Free Acord 130 Form

Form Preview Example

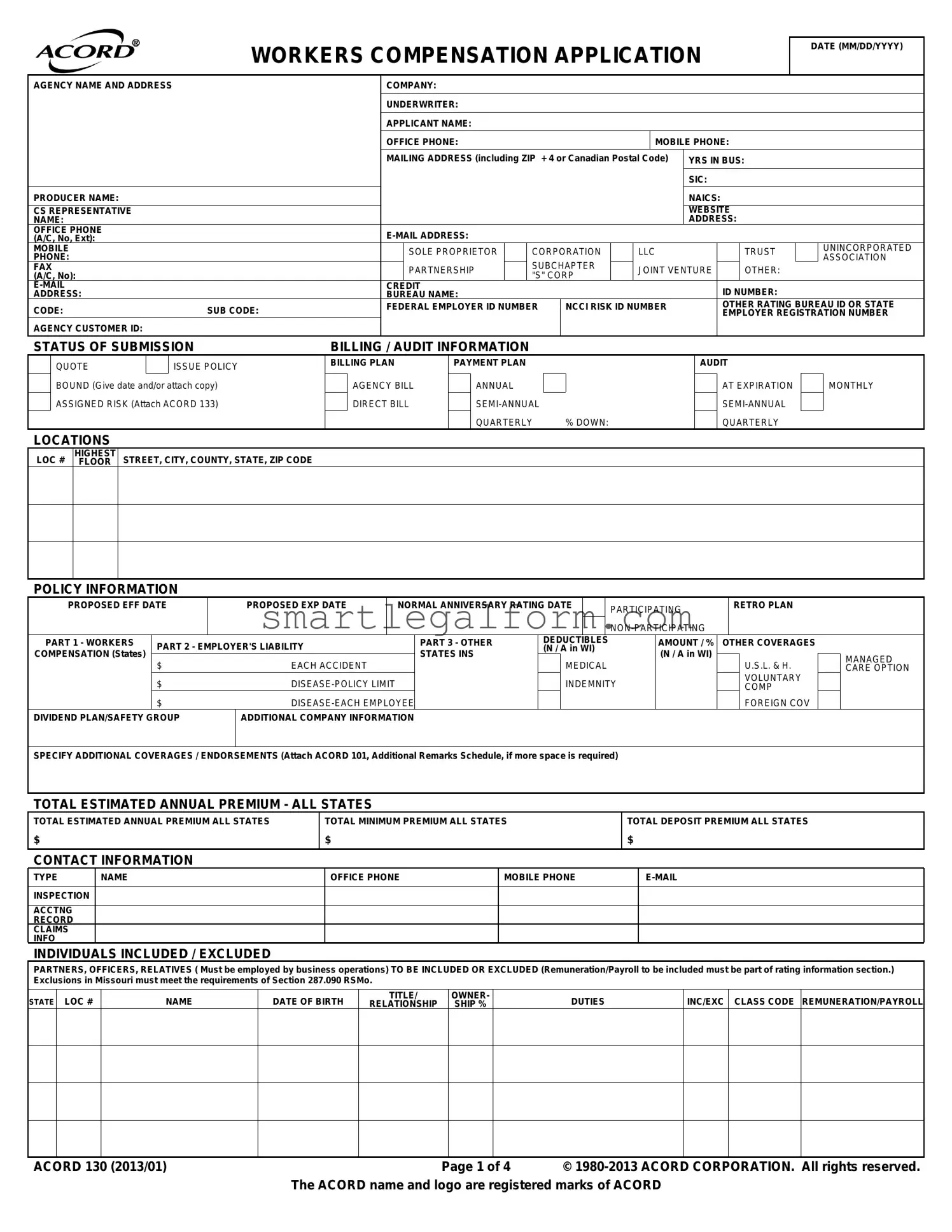

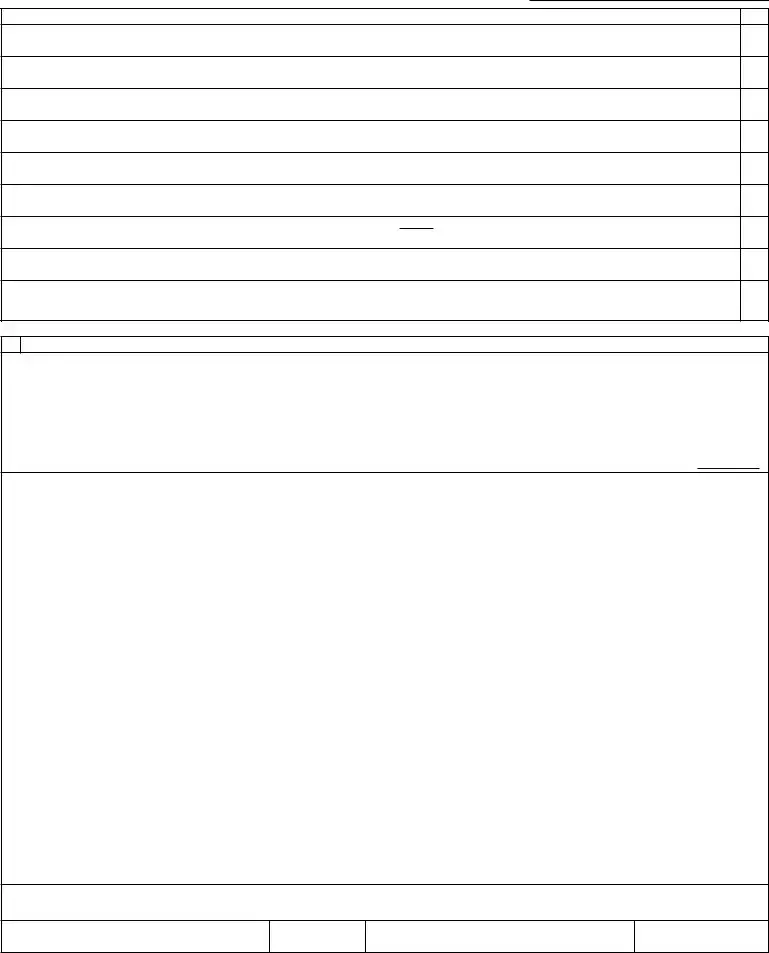

WORKERS COMPENSATION APPLICATION |

DATE (MM/DD/YYYY) |

|

|

|

|

AGENCY NAME AND ADDRESS |

|

|

|

|

COMPANY: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

UNDERWRITER: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

APPLICANT NAME: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OFFICE PHONE: |

|

|

|

|

|

|

|

|

|

|

MOBILE PHONE: |

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MAILING ADDRESS (including ZIP + 4 or Canadian Postal Code) |

YRS IN BUS: |

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIC: |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PRODUCER NAME: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAICS: |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

CS REPRESENTATIVE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WEBSITE |

|

|

|

||||||||||||

NAME: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ADDRESS: |

|

|

|

||||||||

OFFICE PHONE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

(A/C, No, Ext): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

MOBILE |

|

|

|

|

|

|

|

|

|

|

|

|

|

SOLE PROPRIETOR |

|

|

CORPORATION |

|

LLC |

|

|

|

|

|

TRUST |

|

|

|

UNINCORPORATED |

||||||||||||||

PHONE: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ASSOCIATION |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SUBCHAPTER |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

FAX |

|

|

|

|

|

|

|

