Printable California Transfer-on-Death Deed Document

Form Preview Example

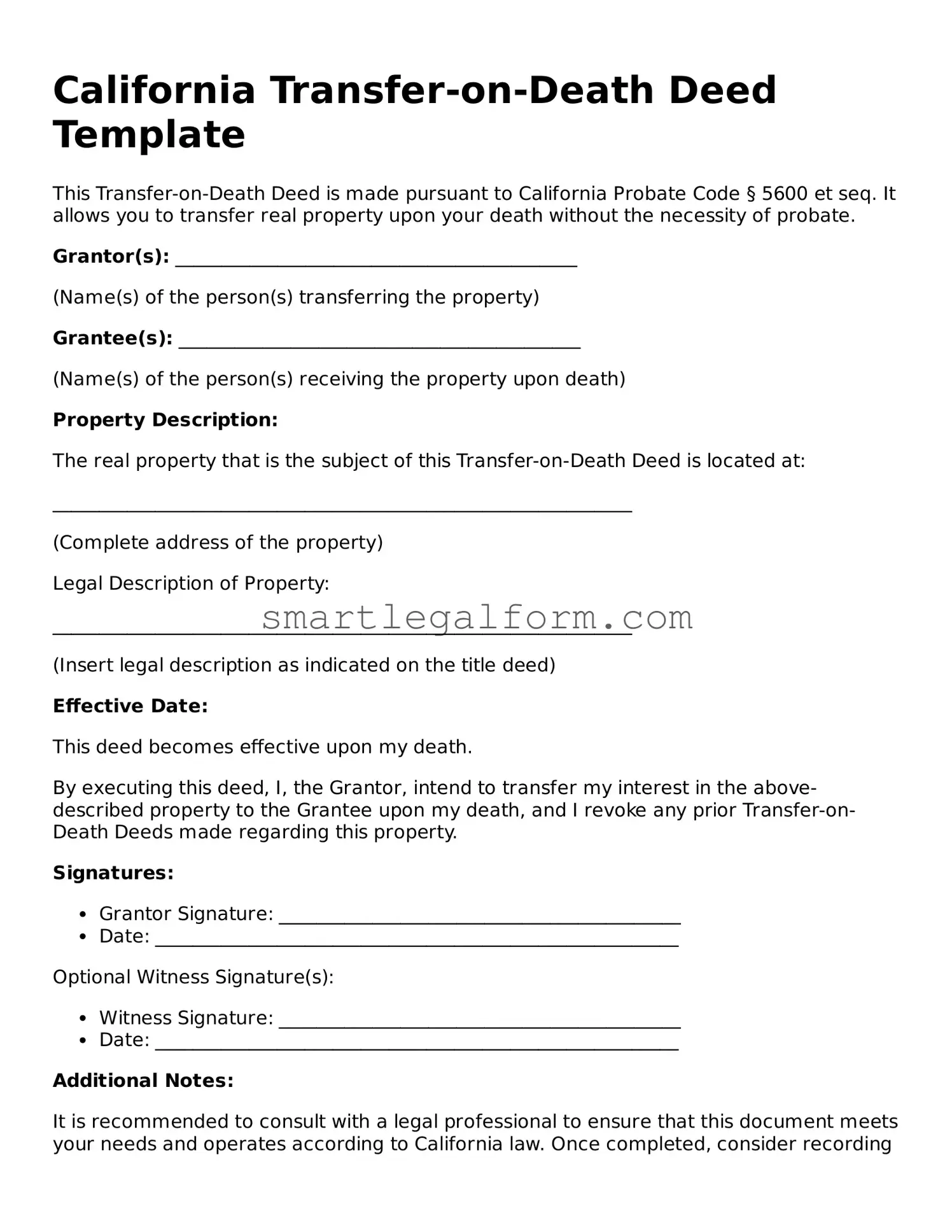

California Transfer-on-Death Deed Template

This Transfer-on-Death Deed is made pursuant to California Probate Code § 5600 et seq. It allows you to transfer real property upon your death without the necessity of probate.

Grantor(s): ___________________________________________

(Name(s) of the person(s) transferring the property)

Grantee(s): ___________________________________________

(Name(s) of the person(s) receiving the property upon death)

Property Description:

The real property that is the subject of this Transfer-on-Death Deed is located at:

______________________________________________________________

(Complete address of the property)

Legal Description of Property:

______________________________________________________________

(Insert legal description as indicated on the title deed)

Effective Date:

This deed becomes effective upon my death.

By executing this deed, I, the Grantor, intend to transfer my interest in the above-described property to the Grantee upon my death, and I revoke any prior Transfer-on-Death Deeds made regarding this property.

Signatures:

- Grantor Signature: ___________________________________________

- Date: ________________________________________________________

Optional Witness Signature(s):

- Witness Signature: ___________________________________________

- Date: ________________________________________________________

Additional Notes:

It is recommended to consult with a legal professional to ensure that this document meets your needs and operates according to California law. Once completed, consider recording the deed with the county recorder's office to provide public notice of the transfer intention.

