Printable California Promissory Note Document

Form Preview Example

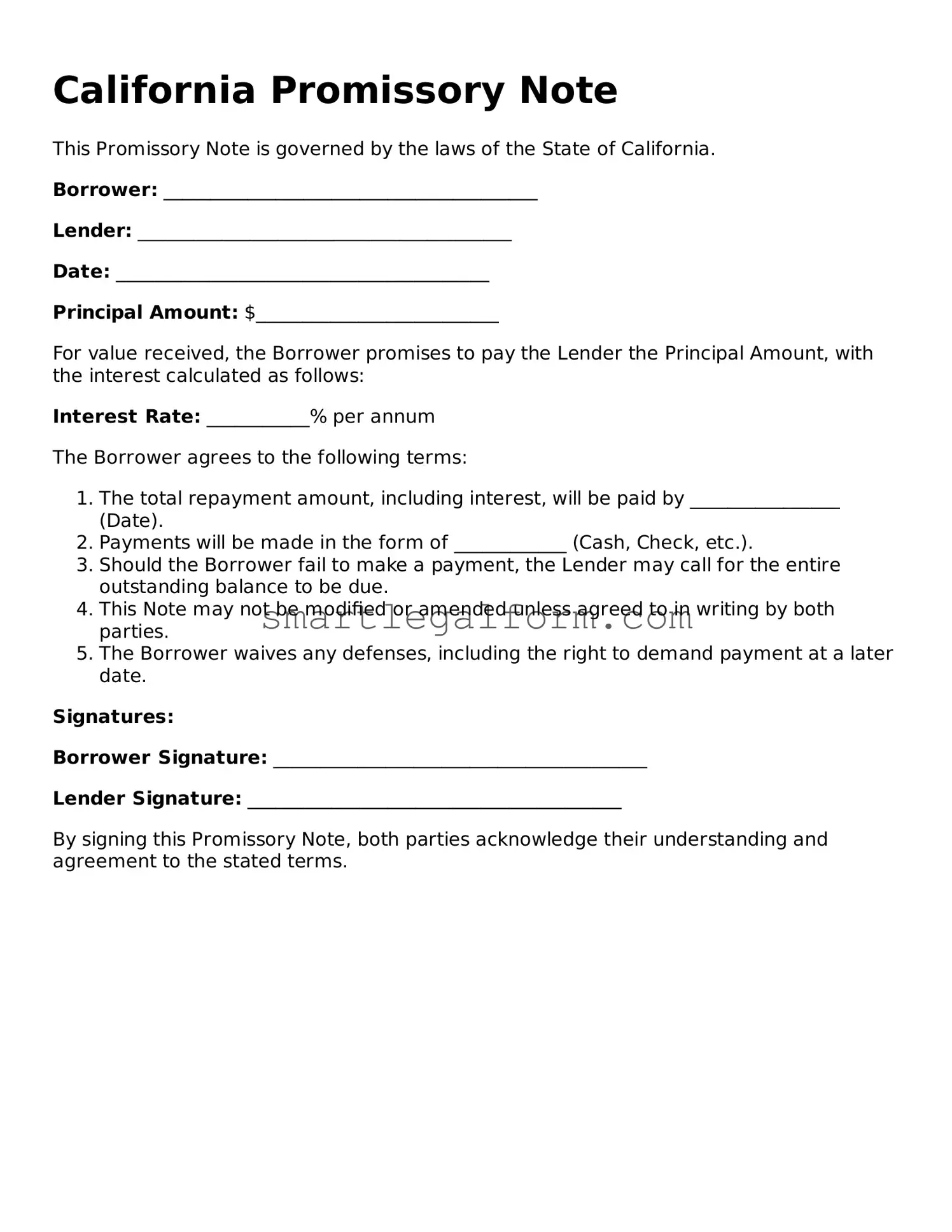

California Promissory Note

This Promissory Note is governed by the laws of the State of California.

Borrower: ________________________________________

Lender: ________________________________________

Date: ________________________________________

Principal Amount: $__________________________

For value received, the Borrower promises to pay the Lender the Principal Amount, with the interest calculated as follows:

Interest Rate: ___________% per annum

The Borrower agrees to the following terms:

- The total repayment amount, including interest, will be paid by ________________ (Date).

- Payments will be made in the form of ____________ (Cash, Check, etc.).

- Should the Borrower fail to make a payment, the Lender may call for the entire outstanding balance to be due.

- This Note may not be modified or amended unless agreed to in writing by both parties.

- The Borrower waives any defenses, including the right to demand payment at a later date.

Signatures:

Borrower Signature: ________________________________________

Lender Signature: ________________________________________

By signing this Promissory Note, both parties acknowledge their understanding and agreement to the stated terms.

Common mistakes

Filling out a California Promissory Note form can seem straightforward, but several common mistakes can lead to complications down the line. One frequent error is neglecting to include the date. Without a clear date, it can be difficult to establish when the loan was initiated, which may cause confusion regarding repayment terms.

