Free California Fotm Reg 262 Form

Form Preview Example

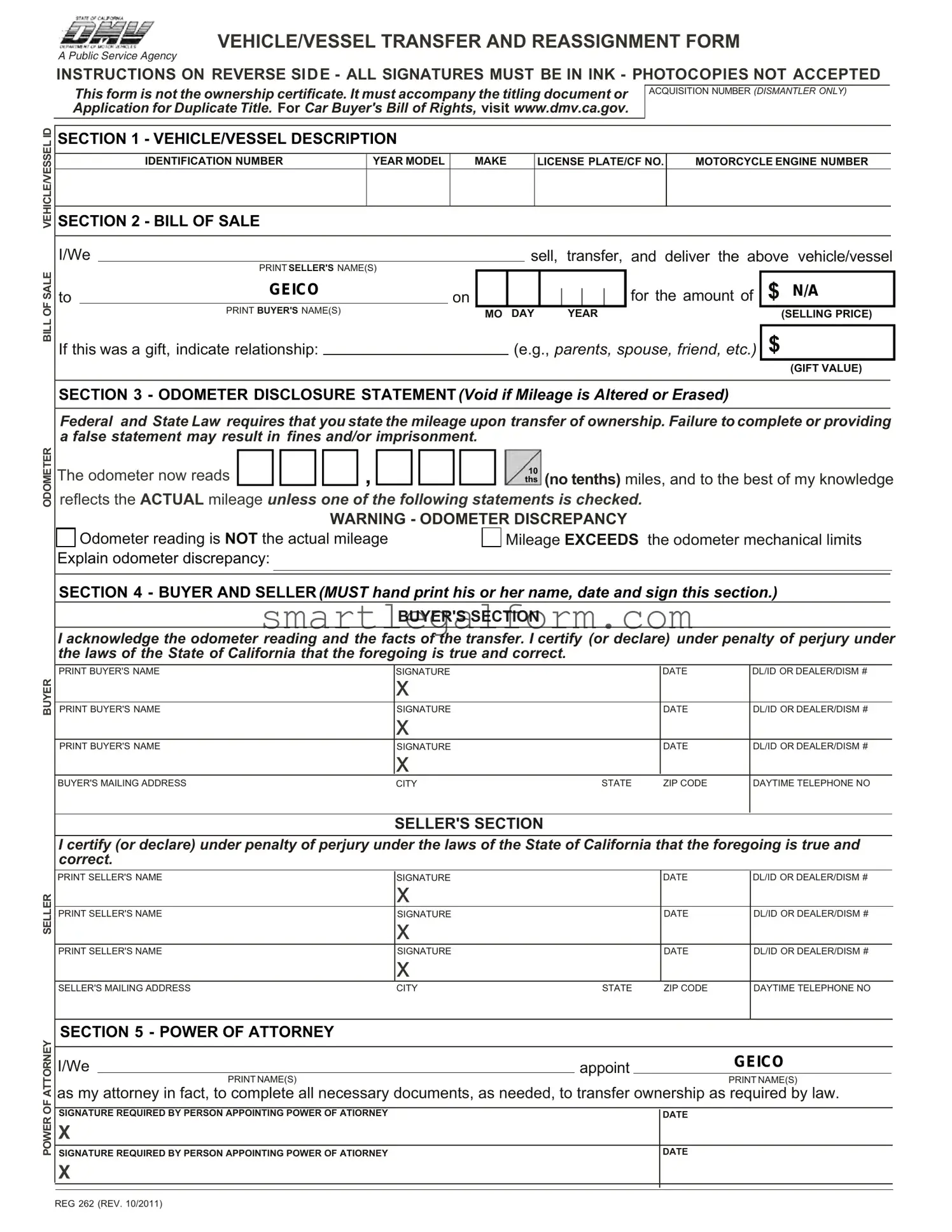

VEHICLE/VESSEL TRANSFER AND REASSIGNMENT FORM

A Public Service Agency

INSTRUCTIONS ON REVERSE SIDE - ALL SIGNATURES MUST BE IN INK - PHOTOCOPIES NOT ACCEPTED

This form is not the ownership certificate. It must accompany the titling document or Application for Duplicate Title. For Car Buyer's Bill of Rights, visit www.dmv.ca.gov.

