Printable Florida Transfer-on-Death Deed Document

Form Preview Example

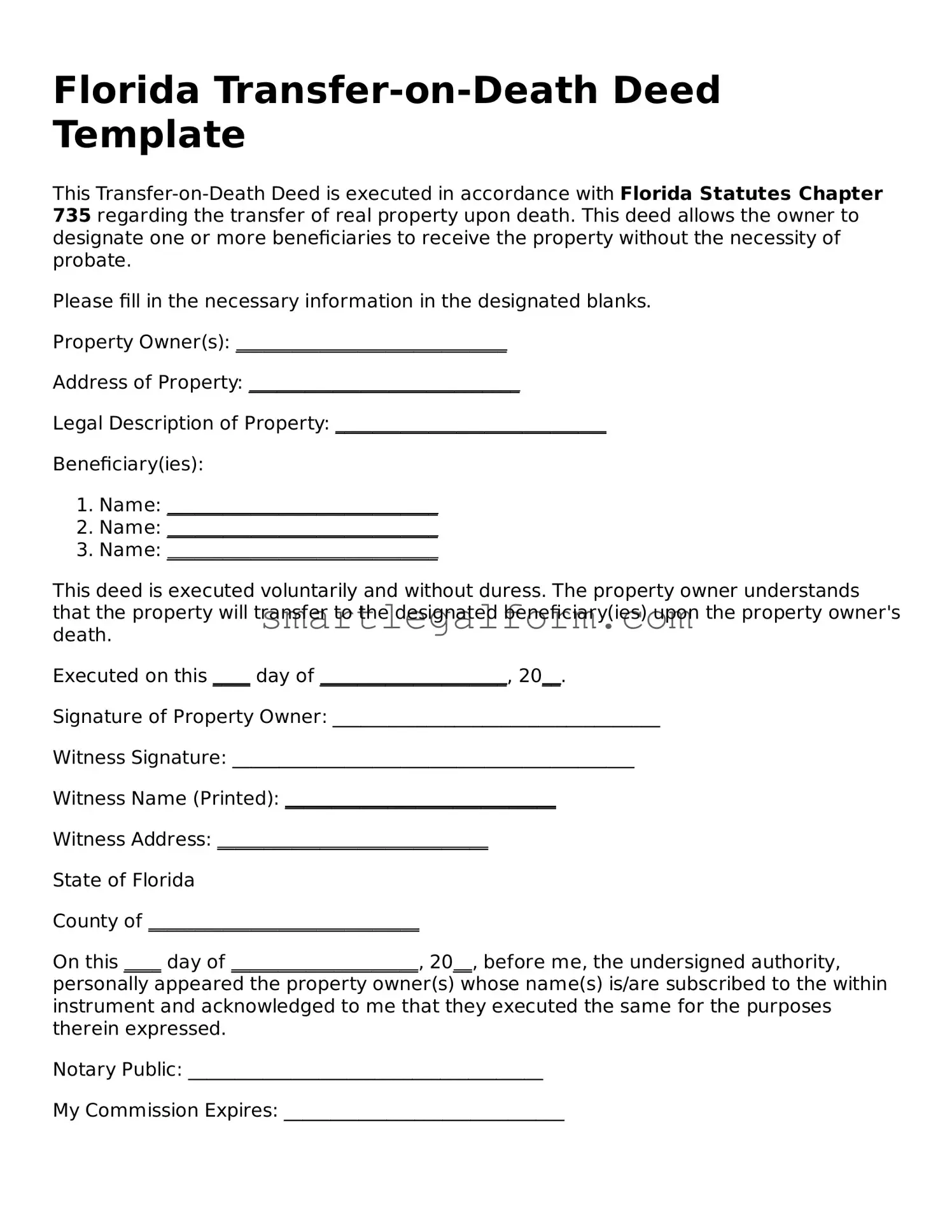

Florida Transfer-on-Death Deed Template

This Transfer-on-Death Deed is executed in accordance with Florida Statutes Chapter 735 regarding the transfer of real property upon death. This deed allows the owner to designate one or more beneficiaries to receive the property without the necessity of probate.

Please fill in the necessary information in the designated blanks.

Property Owner(s): _____________________________

Address of Property: _____________________________

Legal Description of Property: _____________________________

Beneficiary(ies):

- Name: _____________________________

- Name: _____________________________

- Name: _____________________________

This deed is executed voluntarily and without duress. The property owner understands that the property will transfer to the designated beneficiary(ies) upon the property owner's death.

Executed on this ____ day of ____________________, 20__.

Signature of Property Owner: ___________________________________

Witness Signature: ___________________________________________

Witness Name (Printed): _____________________________

Witness Address: _____________________________

State of Florida

County of _____________________________

On this ____ day of ____________________, 20__, before me, the undersigned authority, personally appeared the property owner(s) whose name(s) is/are subscribed to the within instrument and acknowledged to me that they executed the same for the purposes therein expressed.

Notary Public: ______________________________________

My Commission Expires: ______________________________

Common mistakes

Filling out the Florida Transfer-on-Death Deed form can be a straightforward process, but many individuals make common mistakes that can lead to complications later. Understanding these pitfalls is essential for ensuring that the deed is valid and effective. Here are ten mistakes to avoid.

