Attorney-Approved Deed in Lieu of Foreclosure Form

Deed in Lieu of Foreclosure for Particular US States

Form Preview Example

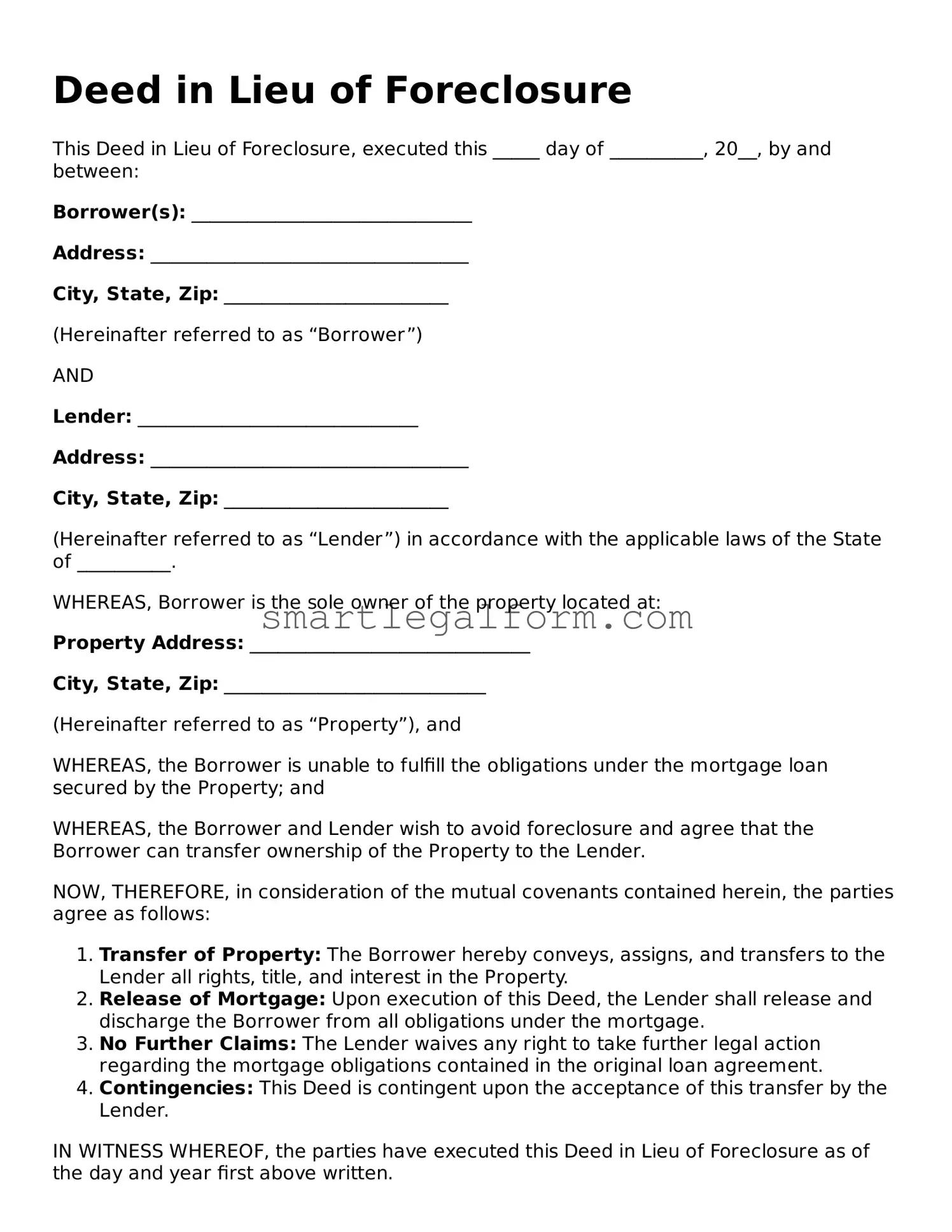

Deed in Lieu of Foreclosure

This Deed in Lieu of Foreclosure, executed this _____ day of __________, 20__, by and between:

Borrower(s): ______________________________

Address: __________________________________

City, State, Zip: ________________________

(Hereinafter referred to as “Borrower”)

AND

Lender: ______________________________

Address: __________________________________

City, State, Zip: ________________________

(Hereinafter referred to as “Lender”) in accordance with the applicable laws of the State of __________.

WHEREAS, Borrower is the sole owner of the property located at:

Property Address: ______________________________

City, State, Zip: ____________________________

(Hereinafter referred to as “Property”), and

WHEREAS, the Borrower is unable to fulfill the obligations under the mortgage loan secured by the Property; and

WHEREAS, the Borrower and Lender wish to avoid foreclosure and agree that the Borrower can transfer ownership of the Property to the Lender.