ACQUISITION NUMBER (DISMANTLER ONLY)

BILL OF SALE VEHICLE/VESSEL ID

ODOMETER

BUYER

SELLER

POWER OF ATTORNEY

SECTION 1 - VEHICLE/VESSEL DESCRIPTION

|

|

IDENTIFICATION NUMBER |

YEAR MODEL |

|

MAKE |

|

|

LICENSE PLATE/CF NO. |

MOTORCYCLE ENGINE NUMBER |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SECTION 2 - BILL OF SALE |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

I/We |

|

|

|

|

|

|

sell, |

transfer, and |

deliver the above |

vehicle/vessel |

||||

PRINT SELLER'S NAME(S) |

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

||||

to |

GEICO |

|

on |

|

|

|

|

for the amount of |

$ |

N/A |

||||

|

|

PRINT BUYER'S NAME(S) |

|

|

MO |

DAY |

YEAR |

|

(SELLING PRICE) |

|||||

If this was a gift, indicate relationship: |

|

|

|

|

(e.g., parents, spouse, friend, etc.) |

$ |

(GIFT VALUE) |

|||||||

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

SECTION 3 - ODOMETER DISCLOSURE STATEMENT (Void if Mileage is Altered or Erased)

Federal and State Law requires that you state the mileage upon transfer of ownership. Failure to complete or providing a false statement may result in fines and/or imprisonment.

The odometer now reads |

, |

ths (no tenths) miles, and to the best of my knowledge |

|

|

|

10 |

|

reflects the ACTUAL mileage unless one of the following statements is checked. |

|||

|

WARNING - ODOMETER DISCREPANCY |

||

Odometer reading is NOT the actual mileage |

Mileage EXCEEDS the odometer mechanical limits |

||

Explain odometer discrepancy: |

|

|

|

SECTION 4 - BUYER AND SELLER (MUST hand print his or her name, date and sign this section.)

BUYER'S SECTION

I acknowledge the odometer reading and the facts of the transfer. I certify (or declare) under penalty of perjury under the laws of the State of California that the foregoing is true and correct.

PRINT BUYER'S NAME |

SIGNATURE |

|

DATE |

DL/ID OR DEALER/DISM # |

|

x |

|

|

|

PRINT BUYER'S NAME |

SIGNATURE |

|

DATE |

DL/ID OR DEALER/DISM # |

|

x |

|

|

|

PRINT BUYER'S NAME |

SIGNATURE |

|

DATE |

DL/ID OR DEALER/DISM # |

|

x |

|

|

|

BUYER'S MAILING ADDRESS |

CITY |

STATE |

ZIP CODE |

DAYTIME TELEPHONE NO |

|

|

|

|

|

SELLER'S SECTION

I certify (or declare) under penalty of perjury under the laws of the State of California that the foregoing is true and correct.

PRINT SELLER'S NAME |

SIGNATURE |

|

|

DATE |

|

DL/ID OR DEALER/DISM # |

|

|

|

x |

|

|

|

|

|

PRINT SELLER'S NAME |

SIGNATURE |

|

|

DATE |

|

DL/ID OR DEALER/DISM # |

|

|

|

x |

|

|

|

|

|

PRINT SELLER'S NAME |

SIGNATURE |

|

|

DATE |

|

DL/ID OR DEALER/DISM # |

|

|

|

x |

|

|

|

|

|

SELLER'S MAILING ADDRESS |

CITY |

STATE |

ZIP CODE |

|

DAYTIME TELEPHONE NO |

||

|

|

|

|

|

|

|

|

SECTION 5 - POWER OF ATTORNEY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I/We |

|

|

appoint |

|

|

GEICO |

|

|

PRINT NAME(S) |

|

|

|

|

PRINT NAME(S) |

|

as my attorney in fact, to complete all necessary documents, as needed, to transfer ownership as required by law. |

