Attorney-Approved Articles of Incorporation Form

Articles of Incorporation for Particular US States

Form Preview Example

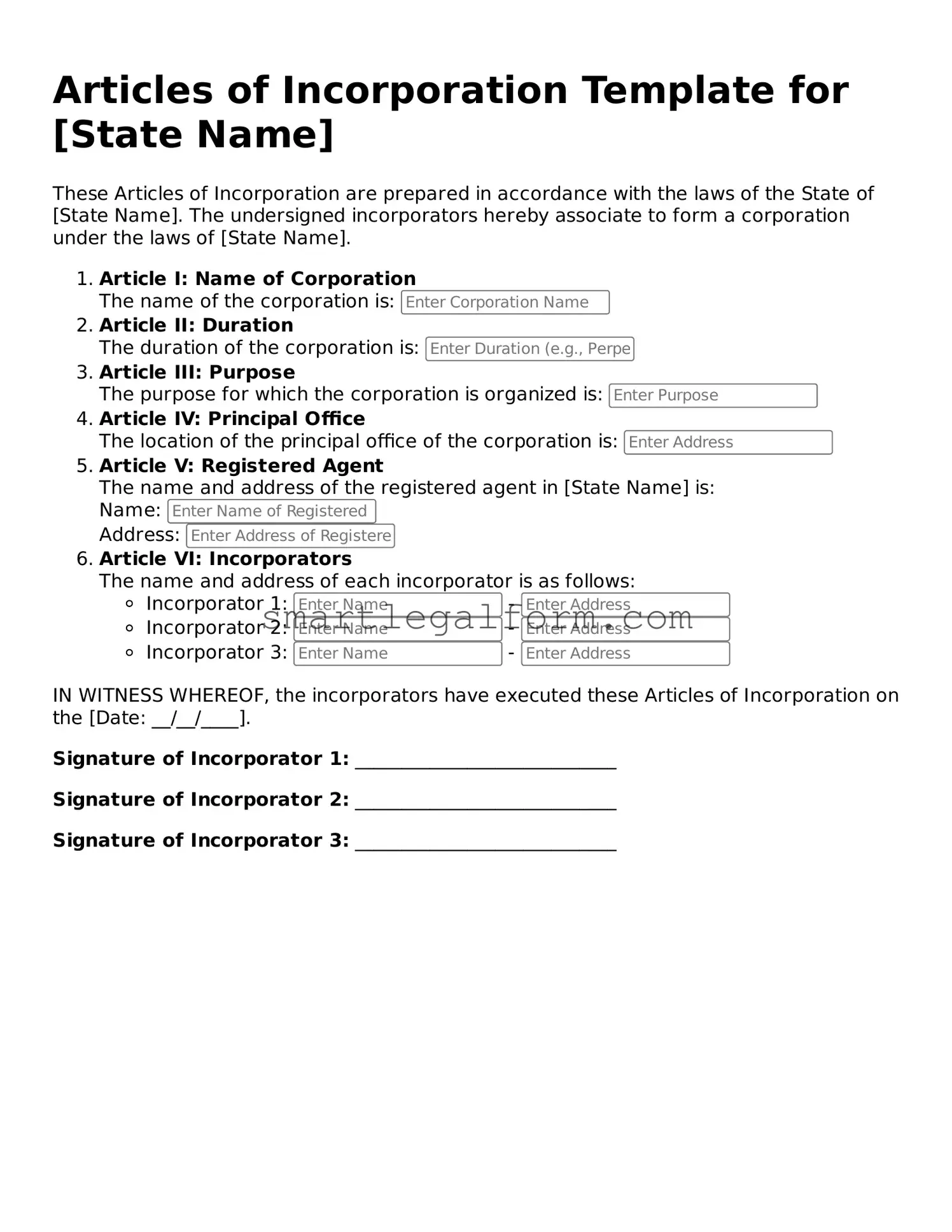

Articles of Incorporation Template for [State Name]

These Articles of Incorporation are prepared in accordance with the laws of the State of [State Name]. The undersigned incorporators hereby associate to form a corporation under the laws of [State Name].

- Article I: Name of Corporation

The name of the corporation is: - Article II: Duration

The duration of the corporation is: - Article III: Purpose

The purpose for which the corporation is organized is: - Article IV: Principal Office

The location of the principal office of the corporation is: - Article V: Registered Agent

The name and address of the registered agent in [State Name] is:

Name:

Address: - Article VI: Incorporators

The name and address of each incorporator is as follows:

- Incorporator 1: -

- Incorporator 2: -

- Incorporator 3: -

IN WITNESS WHEREOF, the incorporators have executed these Articles of Incorporation on the [Date: __/__/____].

