Free Business Credit Application Form

Form Preview Example

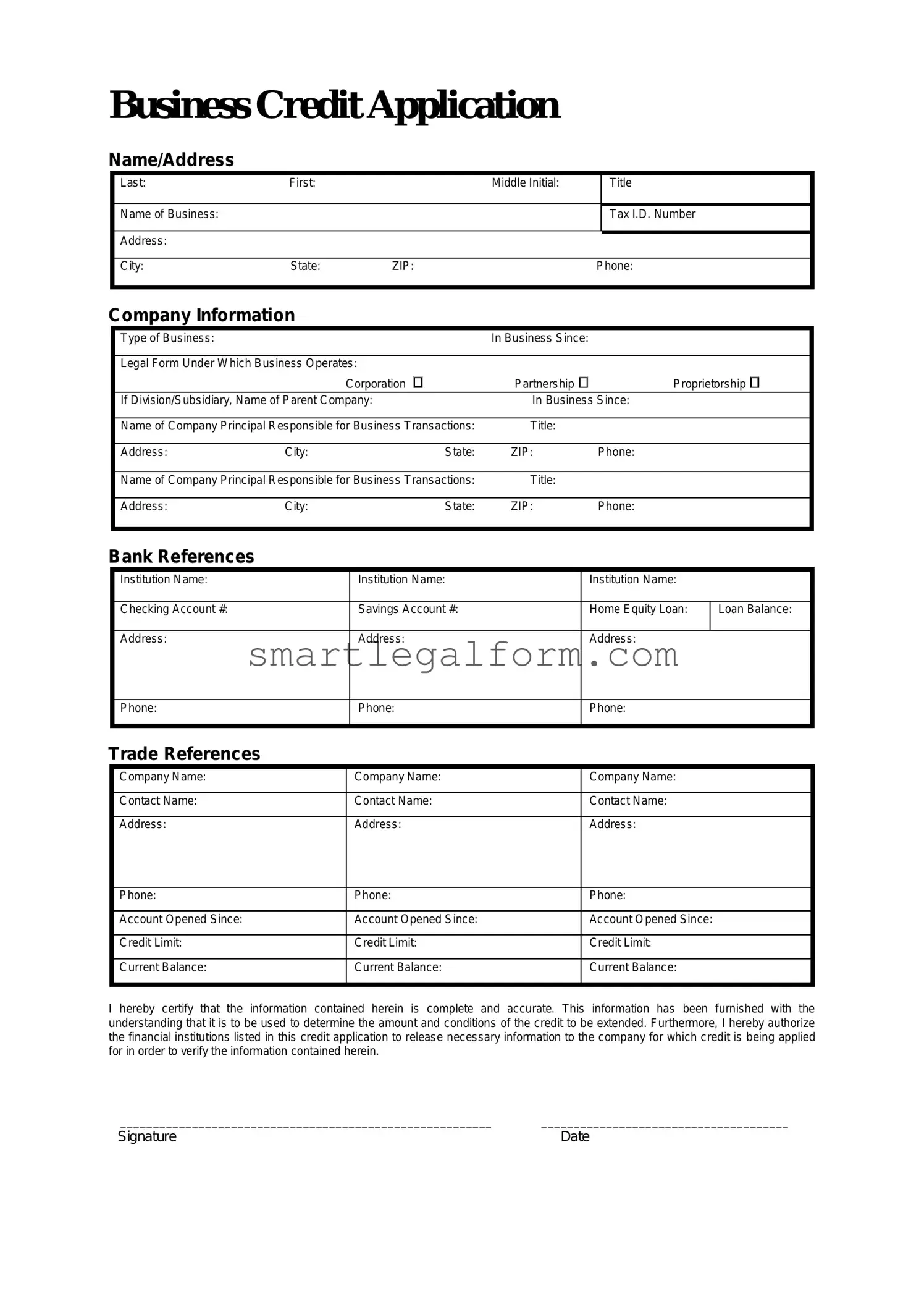

Business Credit Application

Name/Address

Last: |

First: |

|

Middle Initial: |

|

Title |

|

|

|

|

|

|

Name of Business: |

|

|

|

|

Tax I.D. Number |

|

|

|

|

|

|

Address: |

|

|

|

|

|

|

|

|

|

|

|

City: |

State: |

ZIP: |

|

Phone: |

|

|

|

|

|

|

|

Company Information

|

Type of Business: |

|

|

|

In Business Since: |

|

|

|

|

|

|

|

|

|

|

||

|

Legal Form Under Which Business Operates: |

|

|

|

|

|||

|

|

|

Corporation |

Partnership |

Proprietorship |

|

||

|

If Division/Subsidiary, Name of Parent Company: |

In Business Since: |

|

|||||

|

|

|

|

|

|

|

||

|

Name of Company Principal Responsible for Business Transactions: |

Title: |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

Address: |

City: |

|

State: |

ZIP: |

Phone: |

|

|

|

|

|

|

|

|

|

||

|

Name of Company Principal Responsible for Business Transactions: |

Title: |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

Address: |

City: |

|

State: |

ZIP: |

Phone: |

|

|

|

|

|

|

|

|

|

|

|

Bank References |

|

|

|

|

|

|

|

|

|

Institution Name: |

|

|

Institution Name: |

|

Institution Name: |

||

|

|

|

|

|

|

|

|

|

|

Checking Account #: |

|

|

Savings Account #: |

|

Home Equity Loan: |

ILoan Balance: |

|

|

Address: |

|

|

Address: |

|

Address: |

|

|

Phone:

