Printable California Employment Verification Document

Form Preview Example

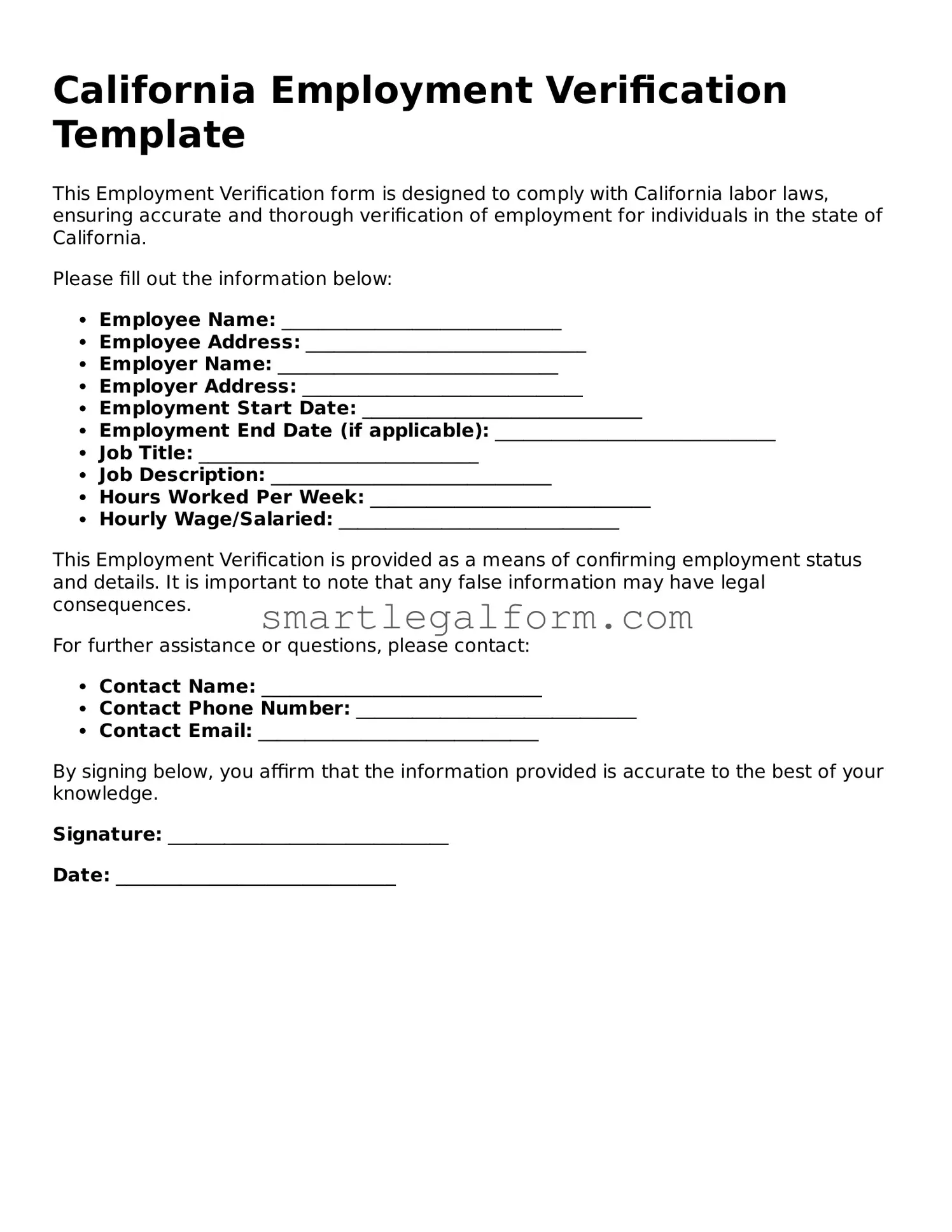

California Employment Verification Template

This Employment Verification form is designed to comply with California labor laws, ensuring accurate and thorough verification of employment for individuals in the state of California.

Please fill out the information below:

- Employee Name: ______________________________

- Employee Address: ______________________________

- Employer Name: ______________________________

- Employer Address: ______________________________

- Employment Start Date: ______________________________

- Employment End Date (if applicable): ______________________________

- Job Title: ______________________________

- Job Description: ______________________________

- Hours Worked Per Week: ______________________________

- Hourly Wage/Salaried: ______________________________

This Employment Verification is provided as a means of confirming employment status and details. It is important to note that any false information may have legal consequences.

