form serves as proof of the transaction and includes vital details such as the purchase price and vehicle identification number (VIN).

- Electronic Funds Transfer (EFT) Authorization Form: This document authorizes the transfer of funds electronically, paralleling the direct deposit form which enables payroll deposits directly into a bank account.

- Loan Payment Authorization Form: This form allows borrowers to set up automatic payments for loan obligations, similar to how the direct deposit form establishes a mechanism for receiving funds into an account.

- Investment Account Transfer Form: This document is used to transfer funds between investment accounts, akin to how the direct deposit form directs funds to a specific bank account.

- Tax Refund Direct Deposit Form: This form authorizes the IRS or state tax authority to deposit tax refunds directly into a taxpayer's bank account, similar to the way the direct deposit form facilitates payroll deposits.