Printable California Gift Deed Document

Form Preview Example

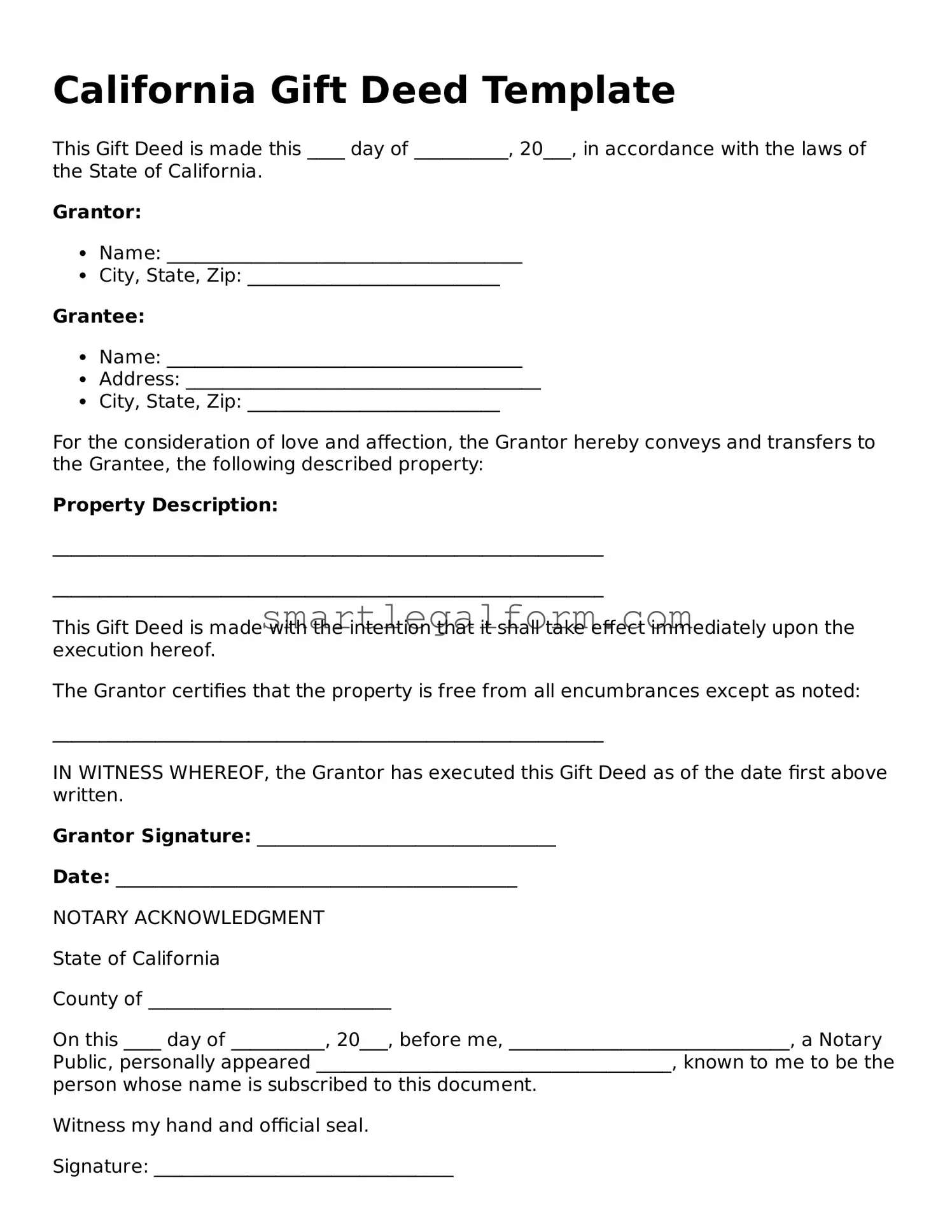

California Gift Deed Template

This Gift Deed is made this ____ day of __________, 20___, in accordance with the laws of the State of California.

Grantor:

- Name: ______________________________________

- City, State, Zip: ___________________________

Grantee:

- Name: ______________________________________

- Address: ______________________________________

- City, State, Zip: ___________________________

For the consideration of love and affection, the Grantor hereby conveys and transfers to the Grantee, the following described property:

Property Description:

___________________________________________________________

___________________________________________________________

This Gift Deed is made with the intention that it shall take effect immediately upon the execution hereof.

The Grantor certifies that the property is free from all encumbrances except as noted:

___________________________________________________________

IN WITNESS WHEREOF, the Grantor has executed this Gift Deed as of the date first above written.

Grantor Signature: ________________________________

Date: ___________________________________________

NOTARY ACKNOWLEDGMENT

State of California

County of __________________________

On this ____ day of __________, 20___, before me, ______________________________, a Notary Public, personally appeared ______________________________________, known to me to be the person whose name is subscribed to this document.

