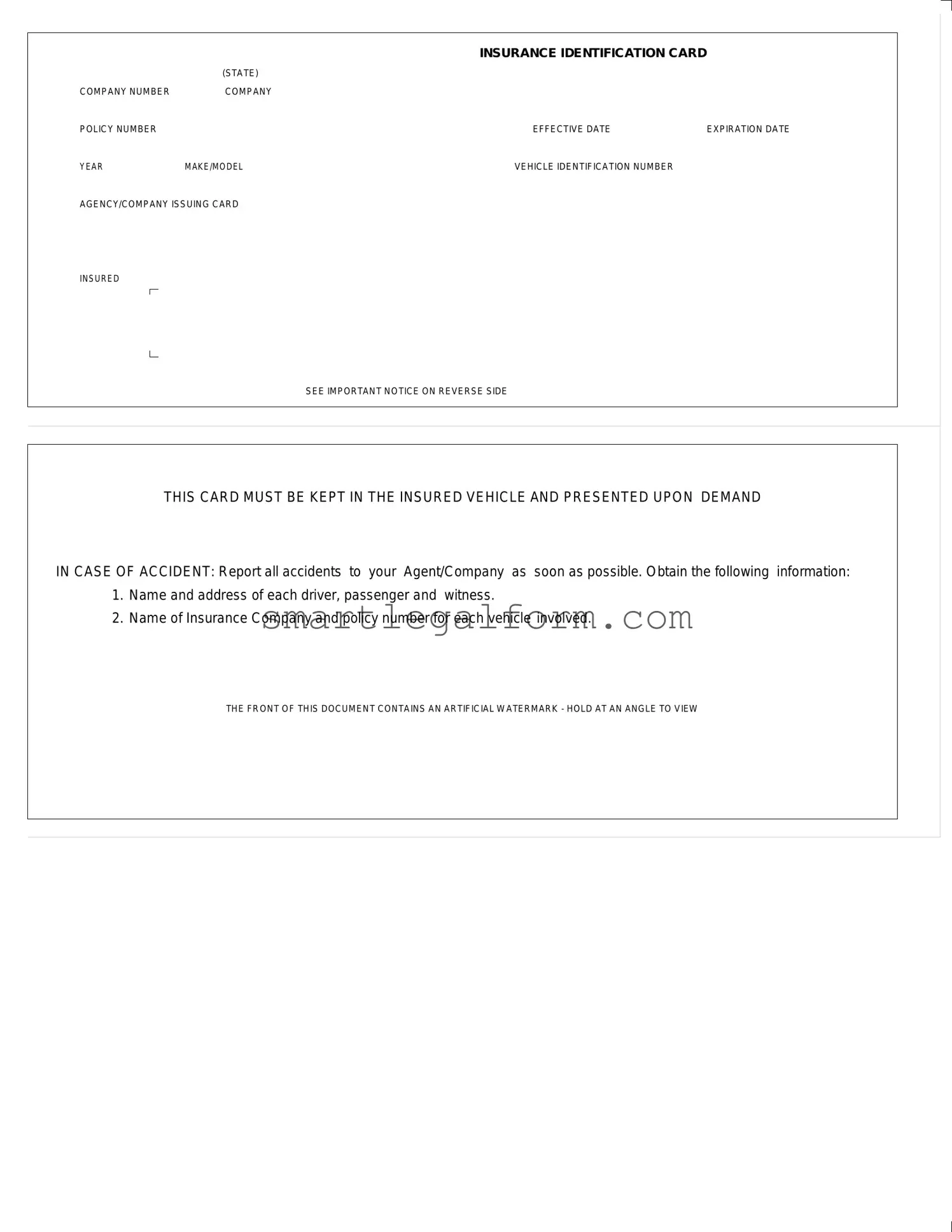

Free Auto Insurance Card Form

Form Preview Example

|

|

INSURANCE IDENTIFICATION CARD |

|

|

(STATE) |

|

|

COMPANY NUMBER |

COMPANY |

|

|

POLICY NUMBER |

|

EFFECTIVE DATE |

EXPIRATION DATE |

YEAR |

MAKE/MODEL |

VEHICLE IDENTIFICATION NUMBER |

|

AGENCY/COMPANY ISSUING CARD

INSURED

SEE IMPORTANT NOTICE ON REVERSE SIDE

THIS CARD MUST BE KEPT IN THE INSURED VEHICLE AND PRESENTED UPON DEMAND

IN CASE OF ACCIDENT: Report all accidents to your Agent/Company as soon as possible. Obtain the following information:

1.Name and address of each driver, passenger and witness.

2.Name of Insurance Company and policy number for each vehicle involved.

