Attorney-Approved Durable Power of Attorney Form

Durable Power of Attorney for Particular US States

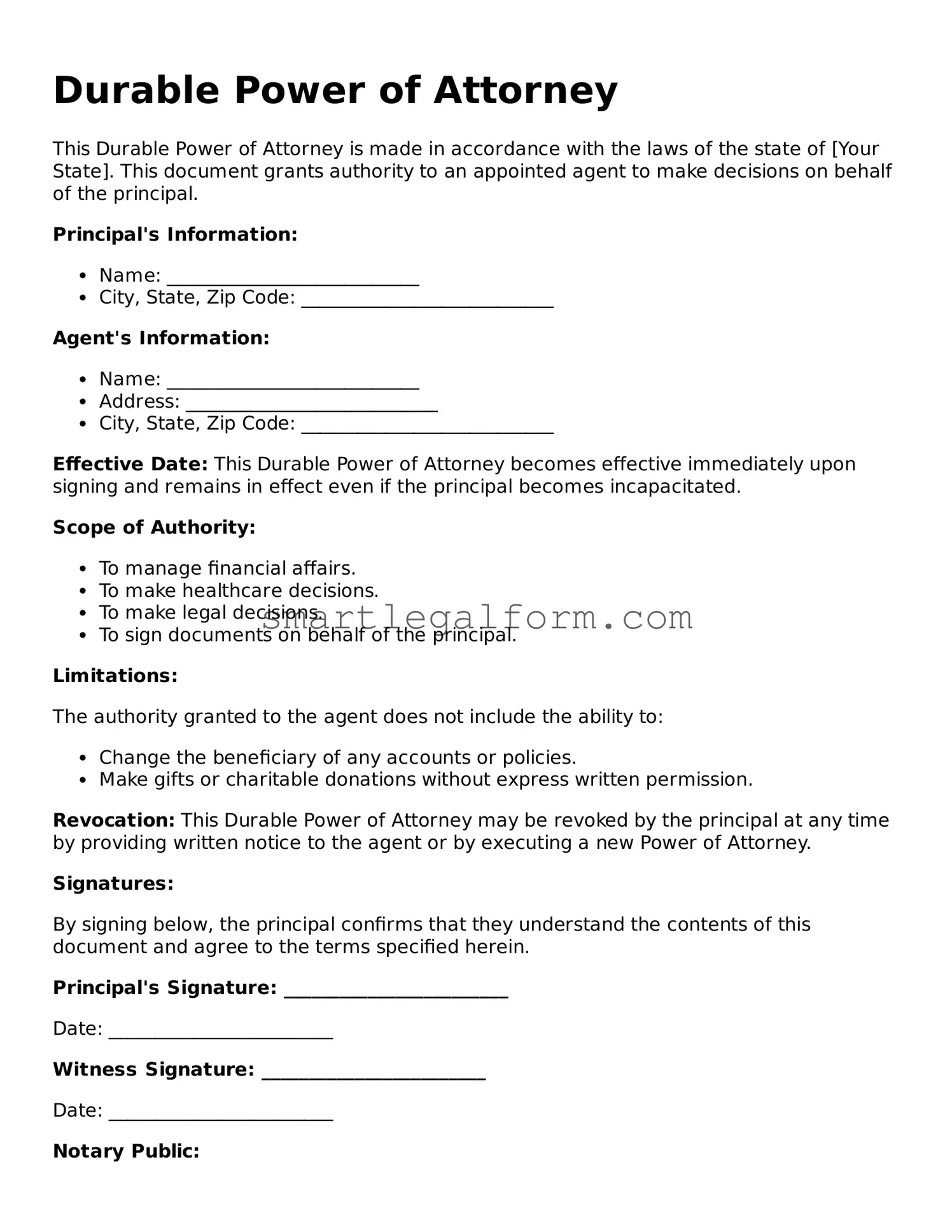

Form Preview Example

Durable Power of Attorney

This Durable Power of Attorney is made in accordance with the laws of the state of [Your State]. This document grants authority to an appointed agent to make decisions on behalf of the principal.

Principal's Information:

- Name: ___________________________

- City, State, Zip Code: ___________________________

Agent's Information:

- Name: ___________________________

- Address: ___________________________

- City, State, Zip Code: ___________________________

Effective Date: This Durable Power of Attorney becomes effective immediately upon signing and remains in effect even if the principal becomes incapacitated.

Scope of Authority:

- To manage financial affairs.

- To make healthcare decisions.

- To make legal decisions.

- To sign documents on behalf of the principal.