|

|

|

|

|

|

PARTNERSHIP |

|

|

|

JOINT VENTURE |

|

|

|

OTHER: |

|

|

|

||||||||||||||||||

(A/C, No): |

|

|

|

|

|

|

|

|

|

|

|

|

|

"S" CORP |

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

CREDIT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ID NUMBER: |

|

|

|

|||||||||||||

ADDRESS: |

|

|

|

|

|

|

|

|

|

|

BUREAU NAME: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

CODE: |

|

|

|

|

|

|

SUB CODE: |

|

|

FEDERAL EMPLOYER ID NUMBER |

|

|

NCCI RISK ID NUMBER |

|

|

|

OTHER RATING BUREAU ID OR STATE |

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EMPLOYER REGISTRATION NUMBER |

|||||||||||||

AGENCY CUSTOMER ID: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

STATUS OF SUBMISSION |

|

BILLING / AUDIT INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

QUOTE |

|

|

|

ISSUE POLICY |

|

BILLING PLAN |

|

PAYMENT PLAN |

|

|

|

|

|

|

|

|

|

|

|

|

AUDIT |

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

BOUND (Give date and/or attach copy) |

|

|

AGENCY BILL |

|

|

ANNUAL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AT EXPIRATION |

|

|

MONTHLY |

||||||||||||||||||

|

ASSIGNED RISK (Attach ACORD 133) |

|

|

DIRECT BILL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

QUARTERLY |

|

|

% DOWN: |

|

|

|

|

|

|

|

QUARTERLY |

|

|

|

||||||||||

LOCATIONS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

LOC # |

HIGHEST |

|

STREET, CITY, COUNTY, STATE, ZIP CODE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

