Printable Florida Lady Bird Deed Document

Form Preview Example

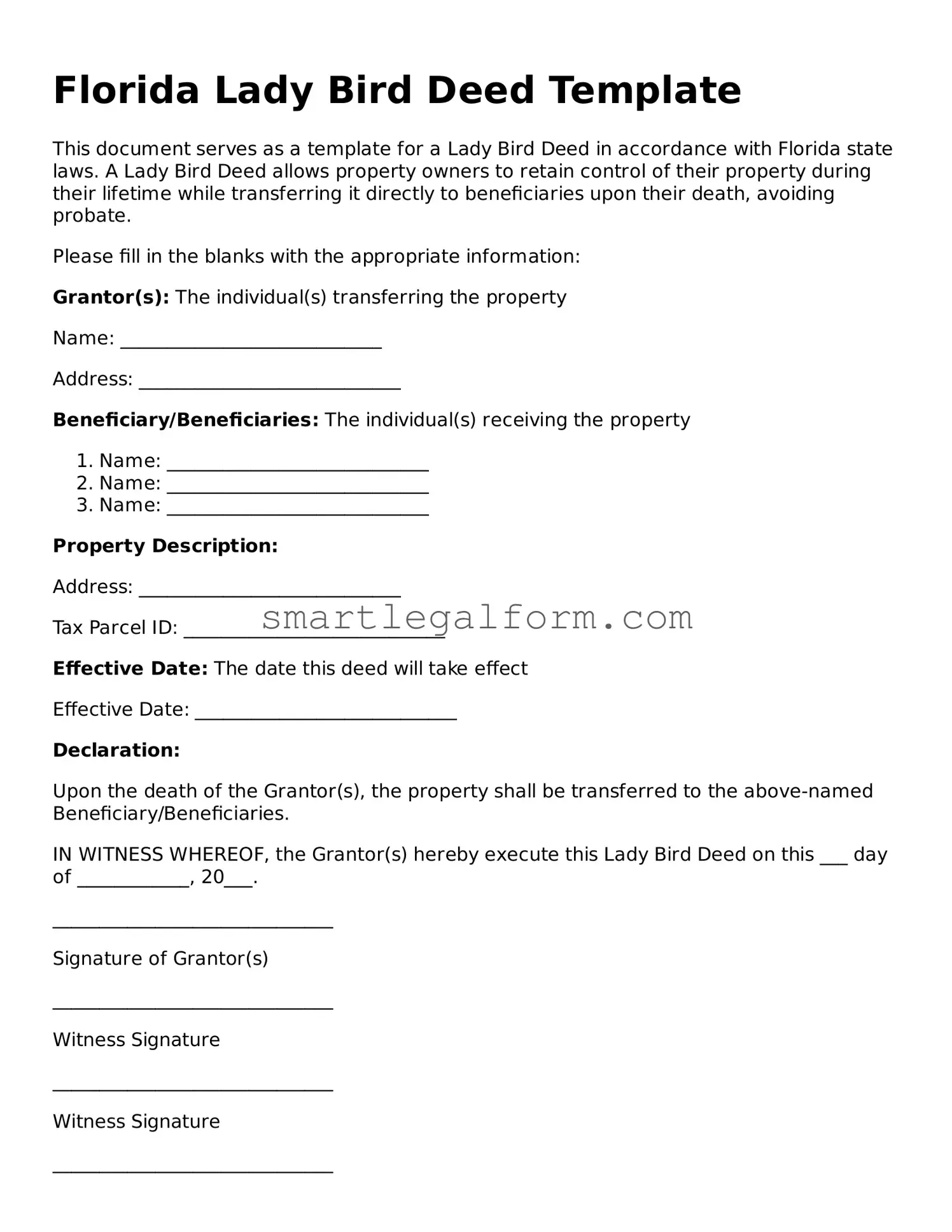

Florida Lady Bird Deed Template

This document serves as a template for a Lady Bird Deed in accordance with Florida state laws. A Lady Bird Deed allows property owners to retain control of their property during their lifetime while transferring it directly to beneficiaries upon their death, avoiding probate.

Please fill in the blanks with the appropriate information:

Grantor(s): The individual(s) transferring the property

Name: ____________________________

Address: ____________________________

Beneficiary/Beneficiaries: The individual(s) receiving the property

- Name: ____________________________

- Name: ____________________________

- Name: ____________________________

Property Description:

Address: ____________________________

Tax Parcel ID: ____________________________

Effective Date: The date this deed will take effect

Effective Date: ____________________________

Declaration:

Upon the death of the Grantor(s), the property shall be transferred to the above-named Beneficiary/Beneficiaries.

IN WITNESS WHEREOF, the Grantor(s) hereby execute this Lady Bird Deed on this ___ day of ____________, 20___.

