Printable California Deed in Lieu of Foreclosure Document

Form Preview Example

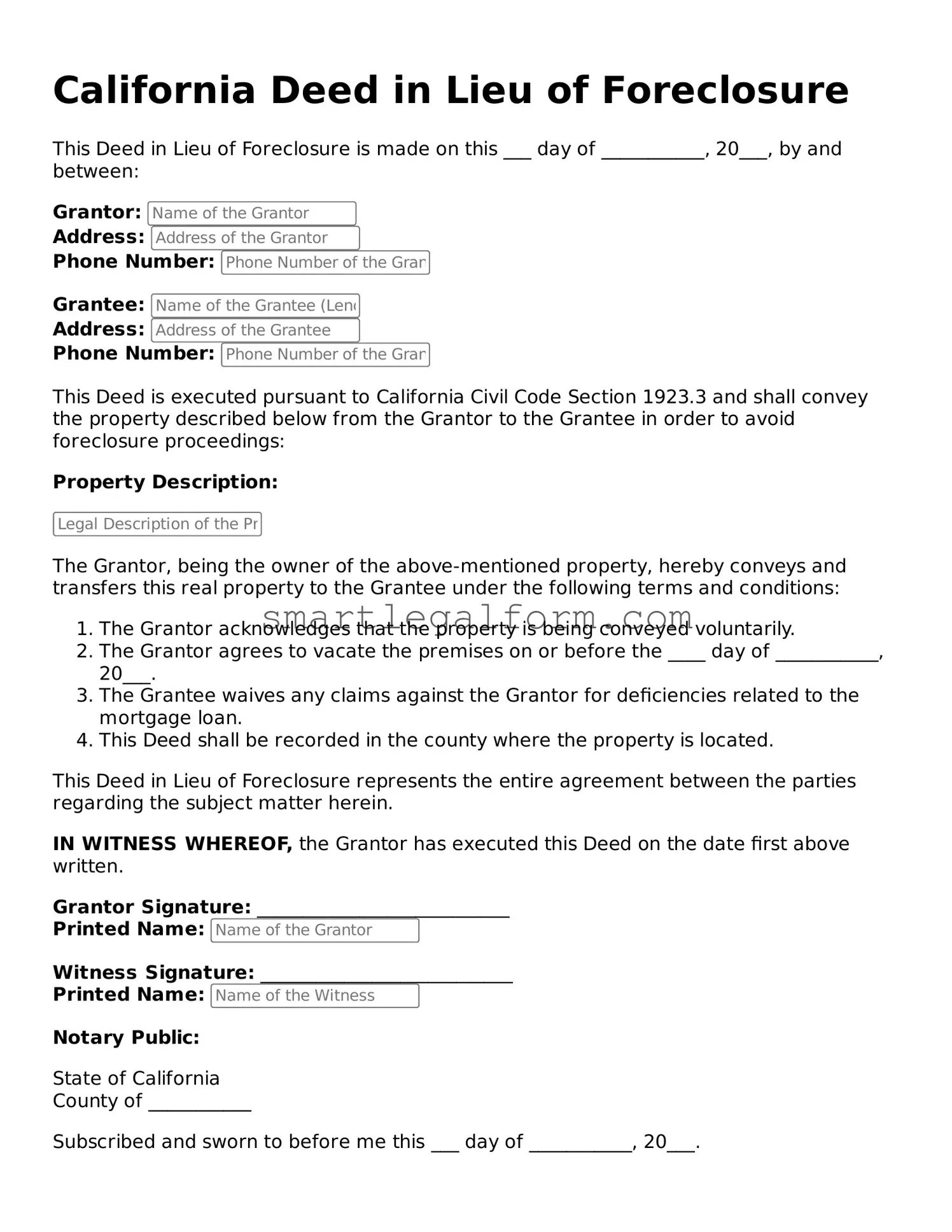

California Deed in Lieu of Foreclosure

This Deed in Lieu of Foreclosure is made on this ___ day of ___________, 20___, by and between:

Grantor:

Address:

Phone Number:

Grantee:

Address:

Phone Number:

This Deed is executed pursuant to California Civil Code Section 1923.3 and shall convey the property described below from the Grantor to the Grantee in order to avoid foreclosure proceedings:

Property Description:

The Grantor, being the owner of the above-mentioned property, hereby conveys and transfers this real property to the Grantee under the following terms and conditions:

- The Grantor acknowledges that the property is being conveyed voluntarily.

- The Grantor agrees to vacate the premises on or before the ____ day of ___________, 20___.

- The Grantee waives any claims against the Grantor for deficiencies related to the mortgage loan.

- This Deed shall be recorded in the county where the property is located.

This Deed in Lieu of Foreclosure represents the entire agreement between the parties regarding the subject matter herein.

IN WITNESS WHEREOF, the Grantor has executed this Deed on the date first above written.

Grantor Signature: ___________________________

Printed Name:

Witness Signature: ___________________________

Printed Name:

Notary Public:

State of California

County of ___________

Subscribed and sworn to before me this ___ day of ___________, 20___.

