Free Citibank Direct Deposit Form

Form Preview Example

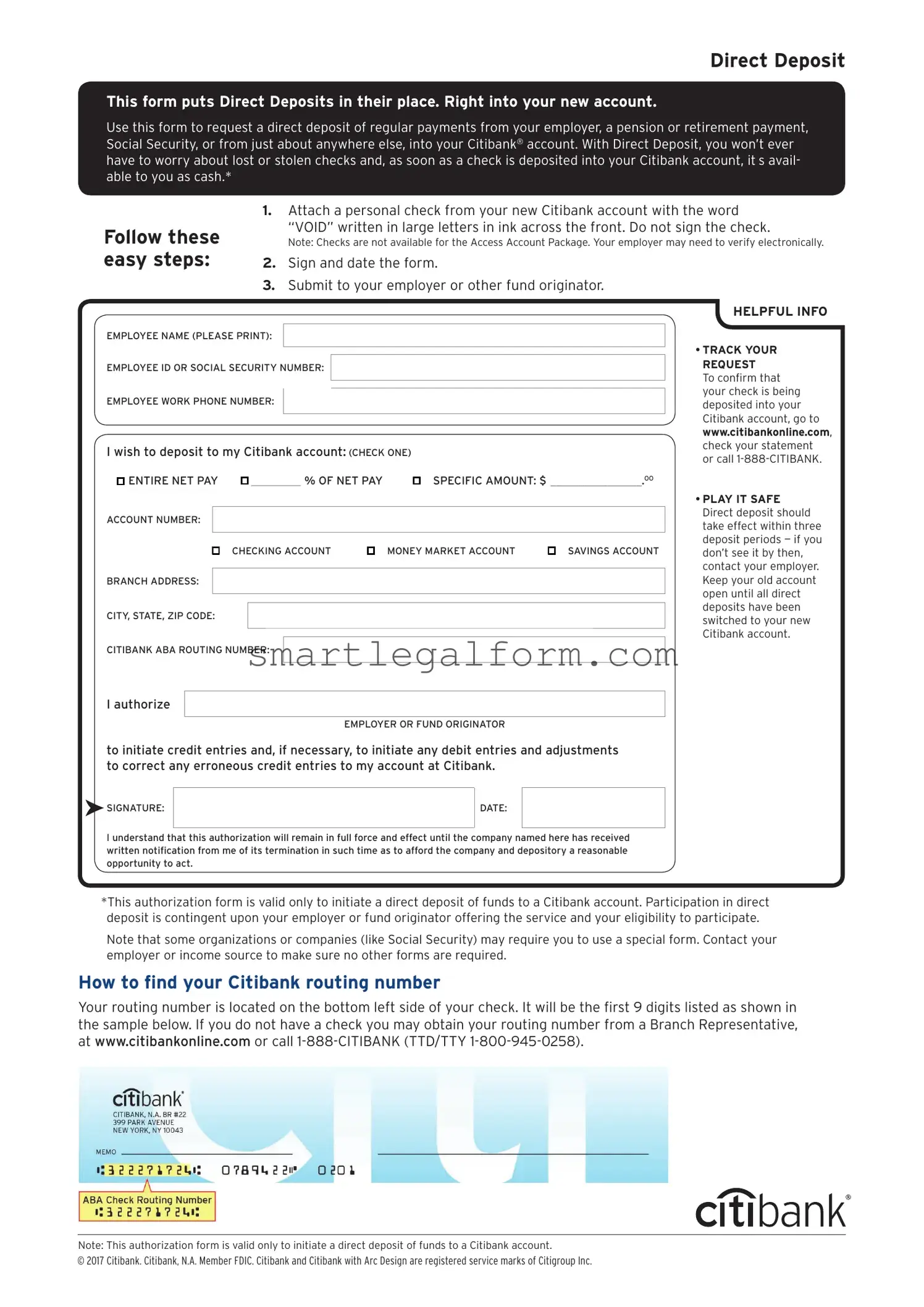

Direct Deposit

This form puts Direct Deposits in their place. Right into your new account.

Use this form to request a direct deposit of regular payments from your employer, a pension or retirement payment, Social Security, or from just about anywhere else, into your Citibank® account. With Direct Deposit, you won’t ever have to worry about lost or stolen checks and, as soon as a check is deposited into your Citibank account, it’s avail- able to you as cash.*

Follow these easy steps:

1.Attach a personal check from your new Citibank account with the word

“VOID” written in large letters in ink across the front. Do not sign the check.

