Attorney-Approved Business Bill of Sale Form

Form Preview Example

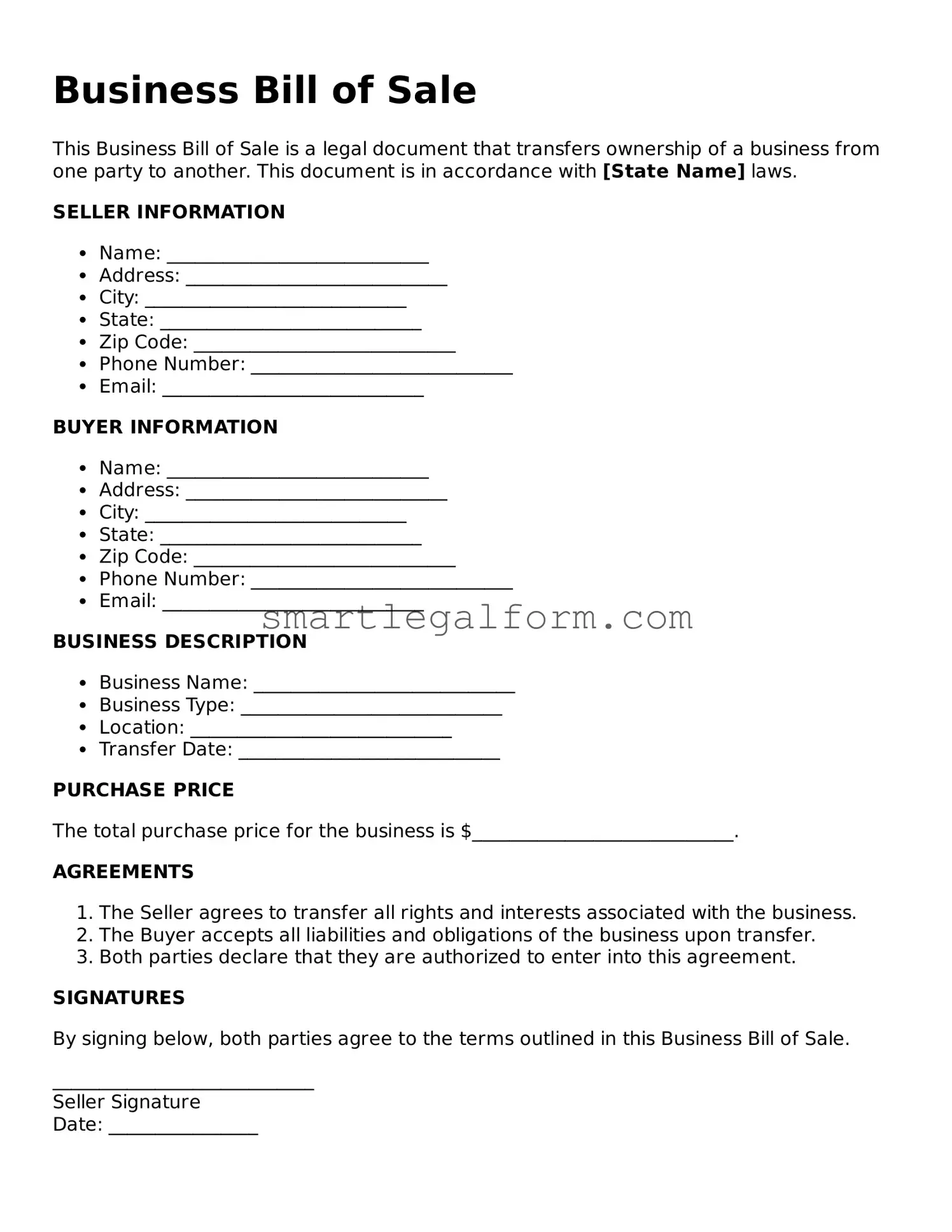

Business Bill of Sale

This Business Bill of Sale is a legal document that transfers ownership of a business from one party to another. This document is in accordance with [State Name] laws.

SELLER INFORMATION

- Name: ____________________________

- Address: ____________________________

- City: ____________________________

- State: ____________________________

- Zip Code: ____________________________

- Phone Number: ____________________________

- Email: ____________________________

BUYER INFORMATION

- Name: ____________________________

- Address: ____________________________

- City: ____________________________

- State: ____________________________

- Zip Code: ____________________________

- Phone Number: ____________________________

- Email: ____________________________

BUSINESS DESCRIPTION

- Business Name: ____________________________

- Business Type: ____________________________

- Location: ____________________________

- Transfer Date: ____________________________

PURCHASE PRICE

The total purchase price for the business is $____________________________.

