Printable California RV Bill of Sale Document

Form Preview Example

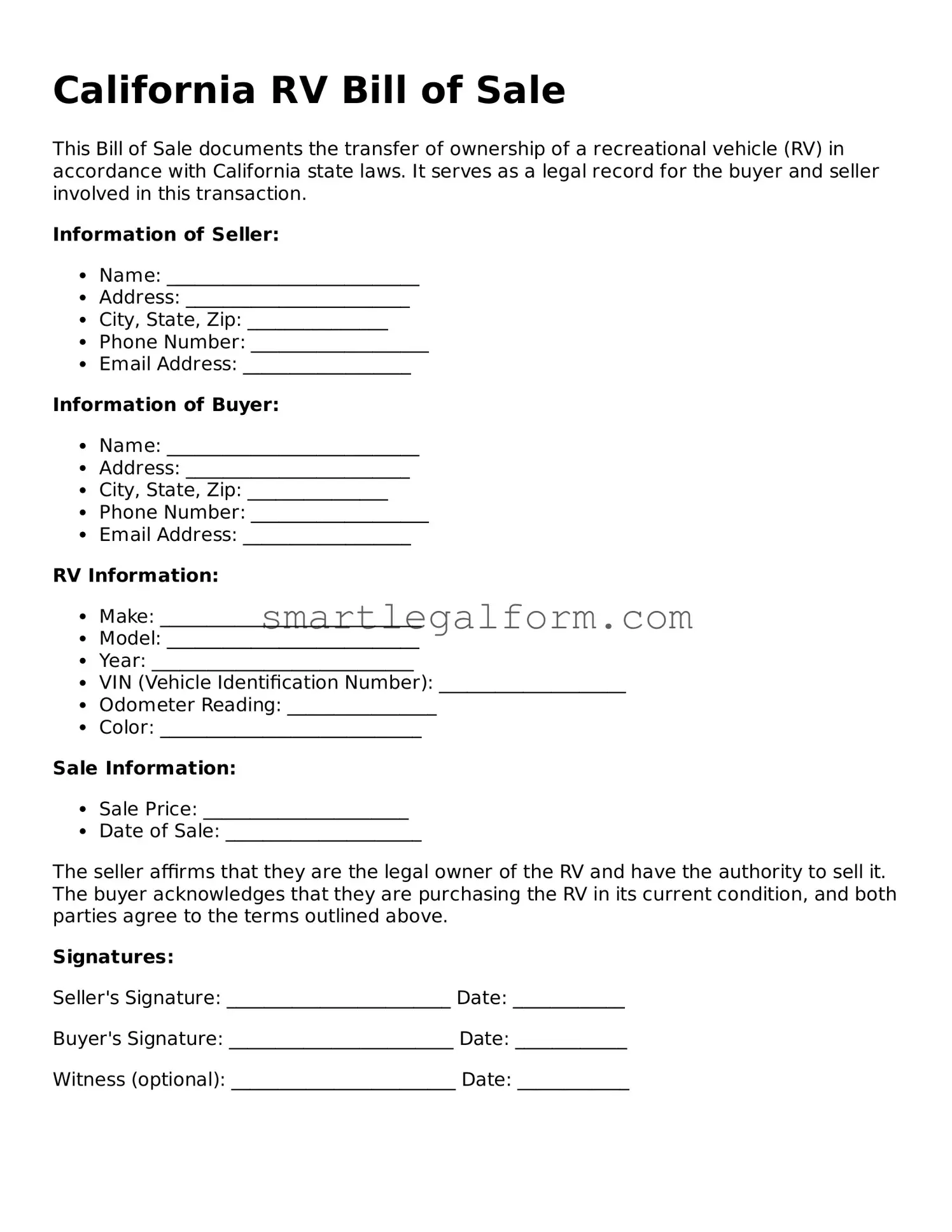

California RV Bill of Sale

This Bill of Sale documents the transfer of ownership of a recreational vehicle (RV) in accordance with California state laws. It serves as a legal record for the buyer and seller involved in this transaction.

Information of Seller:

- Name: ___________________________

- Address: ________________________

- City, State, Zip: _______________

- Phone Number: ___________________

- Email Address: __________________

Information of Buyer:

- Name: ___________________________

- Address: ________________________

- City, State, Zip: _______________

- Phone Number: ___________________

- Email Address: __________________

RV Information:

- Make: ____________________________

- Model: ___________________________

- Year: ____________________________

- VIN (Vehicle Identification Number): ____________________

- Odometer Reading: ________________

- Color: ____________________________

Sale Information:

- Sale Price: ______________________

- Date of Sale: _____________________

The seller affirms that they are the legal owner of the RV and have the authority to sell it. The buyer acknowledges that they are purchasing the RV in its current condition, and both parties agree to the terms outlined above.

