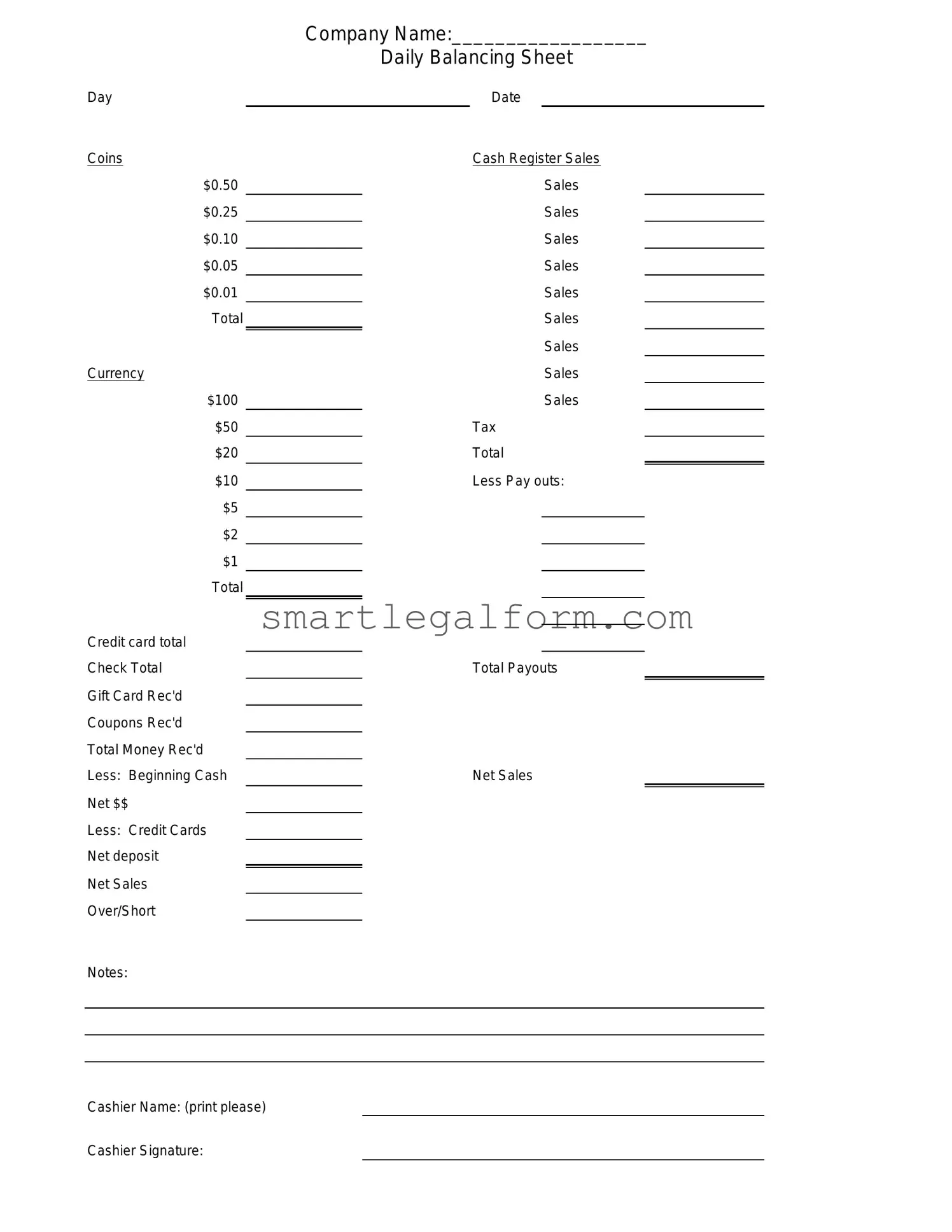

Free Cash Drawer Count Sheet Form

Form Preview Example

|

Company Name:__________________ |

|||||

|

|

Daily Balancing Sheet |

||||

Day |

|

|

Date |

|

||

Coins |

|

|

Cash Register Sales |

|||

$0.50 |

|

|

|

Sales |

|

|

$0.25 |

|

|

|

Sales |

|

|

$0.10 |

|

|

|

Sales |

|

|

$0.05 |

|

|

|

Sales |

|

|

$0.01 |

|

|

|

Sales |

|

|

Total |

|

|

|

Sales |

|

|

|

|

|

|

Sales |

|

|

Currency |

|

|

|

Sales |

|

|

$100 |

|

|

|

Sales |

|

|

$50 |

|

|

Tax |

|

||

$20 |

|

|

Total |

|

||

$10 |

|

|

Less Pay outs: |

|||

$5 |

|

|

|

|

|

|

$2 |

|

|

|

|

|

|

$1 |

|

|

|

|

|

|

Total |

|

|

|

|

|

|

Credit card total |

|

|

|

|

|

|

|

|

|

|

|

|

|

Check Total |

|

|

Total Payouts |

|||

Gift Card Rec'd |

|

|

|

|

|

|

Coupons Rec'd |

|

|

|

|

|

|

Total Money Rec'd |

|

|

|

|

|

|

Less: Beginning Cash |

|

|

Net Sales |

|||

Net $$ |

|

|

|

|

|

|

Less: Credit Cards |

|

|

|

|

|

|

Net deposit |

|

|

|

|

|

|

Net Sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

Over/Short |

|

|

|

|

|

|

Notes: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cashier Name: (print please)

