Printable Florida Prenuptial Agreement Document

Form Preview Example

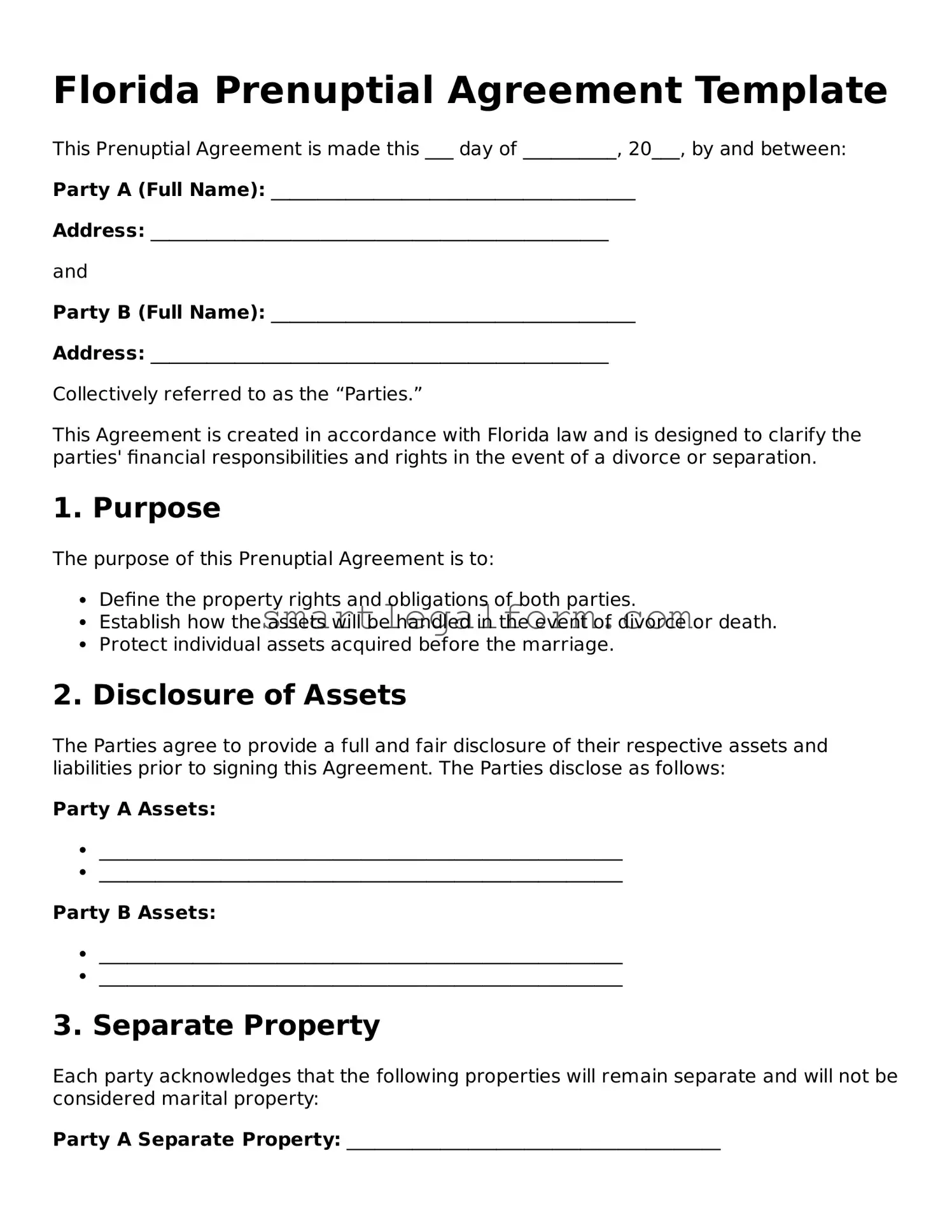

Florida Prenuptial Agreement Template

This Prenuptial Agreement is made this ___ day of __________, 20___, by and between:

Party A (Full Name): _______________________________________

Address: _________________________________________________

and

Party B (Full Name): _______________________________________

Address: _________________________________________________

Collectively referred to as the “Parties.”

This Agreement is created in accordance with Florida law and is designed to clarify the parties' financial responsibilities and rights in the event of a divorce or separation.

1. Purpose

The purpose of this Prenuptial Agreement is to:

- Define the property rights and obligations of both parties.

- Establish how the assets will be handled in the event of divorce or death.

- Protect individual assets acquired before the marriage.

2. Disclosure of Assets

The Parties agree to provide a full and fair disclosure of their respective assets and liabilities prior to signing this Agreement. The Parties disclose as follows:

Party A Assets:

- ________________________________________________________

- ________________________________________________________

Party B Assets:

- ________________________________________________________

- ________________________________________________________

3. Separate Property

Each party acknowledges that the following properties will remain separate and will not be considered marital property:

Party A Separate Property: ________________________________________

Party B Separate Property: ________________________________________

4. Marital Property

The parties agree that marital property will include assets acquired during the marriage after the date of this Agreement.

5. Division of Property

In the event of divorce, the parties agree to the following method of property division:

- All marital property will be divided equally.