FLOOR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

POLICY INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

PROPOSED EFF DATE |

|

|

PROPOSED EXP DATE |

|

|

NORMAL ANNIVERSARY RATING DATE |

|

|

PARTICIPATING |

|

|

|

|

RETRO PLAN |

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

PART 1 - WORKERS |

PART 2 - EMPLOYER'S LIABILITY |

|

|

|

|

|

PART 3 - OTHER |

|

|

DEDUCTIBLES |

|

|

|

|

AMOUNT / % |

OTHER COVERAGES |

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

(N / A in WI) |

|

|

|

|

|

|

||||||||||||||||||||||||||||||

COMPENSATION (States) |

|

|

|

|

|

STATES INS |

|

|

|

|

|

(N / A in WI) |

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

$ |

|

|

|

EACH ACCIDENT |

|

|

|

|

|

MEDICAL |

|

|

|

|

|

|

U.S.L. & H. |

|

|

MANAGED |

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CARE OPTION |

|||||||||||||

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

INDEMNITY |

|

|

|

|

|

|

|

|

VOLUNTARY |

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COMP |

|

|

|

|||||||||||||

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FOREIGN COV |

|

|

|

||||||||

DIVIDEND PLAN/SAFETY GROUP |

|

ADDITIONAL COMPANY INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SPECIFY ADDITIONAL COVERAGES / ENDORSEMENTS (Attach ACORD 101, Additional Remarks Schedule, if more space is required)

TOTAL ESTIMATED ANNUAL PREMIUM - ALL STATES

TOTAL ESTIMATED ANNUAL PREMIUM ALL STATES |

TOTAL MINIMUM PREMIUM ALL STATES |

TOTAL DEPOSIT PREMIUM ALL STATES |

$ |

$ |

$ |

|

|

|

CONTACT INFORMATION

TYPE |

NAME |

OFFICE PHONE |

MOBILE PHONE |

|

|

|

|

|

|

INSPECTION |

|

|

|

|

|

|

|

|

|

ACCTNG |

|

|

|

|

RECORD |

|

|

|

|

CLAIMS |

|

|

|

|

INFO |

|

|

|

|

INDIVIDUALS INCLUDED / EXCLUDED

PARTNERS, OFFICERS, RELATIVES ( Must be employed by business operations) TO BE INCLUDED OR EXCLUDED (Remuneration/Payroll to be included must be part of rating information section.) Exclusions in Missouri must meet the requirements of Section 287.090 RSMo.

STATE |

LOC # |

NAME |

DATE OF BIRTH |

TITLE/ |

OWNER- |

DUTIES |

INC/EXC |

CLASS CODE |

REMUNERATION/PAYROLL |

RELATIONSHIP |

SHIP % |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ACORD 130 (2013/01) |

