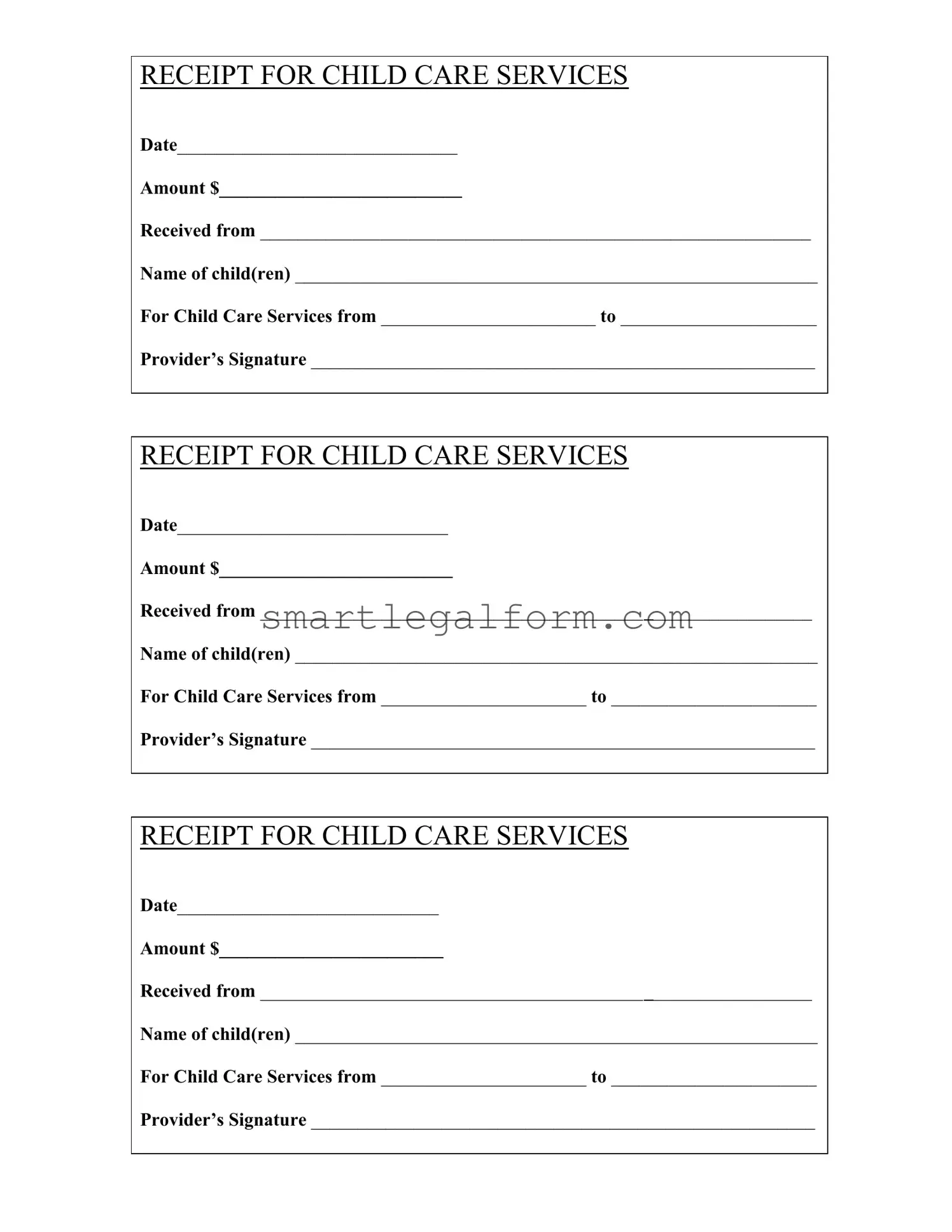

Free Childcare Receipt Form

Form Preview Example

RECEIPT FOR CHILD CARE SERVICES

Date______________________________

Amount $__________________________

Received from ___________________________________________________________

Name of child(ren) ________________________________________________________

For Child Care Services from _______________________ to _____________________

Provider’s Signature ______________________________________________________

RECEIPT FOR CHILD CARE SERVICES

Date_____________________________

Amount $_________________________

Received from ___________________________________________________________

Name of child(ren) ________________________________________________________

For Child Care Services from ______________________ to ______________________

Provider’s Signature ______________________________________________________

RECEIPT FOR CHILD CARE SERVICES

Date____________________________

Amount $________________________

Received from ___________________________________________________________

Name of child(ren) ________________________________________________________

For Child Care Services from ______________________ to ______________________

Provider’s Signature ______________________________________________________

Common mistakes

Filling out the Childcare Receipt form can seem straightforward, but many individuals make common mistakes that can lead to confusion or issues later on. One frequent error is failing to include the date on the receipt. Without a date, it becomes difficult to track when the services were provided, which can create problems for both the provider and the parent.

