Printable California Durable Power of Attorney Document

Form Preview Example

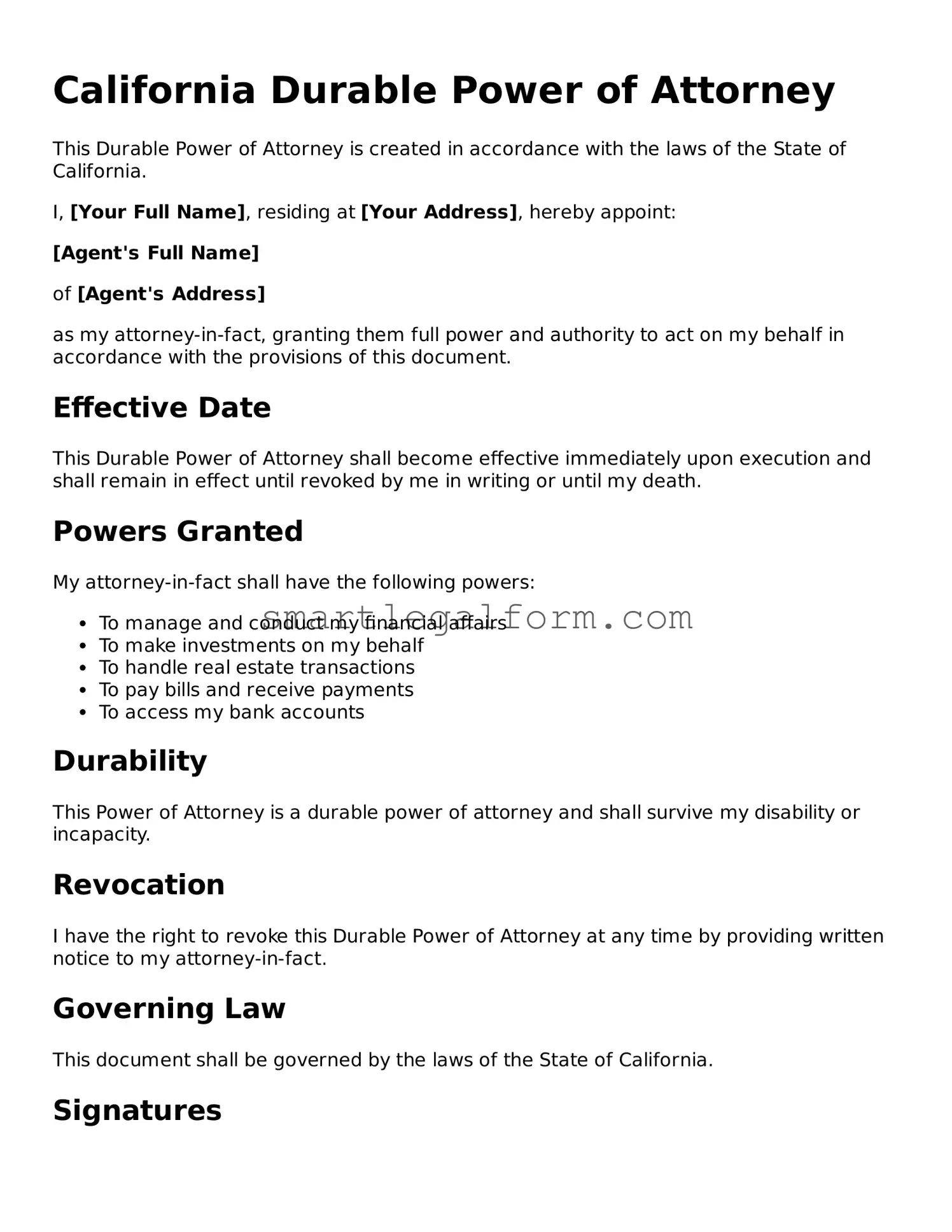

California Durable Power of Attorney

This Durable Power of Attorney is created in accordance with the laws of the State of California.

I, [Your Full Name], residing at [Your Address], hereby appoint:

[Agent's Full Name]

of [Agent's Address]

as my attorney-in-fact, granting them full power and authority to act on my behalf in accordance with the provisions of this document.

Effective Date

This Durable Power of Attorney shall become effective immediately upon execution and shall remain in effect until revoked by me in writing or until my death.

Powers Granted

My attorney-in-fact shall have the following powers:

- To manage and conduct my financial affairs

- To make investments on my behalf

- To handle real estate transactions

- To pay bills and receive payments

- To access my bank accounts

Durability

This Power of Attorney is a durable power of attorney and shall survive my disability or incapacity.

Revocation

I have the right to revoke this Durable Power of Attorney at any time by providing written notice to my attorney-in-fact.

Governing Law

This document shall be governed by the laws of the State of California.

Signatures

By signing below, I acknowledge that I am of sound mind, free of duress, and fully understand the powers granted herein.

Signature: ________________________________

Date: ________________________________

Witness Signature: ________________________________

Date: ________________________________

Common mistakes

Filling out a Durable Power of Attorney (DPOA) form in California can seem straightforward, but many people make common mistakes that could lead to complications down the line. Understanding these pitfalls can help ensure that your wishes are honored when you need it most.