Cashier Signature:

Common mistakes

When filling out the Cash Drawer Count Sheet form, accuracy is crucial. One common mistake is failing to double-check the starting cash amount. This initial figure sets the tone for the entire count. If the starting amount is incorrect, it can lead to discrepancies that complicate the reconciliation process.

Another frequent error involves not recording all transactions. Every sale, refund, or void must be documented. Omitting even a single transaction can skew the final totals and create confusion during audits. Ensure that each transaction is captured accurately to maintain integrity in the reporting.

Many individuals also overlook the importance of documenting the time of the count. This detail is essential for tracking and accountability. Without a timestamp, it becomes challenging to verify the accuracy of the counts or to address any discrepancies that arise later.

In addition, some people fail to have a witness present during the count. Having a second person can provide an extra layer of verification. This practice not only enhances accuracy but also builds trust in the process. A witness can help ensure that all cash is accounted for and that the count is performed correctly.

Another mistake is neglecting to sign and date the form. A signature serves as a confirmation that the count was completed and verified. Without this, the document lacks credibility, which can lead to complications if questions arise about the cash count later.

Lastly, individuals often misplace the completed form. Keeping it in a secure, designated location is vital for future reference. Losing the Cash Drawer Count Sheet can hinder financial reviews and audits, potentially leading to unnecessary complications. Establishing a clear filing system can prevent this oversight.

Dos and Don'ts

When filling out the Cash Drawer Count Sheet form, it is important to follow certain guidelines to ensure accuracy and completeness. Below is a list of dos and don'ts to consider:

- Do verify the cash amount before recording it.

- Do use clear and legible handwriting when filling out the form.

- Do double-check the totals for accuracy.

- Do include all denominations of cash and coins.

- Do sign and date the form upon completion.

- Don't leave any sections of the form blank.

- Don't use correction fluid or tape on the form.

- Don't round off cash amounts; report exact figures.

- Don't forget to keep a copy for your records.

- Don't submit the form without a supervisor's review, if required.

Other PDF Documents

How to Get Acord Insurance Certificate - Employers can provide data on the number of employees and job classifications.

When entering into sensitive business dealings, it is crucial to utilize a California Non-disclosure Agreement (NDA) to maintain confidentiality. This legally binding document not only protects valuable trade secrets but also fosters trust between parties. By ensuring that sensitive information is safeguarded, individuals and organizations can operate confidently in California’s competitive landscape. For further assistance in drafting a comprehensive NDA, consider visiting OnlineLawDocs.com for valuable resources.

Patron List for Church Fundraiser - Help us with what you can, starting with a dollar.

Similar forms

- Daily Sales Report: This document summarizes the total sales made during a specific day, including cash, credit, and other payment methods. It provides a comprehensive overview of daily revenue, similar to how the Cash Drawer Count Sheet tracks cash on hand.

- Cash Register Z Report: This report is generated at the end of a shift and shows the total amount of cash, checks, and credit card sales processed. Like the Cash Drawer Count Sheet, it helps reconcile cash flow and ensures accuracy.

- Petty Cash Log: This document records all petty cash transactions, including receipts and disbursements. It serves a similar purpose in tracking cash movements, much like the Cash Drawer Count Sheet does for cash drawers.

- Bank Deposit Slip: This slip details the cash and checks being deposited into the bank. It is akin to the Cash Drawer Count Sheet in that both documents ensure accurate cash handling and reporting.

- Asylum Application Overview: Understanding the nuances of the USCIS I-589 form is essential for applicants. For comprehensive templates and guidance, visit toptemplates.info/.

- End-of-Day Reconciliation Sheet: This sheet compares the expected cash amount to the actual cash on hand at the end of the day. It functions similarly to the Cash Drawer Count Sheet by confirming cash accuracy.

- Inventory Count Sheet: This document records the quantities of items in stock and is used for inventory management. While it tracks products rather than cash, both sheets are essential for maintaining accurate financial records.

- Transaction Log: This log captures all transactions made during a specific period, including date, time, and payment method. It parallels the Cash Drawer Count Sheet by providing a detailed account of cash movements.

- Sales Receipt: A sales receipt provides proof of purchase and includes details about the transaction. Like the Cash Drawer Count Sheet, it serves as a record for tracking sales and cash flow.