Printable California Last Will and Testament Document

Form Preview Example

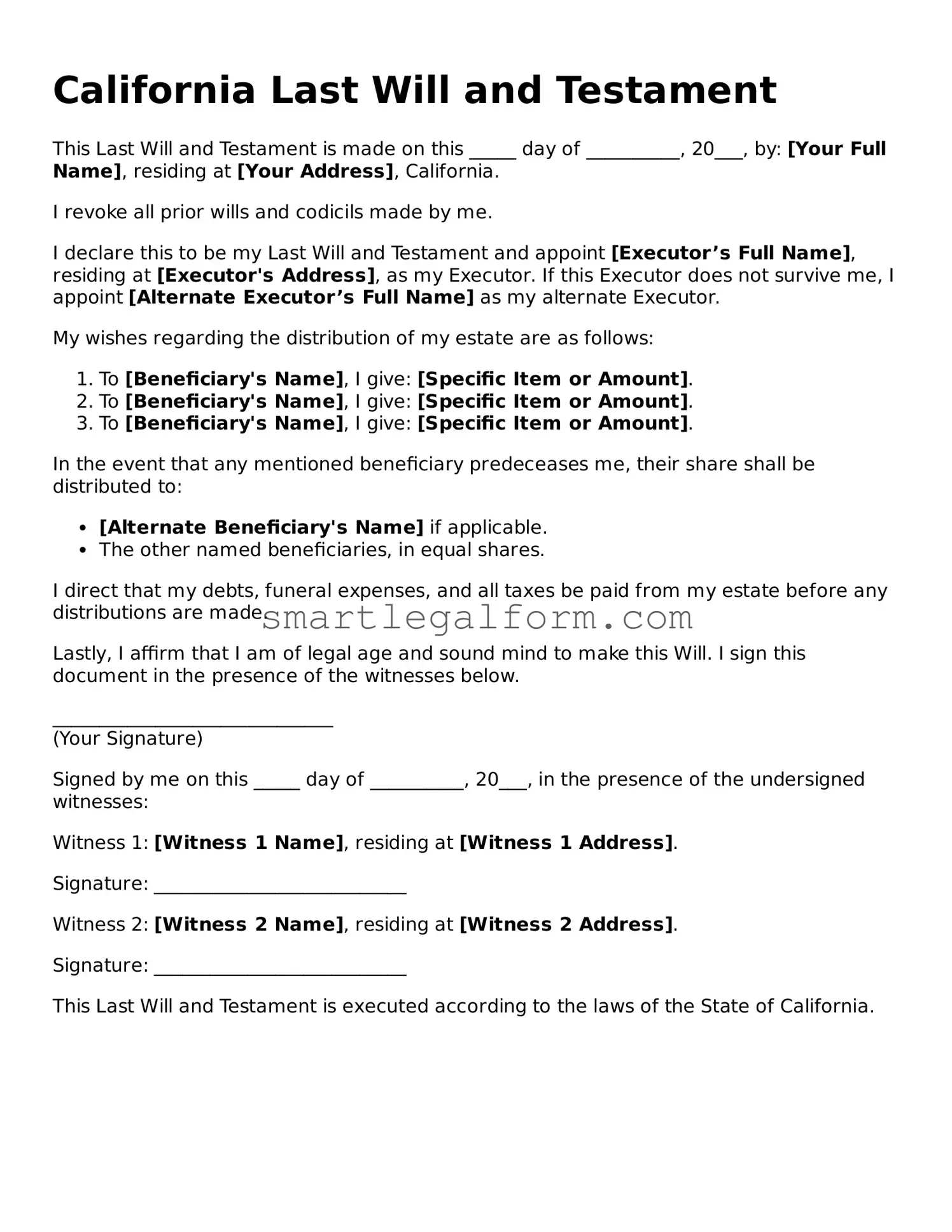

California Last Will and Testament

This Last Will and Testament is made on this _____ day of __________, 20___, by: [Your Full Name], residing at [Your Address], California.

I revoke all prior wills and codicils made by me.

I declare this to be my Last Will and Testament and appoint [Executor’s Full Name], residing at [Executor's Address], as my Executor. If this Executor does not survive me, I appoint [Alternate Executor’s Full Name] as my alternate Executor.

My wishes regarding the distribution of my estate are as follows:

- To [Beneficiary's Name], I give: [Specific Item or Amount].

- To [Beneficiary's Name], I give: [Specific Item or Amount].

- To [Beneficiary's Name], I give: [Specific Item or Amount].

In the event that any mentioned beneficiary predeceases me, their share shall be distributed to:

- [Alternate Beneficiary's Name] if applicable.

- The other named beneficiaries, in equal shares.

I direct that my debts, funeral expenses, and all taxes be paid from my estate before any distributions are made.

