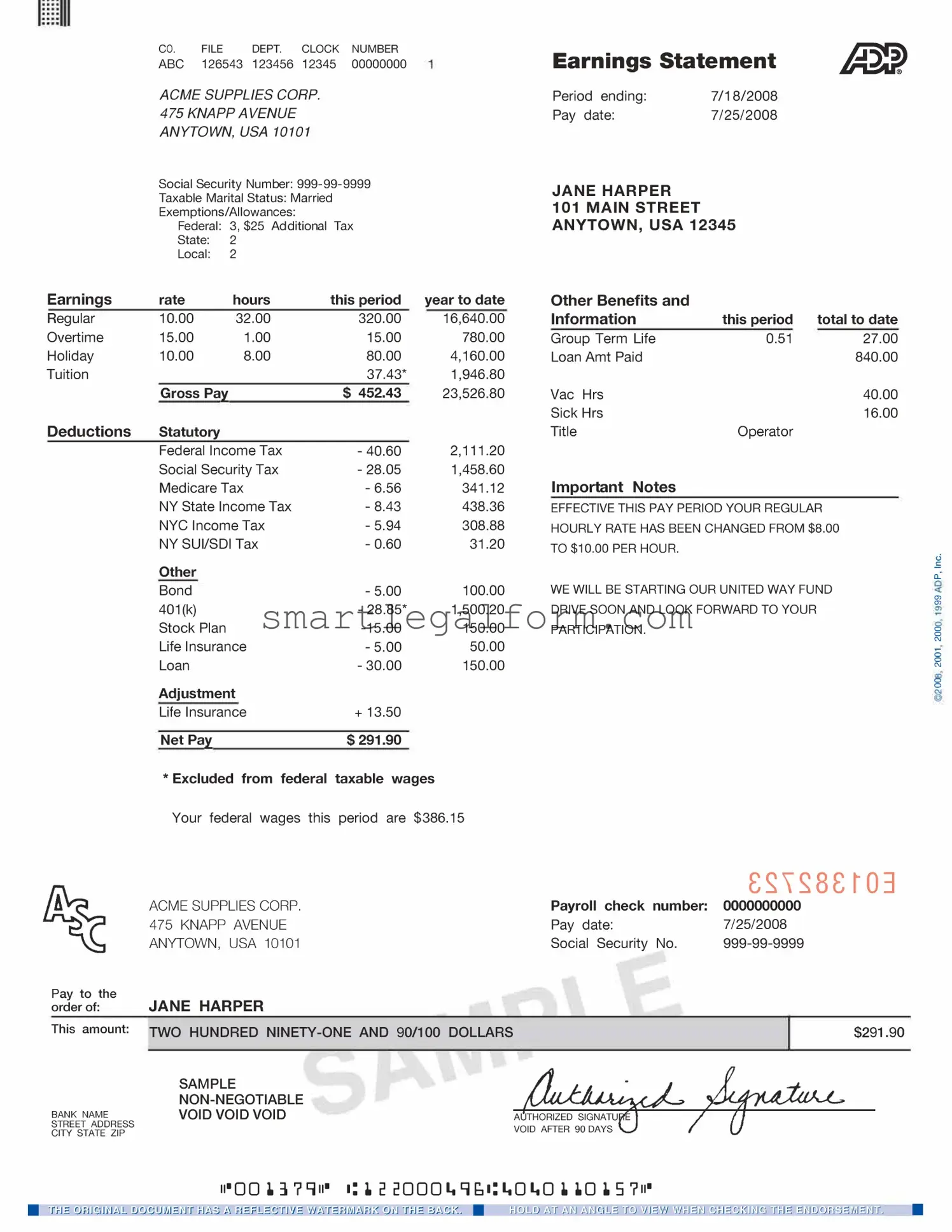

Free Adp Pay Stub Form

Form Preview Example

|

CO. |

FILE |

DEPT. |

CLOCK |

NUMBER |

|

|

ABC |

126543 123456 |

12345 |

00000000 |

|

|

|

ACME SUPPLIES CORP. |

|

|

|||

|

475 KNAPP AVENUE |

|

|

|

||

|

ANYTOWN, USA 10101 |

|

|

|||

|

Social Security Number: |

|

||||

|

Taxable Marital Status: Married |

|

|

|||

|

Exemptions/Allowances: |

|

|

|

||

|

Federal: 3, $25 Additional Tax |

|

||||

|

State: |

2 |

|

|

|

|

|

Local: |

2 |

|

|

|

|

Earnings |

rate |

|

hours |

this period |

year to date |

|

Regular |

10.00 |

|

32.00 |

|

320.00 |

16,640.00 |

Overtime |

15.00 |

|

1.00 |

|

15.00 |

780.00 |

Holiday |

10.00 |

|

8.00 |

|

80.00 |

4,160.00 |

Tuition |

|

|

|

|

37.43* |

1,946.80 |

|

Gross Pa� |

|

|

$ 452.43 |

23,526.80 |

|

Deductions |

Statutory |

|

|

|

2,111.20 |

|

|

Federal Income Tax |

|

- 40.60 |

|||

|

Social Security Tax |

|

- 28.05 |

1,458.60 |

||

|

Medicare Tax |

|

- 6.56 |

341.12 |

||

|

NY State Income Tax |

|

- 8.43 |

438.36 |

||

|

NYC Income Tax |

|

- 5.94 |

308.88 |

||

|

NY SUI/SDI Tax |

|

- 0.60 |

31.20 |

||

|

Other |

|

|

|

|

|

|

Bond |

|

|

|

- 5.00 |

100.00 |

|

401(k) |

|

|

|

- 28.85* |

1,500.20 |

|

Stock Plan |

|

|

150.00 |

||

|

Life Insurance |

|

- 5.00 |

50.00 |

||

|

Loan |

|

|

|

- 30.00 |

150.00 |

|

Adjustment |

|

|

|

||

|

Life Insurance |

|

+ 13.50 |

|

||

|

Net Pa� |

|

|

$291.90 |

|

|

*Excluded from federal taxable wages Your federal wages this period are $386.15

ACME SUPPLIES CORP. 475 KNAPP AVENUE ANYTOWN, USA 10101

Pay to the

order of: JANE HARPER

This amount: TWO HUNDRED

SAMPLE

BANK NAMEVOID VOID VOID

STREET ADDRESS

CITY STATE ZIP

Earnings Statement

Period ending: |

7/18/2008 |

Pay date: |

7/25/2008 |

JANE HARPER

101MAIN STREET

ANYTOWN, USA 12345

Other Benefits and

Information |

this period |

total to date |

|

|

Group Term Life |

0.51 |

27.00 |

|

|

Loan Amt Paid |

|

840.00 |

|

|

Vac Hrs |

|

40.00 |

|

|

Sick Hrs |

|

16.00 |

|

|

Title |

Operator |

|

|

|

Important Notes |

|

|

|

|

EFFECTIVE THIS PAY PERIOD YOUR REGULAR |

|

|||

HOURLY RATE HAS BEEN CHANGED FROM $8.00 |

|

|||

TO $10.00 PER HOUR. |

|

|

0 |

|

|

|

|

||

|

|

|

.!: |

|

WE WILL BE STARTING OUR UNITED WAY FUND |

0: |

|||

"' |

||||

DRIVE SOON AND LOOK FORWARD TO YOUR |

|

|||

|

|

|||

PARTICIPATION. |

|

|

0 |

|

|

|

|

0 |

|

C\J

0

0

C\J

0

0

|

£�,�8£�03 |

Payroll check number: |

0000000000 |

Pay date: |

7/25/2008 |

Social Security No. |

$291.90

Common mistakes

When filling out the ADP Pay Stub form, many individuals make common mistakes that can lead to confusion and errors in their payroll information. One frequent error is not double-checking personal information. Ensuring that your name, address, and Social Security number are accurate is crucial. A simple typo can cause significant issues with tax reporting and benefits.

Another mistake is neglecting to verify hours worked. Employees should always confirm that the total hours entered reflect their actual work hours. If overtime is applicable, it’s important to ensure that those hours are calculated correctly. Misreporting hours can lead to underpayment or overpayment, both of which can create complications.

Failing to review deductions is also a common oversight. Many individuals overlook checking their deductions for taxes, retirement contributions, and health benefits. Understanding what is being deducted from each paycheck can help prevent unexpected surprises during tax season.