For further assistance or questions, please contact:

- Contact Name: ______________________________

- Contact Phone Number: ______________________________

- Contact Email: ______________________________

By signing below, you affirm that the information provided is accurate to the best of your knowledge.

Signature: ______________________________

Date: ______________________________

Common mistakes

Filling out the California Employment Verification form can be a straightforward process, yet many individuals encounter common pitfalls. One frequent mistake is failing to provide accurate personal information. This includes the employee's full name, social security number, and date of birth. Inaccuracies can lead to delays in processing and may even complicate employment verification.

Another common error is neglecting to include the correct dates of employment. It is essential to specify both the start date and the end date, if applicable. Incomplete or incorrect date information can raise questions about the employee's work history, which may hinder the verification process.

Many individuals also overlook the importance of detailing job titles and responsibilities. Providing a comprehensive description of the employee's role helps verify their qualifications and experience. Without this information, the form may appear incomplete, leading to potential misunderstandings regarding the employee's capabilities.

Additionally, some people forget to sign and date the form. A signature is necessary to validate the information provided. Without it, the form may be considered invalid, resulting in further delays and the need to resubmit the documentation.

Another mistake involves using outdated or incorrect contact information for the employer. This can make it difficult for the verifying party to reach out for confirmation. It is crucial to ensure that the employer's name, address, and phone number are current and accurate.

People often misinterpret the instructions for completing the form. Each section has specific requirements, and misunderstanding these can lead to incomplete submissions. Taking the time to read and follow the instructions carefully can prevent this issue.

Moreover, some individuals fail to provide supporting documentation when required. This could include pay stubs or tax forms that validate the information presented on the Employment Verification form. Such documentation can enhance the credibility of the submission and expedite the verification process.

Lastly, a lack of attention to detail when reviewing the completed form can result in overlooked errors. Before submitting, it is advisable to double-check all entries for accuracy and completeness. This simple step can save time and prevent complications in the verification process.

Dos and Don'ts

Filling out the California Employment Verification form can be a straightforward process if you keep a few key points in mind. Here’s a helpful list of things to do and avoid while completing this important document.

- Do ensure all information is accurate and up-to-date. Double-check dates and personal details.

- Don't leave any sections blank unless specifically instructed. Incomplete forms may lead to delays.

- Do provide clear and legible handwriting or type your responses. Clarity is crucial for processing.

- Don't use abbreviations or slang. Stick to formal language to avoid confusion.

- Do sign and date the form where required. An unsigned form may be considered invalid.

- Don't forget to include any necessary supporting documents. Check if additional paperwork is needed.

- Do keep a copy of the completed form for your records. This can be helpful for future reference.

- Don't rush through the process. Take your time to ensure everything is filled out correctly.

By following these guidelines, you can help ensure that your Employment Verification form is completed correctly and efficiently. This attention to detail can make a significant difference in your employment journey.

Other Employment Verification State Forms

State of California Employment Verification - It helps potential employers assess a candidate's work history.

Job Verification Letter Sample - This form captures essential details about an employee’s role and contributions.

Texas Income Letter - The entity requesting verification may need specific details outlined in this form.

Similar forms

The Employment Verification form is an important document used to confirm an individual's employment status, job title, and duration of employment. Several other documents serve similar purposes in various contexts. Below is a list of seven documents that share similarities with the Employment Verification form:

- Pay Stubs: Pay stubs provide evidence of employment by detailing an employee's earnings, deductions, and hours worked. They often include the employer's name and the employee's job title, serving as proof of income and employment status.

- W-2 Forms: A W-2 form is issued by employers to report an employee's annual wages and the taxes withheld. This document verifies employment and provides a summary of earnings for tax purposes, similar to the Employment Verification form.

- Offer Letters: An offer letter outlines the terms of employment and confirms that an individual has been offered a position. It typically includes details such as job title, salary, and start date, which can verify employment status.

- Employment Contracts: Employment contracts are formal agreements between employers and employees. They detail the responsibilities and terms of employment, serving as a verification tool for the employee's role within the company.

- Reference Letters: Reference letters from previous employers can serve as a form of employment verification. These letters often confirm job titles, duties, and the duration of employment, providing insights into the individual's work history.

- Social Security Administration (SSA) Earnings Statements: SSA earnings statements provide a record of an individual's earnings reported to the Social Security Administration. This document can verify employment history and income over time.

- Tax Returns: Personal tax returns may include information about employment income. They can serve as a record of employment and earnings, especially when filed with the IRS, and can be used to verify an individual's financial status.

Each of these documents plays a role in confirming employment status and providing important information about an individual's work history. Understanding their similarities can help individuals navigate employment verification processes more effectively.