Note: Checks are not available for the Access Account Package. Your employer may need to verify electronically.

2.Sign and date the form.

3.Submit to your employer or other fund originator.

HELPFUL INFO

EMPLOYEE NAME (PLEASE PRINT):

• TRACK YOUR

EMPLOYEE ID OR SOCIAL SECURITY NUMBER:

EMPLOYEE WORK PHONE NUMBER:

I wish to deposit to my Citibank account: (CHECK ONE)

ENTIRE NET PAY ı__________ % OF NET PAY |

ı SPECIFIC AMOUNT: $ ________________.OO |

ACCOUNT NUMBER:

ı CHECKING ACCOUNT |

ı MONEY MARKET ACCOUNT |

ı SAVINGS ACCOUNT |

BRANCH ADDRESS:

CITY, STATE, ZIP CODE:

CITIBANK ABA ROUTING NUMBER:

REQUEST

To confirm that your check is being deposited into your Citibank account, go to www.citibankonline.com, check your statement or call

•PLAY IT SAFE Direct deposit should take effect within three deposit periods — if you don’t see it by then, contact your employer. Keep your old account open until all direct deposits have been switched to your new Citibank account.

I authorize

EMPLOYER OR FUND ORIGINATOR

to initiate credit entries and, if necessary, to initiate any debit entries and adjustments to correct any erroneous credit entries to my account at Citibank.

SIGNATURE:

SIGNATURE:

DATE:

I understand that this authorization will remain in full force and effect until the company named here has received written notification from me of its termination in such time as to afford the company and depository a reasonable opportunity to act.

*This authorization form is valid only to initiate a direct deposit of funds to a Citibank account. Participation in direct deposit is contingent upon your employer or fund originator offering the service and your eligibility to participate.

Note that some organizations or companies (like Social Security) may require you to use a special form. Contact your employer or income source to make sure no other forms are required.

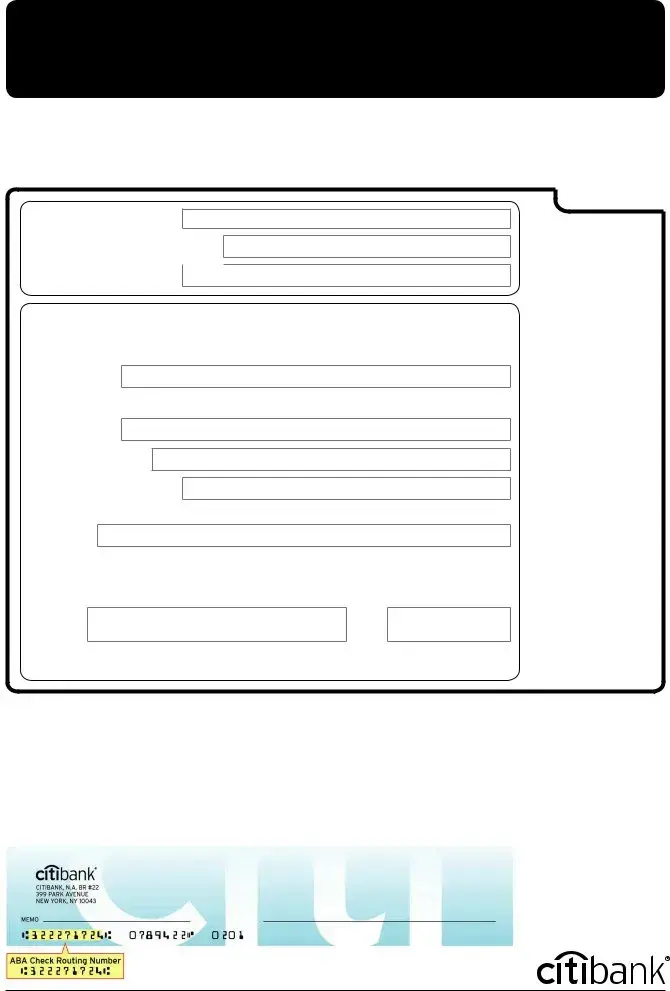

How to find your Citibank routing number

Your routing number is located on the bottom left side of your check. It will be the first 9 digits listed as shown in the sample below. If you do not have a check you may obtain your routing number from a Branch Representative, at www.citibankonline.com or call

Note: This authorization form is valid only to initiate a direct deposit of funds to a Citibank account.

© 2017 Citibank. Citibank, N.A. Member FDIC. Citibank and Citibank with Arc Design are registered service marks of Citigroup Inc.

