Printable Florida Quitclaim Deed Document

Form Preview Example

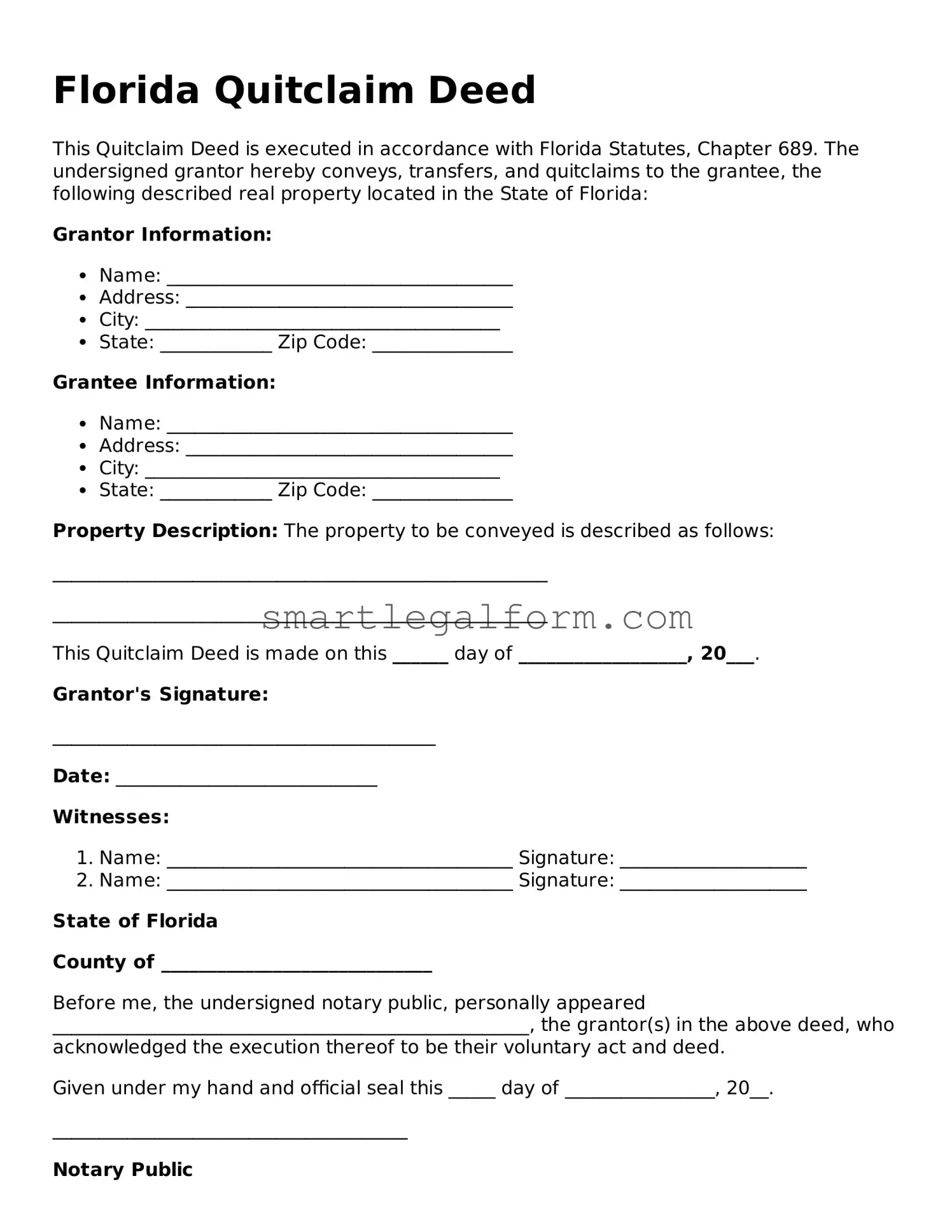

Florida Quitclaim Deed

This Quitclaim Deed is executed in accordance with Florida Statutes, Chapter 689. The undersigned grantor hereby conveys, transfers, and quitclaims to the grantee, the following described real property located in the State of Florida:

Grantor Information:

- Name: _____________________________________

- Address: ___________________________________

- City: ______________________________________

- State: ____________ Zip Code: _______________

Grantee Information:

- Name: _____________________________________

- Address: ___________________________________

- City: ______________________________________

- State: ____________ Zip Code: _______________

Property Description: The property to be conveyed is described as follows:

_____________________________________________________

_____________________________________________________

This Quitclaim Deed is made on this ______ day of __________________, 20___.

Grantor's Signature:

_________________________________________

Date: ____________________________

Witnesses:

- Name: _____________________________________ Signature: ____________________

- Name: _____________________________________ Signature: ____________________

State of Florida

County of _____________________________

Before me, the undersigned notary public, personally appeared ___________________________________________________, the grantor(s) in the above deed, who acknowledged the execution thereof to be their voluntary act and deed.

Given under my hand and official seal this _____ day of ________________, 20__.

______________________________________

Notary Public

My Commission Expires: ____________________

Common mistakes

Filling out a Florida Quitclaim Deed form can seem straightforward, but many people make common mistakes that can lead to complications down the road. Understanding these pitfalls can save time and trouble. Here are nine mistakes to watch out for.