Limitations:

The authority granted to the agent does not include the ability to:

- Change the beneficiary of any accounts or policies.

- Make gifts or charitable donations without express written permission.

Revocation: This Durable Power of Attorney may be revoked by the principal at any time by providing written notice to the agent or by executing a new Power of Attorney.

Signatures:

By signing below, the principal confirms that they understand the contents of this document and agree to the terms specified herein.

Principal's Signature: ________________________

Date: ________________________

Witness Signature: ________________________

Date: ________________________

Notary Public:

State of _______________

County of _______________

Subscribed and sworn to before me on this ___ day of ____________, 20__.

Notary Signature: ________________________

My Commission Expires: ________________________

Common mistakes

Filling out a Durable Power of Attorney (DPOA) form is an important step in planning for the future. However, many individuals make common mistakes that can lead to complications down the line. One frequent error is failing to specify the powers granted to the agent. Without clear instructions, the agent may not have the authority to act in the way the principal intended.

Another mistake is neglecting to sign the document in front of a notary public or witnesses, as required by state law. A DPOA without proper signatures may not be valid, leaving the principal unprotected. It's crucial to check the specific requirements in your state to ensure compliance.

People often overlook the importance of choosing the right agent. Selecting someone who is not trustworthy or lacks the necessary skills can lead to poor decision-making. It’s essential to choose an individual who understands your values and can act in your best interest.

Additionally, many individuals fail to update their DPOA when life circumstances change. Changes in relationships, health, or financial situations may necessitate a new agent or different powers. Regularly reviewing and updating the document can prevent future issues.

Another common mistake is not discussing the DPOA with the chosen agent. Without a conversation about expectations and responsibilities, the agent may be unprepared for the role. Open communication can ensure that everyone is on the same page.

Some people mistakenly believe that a DPOA only applies to financial matters. In reality, a DPOA can cover health care decisions as well. It’s important to clarify what powers are included to avoid confusion during critical times.

Another error is using outdated forms. Laws regarding DPOAs can change, and using an old form may not comply with current regulations. Always obtain the latest version of the form to ensure its validity.

Individuals sometimes fail to keep copies of the completed DPOA. Without copies, the agent may struggle to prove their authority when needed. Store copies in a safe place and provide one to the agent and any relevant institutions.

Additionally, people may not realize that a DPOA can be revoked. If circumstances change, the principal should know how to revoke the document properly. Failing to do so can lead to confusion and potential misuse of authority.

Lastly, many overlook the need for a backup agent. Life is unpredictable, and the primary agent may become unavailable. Designating a secondary agent ensures that there is always someone ready to step in if needed.

Dos and Don'ts

When filling out a Durable Power of Attorney form, it's essential to approach the process with care. Here are some important dos and don'ts to keep in mind:

- Do ensure you understand the responsibilities of the agent you are appointing.

- Do clearly identify the powers you wish to grant to your agent.

- Do sign the document in the presence of a notary public, if required by your state.

- Do keep copies of the signed document for your records and provide one to your agent.

- Don't leave any blank spaces on the form, as this could lead to misunderstandings.

- Don't forget to review the document periodically to ensure it still reflects your wishes.

More Types of Durable Power of Attorney Forms:

Notarized Minor Child Power of Attorney Child Guardianship - The designated authority can make decisions only within the limits set by the parent.

Power of Attorney Revocation Form - Providing clarity for future interactions with third parties is a key goal.

Similar forms

- General Power of Attorney: Like the Durable Power of Attorney, this document allows one person to act on behalf of another. However, it typically becomes invalid if the person who created it becomes incapacitated.

- Healthcare Power of Attorney: This document specifically gives someone the authority to make medical decisions for another person. It is similar to the Durable Power of Attorney in that it remains effective even if the person becomes incapacitated.

- Living Will: A Living Will outlines a person's wishes regarding medical treatment in case they are unable to communicate. While it does not appoint an agent like a Durable Power of Attorney, it serves to express preferences in healthcare decisions.

- Financial Power of Attorney: This document grants someone the authority to manage financial matters. It can be durable, meaning it remains valid even if the person becomes incapacitated, similar to the Durable Power of Attorney.

- Trust: A trust allows a person to transfer assets to another party for management. While it serves a different purpose, both a trust and a Durable Power of Attorney can help manage a person's affairs, especially if they become unable to do so themselves.

- Will: A will outlines how a person's assets should be distributed after their death. Although it does not provide authority while a person is alive, it is similar in that both documents are crucial for managing a person's affairs and ensuring their wishes are honored.