Common mistakes

Filling out the California Transfer-on-Death Deed form can be a straightforward process, but many individuals make common mistakes that can lead to complications down the line. One frequent error is failing to include all required information. This form requires specific details about the property and the beneficiary. Omitting even a small piece of information can render the deed invalid.

Another common mistake is not properly identifying the property. It’s crucial to provide a clear and accurate legal description of the property being transferred. Relying solely on the address may not suffice, as legal descriptions often include lot numbers or parcel numbers. Ensuring that this information is correct helps avoid future disputes.

Many people also overlook the importance of signatures. The deed must be signed by the owner of the property, and if there are multiple owners, all must sign. Neglecting to gather all necessary signatures can result in the deed being challenged or declared void.

Another pitfall is failing to record the deed. After completing the form, it’s essential to file it with the county recorder’s office. If this step is skipped, the transfer will not be recognized, and the property may not pass to the intended beneficiary upon the owner’s death.

People often forget to consider the implications of the Transfer-on-Death Deed on their estate planning. This deed does not replace a will or trust, and it’s important to ensure that all documents work together harmoniously. Ignoring this can lead to confusion and unintended consequences for heirs.

In addition, many individuals underestimate the importance of consulting with a professional. While the form is designed to be user-friendly, the nuances of property law can be complex. Seeking guidance from a legal expert can help prevent costly mistakes and ensure that the deed is executed properly.

Lastly, individuals sometimes neglect to inform their beneficiaries about the deed. Even if the transfer is legally sound, beneficiaries should be aware of the arrangement. This transparency can prevent confusion and potential conflict among family members in the future.

Dos and Don'ts

When filling out the California Transfer-on-Death Deed form, it is crucial to follow specific guidelines to ensure the process goes smoothly. Here are five things to do and five things to avoid.

Things You Should Do:

- Carefully read the instructions that accompany the form to understand each section.

- Provide accurate information about the property, including the legal description and address.

- Ensure that all required signatures are included, especially from the property owner.

- Consider having the document notarized to enhance its validity.

- File the completed deed with the county recorder’s office to make it legally effective.

Things You Shouldn't Do:

- Do not leave any sections of the form blank; incomplete forms can lead to delays.

- Avoid using vague descriptions for the property; clarity is essential.

- Do not forget to double-check for any spelling errors in names and addresses.

- Refrain from submitting the form without verifying that all necessary documents are included.

- Do not assume that a verbal agreement is sufficient; everything must be documented properly.

Other Transfer-on-Death Deed State Forms

Deed Upon Death Form - The Transfer-on-Death Deed protects against the potential for challenge from disinherited relatives after the owner’s death.

Having a sound understanding of your Last Will and Testament preparation process can significantly assist in ensuring your wishes are met while providing transparency for your family during a challenging time.

Transfer on Death Deed Form Pennsylvania - It is important to properly fill out and record the deed to avoid complications later on.

Where Can I Get a Tod Form - A Transfer-on-Death Deed must be executed with the same legal formalities as a regular property deed to be valid.

Similar forms

- Will: A will specifies how a person's assets will be distributed after their death. Like a Transfer-on-Death Deed, it allows for the transfer of property but requires probate.

- Loan Agreement: A Loan Agreement outlines the terms between a borrower and lender, establishing clear parameters for repayment and obligations. For more details, you can refer to TopTemplates.info.

- Living Trust: A living trust holds assets during a person's lifetime and distributes them upon death. Both documents help avoid probate but differ in their management during life.

- Beneficiary Designation: This is commonly used for bank accounts and retirement plans. Similar to a Transfer-on-Death Deed, it allows assets to pass directly to a named beneficiary without going through probate.

- Joint Tenancy with Right of Survivorship: This form of property ownership allows surviving owners to inherit the deceased's share automatically. Both documents facilitate a direct transfer of property upon death.

- Payable-on-Death (POD) Accounts: POD accounts allow individuals to name beneficiaries who will receive the funds upon death. This is similar to a Transfer-on-Death Deed in that it bypasses probate.

- Transfer-on-Death Registration for Securities: This allows for the transfer of stocks or bonds to a designated beneficiary upon death, similar to how a Transfer-on-Death Deed works for real estate.

- Life Estate Deed: A life estate deed allows a person to live in a property until death, after which it transfers to another party. Both documents involve a transfer of ownership but differ in the rights retained during life.

- Community Property with Right of Survivorship: This form of property ownership allows spouses to inherit property automatically upon the death of one partner. It simplifies the transfer process, akin to a Transfer-on-Death Deed.

- Revocable Living Trust: A revocable living trust can be altered during the grantor's lifetime. Like a Transfer-on-Death Deed, it allows for the seamless transfer of assets upon death without probate.

- Declaration of Trust: This document outlines how assets are managed and distributed. Similar to a Transfer-on-Death Deed, it can provide a clear plan for asset transfer upon death.