Page 1 of 4 |

© |

|

The ACORD name and logo are registered marks of ACORD |

|

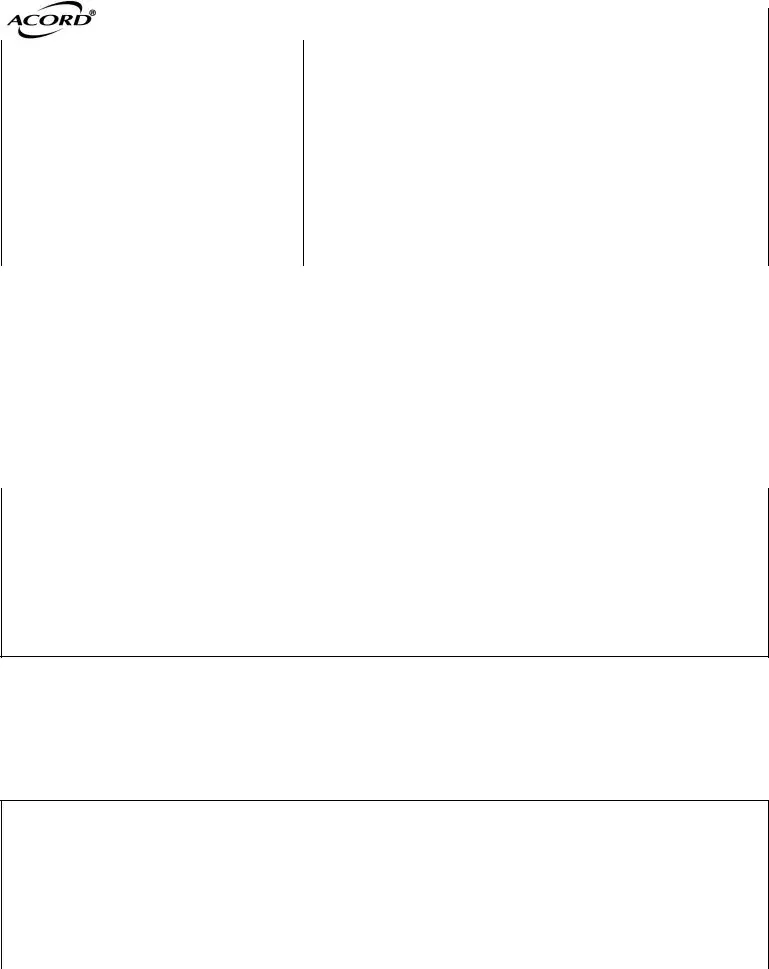

STATE RATING SHEET # |

|

OF |

|

SHEETS |

AGENCY CUSTOMER ID: |

STATE RATING WORKSHEET

FOR MULTIPLE STATES, ATTACH AN ADDITIONAL PAGE 2 OF THIS FORM RATING INFORMATION - STATE:

LOC # CLASS CODE

DESCR

CODE

CATEGORIES, DUTIES, CLASSIFICATIONS

# EMPLOYEES

FULL PART

TIME TIME

SIC

NAICS

ESTIMATED ANNUAL

REMUNERATION/

PAYROLL

ESTIMATED

RATE ANNUAL MANUAL PREMIUM

PREMIUM

STATE: |

FACTOR |

FACTORED PREMIUM |

|

FACTOR |

FACTORED PREMIUM |

TOTAL |

N / A |

$ |

|

|

$ |

INCREASED LIMITS |

|

$ |

SCHEDULE RATING * |

|

$ |

DEDUCTIBLE * |

|

$ |

CCPAP |

|

$ |

|

|

$ |

STANDARD PREMIUM |

|

$ |

EXPERIENCE OR MERIT |

|

$ |

PREMIUM DISCOUNT |

|

$ |

MODIFICATION |

|

|

|||

|

|

$ |

EXPENSE CONSTANT |

N / A |

$ |

ASSIGNED RISK SURCHARGE * |

|

$ |

TAXES / ASSESSMENTS * |

N / A |

$ |

ARAP * |

|

$ |

|

|

$ |

* N / A in Wisconsin |

|

|

|

|

|

TOTAL ESTIMATED ANNUAL PREMIUM

$

MINIMUM PREMIUM

$

DEPOSIT PREMIUM

$

REMARKS (ACORD 101, Additional Remarks Schedule, may be attached if more space is required)

