Attorney-Approved Deed Form

Deed for Particular US States

Form Preview Example

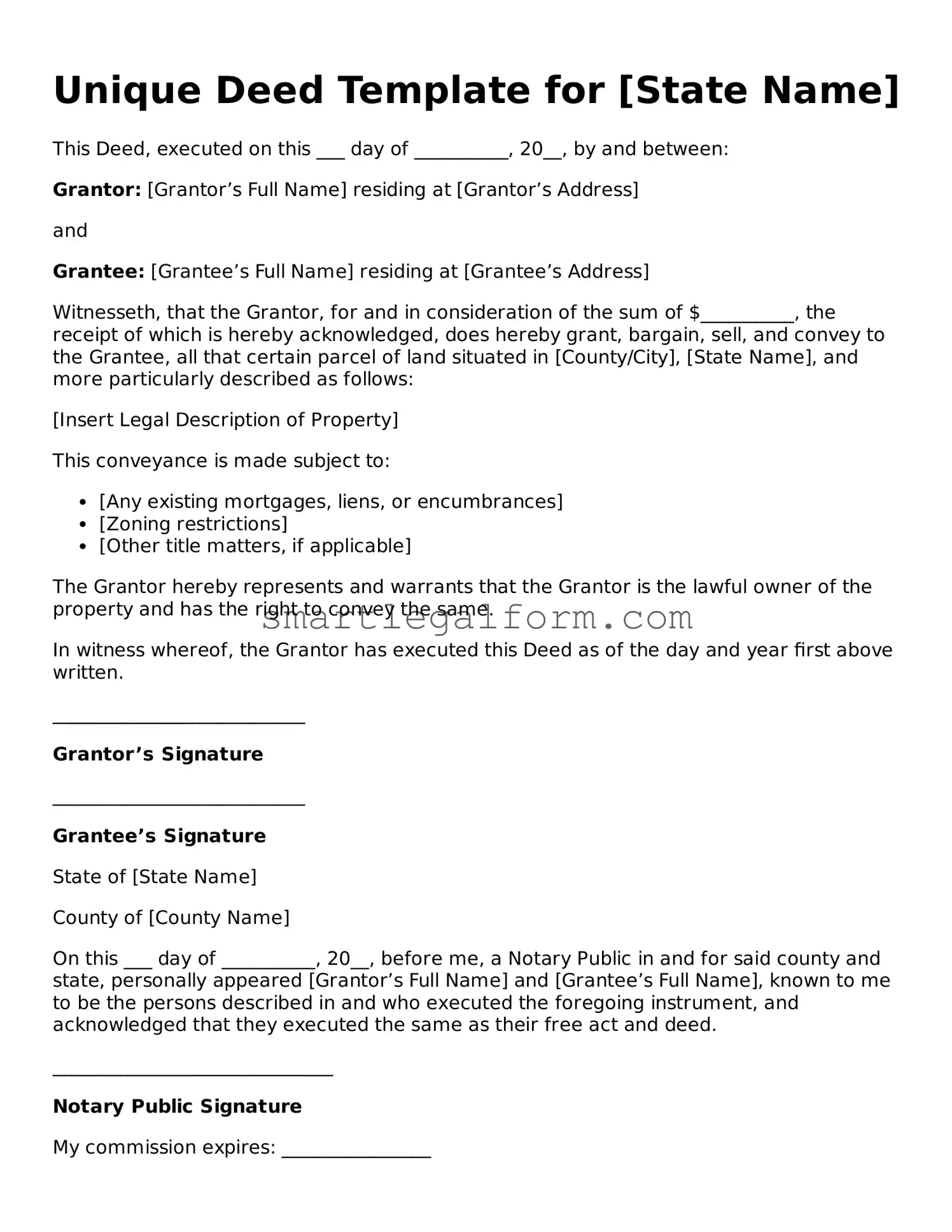

Unique Deed Template for [State Name]

This Deed, executed on this ___ day of __________, 20__, by and between:

Grantor: [Grantor’s Full Name] residing at [Grantor’s Address]

and

Grantee: [Grantee’s Full Name] residing at [Grantee’s Address]

Witnesseth, that the Grantor, for and in consideration of the sum of $__________, the receipt of which is hereby acknowledged, does hereby grant, bargain, sell, and convey to the Grantee, all that certain parcel of land situated in [County/City], [State Name], and more particularly described as follows:

[Insert Legal Description of Property]

This conveyance is made subject to:

- [Any existing mortgages, liens, or encumbrances]

- [Zoning restrictions]

- [Other title matters, if applicable]

The Grantor hereby represents and warrants that the Grantor is the lawful owner of the property and has the right to convey the same.

In witness whereof, the Grantor has executed this Deed as of the day and year first above written.