THE FRONT OF THIS DOCUMENT CONTAINS AN ARTIFICIAL WATERMARK - HOLD AT AN ANGLE TO VIEW

Common mistakes

Filling out the Auto Insurance Card form may seem straightforward, but there are several common mistakes that can lead to complications. One frequent error is neglecting to include the effective date and expiration date. These dates are crucial as they indicate the period during which the insurance coverage is valid. If these dates are missing or incorrect, it could lead to issues when presenting the card in case of an accident.

Another mistake is failing to provide the correct company policy number. This number is essential for identifying the specific insurance policy that covers the vehicle. An incorrect policy number can cause delays in processing claims and may even result in denied coverage during an accident.

People often overlook the importance of accurately entering the vehicle identification number (VIN). The VIN is unique to each vehicle and is used to verify ownership and insurance coverage. A typo in this number can create confusion and complicate the claims process.

Additionally, some individuals forget to include the year, make, and model of their vehicle. This information is necessary for the insurance company to assess risk and determine coverage options. Omitting these details can lead to misunderstandings about the type of coverage provided.

Another common error is not keeping the card in the insured vehicle. The form states clearly that the card must be kept in the vehicle and presented upon demand. Failing to do so can result in fines or complications during an accident.

Many people also neglect to check the agency/company issuing the card. It's important to ensure that the issuing agency is correctly listed to avoid confusion in case of an accident. An incorrect agency name can lead to delays in reaching the right insurance representative.

Finally, some individuals skip reading the important notice on the reverse side of the card. This notice often contains essential information about reporting accidents and what steps to take afterward. Ignoring this information can lead to missed steps that are critical for a smooth claims process.

Dos and Don'ts

When filling out the Auto Insurance Card form, it is essential to follow certain guidelines to ensure accuracy and compliance. Here are nine things to keep in mind:

- Do provide accurate information for each section of the form.

- Do double-check the policy number and effective dates.

- Do include the vehicle identification number (VIN) correctly.

- Do keep the card in your vehicle at all times.

- Do report any accidents to your insurance agent promptly.

- Don't leave any sections blank; fill out every required field.

- Don't use incorrect or outdated information from previous forms.

- Don't ignore the instructions on the reverse side of the card.

- Don't forget to obtain necessary information from others involved in an accident.

Following these guidelines will help you maintain proper documentation and ensure you are prepared in case of an accident.

Other PDF Documents

Free Employment Application - The form may ask about any prior employment with the company.

Daily Security Guard Log Book Sample - Include the security officer's signature as verification of the report.

Understanding the significance of a Durable Power of Attorney form in California is crucial, as it empowers a trusted individual to manage important decisions for someone who is incapacitated, ensuring their wishes are respected in times of need. For additional resources on this matter, you can visit TopTemplates.info.

Da Form 31 Printable - The form's recommended use is outlined in AR 600-8-10.

Similar forms

The Auto Insurance Card serves as a crucial document for vehicle owners, but it shares similarities with several other important documents. Below is a list of eight documents that have comparable features or purposes:

- Registration Certificate: Like the Auto Insurance Card, this document proves legal ownership and registration of the vehicle. It includes details such as the vehicle identification number (VIN) and the owner's information.

- Driver's License: This card verifies the individual's legal ability to operate a vehicle. It contains personal information, including name, address, and a unique identification number, similar to the information found on an insurance card.

- Title Document: The title shows who owns the vehicle. It includes vital information like the VIN and the owner's name, paralleling the identification aspects of the Auto Insurance Card.

- Proof of Insurance Certificate: This document, often provided by the insurance company, confirms that the vehicle is insured. It contains similar details, such as policy numbers and coverage dates, much like the Auto Insurance Card.

- Accident Report Form: After an accident, this form collects critical information about the incident. It often requires details about the involved parties and their insurance, akin to the information needed when presenting the Auto Insurance Card.

- Vehicle Bill of Sale: This document serves as proof of purchase and includes details about the buyer, seller, and vehicle. It shares the emphasis on ownership and vehicle specifics found on the Auto Insurance Card.

Operating Agreement: For limited liability companies, it's essential to have a well-structured comprehensive Operating Agreement document to outline management and operational guidelines.

- Inspection Certificate: This document verifies that a vehicle has passed safety and emissions tests. It includes vehicle information and is often required alongside the Auto Insurance Card for legal driving.

- Rental Agreement: When renting a vehicle, this document outlines the terms of use and includes insurance information. It parallels the Auto Insurance Card by ensuring the driver is covered while using the vehicle.

Each of these documents plays a vital role in vehicle ownership and operation, sharing common themes of identification, ownership, and legal compliance.