Printable California Loan Agreement Document

Form Preview Example

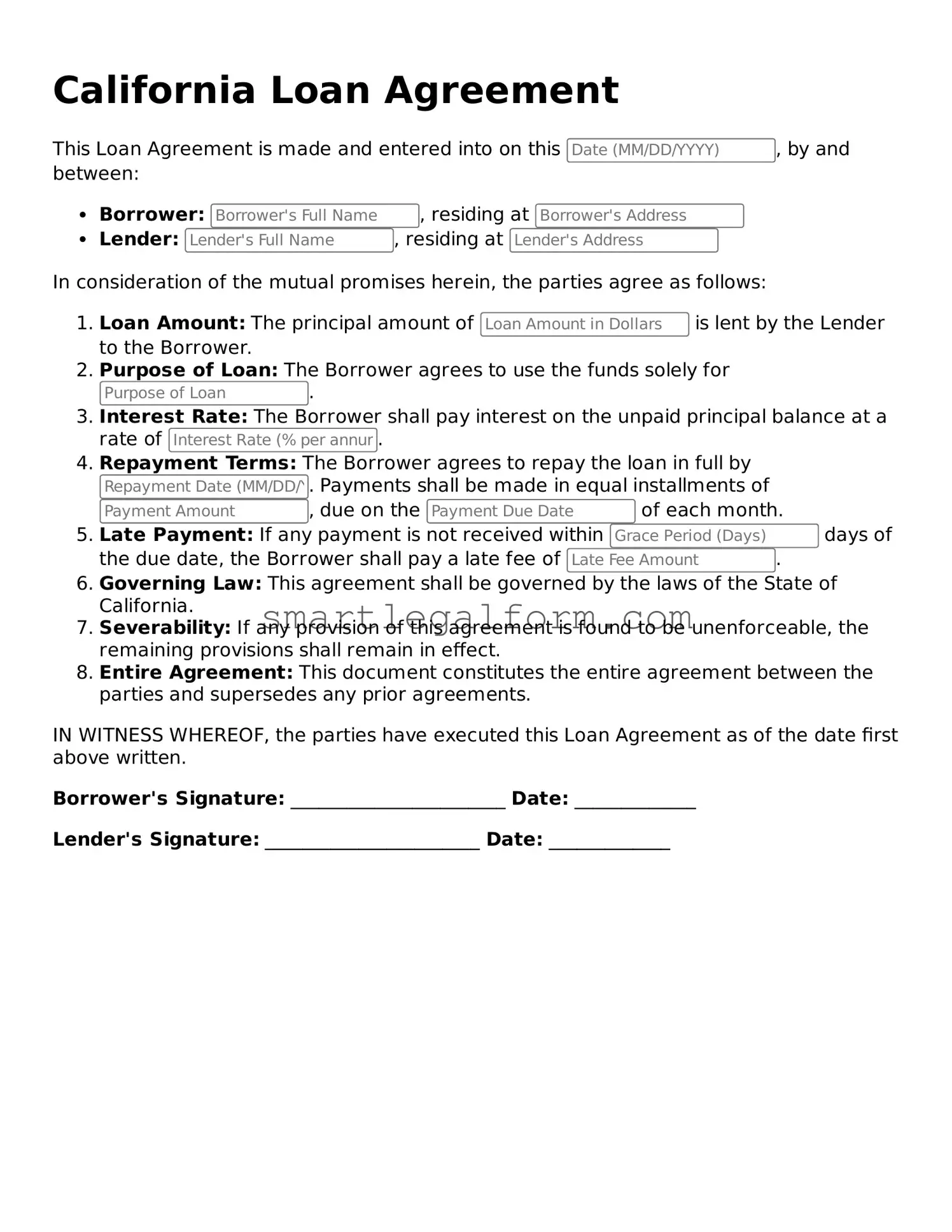

California Loan Agreement

This Loan Agreement is made and entered into on this , by and between:

- Borrower: , residing at

- Lender: , residing at

In consideration of the mutual promises herein, the parties agree as follows:

- Loan Amount: The principal amount of is lent by the Lender to the Borrower.

- Purpose of Loan: The Borrower agrees to use the funds solely for .

