Printable Florida Durable Power of Attorney Document

Form Preview Example

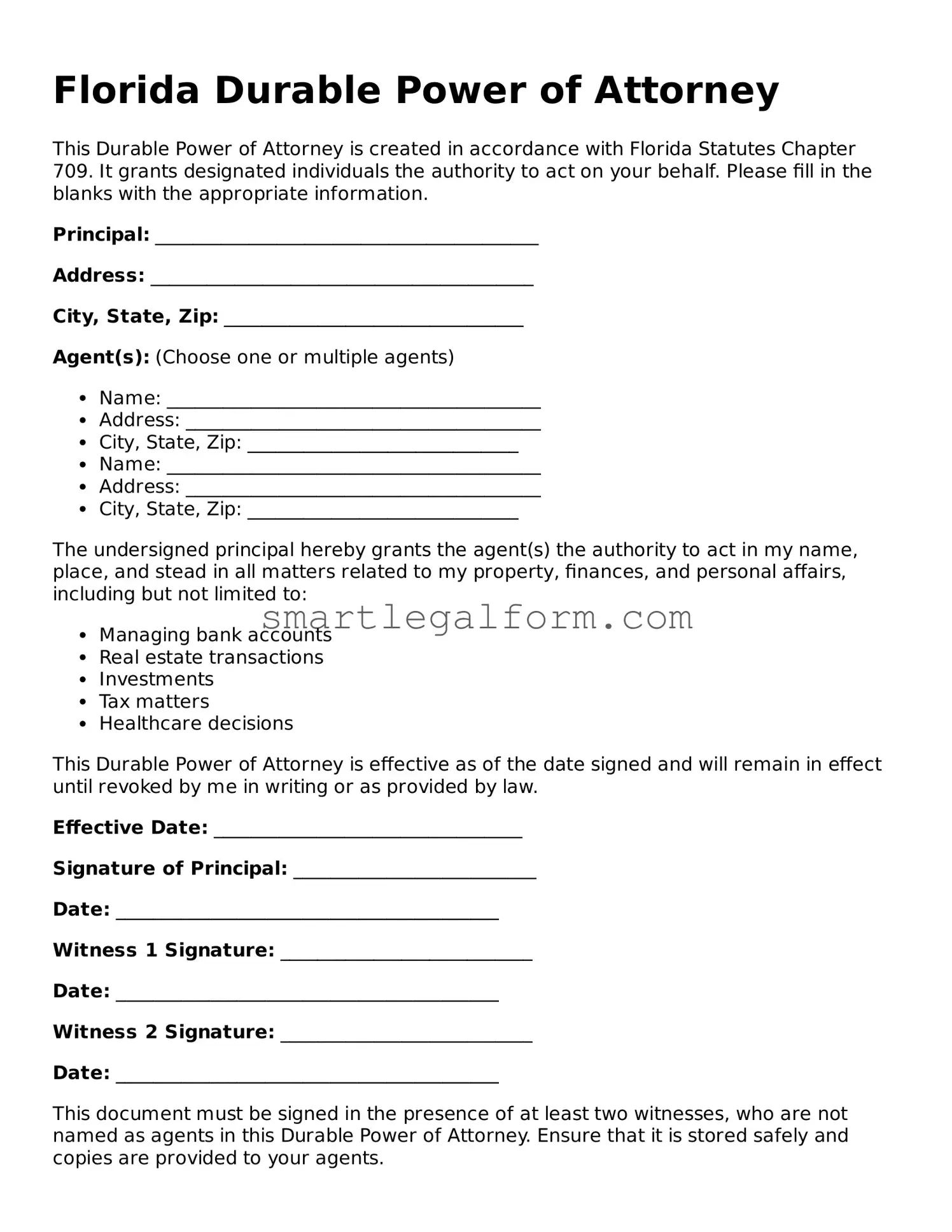

Florida Durable Power of Attorney

This Durable Power of Attorney is created in accordance with Florida Statutes Chapter 709. It grants designated individuals the authority to act on your behalf. Please fill in the blanks with the appropriate information.

Principal: _________________________________________

Address: _________________________________________

City, State, Zip: ________________________________

Agent(s): (Choose one or multiple agents)

- Name: ________________________________________

- Address: ______________________________________

- City, State, Zip: _____________________________

- Name: ________________________________________

- Address: ______________________________________

- City, State, Zip: _____________________________

The undersigned principal hereby grants the agent(s) the authority to act in my name, place, and stead in all matters related to my property, finances, and personal affairs, including but not limited to:

- Managing bank accounts

- Real estate transactions

- Investments

- Tax matters

- Healthcare decisions

This Durable Power of Attorney is effective as of the date signed and will remain in effect until revoked by me in writing or as provided by law.