Lastly, I affirm that I am of legal age and sound mind to make this Will. I sign this document in the presence of the witnesses below.

______________________________

(Your Signature)

Signed by me on this _____ day of __________, 20___, in the presence of the undersigned witnesses:

Witness 1: [Witness 1 Name], residing at [Witness 1 Address].

Signature: ___________________________

Witness 2: [Witness 2 Name], residing at [Witness 2 Address].

Signature: ___________________________

This Last Will and Testament is executed according to the laws of the State of California.

Common mistakes

Creating a Last Will and Testament is a crucial step in ensuring that your wishes are honored after your passing. However, many individuals make mistakes when filling out the California Last Will and Testament form. One common error is failing to properly identify beneficiaries. It is essential to clearly state who will inherit your assets. If a beneficiary is not named specifically or if there is ambiguity in the language, it may lead to disputes among heirs or even result in your estate being distributed contrary to your wishes.

Another frequent mistake is neglecting to sign the document correctly. In California, a will must be signed by the testator, the person creating the will, in the presence of at least two witnesses. If this requirement is not met, the will may be deemed invalid. It is also important that the witnesses are not beneficiaries themselves. This ensures that there is no conflict of interest and helps to uphold the integrity of the will.

People often overlook the importance of updating their wills. Life events such as marriage, divorce, or the birth of a child can significantly alter your wishes regarding asset distribution. Failing to revise your will after such changes may result in unintended consequences, such as excluding a new spouse or child from inheritance. Regularly reviewing and updating your will can help ensure that it reflects your current intentions.

Finally, individuals sometimes underestimate the value of clarity in their instructions. Vague language can lead to confusion and misinterpretation. For instance, stating that certain items should go to “my children” without specifying which children or what items can create complications. Clear and precise language helps to avoid disputes and makes it easier for your loved ones to carry out your wishes as intended.

Dos and Don'ts

When it comes to filling out a Last Will and Testament form in California, there are some important dos and don'ts to keep in mind. This ensures your wishes are clearly expressed and legally valid.

- Do ensure you are of sound mind and at least 18 years old when creating your will.

- Do clearly identify yourself at the beginning of the document, including your full name and address.

- Do specify how you want your assets distributed among your beneficiaries.

- Do name an executor who will carry out your wishes after your passing.

- Don't use vague language that could lead to confusion about your intentions.

- Don't forget to sign and date your will in front of two witnesses who are not beneficiaries.

- Don't make changes to the will without following proper procedures, such as creating a codicil.

- Don't neglect to store your will in a safe yet accessible place for your loved ones to find.

Other Last Will and Testament State Forms

Free Last Will and Testament Forms - Can specify conditions under which certain beneficiaries may inherit assets.

The Free And Invoice PDF form is a document designed to facilitate billing and payment processes between businesses and clients. It helps in clearly outlining goods or services provided, along with their respective costs. Using this form can streamline transactions and ensure transparency in financial exchanges, and you can find it at documentonline.org/blank-free-and-invoice-pdf.

Do You Need a Lawyer to Do a Will - Allows for the appointment of guardians for minor children.

Similar forms

- Living Will: A living will outlines a person's wishes regarding medical treatment in case they become unable to communicate. Like a Last Will and Testament, it expresses personal choices, but it focuses on health care rather than the distribution of assets.

- Trust Document: A trust document allows a person to place assets into a trust for the benefit of others. Similar to a will, it details how assets should be managed and distributed, but it often avoids probate, providing a different mechanism for asset transfer.

- Durable Power of Attorney: This document designates someone to make financial or legal decisions on behalf of another person if they become incapacitated. It shares similarities with a will in that it allows individuals to express their preferences regarding decision-making.

- Health Care Proxy: A health care proxy appoints someone to make medical decisions for a person if they cannot do so themselves. Like a will, it involves personal choices about care and decision-making, emphasizing the importance of individual wishes.

- Beneficiary Designation Forms: These forms specify who will receive certain assets, like life insurance or retirement accounts, upon a person's death. Similar to a will, they direct the distribution of assets but often bypass the probate process.

- Letter of Instruction: This informal document provides guidance to loved ones about personal wishes and preferences, including funeral arrangements. While not legally binding like a will, it complements a will by offering additional insights into a person's desires.

- Codicil: A codicil is an amendment to an existing will. It allows individuals to make changes without creating an entirely new document, maintaining the original will's structure while updating specific provisions.

Durable Power of Attorney: A durable power of attorney form is essential for designating a trusted individual who can make decisions on your behalf if you become incapacitated. For more information, visit TopTemplates.info.

- Revocable Living Trust: This type of trust can be altered or revoked during the grantor's lifetime. Like a will, it details how assets will be handled, but it can provide more flexibility and privacy in asset management and distribution.