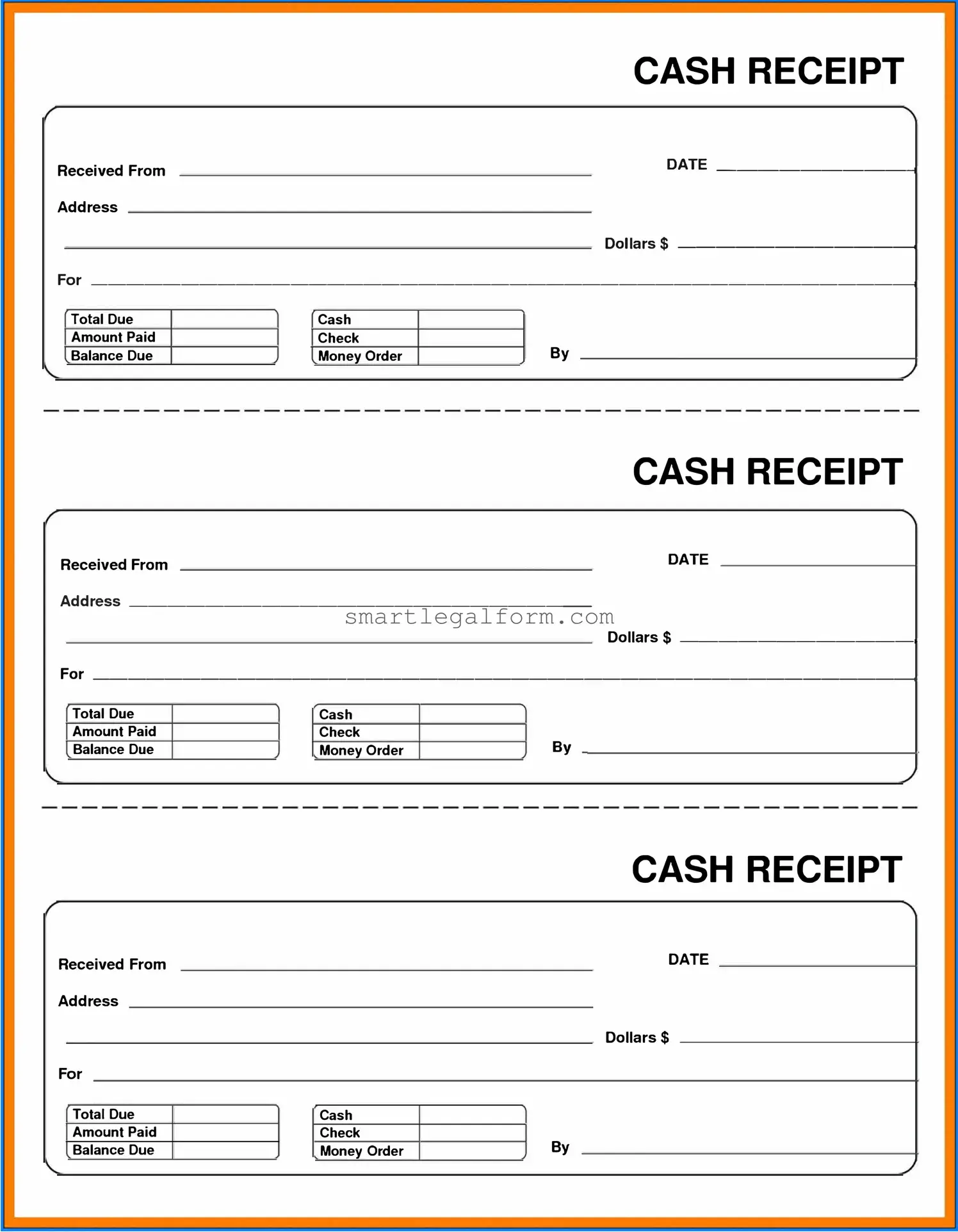

Free Cash Receipt Form

Form Preview Example

CASH RECEIPT

Received From |

|

� |

|||

Address |

|

|

Dollars$ |

||

|

|

|

|

||

|

� |

||||

Total Due

Amount Paid

Balance Due

Cash

Check

Money Order

By

CASH RECEIPT

Received From |

|

|

|

|

|

|

|

|

|

DATE |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

||||||

Address ________________________ |

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

Dollars$ |

+ |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Due |

|

|

|

|

|

Cash |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Amount Paid |

|

|

|

|

|

Check |

|

|

By |

|

|

|

|

|

|

Balance Due |

|

|

|

|

|

Money Order |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH RECEIPT

Received From |

|

DATE |

|||

Address |

|

|

|

||

|

|

|

|

Dollars$ |

|

For |

|

|

|

||

Total Due

Amount Paid

Balance Due

Cash

Check

Money Order

By

Common mistakes

Filling out a Cash Receipt form is a crucial task for ensuring accurate financial records. However, many individuals make common mistakes that can lead to confusion and errors in accounting. One frequent mistake is failing to provide complete information. For example, leaving out the date or the amount received can create discrepancies in the financial records. It's essential to double-check that all required fields are filled in completely to avoid any potential issues later.

Another common error is not clearly identifying the source of the funds. This can lead to difficulties in tracking payments or reconciling accounts. When filling out the form, it is important to specify who made the payment and for what purpose. Without this information, the accounting team may struggle to allocate the funds correctly, which can complicate financial reporting.

Additionally, individuals sometimes overlook the importance of accurate calculations. Simple arithmetic mistakes can result in significant discrepancies in financial reporting. It's advisable to verify all numerical entries, especially the total amount received. A quick review can prevent larger issues down the line, ensuring that the records reflect true and accurate figures.

Lastly, neglecting to obtain necessary signatures can also be a significant oversight. A Cash Receipt form typically requires approval from a supervisor or a designated authority. Without these signatures, the document may lack validity, leading to potential disputes or misunderstandings. Therefore, it is crucial to ensure that all required approvals are obtained before finalizing the form.

Dos and Don'ts

When filling out a Cash Receipt form, it’s important to be diligent and accurate. Here’s a list of ten things you should and shouldn’t do to ensure a smooth process.