Another common mistake is neglecting to specify the amount paid for childcare services. This information is crucial for record-keeping and tax purposes. If the amount is left blank or incorrectly filled out, it can lead to disputes or complications when claiming deductions.

Many people also forget to fill in the name of the child(ren). This omission can cause confusion, especially if the provider cares for multiple children. Each receipt should clearly indicate which child or children the receipt pertains to, ensuring clarity for both parties.

In addition, some individuals make the mistake of not specifying the service period. Leaving the "For Child Care Services from" and "to" sections blank can create uncertainty regarding the timeframe of the care provided. This detail is essential for accurate record-keeping and may be required for tax documentation.

Another error involves the provider’s signature. Some parents forget to obtain this signature, which is vital for validating the receipt. Without the provider's signature, the receipt may not be accepted as proof of payment.

Additionally, people often fail to keep copies of the completed receipts. This can lead to difficulties if the receipt is lost or if there are questions about the payment later. Keeping a record of all receipts ensures that both the provider and the parent have a reference point.

Incorrectly filling out the recipient's information can also be problematic. If the name of the person making the payment is misspelled or incomplete, it may complicate matters when trying to claim deductions or resolve disputes.

Another issue arises when receipts are not filled out in ink. Using pencil or erasable ink can lead to alterations that may not be accepted as valid documentation. Always use a permanent writing instrument to ensure the information remains intact.

Some individuals overlook the importance of clarity in their handwriting. If the form is filled out in illegible handwriting, it may cause misunderstandings. Clear and neat writing helps prevent errors and ensures that all parties can read the information without difficulty.

Lastly, many people forget to review the form before submission. Taking a moment to double-check all entries can catch errors before they become problematic. A thorough review can save time and prevent issues down the line.

Dos and Don'ts

When filling out the Childcare Receipt form, it is important to follow certain guidelines to ensure accuracy and clarity. Here are five things you should and shouldn't do:

- Do write the date clearly at the top of the form.

- Don't leave any sections blank; fill in all required information.

- Do specify the exact amount received for childcare services.

- Don't use abbreviations or shorthand that might confuse the reader.

- Do ensure the provider's signature is included at the bottom of the form.

Other PDF Documents

Utility Bill Generator - Aids in financial planning and forecasting future utility costs.

A Marriage Certificate form is an official document that proves the legal union between two individuals. It serves as an essential record for personal identification, legal, and financial purposes. Obtaining this form is a necessary step for newlyweds to validate their marriage in the eyes of the law, and templates for this document can often be found at TopTemplates.info.

Printable Five Wishes Document Pdf - It’s a practical tool endorsed by numerous healthcare organizations and legal experts for its clarity and user-friendliness.

Identification Card Online - Information provided on this form may be used by law enforcement and insurance companies.

Similar forms

-

Invoice for Services Rendered: Like the Childcare Receipt form, an invoice details services provided, including dates and amounts. It serves as proof of payment and can be used for record-keeping or tax purposes.

-

Payment Receipt: This document confirms that payment has been made. Similar to the Childcare Receipt, it includes the date, amount, and recipient information, ensuring clarity in financial transactions.

-

Service Agreement: A service agreement outlines the terms between a provider and a client. While it does not serve as a receipt, it shares similarities in detailing the scope of services and timelines.

-

Enrollment Form: This form collects essential information about the child and parent, much like the Childcare Receipt captures details about the child receiving care. Both documents are crucial for establishing a provider-client relationship.

- Living Will: To ensure your medical preferences are respected, consider utilizing a detailed Living Will guidance that outlines your healthcare wishes.

-

Tax Document (Form 1099): This form reports income earned by a childcare provider. It relates to the Childcare Receipt as both are used for financial reporting and tax purposes, ensuring proper documentation of earnings.

-

Cancellation Notice: A cancellation notice informs a provider about the termination of services. While it does not confirm payment, it is similar in that it communicates important information regarding childcare services.