Attorney-Approved Employee Loan Agreement Form

Form Preview Example

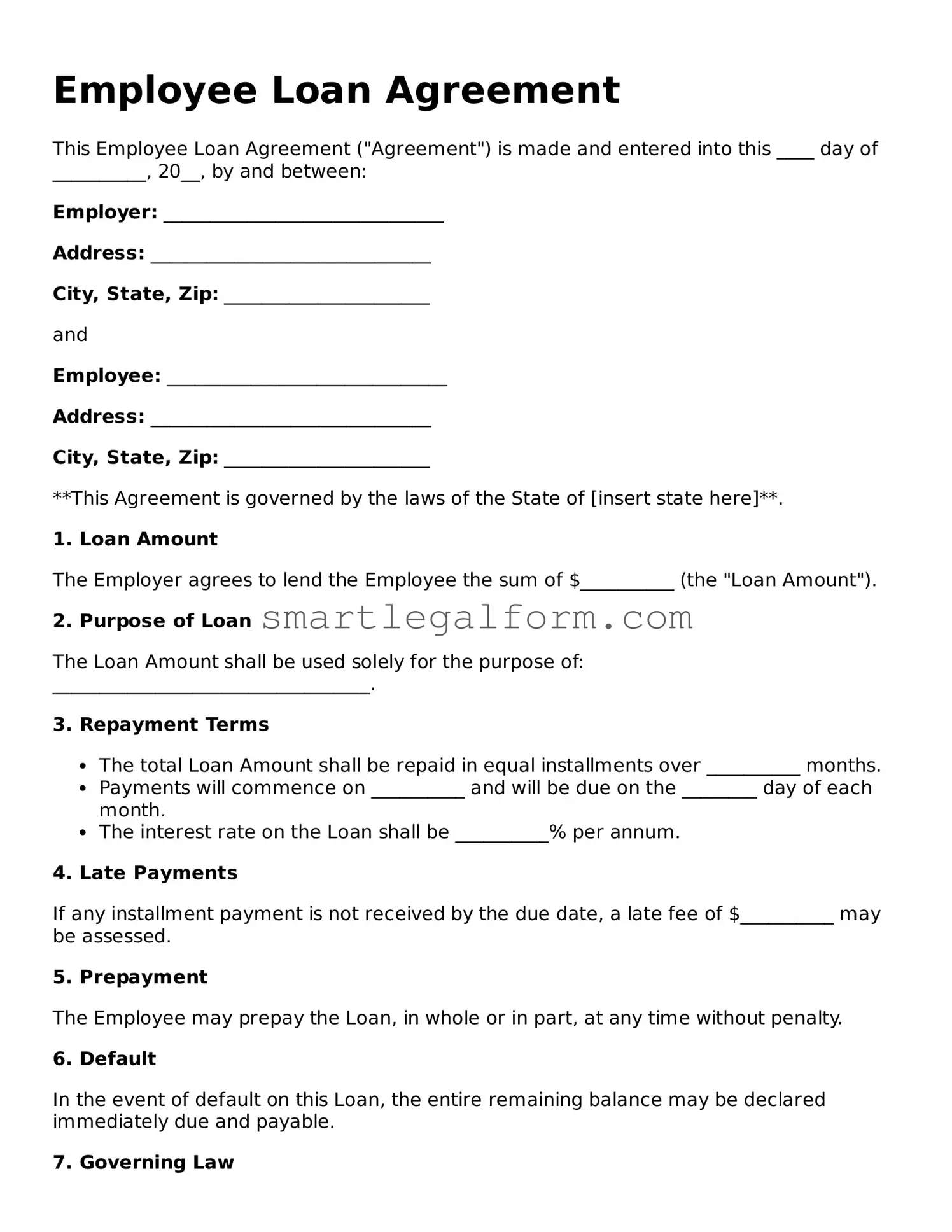

Employee Loan Agreement

This Employee Loan Agreement ("Agreement") is made and entered into this ____ day of __________, 20__, by and between:

Employer: ______________________________

Address: ______________________________

City, State, Zip: ______________________

and

Employee: ______________________________

Address: ______________________________

City, State, Zip: ______________________

**This Agreement is governed by the laws of the State of [insert state here]**.

1. Loan Amount

The Employer agrees to lend the Employee the sum of $__________ (the "Loan Amount").

