Attorney-Approved Business Purchase and Sale Agreement Form

Form Preview Example

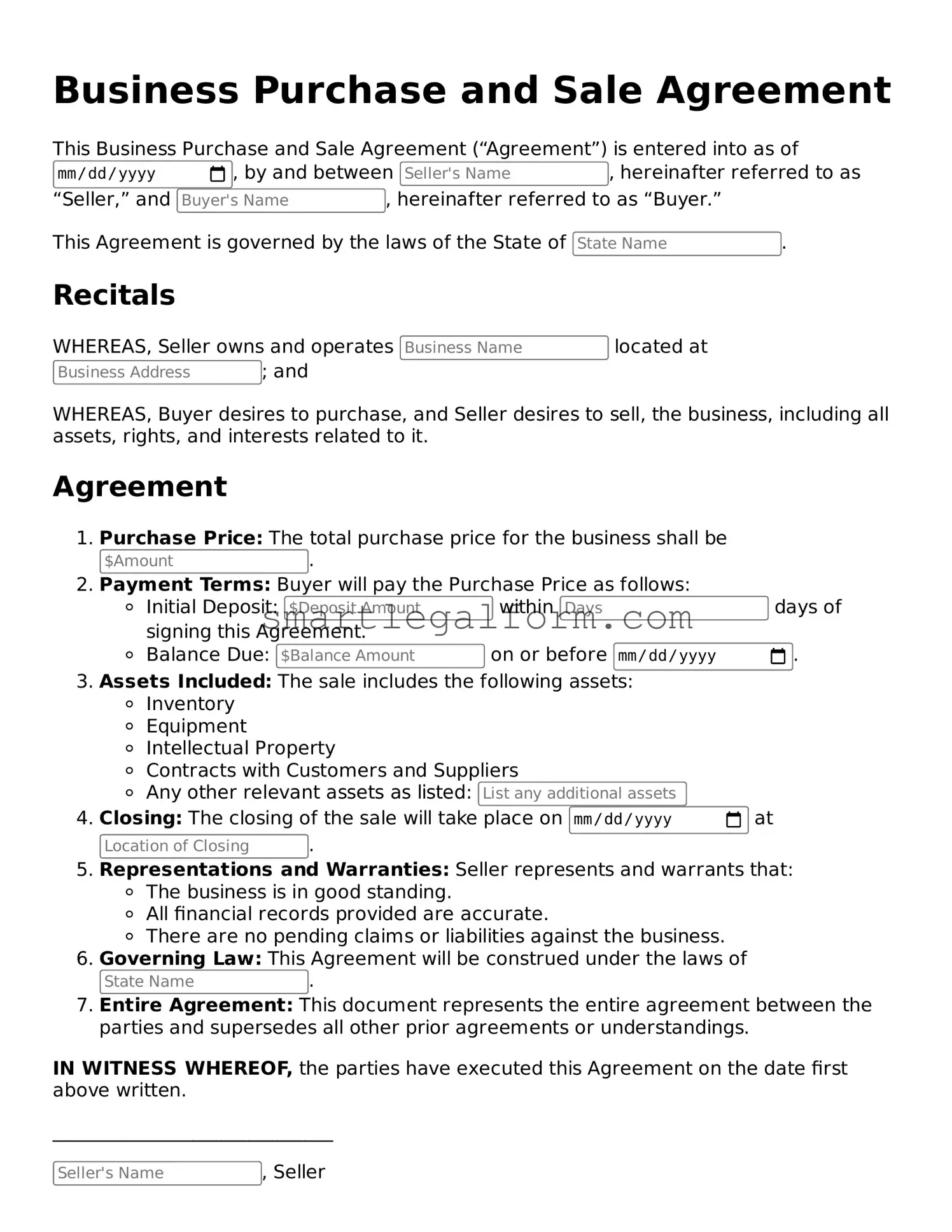

Business Purchase and Sale Agreement

This Business Purchase and Sale Agreement (“Agreement”) is entered into as of , by and between , hereinafter referred to as “Seller,” and , hereinafter referred to as “Buyer.”

This Agreement is governed by the laws of the State of .

Recitals

WHEREAS, Seller owns and operates located at ; and

WHEREAS, Buyer desires to purchase, and Seller desires to sell, the business, including all assets, rights, and interests related to it.

Agreement

- Purchase Price: The total purchase price for the business shall be .

- Payment Terms: Buyer will pay the Purchase Price as follows:

- Initial Deposit: within days of signing this Agreement.

- Balance Due: on or before .

- Assets Included: The sale includes the following assets:

- Inventory

- Equipment

- Intellectual Property

- Contracts with Customers and Suppliers

- Any other relevant assets as listed:

- Closing: The closing of the sale will take place on at .

- Representations and Warranties: Seller represents and warrants that:

- The business is in good standing.

- All financial records provided are accurate.

- There are no pending claims or liabilities against the business.