Effective Date: _________________________________

Signature of Principal: __________________________

Date: _________________________________________

Witness 1 Signature: ___________________________

Date: _________________________________________

Witness 2 Signature: ___________________________

Date: _________________________________________

This document must be signed in the presence of at least two witnesses, who are not named as agents in this Durable Power of Attorney. Ensure that it is stored safely and copies are provided to your agents.

Common mistakes

Filling out a Florida Durable Power of Attorney (DPOA) form can be a straightforward process, but many people make common mistakes that can lead to complications. One frequent error is failing to specify the powers granted. It’s essential to clearly outline what decisions the agent can make on your behalf, such as financial, medical, or legal matters. Without this clarity, the agent may not have the authority needed to act effectively.

Another mistake is not signing the document in front of a notary public. Florida law requires that the DPOA be signed by the principal and witnessed by two individuals or notarized. Skipping this step can render the document invalid. Always ensure that the signing process adheres to these requirements to avoid future disputes.

People often overlook the importance of selecting a trustworthy agent. Choosing someone without considering their reliability and integrity can lead to misuse of power. It’s crucial to select an individual who understands your wishes and can act in your best interest.

Additionally, many individuals forget to update their DPOA after significant life changes, such as marriage, divorce, or the death of an agent. An outdated document may not reflect your current wishes or circumstances. Regularly reviewing and updating your DPOA can prevent potential issues down the line.

Another common error is neglecting to discuss the DPOA with the chosen agent. It’s important to communicate your expectations and wishes clearly. If the agent is unaware of your preferences, they may make decisions that do not align with your intentions.

Some people also fail to consider backup agents. In case the primary agent is unavailable or unable to serve, having a secondary agent designated ensures that someone can step in when needed. This precaution can prevent delays in decision-making during critical times.

Lastly, individuals may not fully understand the implications of granting power of attorney. It’s vital to comprehend the extent of the powers being given and the potential risks involved. Taking the time to educate oneself about the responsibilities and consequences of a DPOA can lead to better decision-making.

Dos and Don'ts

When filling out the Florida Durable Power of Attorney form, it's important to know what to do and what to avoid. Here’s a helpful list:

- Do clearly identify the person you are appointing as your agent.

- Do specify the powers you are granting to your agent.

- Do sign the form in front of a notary public and two witnesses.

- Do keep a copy of the signed document for your records.

- Don't leave any blank spaces on the form.

- Don't appoint someone who may have conflicting interests.

- Don't forget to review the document periodically to ensure it still meets your needs.

Other Durable Power of Attorney State Forms

Durable Power of Attorney Form Pennsylvania - Choosing the right agent is critical, as this person will have significant control over your financial decisions.

For those navigating the complexities of parental authority, understanding the "important Power of Attorney for a Child" document can be vital in ensuring the well-being and care of your child during times of need. This legal form, which delegates decision-making power to another trusted adult, plays a crucial role in safeguarding children's interests when parents are temporarily unavailable. For more insights, you can visit Power of Attorney for a Child.

Durable Power of Attorney Illinois Pdf - Some states may have specific requirements for notarization or witness signatures.

Similar forms

- General Power of Attorney: Like the Durable Power of Attorney, this document allows someone to act on your behalf. However, it typically becomes invalid if you become incapacitated.

- Healthcare Power of Attorney: This form specifically grants authority to make medical decisions for you if you are unable to do so. It focuses solely on healthcare matters.

- Living Will: While a Durable Power of Attorney allows someone to make decisions for you, a Living Will outlines your wishes regarding medical treatment and end-of-life care.

- Free And Invoice PDF Form: This form aids in clarifying billing details between businesses and clients, thus ensuring transparency in transactions. For more information, visit documentonline.org/blank-free-and-invoice-pdf.

- Financial Power of Attorney: Similar to the Durable Power of Attorney, this document focuses on financial matters. It allows someone to manage your finances but may not remain valid if you become incapacitated.

- Trust Document: A trust can manage your assets during your lifetime and after your death. While a Durable Power of Attorney grants authority to act on your behalf, a trust holds and manages your assets.

- Will: A will outlines how your assets will be distributed after your death. Unlike a Durable Power of Attorney, it only takes effect upon your passing.

- Advance Directive: This document combines elements of a Living Will and a Healthcare Power of Attorney. It specifies your healthcare wishes and designates someone to make decisions for you.

- Guardianship Document: If you become incapacitated, a guardianship document appoints someone to make decisions for you, similar to a Durable Power of Attorney but typically involves court approval.

- Banking Power of Attorney: This specific type of power of attorney allows someone to manage your banking transactions. It can be limited to banking matters, unlike a Durable Power of Attorney, which is broader.

- Real Estate Power of Attorney: This document grants authority to handle real estate transactions on your behalf. It is similar to a Durable Power of Attorney but focuses specifically on property matters.