Printable California Tractor Bill of Sale Document

Form Preview Example

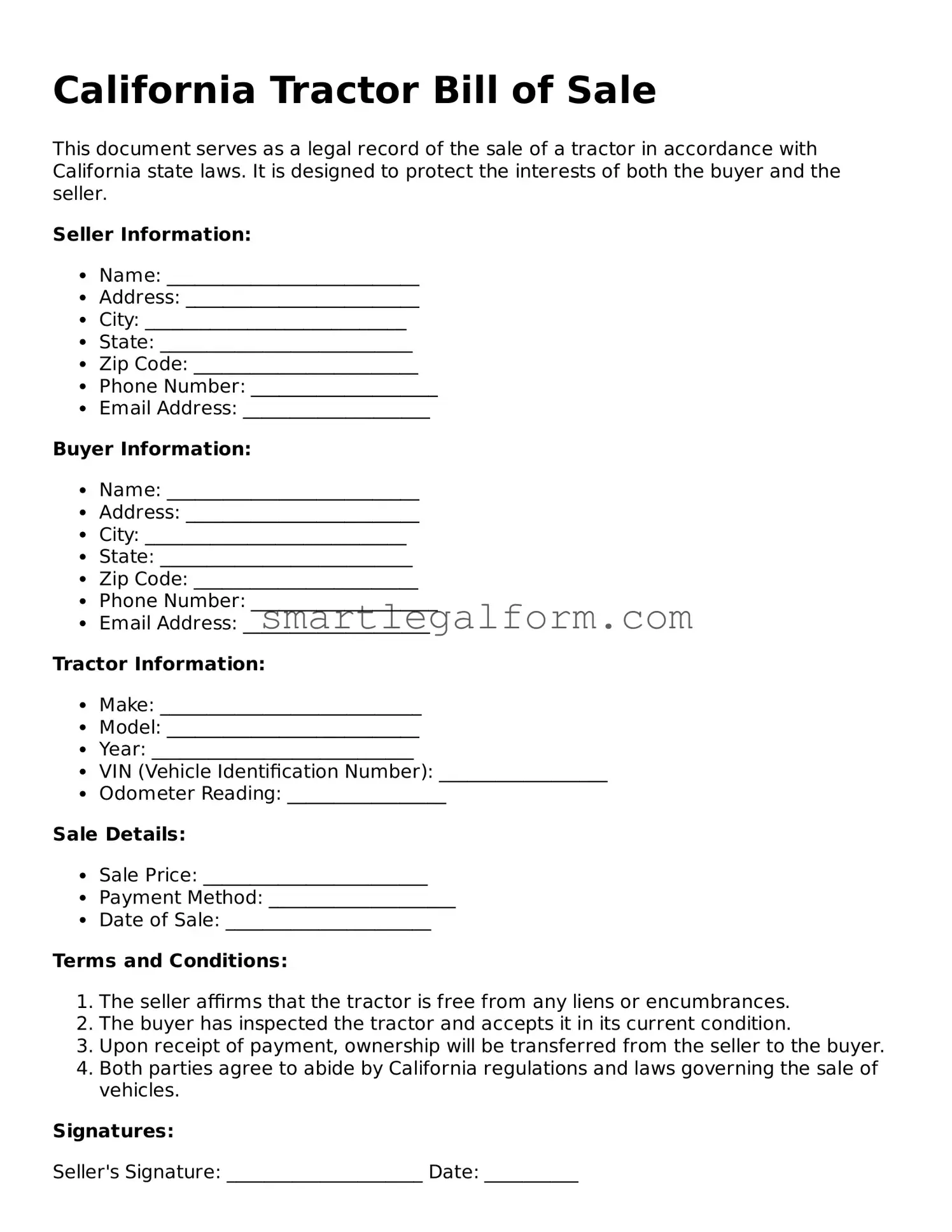

California Tractor Bill of Sale

This document serves as a legal record of the sale of a tractor in accordance with California state laws. It is designed to protect the interests of both the buyer and the seller.

Seller Information:

- Name: ___________________________

- Address: _________________________

- City: ____________________________

- State: ___________________________

- Zip Code: ________________________

- Phone Number: ____________________

- Email Address: ____________________

Buyer Information:

- Name: ___________________________

- Address: _________________________

- City: ____________________________

- State: ___________________________

- Zip Code: ________________________

- Phone Number: ____________________

- Email Address: ____________________

Tractor Information:

- Make: ____________________________

- Model: ___________________________

- Year: ____________________________

- VIN (Vehicle Identification Number): __________________

- Odometer Reading: _________________

Sale Details:

- Sale Price: ________________________

- Payment Method: ____________________

- Date of Sale: ______________________

Terms and Conditions:

- The seller affirms that the tractor is free from any liens or encumbrances.