Some people forget to account for additional income or bonuses. If you receive any bonuses or commissions, these should be included in the appropriate section of the pay stub. Not reporting this income accurately can lead to discrepancies in your overall earnings.

Another mistake is misunderstanding the pay period. It’s essential to know the specific dates that the pay stub covers. Confusion about the pay period can result in miscalculating earnings or failing to recognize what pay period the deductions apply to.

Using incorrect payment methods can also cause issues. For instance, if you typically receive direct deposit but are filling out the form for a paper check, you must ensure the payment method is clearly indicated. This helps avoid delays in receiving your pay.

Some individuals fail to keep a copy of their completed pay stub form. Maintaining a personal record is important for tracking earnings and deductions over time. This can be useful for budgeting and when preparing tax returns.

Lastly, not seeking assistance when needed can lead to mistakes. If there’s confusion about how to fill out the form or what certain sections mean, asking for help is always a good idea. Whether it’s from a supervisor or a human resources representative, clarification can prevent errors and ensure accurate payroll processing.

Dos and Don'ts

When filling out the ADP Pay Stub form, it's important to ensure accuracy and clarity. Here are ten things you should and shouldn't do:

- Do double-check your personal information for accuracy.

- Do ensure that your pay period dates are correct.

- Do review your deductions and contributions to confirm they are accurate.

- Do keep a copy of your completed form for your records.

- Do ask for help if you are unsure about any section.

- Don't leave any required fields blank.

- Don't use nicknames or abbreviations for your name.

- Don't ignore the instructions provided with the form.

- Don't submit the form without reviewing it thoroughly.

- Don't forget to sign and date the form if required.

Other PDF Documents

Form I134 - Sponsors must show they have a solid financial foundation to support the applicant.

Dnd Character Sheet Fillable - A mischievous fairy with a knack for trouble and enchantment.

Similar forms

W-2 Form: This document summarizes an employee's annual wages and the taxes withheld. Like the ADP Pay Stub, it provides crucial information about earnings, but it covers a full year instead of a single pay period.

Paycheck: A physical or electronic check issued to an employee. It contains similar information regarding gross pay, deductions, and net pay, much like the ADP Pay Stub.

Direct Deposit Receipt: This document confirms that an employee's wages have been directly deposited into their bank account. It includes details about the amount deposited, similar to what is found on a pay stub.

Payroll Summary Report: Often provided to employers, this report summarizes the payroll for a specific period. It mirrors the ADP Pay Stub by detailing total earnings and deductions for all employees.

Tax Withholding Statement: This document outlines the amount of federal and state taxes withheld from an employee’s paycheck. It shares similarities with the ADP Pay Stub in detailing deductions.

Benefits Statement: This document details the benefits an employee receives, such as health insurance and retirement contributions. It complements the ADP Pay Stub by providing a broader picture of total compensation.