Another common mistake is failing to accurately identify the parties involved. It is essential to include the full legal names of both the borrower and the lender. Omitting middle names or using nicknames can create issues if disputes arise, as the legal identity of the parties may be questioned.

Many individuals also overlook the importance of specifying the loan amount clearly. Writing the amount in both numerical and written form is advisable. For example, stating “$5,000 (Five Thousand Dollars)” helps to prevent misunderstandings about the exact amount borrowed.

Additionally, borrowers sometimes forget to outline the interest rate. The form should clearly state whether the loan is interest-bearing and, if so, what the rate is. Not specifying this can lead to disputes regarding how much the borrower owes over time.

Another mistake is not detailing the repayment schedule. It is crucial to specify when payments are due and how often they should be made—whether monthly, quarterly, or otherwise. Without a clear repayment schedule, both parties may have different expectations, leading to potential conflicts.

Some people also fail to include any late fees or penalties for missed payments. Including these terms in the Promissory Note can help protect the lender’s interests and ensure that the borrower understands the consequences of late payments.

Furthermore, not having the document signed by both parties is a critical oversight. A Promissory Note is not legally binding unless it is signed. Both the borrower and lender should sign the document in the presence of a witness or notary, if possible, to add an extra layer of legitimacy.

Finally, many individuals neglect to keep a copy of the signed Promissory Note. After filling out and signing the document, it is vital for both parties to retain a copy for their records. This ensures that each party has access to the agreed-upon terms and can refer back to them if necessary.

Dos and Don'ts

When filling out the California Promissory Note form, it is essential to approach the task with care and attention to detail. Here are some important do's and don'ts to consider:

- Do read the entire form carefully before filling it out.

- Do provide accurate information regarding the borrower and lender.

- Do specify the amount of the loan clearly.

- Do include the interest rate if applicable.

- Do outline the repayment terms in detail.

- Don't leave any sections blank unless instructed to do so.

- Don't use vague language; be as specific as possible.

- Don't forget to sign and date the document.

- Don't ignore the need for witnesses or notarization if required.

By following these guidelines, you can help ensure that the Promissory Note is completed correctly and serves its intended purpose effectively.

Other Promissory Note State Forms

Florida Promissory Note Template - This document plays an essential role in real estate transactions involving seller financing.

The Texas Operating Agreement form is essential for establishing a clear operational framework and financial agreements within an LLC, ensuring smooth governance and defined member roles. While Texas does not mandate the creation of this document, having one is advisable for organized business procedures. For those seeking a template, resources like TopTemplates.info can provide valuable assistance in drafting a comprehensive agreement.

Ohio Promissory Note Requirements - This agreement plays a crucial role in personal and business finance management.

Similar forms

The Promissory Note is a financial instrument that outlines a borrower's promise to repay a loan under specific terms. Several other documents share similarities with the Promissory Note, often serving related purposes in financial transactions. Below are nine documents that are comparable to the Promissory Note, along with explanations of how they are similar.

- Loan Agreement: Like a Promissory Note, a loan agreement details the terms of a loan, including the amount borrowed, interest rate, and repayment schedule. Both documents establish the borrower's obligation to repay the lender.

- Mortgage: A mortgage is a type of secured loan that uses real property as collateral. Similar to a Promissory Note, it includes the borrower's promise to repay the loan amount, but it also specifies the property involved.

- Credit Agreement: This document outlines the terms under which credit is extended to a borrower. It shares similarities with a Promissory Note in that it specifies repayment terms and obligations of the borrower.

- Installment Agreement: An installment agreement allows a borrower to repay a debt in scheduled payments. Both this document and a Promissory Note outline the repayment structure and the borrower's commitment to pay.

- Bond: A bond represents a loan made by an investor to a borrower, typically a corporation or government. Like a Promissory Note, it includes a promise to repay the principal along with interest, though bonds are often issued in larger amounts and to multiple investors.

- Lease Agreement: While primarily related to renting property, a lease agreement can include payment terms similar to those in a Promissory Note. Both documents establish financial obligations between parties.

- Personal Guarantee: A personal guarantee is a promise made by an individual to repay a debt if the primary borrower defaults. It is similar to a Promissory Note in that it creates a personal obligation to repay a loan.

- Debt Settlement Agreement: This document outlines the terms under which a debtor agrees to pay a reduced amount to settle a debt. Similar to a Promissory Note, it confirms the borrower's commitment to pay, albeit under modified terms.

- Motor Vehicle Bill of Sale: This document is crucial for transferring ownership of a vehicle, detailing all necessary information about the transaction. For more information, you can visit documentonline.org/blank-florida-motor-vehicle-bill-of-sale/.

- Service Agreement: A service agreement may include payment terms for services rendered. Like a Promissory Note, it specifies the obligations of the parties regarding payment and services provided.