Printable Florida Deed in Lieu of Foreclosure Document

Form Preview Example

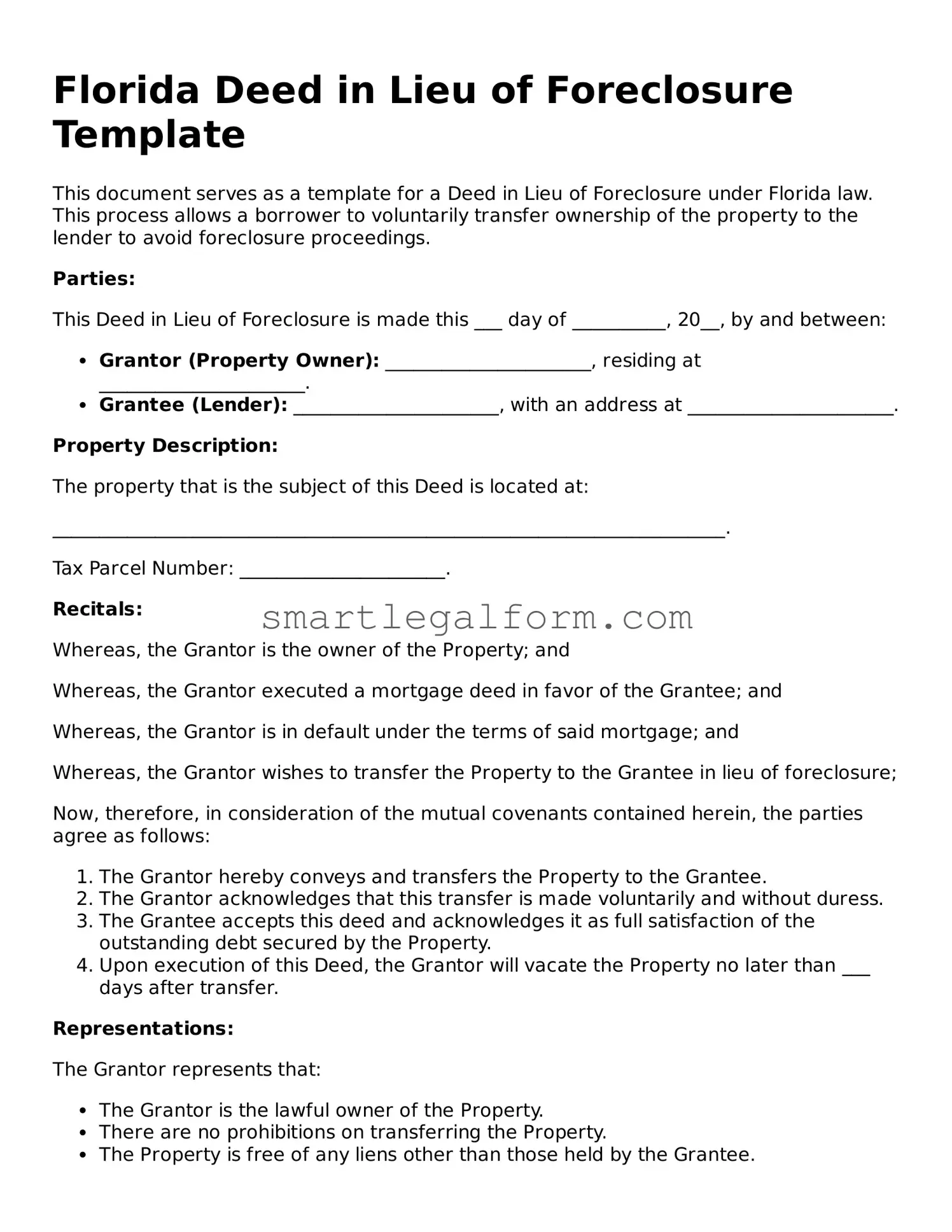

Florida Deed in Lieu of Foreclosure Template

This document serves as a template for a Deed in Lieu of Foreclosure under Florida law. This process allows a borrower to voluntarily transfer ownership of the property to the lender to avoid foreclosure proceedings.

Parties:

This Deed in Lieu of Foreclosure is made this ___ day of __________, 20__, by and between:

- Grantor (Property Owner): ______________________, residing at ______________________.

- Grantee (Lender): ______________________, with an address at ______________________.

Property Description:

The property that is the subject of this Deed is located at:

________________________________________________________________________.

Tax Parcel Number: ______________________.

Recitals:

Whereas, the Grantor is the owner of the Property; and

Whereas, the Grantor executed a mortgage deed in favor of the Grantee; and

Whereas, the Grantor is in default under the terms of said mortgage; and

Whereas, the Grantor wishes to transfer the Property to the Grantee in lieu of foreclosure;

Now, therefore, in consideration of the mutual covenants contained herein, the parties agree as follows:

- The Grantor hereby conveys and transfers the Property to the Grantee.

- The Grantor acknowledges that this transfer is made voluntarily and without duress.

- The Grantee accepts this deed and acknowledges it as full satisfaction of the outstanding debt secured by the Property.

- Upon execution of this Deed, the Grantor will vacate the Property no later than ___ days after transfer.

Representations:

The Grantor represents that:

- The Grantor is the lawful owner of the Property.

- There are no prohibitions on transferring the Property.

- The Property is free of any liens other than those held by the Grantee.

Governing Law:

This Deed shall be governed by and construed in accordance with the laws of the State of Florida.

Signatures:

IN WITNESS WHEREOF, the Grantor has set their hand on the date first above written.