- Interest Rate: The Borrower shall pay interest on the unpaid principal balance at a rate of .

- Repayment Terms: The Borrower agrees to repay the loan in full by . Payments shall be made in equal installments of , due on the of each month.

- Late Payment: If any payment is not received within days of the due date, the Borrower shall pay a late fee of .

- Governing Law: This agreement shall be governed by the laws of the State of California.

- Severability: If any provision of this agreement is found to be unenforceable, the remaining provisions shall remain in effect.

- Entire Agreement: This document constitutes the entire agreement between the parties and supersedes any prior agreements.

IN WITNESS WHEREOF, the parties have executed this Loan Agreement as of the date first above written.

Borrower's Signature: _______________________ Date: _____________

Lender's Signature: _______________________ Date: _____________

Common mistakes

When filling out the California Loan Agreement form, it is common for individuals to make mistakes that could lead to complications later on. One frequent error is the omission of essential borrower information. This includes not providing the full legal names, addresses, or contact details. Such omissions can create confusion and may delay the processing of the loan.

Another common mistake involves incorrect or incomplete financial details. Borrowers may fail to accurately list their income or other financial obligations. This can result in a misrepresentation of their financial situation, which might affect the lender's decision regarding the loan.

People often overlook the importance of clearly defining the loan terms. This includes the interest rate, repayment schedule, and any fees associated with the loan. If these terms are vague or missing, it can lead to misunderstandings between the borrower and lender, potentially resulting in disputes down the line.

Additionally, failing to read the entire agreement before signing is a mistake that many make. It is crucial to understand all the terms and conditions laid out in the document. Skipping this step can lead to agreeing to unfavorable terms without realizing it.

Lastly, not keeping a copy of the completed agreement is a mistake that can have significant consequences. Borrowers should always retain a copy for their records. This ensures that they have access to the terms they agreed to, which can be vital if questions or issues arise in the future.

Dos and Don'ts

When filling out the California Loan Agreement form, it's essential to follow certain guidelines to ensure accuracy and compliance. Here’s a list of things to do and avoid:

- Do read the entire form carefully before starting to fill it out.

- Do provide accurate and complete information to avoid delays.

- Do sign and date the form in the appropriate sections.

- Do keep a copy of the completed form for your records.

- Don't leave any required fields blank; this could lead to rejection.

- Don't use white-out or make alterations to the form after signing.

- Don't rush through the process; take your time to ensure everything is correct.

- Don't forget to check for any specific instructions related to your loan type.

Other Loan Agreement State Forms

Texas Promissory Note Form - This form can support sound financial practices by formalizing loan terms.

To ensure that you have the necessary documentation in place, it is advisable to download the form in pdf, which provides clear guidelines on how to properly execute a Florida Power of Attorney form. This ensures clarity in designating someone to make critical decisions on your behalf.

Promissory Note Template Florida Pdf - Typically, Loan Agreements are detailed and can be quite extensive to cover various scenarios.

Similar forms

Promissory Note: Like a Loan Agreement, a Promissory Note is a legal document that outlines the borrower's promise to repay a loan. It specifies the amount borrowed, interest rate, and repayment schedule, making it a straightforward way to formalize a loan.

Mortgage Agreement: This document is similar in that it secures a loan with property as collateral. A Mortgage Agreement details the terms of the loan, including the consequences of default, ensuring that the lender has a claim to the property if the borrower fails to repay.

Security Agreement: A Security Agreement is akin to a Loan Agreement as it outlines the terms under which collateral is pledged to secure a loan. It specifies what assets are being used as security and the rights of the lender in case of default.

Lease Agreement: While primarily used for renting property, a Lease Agreement shares similarities with a Loan Agreement in that it involves a financial commitment over time. Both documents outline terms, payment schedules, and obligations of the parties involved.

- Motor Vehicle Power of Attorney: This legal document allows a vehicle owner to designate another individual to manage their motor vehicle affairs in Florida, including tasks like registration and title transfer, which can be essential for efficient vehicle management. More details can be found here: https://toptemplates.info/.

Personal Guarantee: This document can accompany a Loan Agreement and serves as a promise from an individual to repay the loan if the borrower defaults. It adds an extra layer of security for the lender, similar to the assurances provided in a Loan Agreement.