Signatures:

Seller's Signature: ________________________ Date: ____________

Buyer's Signature: ________________________ Date: ____________

Witness (optional): ________________________ Date: ____________

Common mistakes

Filling out the California RV Bill of Sale form may seem straightforward, but many people stumble over common mistakes that can complicate the process. One prevalent error is failing to include all necessary information. This includes the names and addresses of both the buyer and the seller, as well as a detailed description of the RV, including the make, model, year, and Vehicle Identification Number (VIN). Omitting even one detail can lead to confusion or disputes later on.

Another mistake often made is not signing the document. Both parties must provide their signatures to validate the sale. Without these signatures, the form lacks legal standing, which can create issues if either party needs to prove ownership or if disputes arise. It's essential to ensure that both the buyer and seller sign the form before any money changes hands.

Many individuals also overlook the date of the sale. This date is crucial as it establishes when the ownership transfer occurred. If the date is missing, it could lead to complications, especially regarding taxes or registration. Buyers should be aware that the date on the Bill of Sale is often used by the DMV to determine when to start the registration process.

Another common pitfall involves incorrect payment details. When filling out the form, it’s vital to specify the sale price clearly. If the amount is left blank or inaccurately reported, it can lead to tax issues down the line. California requires sales tax to be calculated based on the sale price, so clarity in this area is essential.

People sometimes fail to understand the importance of including any additional terms or conditions of the sale. If there are warranties, agreements regarding repairs, or stipulations about the condition of the RV, these should be explicitly stated. This helps protect both parties and ensures everyone is on the same page regarding the sale.

Another mistake is neglecting to provide identification for the buyer and seller. While it might seem unnecessary, including driver's license numbers or other forms of ID can help verify identities and prevent fraud. This extra step adds a layer of security to the transaction.

It’s also common for individuals to forget about the notary requirement. In some cases, having the Bill of Sale notarized can provide additional protection and legitimacy to the document. While not always mandatory, it’s a good practice, especially for high-value transactions like RV sales.

Lastly, many people fail to make copies of the completed Bill of Sale. Keeping a copy for both the buyer and seller is a simple yet crucial step. This ensures that both parties have a record of the transaction, which can be invaluable for future reference, whether for tax purposes or potential disputes.

Dos and Don'ts

When filling out the California RV Bill of Sale form, it’s important to follow certain guidelines to ensure the process goes smoothly. Here are some things you should and shouldn’t do:

- Do: Provide accurate information about the RV, including the Vehicle Identification Number (VIN).

- Do: Include the names and addresses of both the buyer and seller.

- Do: Sign and date the form to make it legally binding.

- Do: Keep a copy of the completed Bill of Sale for your records.

- Don’t: Leave any sections blank; fill out all required fields.

- Don’t: Use incorrect or outdated information regarding the RV's title.

- Don’t: Forget to check for any local regulations that may apply to the sale.

- Don’t: Rely solely on verbal agreements; everything should be documented in writing.

Other RV Bill of Sale State Forms

Florida Trailer Bill of Sale - Streamlines the selling process for RV owners.

The California Power of Attorney form is a legal document that allows a person to appoint another individual to make decisions on their behalf, which can significantly impact financial, legal, and health-related matters. For more detailed information on how to navigate this essential legal tool, you can visit TopTemplates.info, where you will find additional resources and templates to assist with the process.

Similar forms

-

Vehicle Bill of Sale: Similar to the RV Bill of Sale, a Vehicle Bill of Sale documents the transfer of ownership for any motor vehicle. It includes details such as the buyer's and seller's information, vehicle identification number (VIN), and the sale price. Both documents serve as proof of ownership and can be used for registration purposes.

-

Boat Bill of Sale: A Boat Bill of Sale functions similarly to the RV Bill of Sale by formalizing the sale of a boat. It includes pertinent information about the boat, such as its hull identification number, description, and the terms of the sale. Both documents protect the interests of the buyer and seller and provide a clear record of the transaction.

- Non-compete Agreement: For businesses looking to safeguard their interests, our thorough understanding of the Non-compete Agreement form is essential to ensure legal protection against competition.

-

Motorcycle Bill of Sale: Like the RV Bill of Sale, the Motorcycle Bill of Sale records the transfer of ownership for a motorcycle. It details the motorcycle's specifications, including VIN, make, model, and sale price. Both documents are essential for legal ownership and can be required for registration with state authorities.

-

Trailer Bill of Sale: A Trailer Bill of Sale is akin to the RV Bill of Sale in that it documents the sale of a trailer. It captures information such as the trailer's VIN, description, and sale price. Both documents provide a legal basis for ownership transfer and may be necessary for titling and registration.

-

Equipment Bill of Sale: The Equipment Bill of Sale is comparable to the RV Bill of Sale as it outlines the sale of various types of equipment, such as construction machinery or agricultural tools. It includes details like the equipment's description, condition, and sale price. Both documents serve to protect the buyer and seller by providing a clear record of the transaction.