|

|

ACORD 130 (2013/01) |

Page 2 of 4 |

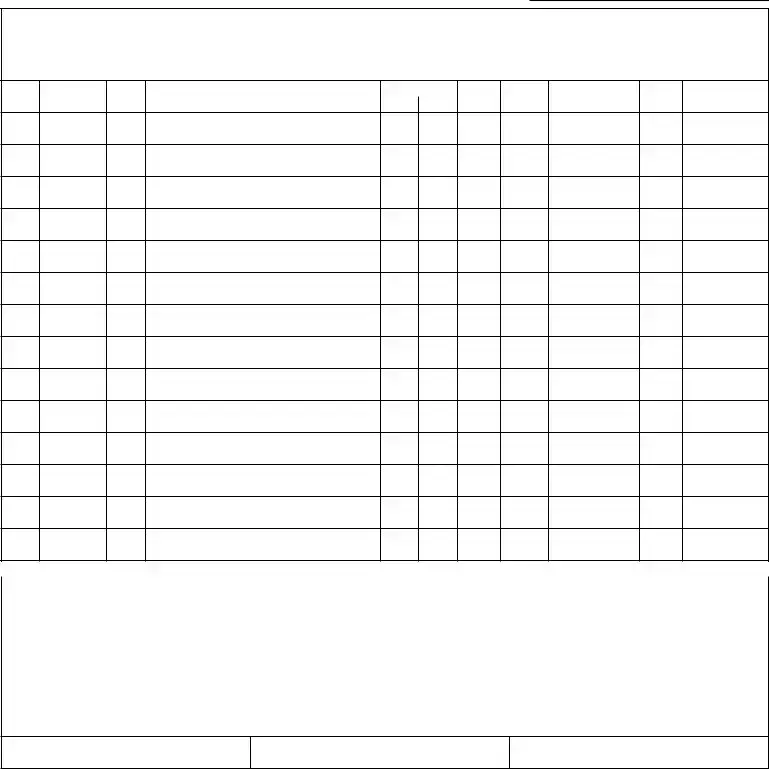

PRIOR CARRIER INFORMATION / LOSS HISTORY

AGENCY CUSTOMER ID:

PROVIDE INFORMATION FOR THE PAST 5 YEARS AND USE THE REMARKS SECTION FOR LOSS DETAILS |

|

|

|

LOSS RUN ATTACHED |

|

||

YEAR |

CARRIER & POLICY NUMBER |

ANNUAL PREMIUM |

MOD |

# CLAIMS |

AMOUNT PAID |

RESERVE |

|

|

CO: |

|

|

|

|

|

|

|

POL #: |

|

|

|

|

|

|

|

CO: |

|

|

|

|

|

|

|

POL #: |

|

|

|

|

|

|

|

CO: |

|

|

|

|

|

|

|

POL #: |

|

|

|

|

|

|

|

CO: |

|

|

|

|

|

|

|

POL #: |

|

|

|

|

|

|

|

CO: |

|

|

|

|

|

|

POL #:

NATURE OF BUSINESS / DESCRIPTION OF OPERATIONS

GIVE COMMENTS AND DESCRIPTIONS OF BUSINESS, OPERATIONS AND PRODUCTS: MANUFACTURING - RAW MATERIALS, PROCESSES, PRODUCT, EQUIPMENT; CONTRACTOR - TYPE OF WORK,

GENERAL INFORMATION

EXPLAIN ALL "YES" RESPONSES

1.DOES APPLICANT OWN, OPERATE OR LEASE AIRCRAFT / WATERCRAFT?

2.DO / HAVE PAST, PRESENT OR DISCONTINUED OPERATIONS INVOLVE(D) STORING, TREATING, DISCHARGING, APPLYING, DISPOSING, OR TRANSPORTING OF HAZARDOUS MATERIAL? (e.g. landfills, wastes, fuel tanks, etc)

3.ANY WORK PERFORMED UNDERGROUND OR ABOVE 15 FEET?

4.ANY WORK PERFORMED ON BARGES, VESSELS, DOCKS, BRIDGE OVER WATER?

5.IS APPLICANT ENGAGED IN ANY OTHER TYPE OF BUSINESS?

6.ARE

7.ANY WORK SUBLET WITHOUT CERTIFICATES OF INSURANCE? (If "YES", payroll for this work must be included in the State Rating Worksheet on Page 2)

8.IS A WRITTEN SAFETY PROGRAM IN OPERATION?

9.ANY GROUP TRANSPORTATION PROVIDED?

10.ANY EMPLOYEES UNDER 16 OR OVER 60 YEARS OF AGE?

11.ANY SEASONAL EMPLOYEES?

12.IS THERE ANY VOLUNTEER OR DONATED LABOR? (If "YES", please specify)

13.ANY EMPLOYEES WITH PHYSICAL HANDICAPS?

14.DO EMPLOYEES TRAVEL OUT OF STATE? (If "YES", indicate state(s) of travel and frequency)

15.ARE ATHLETIC TEAMS SPONSORED?