2. Purpose of Loan

The Loan Amount shall be used solely for the purpose of: __________________________________.

3. Repayment Terms

- The total Loan Amount shall be repaid in equal installments over __________ months.

- Payments will commence on __________ and will be due on the ________ day of each month.

- The interest rate on the Loan shall be __________% per annum.

4. Late Payments

If any installment payment is not received by the due date, a late fee of $__________ may be assessed.

5. Prepayment

The Employee may prepay the Loan, in whole or in part, at any time without penalty.

6. Default

In the event of default on this Loan, the entire remaining balance may be declared immediately due and payable.

7. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of [insert state here].

8. Signatures

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first above written.

Employer Signature: ___________________________

Date: __________

Employee Signature: ___________________________

Date: __________

Common mistakes

Filling out an Employee Loan Agreement form can seem straightforward, but many people make common mistakes that can lead to complications later on. One frequent error is not providing accurate personal information. This includes misspelling names or entering incorrect addresses. Such inaccuracies can cause delays in processing the loan and may create issues in communication.

Another common mistake is overlooking the loan amount. Employees may request a sum that exceeds their eligibility or fail to specify the amount altogether. This can lead to confusion and potential denial of the loan request. It is crucial to double-check the figures and ensure they align with the company’s policies.

Additionally, some individuals neglect to read the terms and conditions of the agreement. This oversight can lead to misunderstandings regarding repayment schedules, interest rates, and other obligations. Understanding these terms is essential for making informed decisions about borrowing.

Many people also forget to include required signatures. An unsigned form is not valid and will not be processed. It is important to ensure that all necessary parties have signed the document before submission to avoid unnecessary delays.

Another mistake is failing to provide supporting documentation. Some agreements may require proof of income or other financial information. Without these documents, the loan application may be incomplete, resulting in rejection.

Finally, individuals often underestimate the importance of keeping a copy of the completed form. Not retaining a record can lead to confusion later on, especially if questions arise about the loan terms or repayment. Keeping a copy ensures that employees have a reference point for any future inquiries.

Dos and Don'ts

When filling out the Employee Loan Agreement form, it's important to approach it with care. Here are some key dos and don'ts to keep in mind:

- Do read the entire form carefully before starting.

- Do provide accurate personal information.

- Do double-check all numbers and amounts.

- Do ensure you understand the repayment terms.

- Don't rush through the form; take your time.

- Don't leave any required fields blank.

- Don't sign the form without reviewing it thoroughly.

Following these guidelines will help ensure that your application is processed smoothly and efficiently.

Similar forms

-

Promissory Note: Similar to an Employee Loan Agreement, a promissory note outlines the borrower's promise to repay a loan. It details the amount borrowed, interest rates, and repayment terms, ensuring both parties understand their obligations.

-

Loan Application: The loan application serves as the initial document where the borrower requests funds. Like the Employee Loan Agreement, it collects essential information about the borrower’s financial situation and purpose for the loan, helping the lender assess risk.

- Florida Loan Agreement Form: For those considering borrowing or lending, the comprehensive Florida loan agreement form resources are essential for outlining the terms and protections involved in the process.

-

Security Agreement: This document is often used when a loan is secured by collateral. It shares similarities with the Employee Loan Agreement by outlining the terms of the loan and the consequences if the borrower defaults, providing protection for the lender.

-

Loan Repayment Schedule: A loan repayment schedule details when payments are due and how much is owed. Like the Employee Loan Agreement, it ensures clarity and accountability for both the borrower and lender regarding repayment expectations.