Printable Florida Loan Agreement Document

Form Preview Example

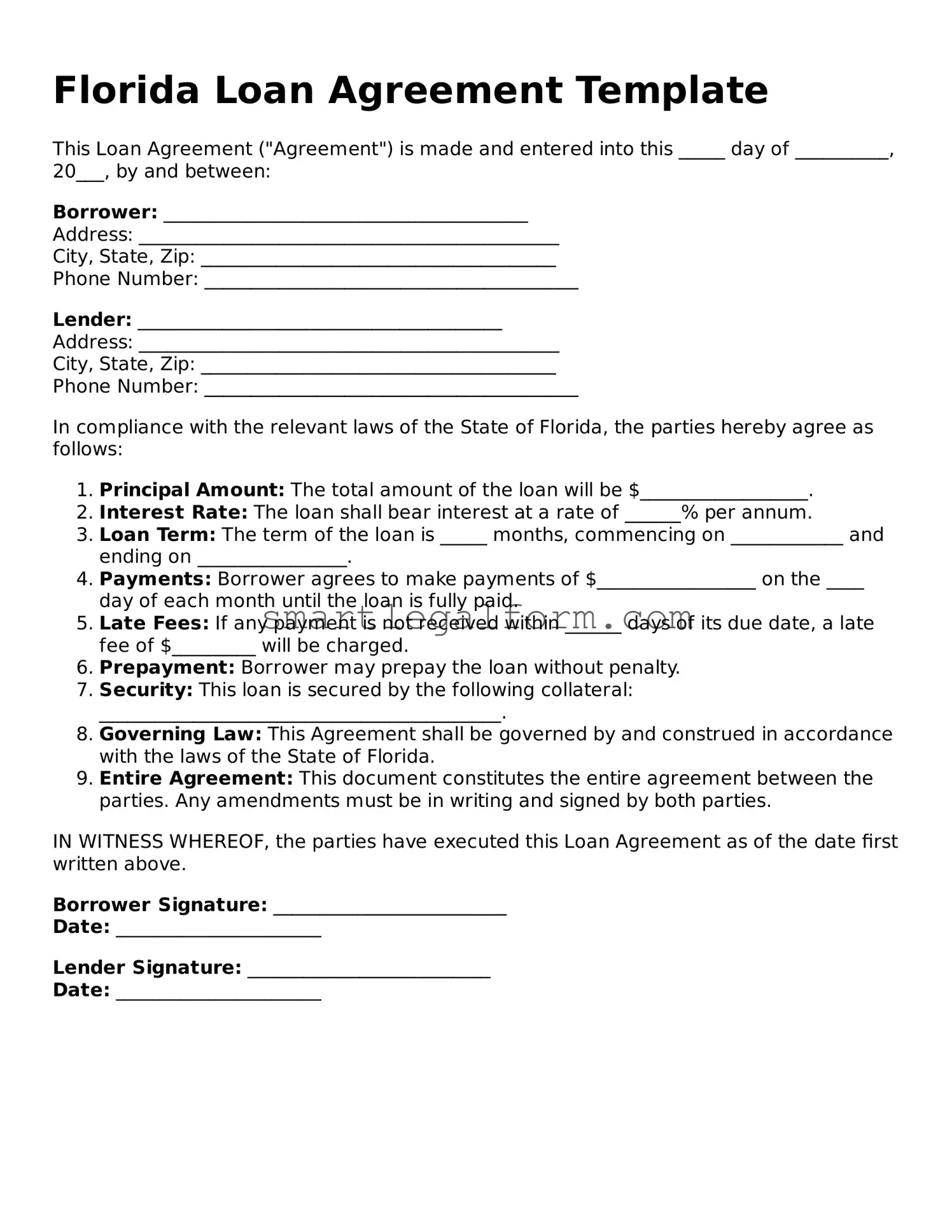

Florida Loan Agreement Template

This Loan Agreement ("Agreement") is made and entered into this _____ day of __________, 20___, by and between:

Borrower: _______________________________________

Address: _____________________________________________

City, State, Zip: ______________________________________

Phone Number: ________________________________________

Lender: _______________________________________

Address: _____________________________________________

City, State, Zip: ______________________________________

Phone Number: ________________________________________

In compliance with the relevant laws of the State of Florida, the parties hereby agree as follows:

- Principal Amount: The total amount of the loan will be $__________________.

