Printable Florida Last Will and Testament Document

Form Preview Example

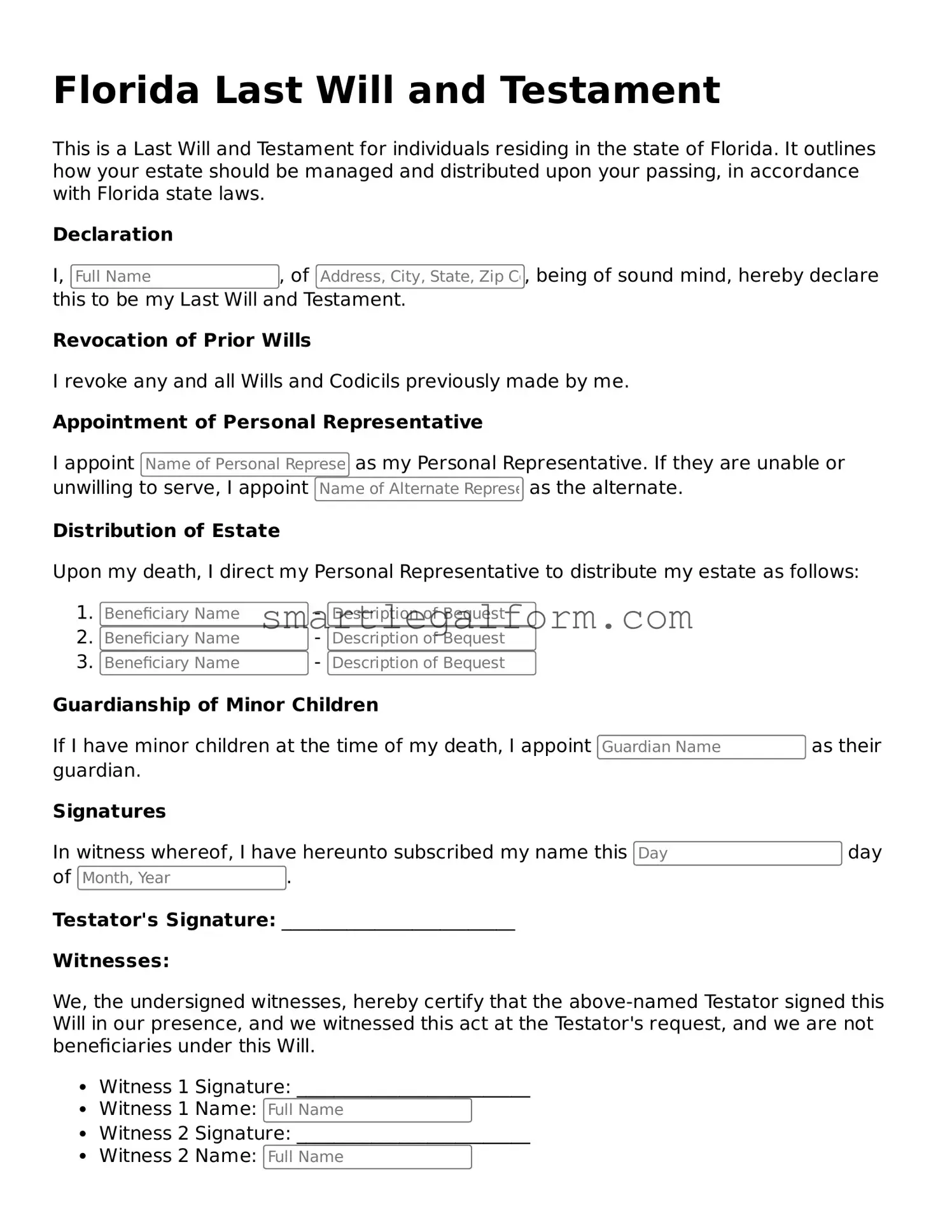

Florida Last Will and Testament

This is a Last Will and Testament for individuals residing in the state of Florida. It outlines how your estate should be managed and distributed upon your passing, in accordance with Florida state laws.

Declaration

I, , of , being of sound mind, hereby declare this to be my Last Will and Testament.

Revocation of Prior Wills

I revoke any and all Wills and Codicils previously made by me.

Appointment of Personal Representative

I appoint as my Personal Representative. If they are unable or unwilling to serve, I appoint as the alternate.

Distribution of Estate

Upon my death, I direct my Personal Representative to distribute my estate as follows:

- -

- -

- -

Guardianship of Minor Children

If I have minor children at the time of my death, I appoint as their guardian.

Signatures

In witness whereof, I have hereunto subscribed my name this day of .

Testator's Signature: _________________________

Witnesses:

We, the undersigned witnesses, hereby certify that the above-named Testator signed this Will in our presence, and we witnessed this act at the Testator's request, and we are not beneficiaries under this Will.