One frequent mistake is not specifying the powers granted. A DPOA allows you to designate someone to make decisions on your behalf, but if the powers are too vague, it can create confusion. Be clear about what decisions your agent can make—whether it's financial, medical, or both. This clarity can prevent disputes and ensure your agent acts in your best interest.

Another common error is failing to date the document. A DPOA must be dated to be valid. If the date is missing, it may be questioned in the future, especially if there are changes in your circumstances. Always double-check that the date is clearly written and easy to find.

Many people also overlook the importance of choosing the right agent. This person will have significant authority over your affairs, so selecting someone trustworthy is crucial. Avoid appointing someone simply because they are a family member or close friend. Evaluate their ability to handle responsibilities and make sound decisions on your behalf.

Additionally, not having the document notarized can lead to issues. While California does not require notarization for a DPOA to be valid, having it notarized can add an extra layer of legitimacy. This is especially important if your agent needs to present the document to banks or healthcare providers.

Some individuals forget to inform their agents that they have been appointed. It’s essential that your chosen agent knows they are responsible for making decisions on your behalf. A surprise appointment can lead to confusion and delays when you need someone to step in quickly.

Another mistake is not considering alternate agents. Life is unpredictable, and your first choice may not always be available when the time comes. Designating an alternate ensures that there is a backup ready to step in, which can save time and prevent complications.

Finally, neglecting to review and update the DPOA regularly can be detrimental. Life changes, such as divorce, illness, or the death of an agent, may necessitate updates to your DPOA. Regularly reviewing the document ensures that it reflects your current wishes and circumstances.

By being aware of these common mistakes, you can better prepare yourself and your loved ones for the future. Taking the time to fill out your Durable Power of Attorney form correctly can provide peace of mind, knowing that your wishes will be respected when it matters most.

Dos and Don'ts

Filling out a California Durable Power of Attorney form is an important step in ensuring that your wishes are respected in the event you become unable to make decisions for yourself. Here are ten things to consider when completing this form:

- Do choose a trusted person as your agent. This individual will have significant authority over your financial and medical decisions.

- Do clearly define the powers you are granting. Specify what decisions your agent can make on your behalf.

- Do sign the document in front of a notary public. This adds an extra layer of validity to your form.

- Do keep a copy of the completed form for your records. This ensures that you have access to your wishes at any time.

- Do review the form periodically. Life circumstances change, and so might your preferences.

- Don't rush the process. Take your time to understand each section of the form before signing.

- Don't choose someone who may have conflicting interests. Your agent should act in your best interest without any personal agenda.

- Don't forget to inform your agent about their responsibilities. They should understand your wishes and how to carry them out.

- Don't assume that a verbal agreement is sufficient. Written documentation is essential for legal recognition.

- Don't overlook state-specific requirements. Ensure you are following California's laws regarding Durable Power of Attorney.

By following these guidelines, you can help ensure that your Durable Power of Attorney reflects your true intentions and protects your interests. It is a vital step in planning for the future.

Other Durable Power of Attorney State Forms

How to File a Power of Attorney in Florida - Grants authority to a trusted individual to make decisions regarding your assets and finances.

Power of Attorney Texas Form - This form can help avoid court intervention in managing your affairs.

New York State Power of Attorney Form 2023 Pdf - In cases where mental decline is anticipated, establishing this document early can safeguard the principal’s interests.

Durable Power of Attorney Illinois Pdf - Individuals should ensure their chosen agent is willing and able to take on the responsibility.

Similar forms

- General Power of Attorney: Like the Durable Power of Attorney, this document allows someone to act on your behalf. However, it typically becomes invalid if you become incapacitated.

- Healthcare Power of Attorney: This document specifically gives someone the authority to make medical decisions for you if you are unable to do so. It focuses on health-related matters.

- Living Will: A Living Will outlines your wishes regarding medical treatment in situations where you cannot communicate. While it doesn’t appoint someone to make decisions, it complements the Healthcare Power of Attorney.

- Financial Power of Attorney: Similar to the Durable Power of Attorney, this document allows someone to manage your financial affairs. It can be limited to specific tasks or broad in scope.

- Revocable Trust: A Revocable Trust allows you to manage your assets during your lifetime and can specify what happens to them after your death. It provides a way to avoid probate, unlike a Durable Power of Attorney.

- Advance Healthcare Directive: This combines both a Healthcare Power of Attorney and a Living Will. It guides healthcare providers on your wishes and designates someone to make decisions for you.

- Guardianship Document: This document appoints a guardian for a minor or incapacitated person. It is similar in that it grants authority to another person but focuses on personal care and custody.

- Will: A Will outlines how your assets should be distributed after your death. While a Durable Power of Attorney manages your affairs during your life, a Will comes into play after death.

- Property Management Agreement: This document allows someone to manage real estate or other properties on your behalf. It shares similarities with a Durable Power of Attorney in terms of authority but is more specific to property management.

- Business Power of Attorney: This document is tailored for business matters, allowing someone to act on your behalf in business transactions. It is similar in function but specific to business-related decisions.