- Interest Rate: The loan shall bear interest at a rate of ______% per annum.

- Loan Term: The term of the loan is _____ months, commencing on ____________ and ending on ________________.

- Payments: Borrower agrees to make payments of $_________________ on the ____ day of each month until the loan is fully paid.

- Late Fees: If any payment is not received within ______ days of its due date, a late fee of $_________ will be charged.

- Prepayment: Borrower may prepay the loan without penalty.

- Security: This loan is secured by the following collateral: ___________________________________________.

- Governing Law: This Agreement shall be governed by and construed in accordance with the laws of the State of Florida.

- Entire Agreement: This document constitutes the entire agreement between the parties. Any amendments must be in writing and signed by both parties.

IN WITNESS WHEREOF, the parties have executed this Loan Agreement as of the date first written above.

Borrower Signature: _________________________

Date: ______________________

Lender Signature: __________________________

Date: ______________________

Common mistakes

Filling out a loan agreement form can be a straightforward process, but mistakes can lead to complications. One common error occurs when individuals fail to provide accurate personal information. This includes names, addresses, and contact details. Inaccuracies can delay the loan approval process or even lead to denial.

Another frequent mistake is overlooking the loan amount. Borrowers sometimes write down an amount that does not match their intended request. This discrepancy can cause confusion and may require the borrower to resubmit the form, wasting valuable time.

People often neglect to read the terms and conditions carefully. Skimming through this section can lead to misunderstandings about interest rates, repayment schedules, or fees. Understanding these details is crucial for making informed decisions about borrowing.

In addition, some individuals forget to sign the document. A signature is a critical part of the agreement, as it indicates consent to the terms outlined. Without a signature, the form is incomplete and cannot be processed.

Another mistake involves not providing necessary documentation. Lenders typically require supporting documents, such as proof of income or identification. Failing to include these can result in delays or rejection of the loan application.

People sometimes miscalculate their repayment ability. They may not consider their current financial situation or future expenses. This oversight can lead to taking on more debt than they can manage, resulting in financial strain.

Some borrowers also overlook the importance of checking for errors before submission. Simple typos or miscalculations can create problems later on. Taking a moment to review the form can help catch mistakes that might otherwise go unnoticed.

Lastly, individuals may not seek clarification on points they do not understand. If something is unclear, it is important to ask questions. Failing to do so can lead to signing an agreement without fully understanding its implications.

Dos and Don'ts

When filling out the Florida Loan Agreement form, it’s essential to approach the task with care. Here are some key do's and don'ts to keep in mind:

- Do read the entire form carefully before starting.

- Do provide accurate and complete information.

- Do double-check all figures and calculations.

- Do sign and date the form where required.

- Don't leave any sections blank unless instructed to do so.

- Don't rush through the process; take your time to ensure everything is correct.

Other Loan Agreement State Forms

Promissory Note Template Illinois - It may require the borrower to maintain certain financial ratios.

For those seeking clarity in employment terms, the important aspects of the Independent Contractor Agreement are crucial for establishing a clear understanding between businesses and independent contractors.

Texas Promissory Note Form - This form is essential for formalizing the lending process and securing both parties' rights.

Similar forms

The Loan Agreement form shares similarities with several other financial documents. Each serves a specific purpose in the realm of lending and borrowing. Here are four documents that are comparable to a Loan Agreement:

- Promissory Note: This document outlines a borrower's promise to repay a loan. It details the amount borrowed, interest rates, and repayment terms, similar to a Loan Agreement, but typically lacks the comprehensive terms found in a full agreement.

- Mortgage Agreement: Used in real estate transactions, this document secures a loan with the property itself. Like a Loan Agreement, it specifies the loan amount, interest rate, and repayment schedule, but it also includes terms related to the property being financed.

Power of Attorney: This essential document allows an individual to designate another person to make legal decisions on their behalf, ensuring that their wishes are honored even when they are unable to act for themselves. For more information, visit toptemplates.info/.

- Security Agreement: This document is used when a borrower pledges collateral to secure a loan. It outlines the collateral details and rights of the lender, akin to a Loan Agreement, but focuses more on the security aspect rather than the loan terms.

- Lease Agreement: While primarily for renting property, a lease can function similarly to a Loan Agreement in that it involves financial obligations over time. It specifies payment terms and conditions, although it pertains to the use of an asset rather than a loan.