Y / N

ACORD 130 (2013/01) |

Page 3 of 4 |

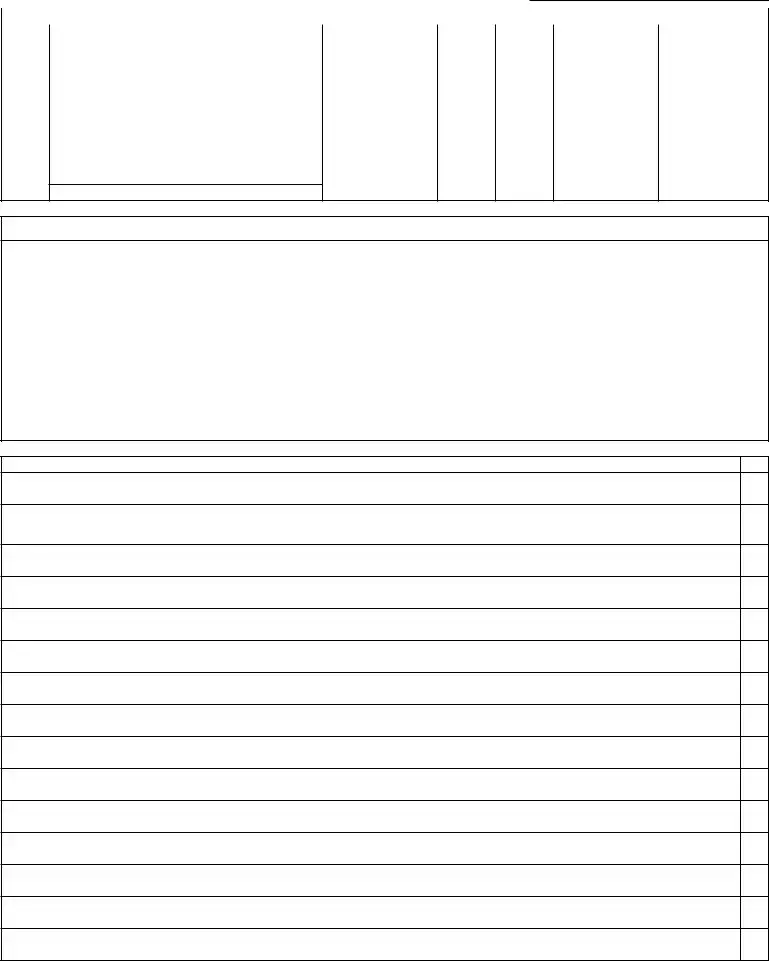

GENERAL INFORMATION (continued)

AGENCY CUSTOMER ID:

EXPLAIN ALL "YES" RESPONSES

16.ARE PHYSICALS REQUIRED AFTER OFFERS OF EMPLOYMENT ARE MADE?

17.ANY OTHER INSURANCE WITH THIS INSURER?

18.ANY PRIOR COVERAGE DECLINED / CANCELLED /

19.ARE EMPLOYEE HEALTH PLANS PROVIDED?

20.DO ANY EMPLOYEES PERFORM WORK FOR OTHER BUSINESSES OR SUBSIDIARIES?

21.DO YOU LEASE EMPLOYEES TO OR FROM OTHER EMPLOYERS?

22.DO ANY EMPLOYEES PREDOMINANTLY WORK AT HOME? If "YES", # of Employees:

23.ANY TAX LIENS OR BANKRUPTCY WITHIN THE LAST FIVE (5) YEARS? (If "YES", please specify)

24.ANY UNDISPUTED AND UNPAID WORKERS COMPENSATION PREMIUM DUE FROM YOU OR ANY COMMONLY MANAGED OR OWNED ENTERPRISES? IF YES, EXPLAIN INCLUDING ENTITY NAME(S) AND POLICY NUMBER(S).

Y / N

SIGNATURE

Copy of the Notice of Information Practices (Privacy) has been given to the applicant. (Not required in all states, contact your agent or broker for your state's requirements.)

PERSONAL INFORMATION ABOUT YOU, INCLUDING INFORMATION FROM A CREDIT OR OTHER INVESTIGATIVE REPORT, MAY BE COLLECTED FROM PERSONS OTHER THAN YOU IN CONNECTION WITH THIS APPLICATION FOR INSURANCE AND SUBSEQUENT AMENDMENTS AND RENEWALS. SUCH INFORMATION AS WELL AS OTHER PERSONAL AND PRIVILEGED INFORMATION COLLECTED BY US OR OUR AGENTS MAY IN CERTAIN CIRCUMSTANCES BE DISCLOSED TO THIRD PARTIES WITHOUT YOUR AUTHORIZATION. CREDIT SCORING INFORMATION MAY BE USED TO HELP DETERMINE EITHER YOUR ELIGIBILITY FOR INSURANCE OR THE PREMIUM YOU WILL BE CHARGED. WE MAY USE A THIRD PARTY IN CONNECTION WITH THE DEVELOPMENT OF YOUR SCORE. YOU MAY HAVE THE RIGHT TO REVIEW YOUR PERSONAL INFORMATION IN OUR FILES AND REQUEST CORRECTION OF ANY INACCURACIES. YOU MAY ALSO HAVE THE RIGHT TO REQUEST IN WRITING THAT WE CONSIDER EXTRAORDINARY LIFE CIRCUMSTANCES IN CONNECTION WITH THE DEVELOPMENT OF YOUR CREDIT SCORE. THESE RIGHTS MAY BE LIMITED IN SOME STATES. PLEASE CONTACT YOUR AGENT OR BROKER TO LEARN HOW THESE RIGHTS MAY APPLY IN YOUR STATE OR FOR INSTRUCTIONS ON HOW TO SUBMIT A REQUEST TO US FOR A MORE DETAILED DESCRIPTION OF YOUR RIGHTS AND OUR PRACTICES REGARDING PERSONAL INFORMATION.