Common mistakes

Filling out the Citibank Direct Deposit form can seem straightforward, but many people make common mistakes that can delay their payments. One frequent error is providing incorrect account information. Double-checking your account number and routing number is essential. A simple typo can lead to funds being deposited into the wrong account.

Another mistake is neglecting to sign the form. Without a signature, the bank cannot process your request. Always ensure that you have signed the form before submission. Additionally, some people forget to include their Social Security number or Employee ID, if required. This information is often necessary for verification purposes.

Not using the correct version of the form is another issue. Banks may update their forms periodically, and using an outdated version can lead to complications. Always download the latest form from the official Citibank website or obtain it directly from your employer.

Some individuals fail to read the instructions carefully. Each section of the form may have specific requirements. Ignoring these can result in incomplete submissions. Take the time to read through the instructions thoroughly to avoid missing any critical details.

Another common mistake is providing outdated contact information. If your phone number or email address has changed, update this information on the form. This ensures that the bank can reach you if there are any issues with your direct deposit.

People often underestimate the importance of checking for errors after filling out the form. A final review can catch mistakes that were initially overlooked. Take a moment to go over the form one last time before submitting it.

Some individuals may also forget to keep a copy of the completed form for their records. Having a copy can be useful for future reference or if any issues arise. Always make a photocopy or save a digital version of the completed form.

Additionally, failing to submit the form to the correct department can cause delays. Ensure that you know where to send the form, whether it’s to your HR department or directly to Citibank. Confirming the submission process can save you time and frustration.

Lastly, not following up on the status of your direct deposit can lead to missed payments. After submitting the form, check with your employer or bank to ensure that everything is set up correctly. Regular follow-ups can help you stay informed and address any potential issues early on.

Dos and Don'ts

When filling out the Citibank Direct Deposit form, it's important to ensure accuracy and completeness. Below are some guidelines to follow and avoid.

- Do: Double-check your account number for accuracy.

- Do: Provide the correct routing number for your bank.

- Do: Use clear and legible handwriting if filling out the form by hand.

- Do: Ensure that all required fields are completed before submitting.

- Do: Keep a copy of the completed form for your records.

- Don't: Forget to sign and date the form.

- Don't: Use an old version of the form; always check for the latest version.

- Don't: Provide information for an account that is not yours.

- Don't: Leave any required fields blank.

- Don't: Share your personal banking information with unauthorized individuals.

Other PDF Documents

Puppy Health Guarantee Template - The document serves as a legal contract binding both the Buyer and Breeder.

For those requiring clarity about the legal processes involved, understanding the "Power of Attorney for a Child" is crucial, especially when assessing its significance in temporary care situations. You can explore more on this topic by checking this guideline about Power of Attorney for a Child.

Mortgage 1098 - Keep track of late fees charged due to missed payments.

Similar forms

The Citibank Direct Deposit form is a crucial document for setting up direct deposits into your bank account. However, it shares similarities with several other financial and administrative documents. Here’s a list of nine documents that resemble the Citibank Direct Deposit form, along with an explanation of how they are alike:

- Payroll Authorization Form: This document allows employees to authorize their employer to deposit their paychecks directly into their bank accounts, similar to how the Citibank form facilitates direct deposits.

- Automatic Payment Authorization Form: Much like the direct deposit form, this document permits a company to withdraw funds directly from a customer's account for recurring payments, ensuring timely transactions.

- W-4 Form: While primarily used for tax withholding, the W-4 form requires personal information and banking details, similar to the information collected on the direct deposit form.

- Bank Account Application: This form collects essential information about the account holder and their banking preferences, paralleling the personal and account details required on the direct deposit form.

- Change of Address Form: This document, like the direct deposit form, is used to update personal information with financial institutions, ensuring that all records are current and accurate.

- Loan Application Form: Both documents require detailed personal and financial information, allowing institutions to process requests efficiently and accurately.

- Credit Card Application: Similar to the direct deposit form, this application collects personal and financial information to assess eligibility and facilitate transactions.

- Investment Account Application: This document gathers essential details about the investor, akin to the direct deposit form's requirement for personal and banking information.

- Motorcycle Bill of Sale Form: This document serves to legally record the transfer of ownership of a motorcycle and can be found at Motorcycle Bill of Sale form.

- Health Insurance Enrollment Form: Like the direct deposit form, this document requests personal information and banking details for premium payments, ensuring seamless enrollment in health plans.

Understanding these similarities can help individuals navigate various financial processes more effectively. Each document serves its purpose while sharing common elements that streamline the collection of important information.