Signature of Incorporator 1: ____________________________

Signature of Incorporator 2: ____________________________

Signature of Incorporator 3: ____________________________

Common mistakes

Filing the Articles of Incorporation is a crucial step in establishing a business entity. However, many individuals make common mistakes that can lead to delays or complications. Understanding these pitfalls can save time and ensure a smoother process.

One frequent mistake is providing inaccurate or incomplete information. When filling out the form, it’s essential to double-check names, addresses, and other details. Errors can lead to rejection of the application, forcing applicants to start over.

Another common error involves selecting the wrong type of corporation. Different types, such as C corporations, S corporations, or nonprofit organizations, have distinct implications for taxes and governance. Failing to choose the appropriate type can result in unforeseen legal and financial consequences.

Many people overlook the importance of a registered agent. A registered agent acts as the official point of contact for legal documents. Not designating one, or choosing an unreliable agent, can lead to missed communications and potential legal issues.

Inadequate understanding of the state-specific requirements can also cause problems. Each state has its own regulations and forms. Ignoring these can lead to filing an incorrect form or missing essential components, such as the purpose of the corporation.

Some individuals forget to include the necessary fees with their application. Each state requires a filing fee, and failing to include this payment can delay the incorporation process significantly. It’s wise to check the current fee schedule before submitting the form.

Another mistake is neglecting to outline the corporate structure clearly. The Articles of Incorporation should specify the number of shares the corporation is authorized to issue and the rights of those shares. Ambiguity in this section can lead to disputes among shareholders later on.

Finally, individuals often underestimate the importance of legal compliance after filing. Incorporating a business is just the beginning. Ongoing compliance with state laws, such as annual reports and taxes, is essential for maintaining good standing. Ignoring these obligations can jeopardize the corporation’s status.

Dos and Don'ts

When filling out the Articles of Incorporation form, it’s crucial to approach the task with care. Here are five important dos and don'ts to consider:

- Do provide accurate information about the corporation's name, ensuring it complies with state regulations.

- Do include the purpose of the corporation clearly and concisely.

- Do list the names and addresses of the initial directors and officers.

- Don't leave any sections blank; incomplete forms can lead to delays in processing.

- Don't forget to check for any required signatures before submitting the form.

Following these guidelines can help ensure a smoother incorporation process.

Common Templates:

Status Change Form Template - This form applies to changes in employment type, such as seasonal to permanent.

Hiv-positive Report Sample - The form provides a framework for potential follow-up care based on test outcomes.

For those navigating real estate transactions, understanding the importance of a well-prepared Deed is crucial. The form plays a vital role in ensuring the validity of ownership transfer, thus safeguarding the rights of the parties involved. To learn more about the requirements, visit this comprehensive resource on how to properly complete a Deed.

How Do You Transfer Ownership of a Golf Cart - Increases transparency in the sale process.

Similar forms

The Articles of Incorporation form is a foundational document for establishing a corporation. It shares similarities with several other legal documents. Here are five such documents:

- Bylaws: Bylaws outline the internal rules and procedures for managing a corporation. Like the Articles of Incorporation, they are essential for corporate governance, detailing how decisions are made and the roles of officers and directors.

- Operating Agreement: This document is used primarily by LLCs (Limited Liability Companies). It defines the management structure and operational procedures, similar to how the Articles of Incorporation define the corporation's structure and purpose.

-

Marriage Certificate: Required for legal recognition of marriage, this document is crucial for documentation and identification, much like how other agreements validate business operations, and you can find useful templates at toptemplates.info.

- Partnership Agreement: A partnership agreement establishes the terms of a partnership. It is akin to the Articles of Incorporation in that it sets forth the roles, responsibilities, and profit-sharing arrangements among partners, much like how the Articles define the roles within a corporation.

- Certificate of Formation: This document is often used in place of Articles of Incorporation for LLCs. It serves a similar purpose by officially creating the entity and outlining basic information about it, such as its name and registered agent.

- Business License: A business license grants permission to operate a business legally within a jurisdiction. While it differs in function, it is similar in that it is a necessary document for legal compliance and often requires the information found in the Articles of Incorporation.