Witness my hand and official seal.

Signature: ________________________________

Notary Public, State of California

My commission expires: ____________________

Common mistakes

Filling out a California Gift Deed form can be a straightforward process, but many people inadvertently make mistakes that can lead to complications later on. One common error is failing to include the correct legal description of the property. It’s essential to provide an accurate and detailed description to avoid any confusion or disputes regarding the property’s boundaries.

Another mistake is neglecting to include the names of both the donor and the recipient. It’s important that these names are clearly stated as they appear on legal documents. Omitting or misspelling a name can create issues when the deed is recorded.

Many individuals also forget to have the Gift Deed notarized. A notary public must witness the signatures of both parties to ensure the document is legally binding. Without this step, the deed may not be recognized by the county recorder’s office.

Some people mistakenly assume that a Gift Deed does not need to be recorded. In California, it’s crucial to file the deed with the county recorder to protect the interests of both the donor and recipient. Failing to record the deed can lead to potential claims from third parties.

Additionally, errors can occur if individuals do not understand the tax implications of gifting property. It’s advisable to consult with a tax professional to understand any potential gift tax liabilities. Ignoring this aspect can result in unexpected financial obligations.

Another frequent oversight is not including a statement of consideration. While a Gift Deed typically indicates that the property is being transferred without payment, it’s still important to state this clearly to avoid misunderstandings.

Some individuals may overlook the need for a legal advisor's review. Having a legal expert examine the Gift Deed can help catch any errors before submission. This step can save time and prevent future legal issues.

Lastly, people often fail to keep copies of the completed Gift Deed. Retaining a copy for personal records is essential. This documentation can serve as proof of the transaction and may be necessary for future reference.

Dos and Don'ts

When filling out the California Gift Deed form, there are important considerations to ensure the process goes smoothly. Below is a list of things you should and shouldn't do:

- Do provide accurate property details, including the legal description.

- Do include the full names of both the giver and the recipient.

- Do ensure that the form is signed by the giver in the presence of a notary public.

- Do check for any outstanding liens or encumbrances on the property before proceeding.

- Do file the completed Gift Deed with the county recorder's office.

- Don't leave any fields blank; incomplete forms can lead to delays.

- Don't forget to include the date of the gift.

- Don't attempt to make the gift without consulting with a legal expert if there are complex issues involved.

- Don't ignore any tax implications that may arise from the gift.

Other Gift Deed State Forms

Texas Gift Deed Pdf - The inclusion of witnesses can strengthen the validity of the Gift Deed.

The Employment Verification Form is a document used by employers to confirm an individual's employment history, including job title, duration of employment, and sometimes salary information. This form plays a crucial role in the hiring process, as it helps potential employers assess a candidate's qualifications and reliability. To access a template for this essential document, you can refer to documentonline.org/blank-employment-verification-form. Understanding how to properly fill out and submit this form can significantly impact both job seekers and employers alike.

Similar forms

A Gift Deed is a legal document that transfers ownership of property from one person to another without any exchange of money. There are several other documents that serve similar purposes in property transfer or conveyance. Below are seven documents that are comparable to a Gift Deed, along with explanations of their similarities.

- Quitclaim Deed: This document transfers whatever interest the grantor has in the property to the grantee. Like a Gift Deed, it does not involve any payment and is often used among family members or friends.

- Warranty Deed: A Warranty Deed provides a guarantee that the grantor holds clear title to the property and has the right to transfer it. While it usually involves a sale, it can also be used in gift transactions to assure the recipient of the property’s title.

- Transfer on Death Deed: This type of deed allows a property owner to transfer their property upon their death without going through probate. Similar to a Gift Deed, it is a way to pass on property without immediate financial exchange.

- Deed of Trust: While primarily used in financing, a Deed of Trust can also be used to transfer property to a trustee for the benefit of a beneficiary. This is similar to a Gift Deed in that it involves the transfer of ownership, though it is often tied to a financial obligation.

- Bill of Sale: Although typically used for personal property, a Bill of Sale can serve a similar purpose for transferring ownership without payment. It documents the transfer of ownership and can be used in gifting scenarios.

- Hold Harmless Agreement: This legal document in Florida shifts liability between parties, protecting individuals and entities from financial risks associated with activities. For more details, visit TopTemplates.info.

- Lease Agreement: A Lease Agreement can sometimes function similarly to a Gift Deed if the property is leased for a nominal fee or as a gift. It allows the lessee to use the property without transferring ownership outright.

- Partition Deed: This document is used when co-owners of a property wish to divide their interests. It can resemble a Gift Deed when one co-owner gifts their interest to another, thereby transferring ownership without a financial transaction.