______________________________

Signature of Grantor(s)

______________________________

Witness Signature

______________________________

Witness Signature

______________________________

Notary Public Signature

My commission expires: ____________________________

Common mistakes

Filling out a Florida Lady Bird Deed form can seem straightforward, but many people make common mistakes that can lead to complications down the road. One frequent error is not including the correct legal description of the property. This description is crucial, as it identifies the specific property being transferred. Omitting or inaccurately describing the property can lead to confusion and potential legal disputes.

Another common mistake is failing to clearly identify the beneficiaries. When filling out the form, it’s essential to specify who will receive the property upon the owner’s passing. If the beneficiaries are not named or are incorrectly identified, it may result in unintended heirs or delays in the transfer process.

Some individuals overlook the importance of signing the deed in the presence of a notary. The Lady Bird Deed must be notarized to be valid. Without this step, the deed may not hold up in court, and the intended transfer of property could be challenged.

In addition, people often neglect to check for existing liens or encumbrances on the property. If there are outstanding debts or legal claims against the property, these can complicate the transfer process. It's vital to ensure that the property is free of such issues before executing the deed.

Another mistake involves misunderstanding the implications of the Lady Bird Deed itself. Some individuals think that it functions like a regular deed, not realizing that it allows the property owner to retain control during their lifetime. This misunderstanding can lead to incorrect assumptions about the rights of the beneficiaries.

Furthermore, failing to update the deed after changes in personal circumstances is a common oversight. Life events such as marriage, divorce, or the birth of a child can necessitate changes to the deed. Not updating the document can lead to confusion and unintended consequences regarding inheritance.

People also sometimes forget to record the deed with the county clerk’s office. Even if the form is filled out correctly and notarized, if it is not recorded, it may not be recognized legally. This step is essential to ensure that the transfer is official and enforceable.

Lastly, many individuals do not seek legal advice when preparing a Lady Bird Deed. While it is possible to fill out the form independently, consulting with a legal expert can help avoid mistakes and ensure that all aspects of the deed are handled correctly. Engaging with a professional can provide peace of mind and clarity regarding the process.

Dos and Don'ts

When it comes to filling out the Florida Lady Bird Deed form, getting it right is crucial. Here’s a handy list of things you should and shouldn’t do to ensure a smooth process.

- Do make sure you have the correct legal description of the property.

- Do clearly identify all parties involved, including the grantor and grantee.

- Do consider consulting with a legal professional if you have any questions.

- Do double-check all information for accuracy before submitting.

- Don’t leave any sections blank; incomplete forms can lead to delays.

- Don’t use vague language; be specific about your intentions with the property.

By following these guidelines, you’ll help ensure that your Lady Bird Deed is completed correctly and efficiently. Taking the time to do it right can save you from headaches down the line!

Other Lady Bird Deed State Forms

Texas Life Estate Deed Form - This form can help shield your property from potential future claims or disputes.

Having a clear understanding of the Durable Power of Attorney form in California is essential for anyone looking to manage their future decisions, especially in times of uncertainty. For guidance on creating one, you can refer to resources like TopTemplates.info, which provide valuable information on the required steps and considerations.

Similar forms

- Transfer on Death Deed (TODD): Like the Lady Bird Deed, this document allows property owners to transfer their real estate to beneficiaries upon death without going through probate.

- Arizona Operating Agreement Form: To ensure your LLC operates smoothly, consult our essential Arizona Operating Agreement form resources for detailed guidance on management and operational structures.

- Life Estate Deed: This deed creates a life estate for the property owner, allowing them to live in the property for life while transferring ownership to another party after their death.

- Joint Tenancy Deed: This deed enables two or more people to own property together, ensuring that if one owner passes away, their share automatically goes to the surviving owner(s).

- Quitclaim Deed: This document transfers whatever interest the grantor has in the property without guaranteeing that the title is clear, similar to how a Lady Bird Deed transfers ownership upon death.

- Warranty Deed: This deed guarantees that the grantor holds clear title to the property, providing assurance to the buyer, similar to how a Lady Bird Deed provides security in the transfer process.

- Revocable Trust: A revocable trust allows property to be transferred to beneficiaries upon the grantor's death, similar to the Lady Bird Deed's function of avoiding probate.

- Power of Attorney: This document allows someone to act on behalf of another person, including making decisions about property, akin to how a Lady Bird Deed can allow for management during the owner's lifetime.

- Beneficiary Deed: Similar to the Lady Bird Deed, this document allows property to pass directly to a beneficiary upon the owner’s death, avoiding probate.

- Special Warranty Deed: This deed offers limited guarantees about the title, transferring property while providing some assurance, much like the Lady Bird Deed does for heirs.

- Deed of Trust: This document secures a loan with real property, ensuring that the property is transferred to a trustee for the benefit of a lender, similar in its legal function to how a Lady Bird Deed manages property interests.