Printable Florida Promissory Note Document

Form Preview Example

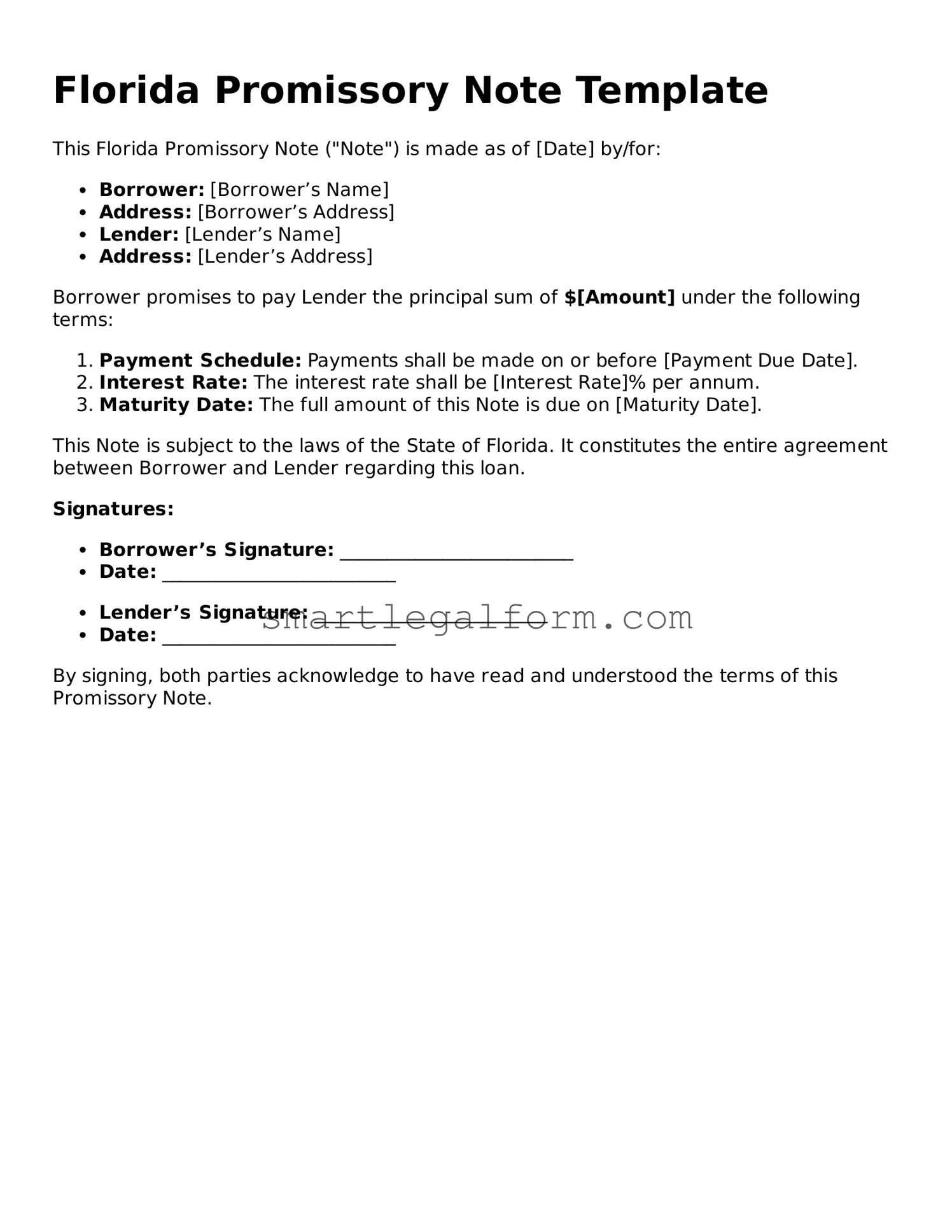

Florida Promissory Note Template

This Florida Promissory Note ("Note") is made as of [Date] by/for:

- Borrower: [Borrower’s Name]

- Address: [Borrower’s Address]

- Lender: [Lender’s Name]

- Address: [Lender’s Address]

Borrower promises to pay Lender the principal sum of $[Amount] under the following terms:

- Payment Schedule: Payments shall be made on or before [Payment Due Date].