- Witness 1 Signature: _________________________

- Witness 1 Name:

- Witness 2 Signature: _________________________

- Witness 2 Name:

This Last Will and Testament is made under the provisions of Florida Statutes Chapter 732.

Common mistakes

Filling out a Last Will and Testament in Florida is a significant step in ensuring your wishes are respected after your passing. However, many individuals make common mistakes that can lead to complications later on. One frequent error is failing to properly identify beneficiaries. It is crucial to clearly state who will inherit your assets. If you simply list a name without specifying the relationship or including full legal names, confusion may arise, potentially leading to disputes among family members.

Another mistake is neglecting to update the will after major life events. Changes such as marriage, divorce, or the birth of a child should prompt a review of your will. If you do not update your document, it may not reflect your current wishes, which can create unnecessary stress for your loved ones during an already difficult time.

Many people also overlook the importance of having witnesses present when signing the will. Florida law requires that the will be signed in the presence of at least two witnesses. If this step is skipped, the will may be deemed invalid. Witnesses must be competent adults who are not beneficiaries of the will to avoid any conflicts of interest.

Additionally, some individuals fail to include a self-proving affidavit. This document can simplify the probate process by allowing the will to be accepted without requiring witnesses to testify in court. Without this affidavit, your loved ones may face delays and additional legal hurdles when executing your wishes.

Finally, not considering the implications of digital assets is a mistake many make. In today’s digital age, online accounts and digital properties are common. It is essential to specify how these assets should be handled in your will. Failing to address digital assets can lead to confusion and potential loss of valuable information or property.

Dos and Don'ts

When filling out the Florida Last Will and Testament form, it is important to approach the task with care. Here are some things to consider:

- Do ensure that you are of sound mind and at least 18 years old.

- Do clearly state your wishes regarding the distribution of your assets.

- Do appoint an executor who will carry out your wishes.

- Do sign the document in the presence of two witnesses.

- Do keep your will in a safe place and inform your executor of its location.

- Don't use unclear or ambiguous language that could lead to confusion.

- Don't forget to date the will, as this establishes the most current version.

- Don't rely on verbal agreements; they are not legally binding.

- Don't leave out important details about your beneficiaries.

- Don't attempt to fill out the form under duress or without understanding its implications.

Other Last Will and Testament State Forms

Will Template Texas - Creating a Last Will is an essential step in estate planning to safeguard one's legacy.

For couples preparing for marriage, understanding a "legal prenuptial agreement" can be vital in establishing financial clarity and expectations. This form outlines important details that aid in asset division and responsibilities should a separation occur. To learn more, you can visit the resource on Prenuptial Agreement.

Can I Create My Own Will - May include a "no-contest" clause to discourage litigation among heirs.

Lawyer to Write a Will - A plan to make the transition of wealth and property smoother for heirs.

Similar forms

The Last Will and Testament is an important legal document that outlines how a person's assets and affairs will be handled after their death. Several other documents serve similar purposes or complement the Last Will and Testament. Here are seven such documents:

- Living Will: This document specifies a person's wishes regarding medical treatment in situations where they cannot communicate their preferences. Like a Last Will, it addresses important decisions but focuses on healthcare rather than asset distribution.

- Durable Power of Attorney: A Durable Power of Attorney allows an individual to appoint someone to make financial and legal decisions on their behalf if they become incapacitated. This document ensures that someone can manage affairs when the person is unable to do so, similar to how a will manages affairs after death.

- Trust: A trust is a legal arrangement where one party holds property for the benefit of another. Trusts can be used to manage assets during a person's lifetime and after death, providing a way to distribute assets that can be more efficient than a will.

- Durable Power of Attorney: A Durable Power of Attorney enables individuals to grant authority to another person to manage their financial matters even if they become incapacitated. It is an essential component of estate planning and is crucial for safeguarding one’s financial future. For more information, visit TopTemplates.info.

- Healthcare Proxy: A Healthcare Proxy designates someone to make medical decisions on behalf of another person if they are unable to do so. This document complements a living will, ensuring that a trusted individual can advocate for the person's healthcare preferences.

- Letter of Instruction: This informal document provides guidance to loved ones about personal wishes and arrangements not covered in a will. It can include funeral preferences, asset distribution details, and other personal messages, serving as a supplement to the Last Will.

- Codicil: A codicil is an amendment to an existing will. It allows a person to make changes or updates to their will without needing to create an entirely new document, maintaining the original will's validity while addressing new circumstances.

- Beneficiary Designation Forms: These forms allow individuals to designate beneficiaries for specific assets, such as life insurance policies or retirement accounts. These designations can override instructions in a will, making them crucial for ensuring that assets are distributed according to one's wishes.

Understanding these documents can help individuals create a comprehensive plan for their assets and healthcare decisions, ensuring that their wishes are honored both during their lifetime and after their passing.