One frequent error is not properly identifying the property. It’s crucial to provide a complete legal description of the property being transferred. Simply listing the address may not suffice. Omitting important details can lead to confusion and may invalidate the deed.

Another mistake involves failing to sign the deed in front of a notary public. In Florida, a Transfer-on-Death Deed must be signed and notarized to be legally binding. Skipping this step can render the document ineffective, leaving the property in limbo.

Many people forget to record the deed with the county clerk's office. After completing the form, it must be filed to ensure that it is recognized by the state. Neglecting this step can result in the deed not being honored upon the owner’s passing.

In addition, some individuals mistakenly believe that they can name multiple beneficiaries without understanding the implications. While it’s possible to name more than one beneficiary, doing so can complicate the transfer process. Each beneficiary must be clearly identified to avoid disputes later.

Another common oversight is not considering the implications of joint ownership. If the property is owned jointly with another person, the Transfer-on-Death Deed may not work as intended. The surviving owner may automatically inherit the property, which could create confusion regarding the deed.

People also often overlook the need for clarity in beneficiary designations. Using vague terms or nicknames can lead to misunderstandings. It’s best to use full legal names to ensure that there is no ambiguity about who the intended recipient is.

Additionally, individuals sometimes neglect to update the deed after significant life changes, such as marriage, divorce, or the death of a beneficiary. Keeping the deed current is essential to ensure that it reflects the owner’s wishes.

Another mistake involves failing to inform beneficiaries about the deed. It’s important for those named in the deed to be aware of their status. Without this knowledge, beneficiaries may not take necessary actions or may be surprised upon the owner’s passing.

Lastly, many people do not seek legal advice when filling out the form. Consulting with a legal professional can provide valuable insights and help avoid potential pitfalls. While the process may seem simple, having expert guidance can ensure that all aspects are properly addressed.

Avoiding these common mistakes can make the process of creating a Transfer-on-Death Deed smoother and more effective. By being diligent and informed, individuals can ensure that their wishes are honored and that their loved ones are taken care of in the future.

Dos and Don'ts

When filling out the Florida Transfer-on-Death Deed form, it is essential to approach the process with care. Here are some important guidelines to follow:

- Do ensure that you have the correct property description.

- Do provide the full legal names of all parties involved.

- Do consult with a legal professional if you have questions.

- Do keep a copy of the completed deed for your records.

- Don't leave any fields blank; fill in all required information.

- Don't forget to sign the deed in the presence of a notary.

Following these guidelines can help ensure that your Transfer-on-Death Deed is completed accurately and effectively. Take your time, and remember that this deed is an important document that will affect your loved ones in the future.

Other Transfer-on-Death Deed State Forms

Transfer on Death Deed Form Ohio - Consulting with an estate planner before using a Transfer-on-Death Deed is advisable.

For those looking to understand property transfers, the Arizona deed form is crucial as it formalizes the transition of ownership in real estate transactions. You can learn more about this important document by visiting our guide on the Arizona deed process.

Tod in California - A Transfer-on-Death Deed can provide a straightforward solution for those looking to avoid potential family conflicts over property.

Transfer on Death Instrument - A Transfer-on-Death Deed can be beneficial for individuals seeking to provide for minor children after their demise.

Similar forms

- Will: A will outlines how a person wishes their assets to be distributed after their death. Like a Transfer-on-Death Deed, it allows for the transfer of property but typically requires probate to be executed.

- Living Trust: A living trust is a legal entity that holds a person's assets during their lifetime and specifies how those assets are to be distributed after death. Both documents facilitate the transfer of property without the need for probate.

- Beneficiary Designation Forms: These forms are used for financial accounts, such as life insurance policies and retirement accounts, to designate who will receive the assets upon the account holder's death. Similar to a Transfer-on-Death Deed, they allow for direct transfer without probate.

- Joint Tenancy with Right of Survivorship: This form of property ownership allows two or more individuals to own a property together. When one owner passes away, their share automatically transfers to the surviving owner, similar to how a Transfer-on-Death Deed works.

- Payable-on-Death (POD) Accounts: These bank accounts allow the owner to designate a beneficiary who will receive the funds upon the owner's death. This is akin to a Transfer-on-Death Deed in that it bypasses probate for the transfer of assets.

- Transfer-on-Death Registration for Securities: This registration allows an individual to designate a beneficiary for their securities, such as stocks and bonds. It functions similarly to a Transfer-on-Death Deed by facilitating direct transfer upon death.

- Life Estate Deed: A life estate deed grants a person the right to use a property during their lifetime, with the property passing to another designated individual upon their death. This is comparable to a Transfer-on-Death Deed in terms of post-death property transfer.

- Gift Certificate: A Gift Certificate allows the holder to purchase goods or services up to a specific value, enhancing the gift-giving experience while promoting business patronage. For more information, visit TopTemplates.info.

- Community Property with Right of Survivorship: In community property states, this arrangement allows spouses to own property together, ensuring that the surviving spouse automatically inherits the deceased spouse's share. This is similar to the intent behind a Transfer-on-Death Deed.

- Durable Power of Attorney: While primarily used for managing a person's affairs while they are alive, a durable power of attorney can also include provisions for transferring assets upon death. This document shares a similar goal of asset management and transfer.