- Do: Double-check the date to ensure it is accurate.

- Do: Clearly write the amount received in both numbers and words.

- Do: Include the purpose of the payment for clarity.

- Do: Ensure the form is signed by the authorized person.

- Do: Keep a copy of the completed form for your records.

- Don't: Leave any fields blank; fill in all required information.

- Don't: Use correction fluid; it can create confusion.

- Don't: Forget to verify the payment method, whether cash, check, or credit.

- Don't: Alter the form after it has been signed.

- Don't: Ignore any specific instructions provided with the form.

By following these guidelines, you can help ensure that your Cash Receipt form is filled out correctly and efficiently.

Other PDF Documents

Free Employment Application - This form is essential for applying for employment opportunities.

For individuals looking to understand the process, the informative guide to the Mobile Home Bill of Sale is invaluable in ensuring that all necessary details are covered during the transfer of ownership. You can learn more by visiting this link.

Affidavit of Support - A properly completed I-864 form supports the immigrant's integration into society.

How to Write a Lien Letter - This form plays a crucial role in the construction lien process in Florida.

Similar forms

- Invoice: Both documents serve as proof of a transaction. An invoice details the goods or services provided, while a cash receipt confirms payment for those items.

- Payment Voucher: A payment voucher outlines the amount owed and provides authorization for payment. Similar to a cash receipt, it confirms that payment has been made.

- Power of Attorney: The California Power of Attorney form is a vital document that grants one person the authority to act on another's behalf in various matters. This form, like the listed documents, plays a crucial role in ensuring that decisions can be made when individuals are unable to manage their affairs on their own. For more details, visit TopTemplates.info.

- Sales Receipt: This document is issued to customers upon payment for goods. Like a cash receipt, it serves as evidence of the transaction and includes details about the items purchased.

- Deposit Slip: A deposit slip is used to deposit cash or checks into a bank account. It shares the purpose of documenting the receipt of funds, similar to a cash receipt.

- Credit Memo: A credit memo is issued when a customer returns goods or receives a discount. It reflects adjustments to previous transactions, just like a cash receipt confirms a completed transaction.

- Receipt for Payment: This document acknowledges that payment has been received. It functions similarly to a cash receipt by providing proof of payment for services or goods rendered.