(Not applicable in AZ, CA, DE, KS, MA, MN, ND, NY, OR, VA, or WV. Specific ACORD 38s are available for applicants in these states.)

Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance containing any materially false information or conceals, for the purpose of misleading, information concerning any fact material thereto commits a fraudulent insurance act, which is a crime and subjects that person to criminal and civil penalties (In Oregon, the aforementioned actions may constitute a fraudulent insurance act which may be a crime and may subject the person to penalties). (In New York, the civil penalty is not to exceed five thousand dollars ($5,000) and the stated value of the claim for each such violation). (Not applicable in AL, AR, AZ, CO, DC, FL, KS, LA, ME, MD, MN, NM, OK, PR, RI, TN, VA, VT, WA and WV).

Applicable in AL, AR, AZ, DC, LA, MD, NM, RI and WV: Any person who knowingly (or willfully in MD) presents a false or fraudulent claim for payment of a loss or benefit or who knowingly (or willfully in MD) presents false information in an application for insurance is guilty of a crime and may be subject to fines or confinement in prison.

Applicable in Colorado: It is unlawful to knowingly provide false, incomplete, or misleading facts or information to an insurance company for the purpose of defrauding or attempting to defraud the company, Penalties may include imprisonment, fines, denial of insurance and civil damages. Any insurance company or agent of an insurance company who knowingly provides false, incomplete, or misleading facts or information to a policyholder or claimant for the purpose of defrauding or attempting to defraud the policyholder or claimant with regard to a settlement or award payable from insurance proceeds shall be reported to the Colorado Division of Insurance within the department of regulatory agencies.

Applicable in Florida and Oklahoma: Any person who knowingly and with intent to injure, defraud, or deceive any insurer files a statement of claim or an application containing any false, incomplete, or misleading information is guilty of a felony (In FL, a person is guilty of a felony of the third degree).

Applicable in Kansas: Any person who, knowingly and with intent to defraud, presents, causes to be presented or prepares with knowledge or belief that it will be presented to or by an insurer, purported insurer, broker or any agent thereof, any written statement as part of, or in support of, an application for the issuance of, or the rating of an insurance policy for personal or commercial insurance, or a claim for payment or other benefit pursuant to an insurance policy for commercial or personal insurance which such person knows to contain materially false information concerning any fact material thereto; or conceals, for the purpose of misleading, information concerning any fact material thereto commits a fraudulent insurance act.

Applicable in Maine, Tennessee, Virginia and Washington: It is a crime to knowingly provide false, incomplete or misleading information to an insurance company for the purpose of defrauding the company. Penalties may include imprisonment, fines or a denial of insurance benefits.

Applicable in Puerto Rico: Any person who knowingly and with the intention of defrauding presents false information in an insurance application, or presents, helps, or causes the presentation of a fraudulent claim for the payment of a loss or any other benefit, or presents more than one claim for the same damage or loss, shall incur a felony and, upon conviction, shall be sanctioned for each violation by a fine of not less than five thousand dollars ($5,000) and not more than ten thousand dollars ($10,000), or a fixed term of imprisonment for three (3) years, or both penalties. Should aggravating circumstances be present, the penalty thus established may be increased to a maximum of five (5) years, if extenuating circumstances are present, it may be reduced to a minimum of two (2) years.

Applicable in Utah: Any person who knowingly presents false or fraudulent underwriting information, files or causes to be filed a false or fraudulent claim for disability compensation or medical benefits, or submits a false or fraudulent report or billing for health care fees or other professional services is guilty of a crime and may be subject to fines and confinement in state prison.