- Governing Law: This Agreement will be construed under the laws of .

- Entire Agreement: This document represents the entire agreement between the parties and supersedes all other prior agreements or understandings.

IN WITNESS WHEREOF, the parties have executed this Agreement on the date first above written.

______________________________

, Seller

______________________________

, Buyer

Common mistakes

Filling out a Business Purchase and Sale Agreement can be a complex task, and mistakes can lead to significant issues down the line. One common mistake is not providing complete and accurate information about the business being sold. This includes details such as the business name, address, and any relevant identification numbers. Incomplete information can create confusion and may lead to disputes between the buyer and seller.

Another frequent error is neglecting to specify the terms of payment clearly. Buyers and sellers should agree on how the payment will be structured, whether it’s a lump sum or installment payments. Without clear terms, misunderstandings can arise, which may complicate the transaction and lead to mistrust between the parties involved.

Additionally, many individuals fail to include all necessary contingencies in the agreement. Contingencies are conditions that must be met for the sale to proceed. For example, a buyer might want to include a contingency that allows them to back out of the sale if they cannot secure financing. Omitting these details can leave one party vulnerable and lead to potential financial losses.

Another mistake is overlooking the importance of legal compliance. Each state has specific laws regarding business transactions. Ensuring that the agreement complies with local regulations is crucial. Ignoring these requirements can result in legal complications that could jeopardize the sale.

Finally, many people underestimate the value of having a professional review the agreement before signing. A contract specialist or attorney can provide insights and catch errors that the parties may have missed. Skipping this step can lead to costly mistakes that could have been avoided with proper guidance.

Dos and Don'ts

When filling out a Business Purchase and Sale Agreement form, it is essential to approach the task with care and attention to detail. Here are some important dos and don'ts to consider:

- Do read the entire agreement thoroughly before filling it out. Understanding all terms and conditions is crucial.

- Do provide accurate and complete information. Inaccuracies can lead to misunderstandings or legal complications.

- Do consult with a legal professional if you have any questions. Their expertise can help clarify complex issues.

- Do keep a copy of the completed agreement for your records. This will be important for future reference.

- Don't rush through the process. Taking your time can prevent mistakes that may be costly later.

- Don't leave any sections blank unless instructed to do so. Missing information can invalidate the agreement.

- Don't ignore the importance of signatures. Ensure that all necessary parties sign the document to make it legally binding.

- Don't hesitate to ask for clarification on any terms you do not understand. It is better to seek help than to proceed with uncertainty.

Common Templates:

Broward County Animal Care and Adoption - The completion of this certificate helps safeguard both pets and public health.

W9 Form Example - Provide accurate information on the W-9 to prevent IRS penalties.

When preparing for the future, understanding the implications of a Durable Power of Attorney form is essential, as it essentially enables you to designate a trusted person to make vital decisions on your behalf if you are unable to do so. This arrangement not only ensures that your wishes are honored, but it also provides clarity during challenging times. For further details on how to create this important document, visit TopTemplates.info.

Eoir Case Status a Number - The details you provide on the I-589 can significantly affect the outcome of your asylum application.

Similar forms

Asset Purchase Agreement: This document outlines the terms under which specific assets of a business are purchased. Similar to a Business Purchase and Sale Agreement, it details the assets being transferred, the purchase price, and the responsibilities of both parties.

Stock Purchase Agreement: This agreement focuses on the sale of stock in a corporation. Like the Business Purchase and Sale Agreement, it includes terms regarding the sale price and conditions of the sale, but it specifically pertains to ownership interests rather than physical assets.

Letter of Intent: Often used in the initial stages of a business transaction, a Letter of Intent outlines the preliminary understanding between the buyer and seller. It shares similarities with the Business Purchase and Sale Agreement as it sets the stage for the final agreement by summarizing key terms.

Confidentiality Agreement: This document protects sensitive information exchanged during negotiations. It is similar to the Business Purchase and Sale Agreement in that it helps ensure that both parties can freely share information without fear of disclosure.

Non-Compete Agreement: This agreement prevents the seller from starting a competing business after the sale. It complements the Business Purchase and Sale Agreement by protecting the buyer’s investment and ensuring the seller does not undermine the business.

Due Diligence Checklist: While not a formal agreement, this checklist is used during the evaluation process before finalizing a sale. It is related to the Business Purchase and Sale Agreement as it helps both parties assess the viability of the transaction.

Operating Agreement: Particularly for LLCs, this document outlines the management structure and operational procedures. It is similar to the Business Purchase and Sale Agreement in that it defines the roles and responsibilities of the parties involved in the business.

- Operating Agreement: For businesses organized as LLCs, it's essential to have a clear detailed Operating Agreement template to outline management roles and operational guidelines.

Escrow Agreement: This document details the terms under which funds or assets are held by a third party until certain conditions are met. Like the Business Purchase and Sale Agreement, it provides a framework for ensuring that both parties fulfill their obligations before the transaction is completed.