______________________________

Grantor Signature

______________________________

Print Name of Grantor

Witness:

______________________________

Witness Signature

______________________________

Print Name of Witness

Notary Public:

State of Florida

County of ________________

On this ___ day of __________, 20__, before me, a Notary Public, personally appeared ______________________, known to me to be the person whose name is subscribed to this instrument, and acknowledged that they executed the same for the purposes therein contained.

______________________________

Notary Public Signature

My Commission Expires: _____________

Common mistakes

Filling out the Florida Deed in Lieu of Foreclosure form can be a straightforward process, but many people make mistakes that can complicate or delay the transfer of property. One common error is failing to provide complete information about the property. Omitting details such as the legal description or the correct address can lead to confusion and potential legal issues later on.

Another frequent mistake is not signing the form correctly. The form requires signatures from all parties involved. If one person neglects to sign or if the signatures do not match the names on the title, the deed may be deemed invalid. It's essential to ensure that every required signature is present and accurate.

Many individuals also overlook the need for notarization. The Florida Deed in Lieu of Foreclosure must be notarized to be legally binding. Without a notary's signature and seal, the document may not hold up in court, which can cause significant delays in the foreclosure process.

Additionally, people often fail to check for outstanding liens or encumbrances on the property. If there are existing debts tied to the property, these issues need to be resolved before executing the deed. Ignoring this step can lead to complications that affect the transfer and ownership of the property.

Another mistake is not understanding the implications of the deed itself. A Deed in Lieu of Foreclosure can have tax consequences. Individuals should consult a tax professional to understand how this action may impact their financial situation. Failing to do so could lead to unexpected tax liabilities.

Some individuals rush through the process and do not read the entire form carefully. This can result in misunderstandings about the terms and conditions outlined in the deed. Taking the time to review the document thoroughly can prevent future disputes and ensure that all parties are on the same page.

People sometimes forget to provide the necessary supporting documentation. This may include proof of identity or other relevant information that the lender may require. Without this documentation, the process may stall, causing unnecessary delays.

Lastly, individuals may not keep copies of the completed form and any associated documents. It’s crucial to retain copies for personal records and future reference. Not having these documents can create problems if questions arise later regarding the deed or the property.

Dos and Don'ts

When filling out the Florida Deed in Lieu of Foreclosure form, it's essential to approach the process with care. Here’s a list of things you should and shouldn't do to ensure everything goes smoothly.

- Do ensure that you fully understand the implications of signing a deed in lieu of foreclosure.

- Do consult with a legal advisor or real estate professional before proceeding.

- Do provide accurate information about the property and your ownership status.

- Do review the form carefully for any errors or omissions.

- Do sign the document in the presence of a notary public to ensure its validity.

- Don't rush through the form; take your time to fill it out correctly.

- Don't ignore any outstanding liens or encumbrances on the property.

- Don't assume that the lender will accept the deed without proper communication.

- Don't forget to keep copies of all documents for your records.

- Don't overlook the potential tax implications of transferring the property.

By following these guidelines, you can navigate the deed in lieu of foreclosure process more effectively and minimize potential issues down the line.

Other Deed in Lieu of Foreclosure State Forms

What Does an Arizona Homeowner Lose When Choosing to Use Deed in Lieu of Foreclosure? - This strategy can sometimes result in lesser financial loss than pursuing a traditional foreclosure.

The Loan Servicer Might Agree to Put the Foreclosure on Hold to Give You Some Time to Sell Your Home - Property condition may significantly impact negotiations and acceptance of this form by lenders.

California Voluntary Foreclosure Deed - In many cases, a Deed in Lieu might result in a less damaging impact on the borrower's credit report.

Having a comprehensive Texas Operating Agreement form is vital for any LLC looking to establish clear operational guidelines and member responsibilities. By detailing the internal processes and financial arrangements, it helps prevent potential disputes among members. For those interested in utilizing templates for such agreements, resources like toptemplates.info can provide valuable insights and tools to assist in drafting an effective document.

Foreclosure Vs Deed in Lieu - A possible remedy for a homeowner facing a challenging financial situation, benefiting both parties involved.

Similar forms

- Short Sale Agreement: This document allows a homeowner to sell their property for less than the amount owed on the mortgage, with the lender's approval. Like a deed in lieu, it helps avoid foreclosure.

- Loan Modification Agreement: This document modifies the terms of the existing mortgage to make payments more affordable. Both options aim to prevent foreclosure and assist the homeowner.

- Forbearance Agreement: This is an agreement between the lender and borrower to temporarily reduce or suspend mortgage payments. Similar to a deed in lieu, it provides relief to the homeowner facing financial difficulties.

- Hold Harmless Agreement: A Hold Harmless Agreement in California is a vital document whereby one party agrees to protect the other from any liabilities that may arise during a transaction. This understanding ensures safety and clarity in dealings, making it essential in various business scenarios. For more information, visit OnlineLawDocs.com.

- Mortgage Release: This document releases the borrower from their mortgage obligation, typically after a sale or deed in lieu. Both documents signify the end of the borrower's responsibility for the loan.

- Settlement Agreement: This is a mutual agreement between the lender and borrower to settle a debt. Like a deed in lieu, it can lead to the resolution of financial obligations without foreclosure.

- Quitclaim Deed: This document transfers ownership of a property without any warranties. It can be similar to a deed in lieu if the homeowner voluntarily transfers the property to the lender.

- Deed of Trust: This document secures a loan by transferring the property to a trustee until the loan is paid off. It shares similarities with a deed in lieu in that it involves property transfer related to mortgage obligations.

- Bankruptcy Filing: Filing for bankruptcy can help a homeowner manage debts and may lead to the loss of the home. Both bankruptcy and a deed in lieu can be options to avoid foreclosure.

- Property Settlement Agreement: This agreement outlines the division of property in a divorce. It can resemble a deed in lieu when one party transfers property to the other to resolve financial issues.