- The buyer has inspected the tractor and accepts it in its current condition.

- Upon receipt of payment, ownership will be transferred from the seller to the buyer.

- Both parties agree to abide by California regulations and laws governing the sale of vehicles.

Signatures:

Seller's Signature: _____________________ Date: __________

Buyer's Signature: _____________________ Date: __________

Common mistakes

Completing the California Tractor Bill of Sale form can be straightforward, but several common mistakes can lead to complications. One frequent error is failing to provide accurate information about the tractor. This includes the Vehicle Identification Number (VIN), make, model, and year. Inaccurate details can result in registration issues or disputes over ownership.

Another mistake involves neglecting to include the sale price. The bill of sale should clearly state the amount for which the tractor was sold. Omitting this information can create confusion and may affect tax obligations. Buyers and sellers need to document the transaction amount to ensure transparency.

People often forget to sign the document. Both the seller and the buyer must sign the bill of sale to validate the transaction. Without these signatures, the document may not be considered legally binding. This step is crucial for protecting both parties' interests.

Some individuals also overlook the date of the transaction. Including the date is essential for record-keeping and can impact the timeline for registration. A missing date can lead to complications if either party needs to reference the sale in the future.

Another common error is not providing complete contact information for both the buyer and seller. This includes full names, addresses, and phone numbers. Incomplete contact details can hinder communication and create difficulties if issues arise after the sale.

Lastly, failing to keep a copy of the completed bill of sale is a mistake that can have lasting consequences. Both parties should retain a copy for their records. This document serves as proof of the transaction and may be needed for future reference, especially during registration or if disputes occur.

Dos and Don'ts

When filling out the California Tractor Bill of Sale form, it is important to follow certain guidelines to ensure the document is completed correctly. Here are five things you should and shouldn't do:

- Do provide accurate information about the tractor, including make, model, year, and Vehicle Identification Number (VIN).

- Do include the names and addresses of both the buyer and the seller to ensure clear identification.

- Do sign and date the form to validate the transaction.

- Don't leave any required fields blank, as this can lead to delays or complications in the sale.

- Don't use incorrect terminology or abbreviations that may confuse the reader or lead to misunderstandings.

Following these guidelines will help facilitate a smooth transaction and ensure that all necessary information is captured accurately.

Other Tractor Bill of Sale State Forms

Bill of Sale Tractor - Can serve as a checklist for buyers when inspecting the tractor.

In many cases, it is advisable to utilize resources that provide comprehensive information about legal agreements, such as the OnlineLawDocs.com, to ensure that all terms are well understood and appropriately documented, thereby enhancing the legal validity of a Hold Harmless Agreement.

Farm Tractor Bill of Sale - The Tractor Bill of Sale may also include clauses outlining any warranties or guarantees offered by the seller.

Similar forms

- Vehicle Bill of Sale: Similar to the Tractor Bill of Sale, this document transfers ownership of a vehicle. It includes details such as the buyer, seller, vehicle identification number (VIN), and sale price.

- Boat Bill of Sale: This document serves a similar purpose for boats. It outlines the terms of the sale, including the boat's make, model, and hull identification number, ensuring legal ownership transfer.

- Motorcycle Bill of Sale: Like the Tractor Bill of Sale, this form facilitates the transfer of ownership for motorcycles. It captures essential details like the motorcycle's VIN and the sale price, protecting both parties in the transaction.

- Equipment Bill of Sale: This document is used for various types of equipment sales. It details the equipment's specifications and terms of sale, similar to how the Tractor Bill of Sale operates.

- Real Estate Purchase Agreement: While this document pertains to real estate, it shares similarities in that it outlines the terms of a sale, including buyer and seller information, property description, and price.

- Florida Durable Power of Attorney: This vital legal document empowers an individual to designate an agent to manage their financial matters, even in the event of incapacitation. For more information, visit https://toptemplates.info/.

- Personal Property Bill of Sale: This document covers the sale of personal property, such as furniture or electronics. It serves the same purpose as the Tractor Bill of Sale by providing proof of ownership transfer.