One frequent error is failing to include a legal description of the property. This description must be precise and detailed. Without it, the deed may not be valid, and the transfer of property could be contested. Always ensure that the legal description matches what is recorded in public records.

Another common mistake is not signing the deed in front of a notary public. A Quitclaim Deed must be notarized to be legally binding. Skipping this step can render the document invalid, leading to potential disputes over ownership.

People often overlook the need for the grantor and grantee to be clearly identified. Both parties should be named correctly, including their full legal names. Any discrepancies can create confusion and may complicate the transfer process.

Some individuals mistakenly believe that a Quitclaim Deed does not require any consideration. However, it is important to include a nominal amount, such as $10, to signify that a transfer is taking place. This small detail can help avoid legal issues later.

Another issue arises when people forget to file the Quitclaim Deed with the county clerk's office. Even after completing the form, the deed must be recorded to be effective. Failing to do so can lead to problems with proving ownership in the future.

Additionally, not checking for existing liens or encumbrances on the property can lead to surprises after the transfer. It is wise to conduct a title search to ensure that the property is free from any legal claims that could affect ownership.

Sometimes, individuals use outdated forms or templates found online. Laws and requirements can change, so it is crucial to use the most current version of the Quitclaim Deed form. This helps ensure compliance with state regulations.

Another mistake is neglecting to consult with a real estate professional or attorney. While it might seem unnecessary, having an expert review the deed can help catch errors and clarify any questions. This extra step can save time and prevent future legal headaches.

Lastly, not understanding the implications of a Quitclaim Deed can lead to unintended consequences. Unlike a warranty deed, a Quitclaim Deed does not guarantee that the grantor holds clear title to the property. It is essential to understand what this means for both parties involved in the transaction.

By being aware of these common mistakes, individuals can navigate the process of filling out a Florida Quitclaim Deed more effectively. Taking the time to double-check details and seek guidance can lead to a smoother property transfer experience.

Dos and Don'ts

When filling out a Florida Quitclaim Deed form, it’s essential to approach the task with care. This document serves to transfer property ownership, so accuracy is crucial. Here’s a guide on what to do and what to avoid:

- Do ensure that the names of all parties involved are spelled correctly.

- Do include a complete legal description of the property being transferred.

- Do sign the document in the presence of a notary public.

- Do check for any outstanding liens or encumbrances on the property before proceeding.

- Don't leave any blank spaces on the form; fill in all required fields.

- Don't use the Quitclaim Deed for properties with significant title issues unless you fully understand the implications.

- Don't forget to record the deed with the county clerk's office after it has been executed.

- Don't rush through the process; take your time to review all information for accuracy.

Following these guidelines can help ensure that the transfer of property is smooth and legally sound.

Other Quitclaim Deed State Forms

Printable Quit Claim Deed Form - It is often a simple one-page document.

How Much Does a Deed Cost - Useful for adding or removing a co-owner on a property.

Is a Quit Claim Deed Legally Binding - A Quitclaim Deed does not require the property value to be set.

Creating a Florida Durable Power of Attorney is essential for anyone looking to secure their financial interests in the future. This legal document designates an agent to handle the principal's financial affairs, providing peace of mind even in cases of incapacitation. For detailed guidance on this important process, visit TopTemplates.info, a valuable resource for understanding the nuances of durable power of attorney in Florida.

Quitclaim Deed Ohio - The Quitclaim Deed must be notarized to be legally effective.

Similar forms

A Quitclaim Deed is a legal document used to transfer ownership of real estate. While it serves a specific purpose, there are other documents that share similarities in function or intent. Below is a list of seven documents that are comparable to a Quitclaim Deed, along with explanations of how they relate.

- Warranty Deed: This document also transfers ownership of property but offers guarantees about the title. Unlike a Quitclaim Deed, which provides no warranties, a Warranty Deed assures the buyer that the seller has a clear title to the property.

- Quitclaim Deed: To simplify real estate transactions among familiar parties, consider using a practical Quitclaim Deed approach to facilitate ownership transfers without guaranteeing the title’s clarity.

- Grant Deed: Similar to a Warranty Deed, a Grant Deed conveys property ownership while providing some assurances about the title. It guarantees that the property has not been sold to anyone else and that there are no undisclosed encumbrances.

- Deed of Trust: This document is used in real estate transactions to secure a loan. It involves three parties: the borrower, the lender, and a trustee. While it does not transfer ownership outright, it functions similarly by establishing rights related to property.

- Bill of Sale: This document transfers ownership of personal property rather than real estate. It is similar to a Quitclaim Deed in that it conveys rights from one party to another without any warranties about the condition of the item being sold.

- Lease Agreement: While primarily a rental contract, a Lease Agreement allows one party to occupy and use property owned by another. It shares similarities with a Quitclaim Deed in that it outlines rights and responsibilities regarding property use.

- Power of Attorney: This document grants one person the authority to act on behalf of another in legal matters, including property transactions. Like a Quitclaim Deed, it involves the transfer of rights, although it does not itself transfer ownership.

- Affidavit of Title: This document is often used in conjunction with a property transfer. It provides a sworn statement regarding the ownership and condition of the title. Similar to a Quitclaim Deed, it plays a role in clarifying ownership but does not transfer rights itself.