NOW, THEREFORE, in consideration of the mutual covenants contained herein, the parties agree as follows:

- Transfer of Property: The Borrower hereby conveys, assigns, and transfers to the Lender all rights, title, and interest in the Property.

- Release of Mortgage: Upon execution of this Deed, the Lender shall release and discharge the Borrower from all obligations under the mortgage.

- No Further Claims: The Lender waives any right to take further legal action regarding the mortgage obligations contained in the original loan agreement.

- Contingencies: This Deed is contingent upon the acceptance of this transfer by the Lender.

IN WITNESS WHEREOF, the parties have executed this Deed in Lieu of Foreclosure as of the day and year first above written.

Borrower's Signature: ______________________

Date: ______________________________

Lender's Signature: ______________________

Date: ______________________________

STATE OF __________

COUNTY OF __________

SUBSCRIBED AND SWORN to before me this ____ day of __________, 20__.

Notary Public: _________________________

My Commission Expires: _______________

Common mistakes

Filling out a Deed in Lieu of Foreclosure form can be a straightforward process, but many people make common mistakes that can complicate matters. One major error is failing to provide accurate property information. When the address or legal description of the property is incorrect, it can lead to delays or even rejection of the deed. Always double-check the details to ensure they match official records.

Another mistake is neglecting to understand the implications of signing the form. A Deed in Lieu of Foreclosure transfers ownership of the property back to the lender, which may have consequences for the borrower’s credit score and future borrowing ability. It is crucial to fully comprehend these effects before proceeding.

Additionally, some individuals overlook the requirement for obtaining lender approval. Submitting the deed without confirming that the lender accepts this method of resolving the mortgage can result in wasted time and effort. Always communicate with the lender to confirm their acceptance of a Deed in Lieu of Foreclosure.

Lastly, many people fail to seek legal advice. While the form may seem simple, the legal ramifications can be significant. Consulting with a real estate attorney can help clarify any uncertainties and ensure that the form is filled out correctly. Taking this step can prevent future complications and protect the borrower’s interests.

Dos and Don'ts

When filling out the Deed in Lieu of Foreclosure form, it’s important to approach the process carefully. Here are some things you should and shouldn’t do:

- Do read the entire form thoroughly before starting.

- Do ensure that all information is accurate and complete.

- Do consult with a legal professional if you have questions.

- Do provide your lender with any required documentation promptly.

- Do keep copies of all documents for your records.

- Don't rush through the form; take your time to avoid mistakes.

- Don't leave any sections blank unless instructed to do so.

- Don't ignore any deadlines set by your lender.

- Don't sign the form without understanding its implications.

More Types of Deed in Lieu of Foreclosure Forms:

Deed of Gift Property - This form may incorporate language that specifies any rights or limitations related to the gifted property.

The FedEx Bill of Lading form is not only essential for shipping goods but can also be found online for convenience. For those looking to access a blank version of this important document, you can visit documentonline.org/blank-fedex-bill-of-lading/, ensuring you have the necessary paperwork ready for a seamless shipping experience.

Lady Bird Deed Form Michigan - This form provides relatives with a straightforward way to inherit property without judicial involvement.

Similar forms

-

Short Sale Agreement: Like a Deed in Lieu of Foreclosure, a short sale agreement allows a homeowner to sell their property for less than what they owe on the mortgage. Both options aim to avoid the lengthy foreclosure process, providing a way for homeowners to relieve financial burdens while still involving the lender in the transaction.

- Texas Last Will and Testament: This essential legal document outlines how a person's estate should be distributed after their death, ensuring that final wishes are respected. For more information, visit TopTemplates.info.

-

Loan Modification Agreement: A loan modification agreement alters the terms of an existing mortgage to make it more manageable for the borrower. Similar to a Deed in Lieu of Foreclosure, this document seeks to provide relief to homeowners facing financial difficulties, although it keeps the homeowner in their property instead of transferring ownership.

-

Bankruptcy Filing: Filing for bankruptcy can halt foreclosure proceedings and provide a structured way to manage debts. While the Deed in Lieu of Foreclosure allows for a voluntary transfer of property, bankruptcy can protect a homeowner's assets and provide a fresh start, albeit with more long-term implications.

-

Forbearance Agreement: A forbearance agreement temporarily suspends or reduces mortgage payments for a specific period. Both documents aim to help homeowners in distress, but while the Deed in Lieu of Foreclosure involves relinquishing property, a forbearance keeps the homeowner in their home during a financial crisis.

-

Quitclaim Deed: A quitclaim deed transfers ownership of property without any guarantees regarding the title. Similar to a Deed in Lieu of Foreclosure, it involves the transfer of property, but a quitclaim deed is often used in informal situations, such as transferring property between family members, rather than as a formal solution to foreclosure.