Phone:

Phone:

Trade References

Company Name: |

Company Name: |

Company Name: |

|

|

|

Contact Name: |

Contact Name: |

Contact Name: |

|

|

|

Address: |

Address: |

Address: |

|

|

|

Phone: |

Phone: |

Phone: |

|

|

|

Account Opened Since: |

Account Opened Since: |

Account Opened Since: |

|

|

|

Credit Limit: |

Credit Limit: |

Credit Limit: |

|

|

|

Current Balance: |

Current Balance: |

Current Balance: |

|

|

|

I hereby certify that the information contained herein is complete and accurate. This information has been furnished with the understanding that it is to be used to determine the amount and conditions of the credit to be extended. Furthermore, I hereby authorize the financial institutions listed in this credit application to release necessary information to the company for which credit is being applied for in order to verify the information contained herein.

_________________________________________________________ ______________________________________

Signature |

Date |

Common mistakes

Completing a Business Credit Application form can be a crucial step for many entrepreneurs seeking financial support. However, several common mistakes can hinder the approval process. Understanding these pitfalls can help applicants present themselves in the best light.

One frequent mistake is incomplete information. When applicants skip sections or provide vague answers, it raises red flags for lenders. Every detail matters, from the business's legal name to its financial history. Ensure that all fields are filled out accurately and completely to avoid delays or denials.

Another common error is failing to check credit history before submitting the application. Lenders will review an applicant's credit report, and any inaccuracies can impact their decision. By checking their credit history in advance, applicants can address any discrepancies and improve their chances of approval.

Many applicants also underestimate the importance of providing accurate financial statements. These documents should reflect the business's current financial health. Inaccurate or outdated statements can lead to a lack of trust from lenders. It's essential to present a clear and truthful picture of the business's finances.

Additionally, some individuals neglect to include supporting documentation. Lenders often require additional paperwork, such as tax returns or bank statements, to verify the information provided. Failing to include these documents can result in a longer review process or outright rejection.

Another mistake is not understanding the terms of credit being applied for. Applicants should be familiar with the interest rates, repayment terms, and any fees associated with the credit. This knowledge not only helps in making informed decisions but also demonstrates to lenders that the applicant is serious and responsible.

Moreover, applicants sometimes rush the application process. Taking the time to review and revise the application can make a significant difference. Errors made in haste can be detrimental. A well-thought-out application reflects professionalism and attention to detail.

Lastly, many people fail to follow up after submitting their application. A polite inquiry about the status of the application can show interest and initiative. It also provides an opportunity to address any concerns that the lender may have. Following up can help keep the application on the lender's radar.

By being aware of these common mistakes, applicants can improve their chances of securing the credit they need. Attention to detail, thoroughness, and understanding the requirements are key components of a successful Business Credit Application.

Dos and Don'ts

When filling out a Business Credit Application form, it is essential to approach the process with care. Here are some important do's and don'ts to keep in mind:

- Do provide accurate and complete information. Ensure all fields are filled out correctly to avoid delays.

- Do review the application thoroughly before submission. Double-check for any errors or missing information.

- Do include all necessary supporting documents. Attach financial statements or any other required paperwork.

- Do be honest about your business's financial situation. Transparency can build trust with the lender.

- Don't rush through the application process. Take your time to ensure everything is accurate.

- Don't omit any relevant information. Failing to disclose important details can lead to complications later.

Following these guidelines can help facilitate a smoother application process and increase the chances of approval.

Other PDF Documents

Free Printable Puppy Shot Record - Provides assurance of necessary vaccinations for your pet.

Wage and Tax Statement - Taxpayers can face delays in refunds if their W-2 information does not match IRS records.

Irs Transcripts - The document clarifies the difference between reported income and adjusted amounts.

Similar forms

- Personal Credit Application: Similar to the Business Credit Application, this form collects personal financial information from individuals seeking credit. It includes details about income, debts, and credit history.

- Loan Application Form: This document is used by individuals or businesses to apply for loans. It requires similar financial disclosures, including assets, liabilities, and purpose of the loan.

- Vendor Credit Application: Vendors use this form to assess a business's creditworthiness before extending credit terms. It asks for similar information regarding financial stability and payment history.

- Lease Application: When renting commercial space, businesses complete a lease application. This document gathers financial details to evaluate the ability to meet lease obligations.

- Business Partnership Agreement: While not a credit application, this agreement often includes financial disclosures about each partner's investment and creditworthiness, similar to what is found in a credit application.

- Business Plan: A business plan outlines financial projections and funding needs. It provides a comprehensive view of the business's financial health, akin to what lenders seek in a credit application.

- Financial Statement: Businesses submit financial statements to show their economic status. These documents detail income, expenses, and overall financial performance, similar to the information requested in a credit application.

- Trade Credit Application: This form is specifically for businesses seeking credit from suppliers. It includes similar financial information to assess the risk of extending credit.

- Credit Reference Request: This document is used to gather information from other creditors about a business's credit history. It is similar in that it seeks to evaluate creditworthiness based on past behavior.