- Individual debts incurred during the marriage will be shared unless specified otherwise.

6. Spousal Support

The Parties may agree, in advance, to waive the right to spousal support. If support is to be provided, terms should be outlined here:

- ________________________________________________________

- ________________________________________________________

7. Amendments

This Agreement may be amended only in writing and must be signed by both Parties.

8. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of Florida.

9. Signatures

IN WITNESS WHEREOF, the Parties hereto have executed this Prenuptial Agreement on the date first above written.

Party A Signature: ___________________________

Date: _______________

Party B Signature: ___________________________

Date: _______________

Witness Signature: ___________________________

Date: _______________

Common mistakes

Filling out a Florida Prenuptial Agreement form can be a straightforward process, but mistakes can lead to complications. One common error is failing to provide complete financial disclosures. Both parties should list all assets, debts, and income sources accurately. Omitting this information can cause disputes later, as the agreement may be deemed unenforceable.

Another mistake is using vague language. Clarity is essential in a prenuptial agreement. If terms and conditions are not clearly defined, it can lead to misunderstandings. Each party should ensure that all provisions are specific and unambiguous to avoid potential legal issues in the future.

Additionally, people sometimes overlook the importance of having the agreement reviewed by legal professionals. While it may seem unnecessary, consulting with an attorney can provide valuable insights. A legal expert can help ensure that the agreement complies with Florida laws and that both parties' interests are adequately protected.

Some individuals may also rush the process, leading to incomplete or poorly thought-out agreements. Taking the time to discuss and negotiate terms thoroughly is crucial. A hasty approach can result in missing essential clauses that could safeguard individual interests.

Lastly, neglecting to update the prenuptial agreement after significant life changes can be a mistake. Major events, such as the birth of a child or a substantial change in financial status, may warrant a review and modification of the agreement. Keeping the document current helps ensure it remains relevant and effective.

Dos and Don'ts

When filling out the Florida Prenuptial Agreement form, there are important considerations to keep in mind. Below is a list of things you should and shouldn't do.

- Do ensure that both parties fully disclose their financial information. Transparency is crucial.

- Do consult with a legal professional to understand the implications of the agreement.

- Do discuss and agree on the terms together, ensuring both parties are comfortable.

- Do keep the language clear and straightforward to avoid misunderstandings.

- Do review the agreement periodically, especially if financial circumstances change.

- Don't pressure the other party into signing the agreement without adequate time to review it.

- Don't include any provisions that are illegal or against public policy.

- Don't forget to sign the agreement in the presence of a notary public.

- Don't assume that a verbal agreement is sufficient; written documentation is essential.

- Don't overlook the importance of having separate legal representation for both parties.

Other Prenuptial Agreement State Forms

Ohio Premarital Contract - This agreement clarifies asset distribution in case of divorce or separation.

In addition to the aforementioned details, it is crucial for parties involved in the transaction to familiarize themselves with the specific requirements for their state, as it may vary; for example, Florida residents can reference the comprehensive guide available at https://documentonline.org/blank-florida-bill-of-sale/ to ensure they adhere to all necessary regulations and complete the Bill of Sale accurately.

Illinois Premarital Contract - It helps couples outline their financial rights and responsibilities.

Similar forms

A Prenuptial Agreement is a unique document that helps couples outline their financial and property arrangements before marriage. However, it shares similarities with several other legal documents. Here’s a list of nine documents that have comparable features to a Prenuptial Agreement:

- Postnuptial Agreement: Like a prenuptial agreement, this document is created after marriage to outline the financial arrangements and property rights of each spouse.

- Separation Agreement: This document is used when a couple decides to separate. It details the division of assets, debts, and other arrangements, similar to how a prenuptial agreement addresses these issues before marriage.

- Divorce Settlement Agreement: In the event of a divorce, this agreement outlines how assets and debts will be divided. It serves a similar purpose as a prenuptial agreement but is enacted after the marriage has ended.

Last Will and Testament: A vital document for anyone looking to ensure their wishes are honored after passing, the comprehensive Last Will and Testament form provides a clear framework for asset distribution and responsibilities.

- Living Together Agreement: For couples who choose to cohabit without marrying, this document outlines property rights and financial responsibilities, mirroring the intentions of a prenuptial agreement.

- Trust Agreement: This document establishes a trust to manage assets for beneficiaries. It can complement a prenuptial agreement by detailing how certain assets will be handled in the event of a divorce.

- Power of Attorney: While primarily used for healthcare and financial decisions, a power of attorney can outline financial responsibilities, similar to a prenuptial agreement's focus on financial matters.

- Will: A will outlines how a person's assets will be distributed upon death. While not directly comparable, both documents deal with the management of assets and can be part of an overall estate plan.

- Business Partnership Agreement: This document governs the relationship between business partners, detailing ownership and financial arrangements. It shares the same intent of protecting individual interests as a prenuptial agreement does in marriage.

- Asset Protection Agreement: This document is designed to protect assets from creditors and legal claims. It serves a similar purpose to a prenuptial agreement by safeguarding individual financial interests.

Understanding these documents can help individuals and couples navigate their financial and legal responsibilities, ensuring clarity and protection in various life circumstances.