- Interest Rate: The interest rate shall be [Interest Rate]% per annum.

- Maturity Date: The full amount of this Note is due on [Maturity Date].

This Note is subject to the laws of the State of Florida. It constitutes the entire agreement between Borrower and Lender regarding this loan.

Signatures:

- Borrower’s Signature: _________________________

- Date: _________________________

- Lender’s Signature: _________________________

- Date: _________________________

By signing, both parties acknowledge to have read and understood the terms of this Promissory Note.

Common mistakes

Filling out a Florida Promissory Note form can seem straightforward, but many people make common mistakes that can lead to issues later. One frequent error is not including all necessary details. A promissory note should clearly state the amount borrowed, the interest rate, and the repayment schedule. Omitting any of this information can create confusion and lead to disputes down the line.

Another mistake is failing to identify the parties involved correctly. Both the borrower and the lender must be clearly named, along with their addresses. If this information is inaccurate or incomplete, it can complicate enforcement of the note. Always double-check that names are spelled correctly and that all contact details are current.

People often overlook the importance of signatures. A promissory note is not legally binding unless it is signed by both parties. Some individuals may forget to sign or may assume that a verbal agreement is sufficient. This can result in the note being deemed invalid. Ensure that both the lender and borrower sign the document in the appropriate places.

Lastly, not keeping a copy of the signed promissory note is a common oversight. After the document is completed and signed, both parties should retain a copy for their records. This can serve as crucial evidence if any disputes arise in the future. Keeping a record helps ensure that everyone is on the same page regarding the terms of the loan.

Dos and Don'ts

When filling out the Florida Promissory Note form, it's important to follow certain guidelines to ensure the document is valid and enforceable. Here are five things you should do and five things you should avoid.

Things You Should Do:

- Read the entire form carefully before starting.

- Provide accurate information about both the borrower and lender.

- Clearly state the loan amount and interest rate.

- Specify the repayment terms, including due dates.

- Sign and date the document in the appropriate places.

Things You Shouldn't Do:

- Don't leave any sections blank unless instructed.

- Don't use vague language; be clear and specific.

- Don't forget to include any applicable fees or penalties.

- Don't rush through the process; take your time to avoid mistakes.

- Don't overlook the importance of having a witness or notary if required.

Other Promissory Note State Forms

Promissory Note California - Prepared correctly, this form can facilitate smooth financial transactions.

Texas Promissory Note Template - Promissory notes are commonly used in private lending situations.

In California, it is important for landlords to be familiar with the California Notice to Quit form, as it plays a crucial role in the eviction process. This document not only serves as a formal warning to tenants who have breached lease agreements but also provides them with an opportunity to correct their actions or leave the premises within a designated timeframe. For further details on how to properly utilize this form, landlords can refer to resources like TopTemplates.info, which offers valuable insights into the notice process and tenant rights.

Create a Promissory Note - It can be a valuable tool for managing personal finances and investments.

Similar forms

-

Loan Agreement: A loan agreement outlines the terms of a loan, similar to a promissory note. It specifies the amount borrowed, interest rates, repayment schedule, and the obligations of both the borrower and lender. While a promissory note is a straightforward promise to pay, a loan agreement provides more detailed terms and conditions.

- Marital Separation Agreement: For couples navigating separation, our comprehensive Marital Separation Agreement guidelines detail essential terms and conditions for a smooth transition.

-

Secured Note: A secured note is a type of promissory note backed by collateral. This means that if the borrower fails to repay, the lender has the right to seize the collateral. Both documents serve the purpose of ensuring repayment, but a secured note adds an extra layer of security for the lender.

-

Installment Agreement: An installment agreement allows a borrower to repay a debt in smaller, regular payments over time. Like a promissory note, it details the repayment terms, but it specifically breaks down the payments into installments, making it easier for borrowers to manage their finances.

-

Personal Guarantee: A personal guarantee is a promise made by an individual to repay a debt if the primary borrower defaults. While a promissory note is a direct commitment to pay, a personal guarantee serves as an additional assurance for the lender, often used in business loans where the borrower may not have sufficient credit history.