Notary Public Signature: ___________________________

Common mistakes

Filling out the California Deed in Lieu of Foreclosure form can be a straightforward process, but mistakes can lead to complications down the line. One common error is failing to provide accurate property information. The address, parcel number, and legal description must all be correct. Omitting or miswriting any of these details can result in delays or even rejection of the deed.

Another frequent mistake is not obtaining the necessary signatures. All parties involved must sign the document for it to be valid. This includes not only the borrower but also any co-borrowers or individuals who hold an interest in the property. Missing a signature can render the deed ineffective.

Some individuals overlook the requirement to provide a clear title. If there are existing liens or claims against the property, these must be addressed before submitting the deed. Failing to do so can complicate the process and may lead to legal disputes later.

Additionally, people sometimes forget to include a date on the form. The date is crucial as it establishes when the deed takes effect. Without it, the document may be considered incomplete, and that could stall the foreclosure process.

Another mistake involves not properly notarizing the document. A notary public must witness the signing of the deed to ensure its authenticity. Neglecting this step can lead to challenges regarding the validity of the deed in the future.

Some individuals also fail to provide the appropriate supporting documentation. This could include proof of ownership or other relevant documents. Incomplete submissions can result in the rejection of the deed.

Another common oversight is not keeping copies of the submitted documents. It is essential to retain a copy for personal records. This can be helpful in case any issues arise later, providing a reference point for what was submitted.

People sometimes misunderstand the implications of a deed in lieu of foreclosure. They may not realize that it can affect their credit score or future borrowing ability. Understanding these consequences is vital before proceeding.

Lastly, some individuals rush through the process without fully understanding the terms and conditions outlined in the deed. Taking the time to read and comprehend the document can prevent misunderstandings and ensure that all parties are on the same page.

Dos and Don'ts

When considering a Deed in Lieu of Foreclosure in California, it is crucial to navigate the process carefully. Here are seven essential dos and don'ts to keep in mind while filling out the form:

- Do ensure that you fully understand the implications of a Deed in Lieu of Foreclosure. This action transfers ownership of the property back to the lender, which can impact your credit score.

- Do consult with a legal professional or a housing counselor before proceeding. Their expertise can provide clarity and help you make informed decisions.

- Do gather all necessary documentation. This may include mortgage statements, proof of income, and any correspondence with your lender.

- Do communicate openly with your lender. Keeping them informed about your situation can facilitate a smoother process.

- Don't rush through the form. Take your time to ensure that all information is accurate and complete.

- Don't overlook potential tax implications. The cancellation of debt may be considered taxable income, so it's wise to seek advice on this matter.

- Don't assume that a Deed in Lieu of Foreclosure will resolve all your financial issues. Consider exploring other options, such as loan modifications or short sales, if applicable.

By following these guidelines, individuals can approach the Deed in Lieu of Foreclosure process with greater confidence and understanding.

Other Deed in Lieu of Foreclosure State Forms

Deed in Lieu of Foreclosure Ny - This form is often seen as a last resort for homeowners struggling to make mortgage payments.

The Florida Employment Verification form serves as a document used by employers to verify the employment eligibility of their workers, ensuring compliance with federal and state regulations. For additional resources and templates, you can visit TopTemplates.info, which offers valuable information to help understand the requirements involved in establishing both identity and employment authorization of individuals seeking employment.

Foreclosure Vs Deed in Lieu - Through this document, borrowers can clarify the terms of their property transfer and avoid litigation.

Deed in Lieu of Foreclosure Sample - Homeowners can negotiate any deficiencies before executing the deed.

Similar forms

- Short Sale Agreement: Both documents allow homeowners to avoid foreclosure by selling the property for less than the mortgage balance. In a short sale, the lender agrees to accept the sale proceeds as full payment.

- Mortgage Modification Agreement: This document modifies the terms of the existing mortgage. It can reduce monthly payments or extend the loan term, helping homeowners keep their homes and avoid foreclosure.

- Employee Handbook: An essential document that outlines company policies, procedures, and employee expectations. For further assistance, refer to the https://documentonline.org/blank-employee-handbook.

- Loan Assumption Agreement: This allows another party to take over the mortgage payments. It can help the original homeowner avoid foreclosure by transferring the loan to someone who can afford it.

- Forbearance Agreement: In this document, the lender agrees to temporarily reduce or suspend payments. This can provide relief to homeowners facing financial difficulties, helping them avoid foreclosure.

- Repayment Plan: This outlines a plan for the homeowner to catch up on missed payments over time. It helps avoid foreclosure by allowing the homeowner to gradually return to good standing.

- Bankruptcy Filing: Filing for bankruptcy can halt foreclosure proceedings temporarily. It gives homeowners a chance to reorganize their debts and potentially keep their homes.

- Quitclaim Deed: This document transfers ownership of the property to another party. It can be used to avoid foreclosure by transferring the property to someone who can manage the mortgage.

- Property Deed Transfer: Similar to a quitclaim deed, this document transfers ownership. It can help a homeowner avoid foreclosure by selling or giving the property to another person.

- Deed of Trust: This is a legal document that secures a loan with real property. While it is often used in the loan process, it can also play a role in avoiding foreclosure by allowing for alternative arrangements.

- Release of Mortgage: This document indicates that a mortgage has been paid off. It can help in situations where a homeowner has settled their debt, thus avoiding foreclosure.