THE UNDERSIGNED IS AN AUTHORIZED REPRESENTATIVE OF THE APPLICANT AND REPRESENTS THAT REASONABLE INQUIRY HAS BEEN MADE TO OBTAIN THE ANSWERS TO QUESTIONS ON THIS APPLICATION. HE/SHE REPRESENTS THAT THE ANSWERS ARE TRUE, CORRECT AND COMPLETE TO THE BEST OF HIS/HER KNOWLEDGE.

APPLICANT'S SIGNATURE (Must be Officer, Owner or Partner)

DATE

PRODUCER'S SIGNATURE

NATIONAL PRODUCER NUMBER

ACORD 130 (2013/01) |

Page 4 of 4 |

Common mistakes

Filling out the Acord 130 form can be a straightforward process, but several common mistakes can lead to complications. One frequent error occurs when applicants neglect to provide complete contact information. Missing details such as the office phone number or email address can delay communication and processing. Ensuring that all contact fields are filled out accurately is essential for smooth correspondence.

Another mistake is failing to include the correct classification codes. The SIC and NAICS codes help insurers understand the nature of the business. Inaccurate or omitted codes can lead to miscalculations in premium rates. Therefore, it is crucial to verify that these codes accurately reflect the business operations.

Many applicants also overlook the importance of detailing the nature of their business operations. Incomplete descriptions can raise red flags during the underwriting process. Providing a thorough overview of activities, products, and services offered helps insurers assess risk accurately. This transparency can ultimately affect the coverage options available.

Additionally, some individuals forget to report all employees accurately. When listing individuals included or excluded from coverage, it is vital to include all relevant personnel, including partners and relatives. Omitting any employees can lead to gaps in coverage and unexpected liabilities.

Another common pitfall involves the proposed effective and expiration dates. Errors in these dates can cause confusion regarding the coverage period. Applicants should double-check these fields to ensure they align with their intended policy timeline.

Lastly, applicants may fail to attach necessary documents, such as loss history or additional remarks. This omission can hinder the underwriting process and delay the issuance of the policy. It is always best to review the application requirements and ensure all supporting documents are included before submission.

Dos and Don'ts

When filling out the ACORD 130 form, consider the following guidelines:

- Do provide accurate and complete information for each section.

- Do ensure that all contact details are current and correct.

- Do include the correct Federal Employer ID Number.

- Do specify all employees included or excluded from coverage.

- Do attach any necessary supporting documents, such as loss runs.

- Don't leave any sections blank; all fields must be filled out.

- Don't provide false or misleading information.

- Don't forget to sign and date the application where required.

- Don't overlook the need for additional remarks if necessary.

Other PDF Documents

Broward County Animal Care and Adoption - This certificate can be crucial for out-of-state travel with pets.

Utilizing a Hold Harmless Agreement can be crucial for parties engaging in high-risk activities, as it not only delineates responsibilities but also helps prevent legal disputes. For those in California seeking more information on this important document, resources like TopTemplates.info can provide valuable insights and templates to ensure proper usage and enforceability.

I-9 - Establish the nature of employment, whether full-time or part-time.

Similar forms

The ACORD 130 form serves as a comprehensive application for workers' compensation insurance. Several other documents share similarities with it, each serving specific purposes in the insurance process. Below are four documents that are comparable to the ACORD 130 form:

- ACORD 133 - Workers' Compensation Assigned Risk Plan Application: Like the ACORD 130, this form is used to apply for workers' compensation insurance, particularly for businesses that may not qualify for standard coverage. It collects similar information about the applicant's business operations and employee details.

- ACORD 125 - Commercial Insurance Application: This document functions as a general application for various types of commercial insurance, including liability and property. It parallels the ACORD 130 by gathering essential information about the business, such as its structure, operations, and coverage needs.

-

Employment Application PDF: This form is crucial for employers to gather vital applicant information, including personal details, work history, and qualifications. To learn more about this form, visit https://documentonline.org/blank-employment-application-pdf/.

- ACORD 101 - Additional Remarks Schedule: While not an application form itself, the ACORD 101 allows applicants to provide additional details or remarks that may not fit within the standard forms. It complements the ACORD 130 by enabling the applicant to elaborate on specific areas or provide clarification.

- ACORD 26 - Certificate of Liability Insurance: This certificate serves as proof of insurance coverage and is often requested by clients or vendors. It relates to the ACORD 130 in that both documents deal with insurance coverage, but the ACORD 26 focuses on confirming existing coverage rather than applying for it.