|||||||

SIGNATURE REQUIRED BY PERSON APPOINTING POWER OF ATIORNEY |

|

|

|

DATE |

|

|

|

x |

|

|

|

|

|

|

|

SIGNATURE REQUIRED BY PERSON APPOINTING POWER OF ATIORNEY |

|

|

|

DATE |

|

|

|

x |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REG 262 (REV. 10/2011) |

|

|

|

|

|

|

|

Common mistakes

Filling out the California Form REG 262 can be a straightforward process, but many people still make common mistakes that can lead to delays or complications. One of the most frequent errors occurs in Section 1, where individuals often forget to include essential vehicle or vessel identification details. This section requires specific information such as the vehicle identification number (VIN), year, make, and model. Omitting any of these details can render the form incomplete, resulting in the need for resubmission.

Another common mistake involves the Bill of Sale section. Here, sellers must accurately state the selling price or gift value. People sometimes write down the wrong amount or fail to indicate if the transfer is a gift. This oversight can lead to misunderstandings about the transaction's nature and may complicate tax implications. Additionally, not providing the date of sale can cause further issues, as this date is crucial for establishing the timeline of ownership transfer.

In Section 3, the odometer disclosure statement is another area where errors frequently occur. Some individuals mistakenly alter the mileage or fail to provide the correct reading, which can void the entire disclosure. The law mandates that the odometer reading must reflect actual mileage, and any changes, such as cross-outs or erasures, will invalidate this section. This mistake can lead to serious legal repercussions, including fines or imprisonment for providing false information.

Finally, many people overlook the importance of signatures in Sections 4 and 5. Both the buyer and seller must hand-print their names, sign, and date the form. Failing to include a signature or date can result in the form being rejected. Additionally, if there are multiple owners, it is crucial to ensure that all required signatures are present. Not adhering to these signature requirements can delay the registration process and create unnecessary complications.

Dos and Don'ts

When filling out the California Form Reg 262, it is important to follow specific guidelines to ensure the process goes smoothly. Here are seven things you should and shouldn't do:

- Do complete all required sections of the form accurately.

- Don't use photocopies of the form; the original must be submitted.

- Do sign the form in ink; electronic signatures are not accepted.

- Don't alter any information on the form, especially the odometer reading.

- Do provide the correct vehicle identification number (VIN) and other details.

- Don't forget to include the date of sale or gift, along with the selling price or gift value.

- Do ensure that both the buyer and seller print their names and sign the form.

Other PDF Documents

Progressive Logo - The card's clear layout makes it easy to find necessary information quickly.

Guardianship Documents - This form addresses custody during a legal separation.

Similar forms

- California Form REG 256: This form serves as a Notice of Transfer and Release of Liability. It informs the DMV that the vehicle has been sold or transferred, similar to how the REG 262 documents ownership transfer.

- California Form REG 227: The Application for Duplicate Title is used when a vehicle's title is lost or damaged. Like REG 262, it is essential for establishing ownership and must accompany the appropriate documentation.

- California Form REG 343: This is the Vehicle/Vessel Bill of Sale, which provides proof of the sale. It complements the REG 262 by detailing the transaction between buyer and seller.

- California Form REG 135: The Application for Title or Registration is used to apply for a new title or registration. It is similar to REG 262 in that both are necessary for transferring ownership legally.

- California Form REG 5103: This form is a Notice of Transfer of Ownership for vehicles that are gifted. It serves a similar purpose as the REG 262 by documenting the transfer of ownership.

- California Form REG 262A: The Vehicle/Vessel Transfer and Reassignment Form is an alternative to REG 262 for specific situations. Both forms facilitate the transfer of ownership.

- California Form REG 131: This is the Application for a Certificate of Title for vehicles that have not been previously registered. Like REG 262, it helps establish legal ownership.

- California Form REG 256A: This is a Notice of Release of Liability for vehicles sold to a dealer. It functions similarly to REG 262 in notifying the DMV of ownership changes.

- California Form REG 462: The Statement of Facts form can be used to explain unusual circumstances surrounding a vehicle transfer. It supports the REG 262 by providing additional context for ownership changes.

- California Form REG 505: This form is used for the transfer of ownership of a vehicle that is part of a trust. It serves a similar purpose as REG 262 by documenting the change in ownership.