Attorney-Approved Employment Verification Form

Employment Verification for Particular US States

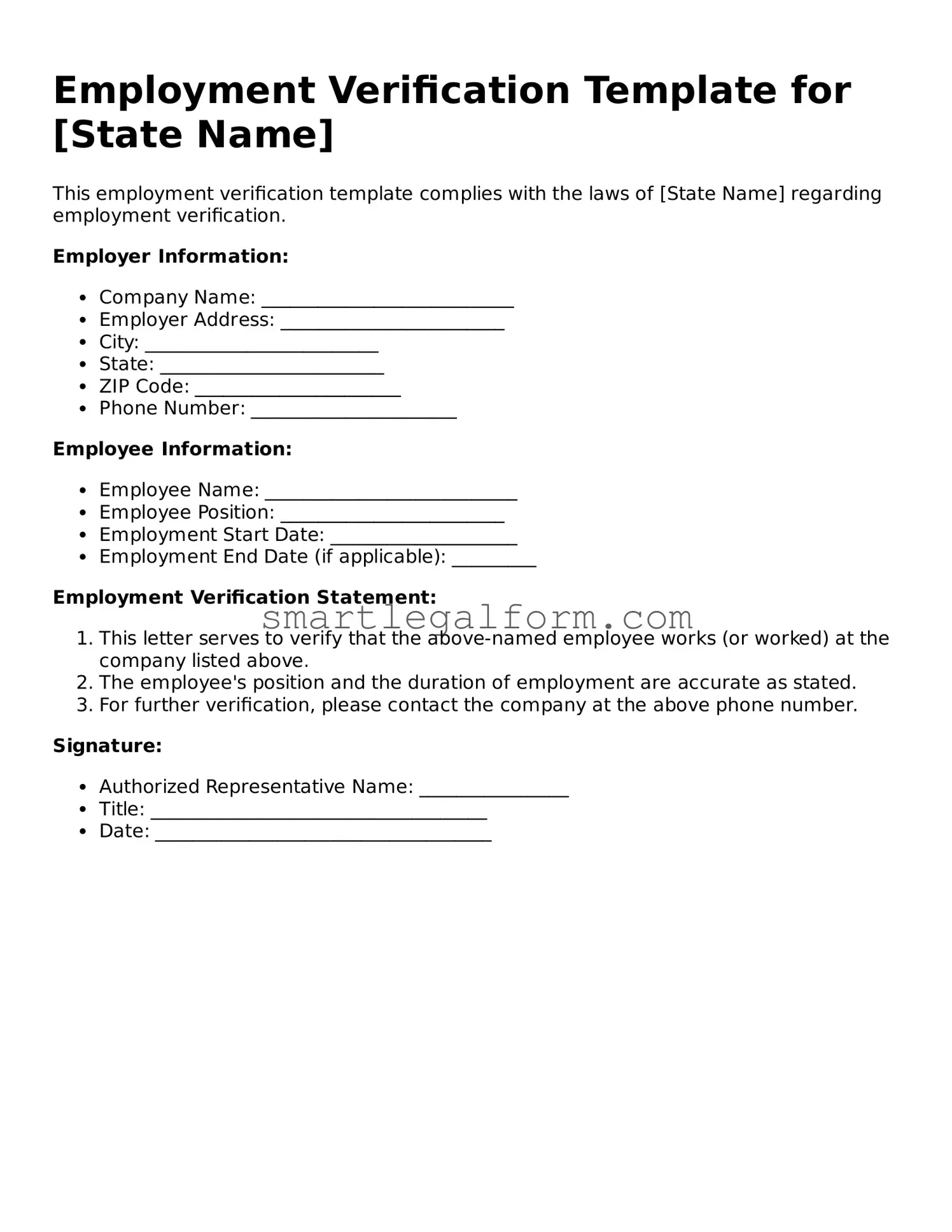

Form Preview Example

Employment Verification Template for [State Name]

This employment verification template complies with the laws of [State Name] regarding employment verification.

Employer Information:

- Company Name: ___________________________

- Employer Address: ________________________

- City: _________________________

- State: ________________________

- ZIP Code: ______________________

- Phone Number: ______________________

Employee Information:

- Employee Name: ___________________________

- Employee Position: ________________________

- Employment Start Date: ____________________

- Employment End Date (if applicable): _________

Employment Verification Statement:

- This letter serves to verify that the above-named employee works (or worked) at the company listed above.

- The employee's position and the duration of employment are accurate as stated.

- For further verification, please contact the company at the above phone number.

Signature:

- Authorized Representative Name: ________________

- Title: ____________________________________

- Date: ____________________________________

Common mistakes

When completing the Employment Verification form, individuals often overlook important details that can lead to delays or complications in the verification process. One common mistake is providing inaccurate or incomplete employment dates. It is essential to ensure that the start and end dates of employment are correct. Missing or incorrect information can cause confusion and may require additional follow-up.

Another frequent error is failing to include the correct job title. The job title should accurately reflect the position held at the time of employment. If the title is vague or incorrect, it may not align with the employer's records, leading to potential discrepancies during verification.

People sometimes neglect to provide the necessary contact information for their previous employer. This includes the name of the company, the address, and a phone number for the HR department or the supervisor. Without this information, it becomes difficult for the verifying party to reach out and confirm employment details.

Additionally, individuals may not sign or date the form appropriately. An unsigned or undated form can be considered invalid, which means the verification process cannot proceed. It is crucial to review the form carefully to ensure that all required signatures are present.

Lastly, some individuals fail to read the instructions carefully before filling out the form. Each employer may have specific requirements for the Employment Verification form. Ignoring these instructions can result in incomplete submissions or the need for resubmission, causing unnecessary delays in the verification process.

Dos and Don'ts

When filling out an Employment Verification form, it's important to get it right. Here are some key dos and don'ts to keep in mind:

- Do provide accurate and complete information about your employment history.

- Do double-check your contact details to ensure they are correct.

- Do include the name and contact information of your supervisor or HR representative.

- Do sign and date the form where required.

- Don't leave any sections blank unless instructed to do so.

- Don't provide false information; this can lead to serious consequences.

Following these guidelines can help ensure your Employment Verification form is processed smoothly and accurately.

Common Templates:

How to Write Up a Bill of Sale for a Boat - Includes signatures of both parties to validate the sale.

Printable Five Wishes Document Pdf - This document is a vital step in honoring your life’s values and ensuring they guide your medical care during challenging times.

Printable Pdf Simple Direct Deposit Form - The form requires all information to be filled correctly to avoid delays in processing payments.

Similar forms

- W-2 Form: This document summarizes an employee's annual wages and the taxes withheld. Like the Employment Verification form, it confirms employment status and income level, often required for loans or financial applications.

- Pay Stubs: These are issued by employers to employees, detailing earnings for a specific pay period. They serve a similar purpose in verifying employment and income, providing proof of regular payments.

- Offer Letter: This letter outlines the terms of employment, including job title, salary, and start date. It serves as an initial verification of employment, confirming that an individual has accepted a job offer.

- Tax Returns: Personal tax returns can provide evidence of employment and income over a specific period. They are often used in conjunction with the Employment Verification form to verify financial stability.

- Reference Letters: These letters from previous employers or supervisors can confirm an individual's employment history and skills. They serve as a personal endorsement of the applicant's professional experience.

- Employment Contracts: These legally binding agreements outline the terms of employment between an employer and employee. They verify employment status and often include details about job responsibilities and compensation.

- Social Security Administration (SSA) Earnings Record: This document provides a summary of an individual's earnings history as reported to the SSA. It can be used to verify employment and income, similar to the Employment Verification form.