AGREEMENTS

- The Seller agrees to transfer all rights and interests associated with the business.

- The Buyer accepts all liabilities and obligations of the business upon transfer.

- Both parties declare that they are authorized to enter into this agreement.

SIGNATURES

By signing below, both parties agree to the terms outlined in this Business Bill of Sale.

____________________________

Seller Signature

Date: ________________

____________________________

Buyer Signature

Date: ________________

Common mistakes

Filling out a Business Bill of Sale form can be straightforward, but many people make common mistakes that can lead to complications. One frequent error is not providing complete information about the buyer and seller. It’s essential to include full names, addresses, and contact details. Omitting any of this information can create confusion and make it difficult to enforce the agreement later.

Another common mistake is failing to accurately describe the business being sold. This includes not detailing the assets included in the sale, such as equipment, inventory, or intellectual property. A vague description can lead to disputes down the line regarding what was actually included in the transaction.

People often overlook the importance of including the sale price. Clearly stating the amount paid for the business is crucial. Without this, the document may lack legal clarity, making it harder to resolve any future disagreements over the terms of the sale.

Additionally, many individuals forget to sign and date the document. A Business Bill of Sale must be signed by both parties to be legally binding. If either party neglects to sign, the agreement may be rendered invalid, leaving both parties without legal recourse.

Another mistake involves not having witnesses or notarization when required. Depending on the state, having a witness or notarizing the document may be necessary for it to hold up in court. Failing to do so can weaken the enforceability of the sale.

Finally, people sometimes assume that a generic template will suffice for their specific situation. Each business transaction is unique, and using a one-size-fits-all approach can lead to missing crucial details. Tailoring the form to fit the specifics of the sale is vital for protecting both parties’ interests.

Dos and Don'ts

When filling out a Business Bill of Sale form, attention to detail is crucial. Here are some important dos and don’ts to keep in mind:

- Do provide accurate information about the business being sold.

- Do include the full names and addresses of both the buyer and seller.

- Do clearly describe the items or assets being sold.

- Do specify the sale price and payment terms.

- Do ensure all parties sign and date the document.

- Don't leave any sections blank; fill out every required field.

- Don't use vague language; be specific in descriptions.

- Don't forget to keep a copy for your records.

- Don't rush through the process; take your time to review.

More Types of Business Bill of Sale Forms:

How to Write a Bill of Sale for Atv - A simple document to transfer ownership of an ATV from one person to another.

In addition to its importance in private sales, a Florida Bill of Sale form can also be conveniently accessed through resources such as OnlineLawDocs.com, which provides templates and guidance to ensure that the document meets all legal requirements.

Rv Bill of Sale Printable - This form provides essential details about the buyer and seller of the RV.

Similar forms

The Business Bill of Sale form is an important document for transferring ownership of a business. Several other documents serve similar purposes in various contexts. Here are seven documents that share similarities with the Business Bill of Sale:

- Personal Bill of Sale: This document is used for selling personal items. It outlines the transaction details, including the buyer, seller, and item description, much like a Business Bill of Sale does for business assets.

- Vehicle Bill of Sale: When buying or selling a vehicle, this document is essential. It contains similar information, such as the vehicle’s make, model, and VIN, ensuring a clear transfer of ownership.

- Real Estate Purchase Agreement: This document is used when buying or selling property. It details the terms of the sale, including the price and conditions, similar to how a Business Bill of Sale outlines business asset transfers.

- Motorcycle Bill of Sale: To document the sale of your motorcycle, refer to the comprehensive Motorcycle Bill of Sale form guide to ensure all legal details are accurately recorded.

- Equipment Bill of Sale: This form is specific to the sale of equipment. It includes details about the equipment being sold and the agreed price, paralleling the structure of a Business Bill of Sale.

- Inventory Transfer Document: Used for transferring inventory between businesses or locations, this document lists the items being transferred, similar to how a Business Bill of Sale lists business assets.

- Partnership Dissolution Agreement: When partners decide to end a business relationship, this document outlines the terms of asset distribution. It serves a similar purpose of clarifying ownership and responsibilities.

- Franchise Agreement: This document establishes the terms under which a franchise operates. It includes details about the rights and responsibilities of both parties, similar to how a Business Bill of Sale defines the transaction between buyer and seller.

Each of these documents plays a vital role in ensuring that transactions are clear and legally binding. Understanding their similarities can help in recognizing the importance of proper documentation in various business dealings.