___________________________

Grantor’s Signature

___________________________

Grantee’s Signature

State of [State Name]

County of [County Name]

On this ___ day of __________, 20__, before me, a Notary Public in and for said county and state, personally appeared [Grantor’s Full Name] and [Grantee’s Full Name], known to me to be the persons described in and who executed the foregoing instrument, and acknowledged that they executed the same as their free act and deed.

______________________________

Notary Public Signature

My commission expires: ________________

Common mistakes

Filling out a Deed form can be a straightforward process, but many individuals make common mistakes that can lead to complications down the line. One frequent error is failing to include the full legal names of all parties involved. It's essential to ensure that names match exactly as they appear on legal documents. Omitting middle names or using nicknames can create confusion and may even invalidate the Deed.

Another mistake people often make is neglecting to provide a proper description of the property. A vague or incomplete description can lead to disputes over boundaries or ownership. It's crucial to include details such as the property's address and any identifying information, such as parcel numbers, to avoid any ambiguity.

Many individuals also overlook the importance of signatures. All parties must sign the Deed for it to be legally binding. Sometimes, one party may assume that their signature is unnecessary, but this can lead to significant issues later. Additionally, the signatures should be notarized to add an extra layer of validity.

Inaccuracies in the date can also pose problems. People often forget to date the document or mistakenly write the wrong date. This seemingly minor error can have major implications, especially if the Deed is ever contested in court. Always double-check the date before finalizing the form.

Another common oversight is failing to include any necessary witnesses. Depending on state laws, some Deeds require one or more witnesses to be present during the signing. Not having the required witnesses can render the Deed unenforceable, so it's important to understand local requirements.

Individuals sometimes forget to review local laws and regulations regarding property transfers. Each state has its own rules governing Deeds, and not adhering to these can create legal hurdles. Familiarizing oneself with local requirements can save a lot of trouble in the future.

People may also neglect to record the Deed with the appropriate government office. After completing the Deed, it must be submitted to the local county recorder or clerk’s office. Failing to do this means the transfer of ownership may not be recognized legally, which can lead to complications when selling or transferring the property in the future.

Another frequent mistake is not keeping copies of the completed Deed. Once the Deed is signed and recorded, it’s important to retain a copy for personal records. This can be invaluable for future reference or if any disputes arise regarding the property.

Lastly, individuals sometimes rush through the process without seeking professional advice. While it may seem straightforward, consulting with a legal expert can help identify potential pitfalls and ensure that everything is filled out correctly. Taking the time to do it right can save a lot of headaches later on.

Dos and Don'ts

When filling out a Deed form, attention to detail is crucial. Here are some guidelines to help ensure accuracy and compliance.

- Do: Read the instructions carefully before starting.

- Do: Use clear and legible handwriting or type the information.

- Do: Double-check all names and addresses for accuracy.

- Do: Sign the document in the appropriate places.

- Don't: Leave any required fields blank.

- Don't: Use abbreviations unless specified in the instructions.

- Don't: Alter the form in any way that could obscure the information.

- Don't: Forget to include any required supporting documents.

Following these guidelines can help prevent delays or issues with the processing of the Deed form.

Common Templates:

Letter of Intent to Purchase Business - Indicates potential terms for future discussions and agreements.

In today's competitive landscape, understanding the importance of a California Non-disclosure Agreement (NDA) is crucial for protecting sensitive information. By establishing a legal framework for confidentiality, this agreement safeguards trade secrets and proprietary data from being exposed to unauthorized individuals or entities. For further guidance on drafting or understanding these agreements, you can visit OnlineLawDocs.com, which provides valuable resources tailored to navigate the complexities of non-disclosure agreements in California.

Test Drive Agreement Form - The dealership's representative will guide you through the process of the test drive.

Similar forms

- Title Insurance Policy: This document provides protection to the buyer against any defects in the title of the property. Like a deed, it confirms ownership but focuses on safeguarding against potential legal issues that may arise after the purchase.

- Bill of Sale: A bill of sale transfers ownership of personal property from one party to another. Similar to a deed, it serves as proof of ownership, but it typically pertains to movable items rather than real estate.

- Lease Agreement: A lease agreement outlines the terms under which one party agrees to rent property from another. It is similar to a deed in that it establishes rights to use property, but it does not transfer ownership.

- Mortgage Document: A mortgage document secures a loan against a property. While a deed conveys ownership, a mortgage establishes a lien on the property, ensuring the lender can reclaim the property if the borrower defaults.

- Quitclaim Deed: This type of deed transfers any interest one party has in a property to another without guaranteeing that the title is clear. It is similar to a standard deed but lacks the warranty of title, making it less secure.

- Advanced Healthcare Directive: This document allows individuals to outline their medical preferences in case they become unable to make decisions. It complements a Power of Attorney by ensuring that health-related choices align with the individual’s wishes, a crucial aspect of estate planning. For more details, visit toptemplates.info/.

- Trust Agreement: A trust agreement establishes a fiduciary relationship where one party holds property for the benefit of another. Like a deed, it involves property ownership, but it also includes specific instructions on how the property should be managed and distributed.